- Crypto analyst Moustache has recently unveiled charts showing two critical correlations, suggesting that a significant market shift could be near.

- TON and SOL are positioned to lead the charge should the altseason commence.

Though the crypto market is still rebounding from a widespread crash, recently, it has achieved a semblance of stability.

The crypto market capitalization has decreased by 1.56% in the last 24 hours, and it was valued at $2.11 trillion at press time. Meanwhile, Bitcoin’s [BTC] dominance has fallen by 0.26% within the same timeframe.

This decline in Bitcoin’s dominance is a key indicator for assessing the relative strength of altcoins in the broader cryptocurrency market.

A lower dominance often presages a potential rise in altcoin values, pointing to the onset of an altcoin season.

What an altseason means for the market

Altseason, or “altcoin season,” marks a key period in the cryptocurrency market when altcoins—cryptocurrencies other than Bitcoin—see significant price gains.

During altseason, investors pivot their focus from Bitcoin to altcoins, reducing the king coin’s dominance and reshaping market dynamics.

Crypto analyst Moustache predicts a forthcoming rally in altcoins—altseason—that could dramatically heighten asset values across the board.

His forecast is supported by two major technical convergences signaling a potential market turnaround.

Moustache explained,

“Altcoins are on the verge of breaking out of a falling wedge that has been in the making for 9 months.”

At press time, prices were interacting with the lower boundary of this extensive triangle pattern acting as a support. Historical trends suggested that reaching this level typically triggers an upward rally.

Source: Moustache/X

The convergence of this falling wedge pattern with current trading levels intensified the bullish sentiment surrounding altcoins.

Should this key support hold, the crypto market could see an explosive rally, with numerous altcoins hitting new all-time highs or establishing higher peaks.

AMBCrypto’s recent analysis also highlights that Toncoin [TON] and Solana [SOL] stand to gain significantly should alt season ignite, pointing to a profitable season ahead for altcoin investors.

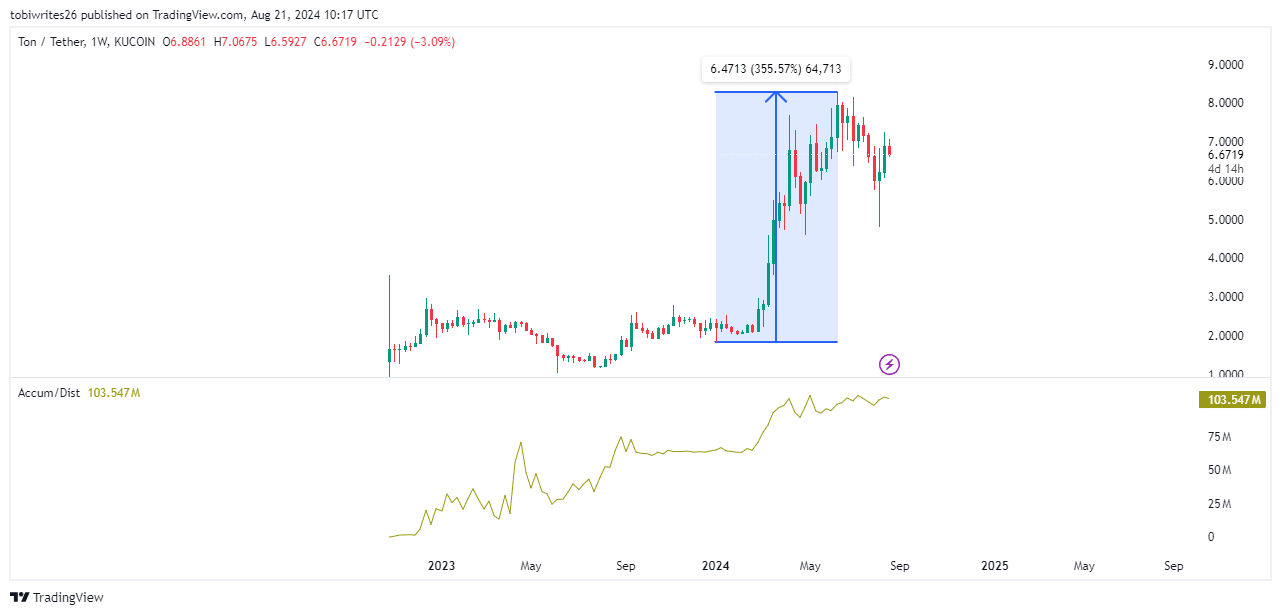

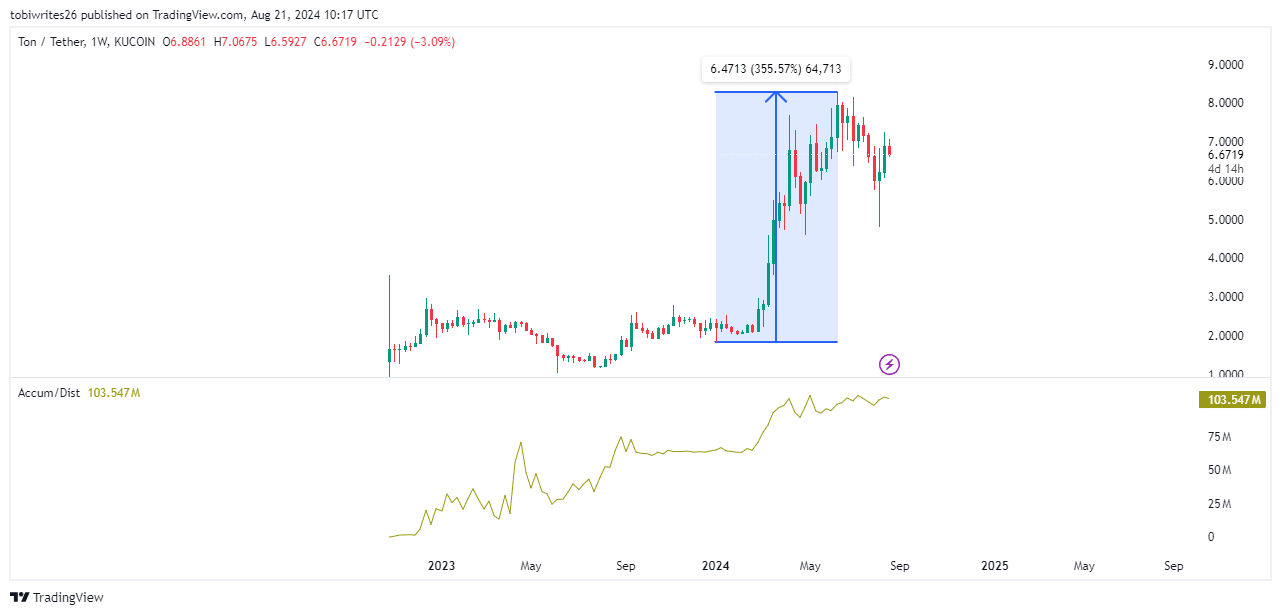

Toncoin’s massive rise

TON, or “The Open Network,” has experienced a meteoric rise since its inception. From the 1st of January to the 10th of June, TON surged by an impressive 335.57%.

Although it faced a minor correction from the 11th of June onwards, this only slightly adjusted its market valuation to $16 billion, showcasing its resilience and potential.

Source: TradingView

According to data from Coinglass, TON’s Open Interest increased dramatically from $912.34K on the 29th of July to $20.17 million by the 21st of August, indicating a strong bullish presence in the market.

With the potential onset of an altcoin season, this bullish momentum could further propel TON’s price, potentially reaching as high as $20 at the market’s peak.

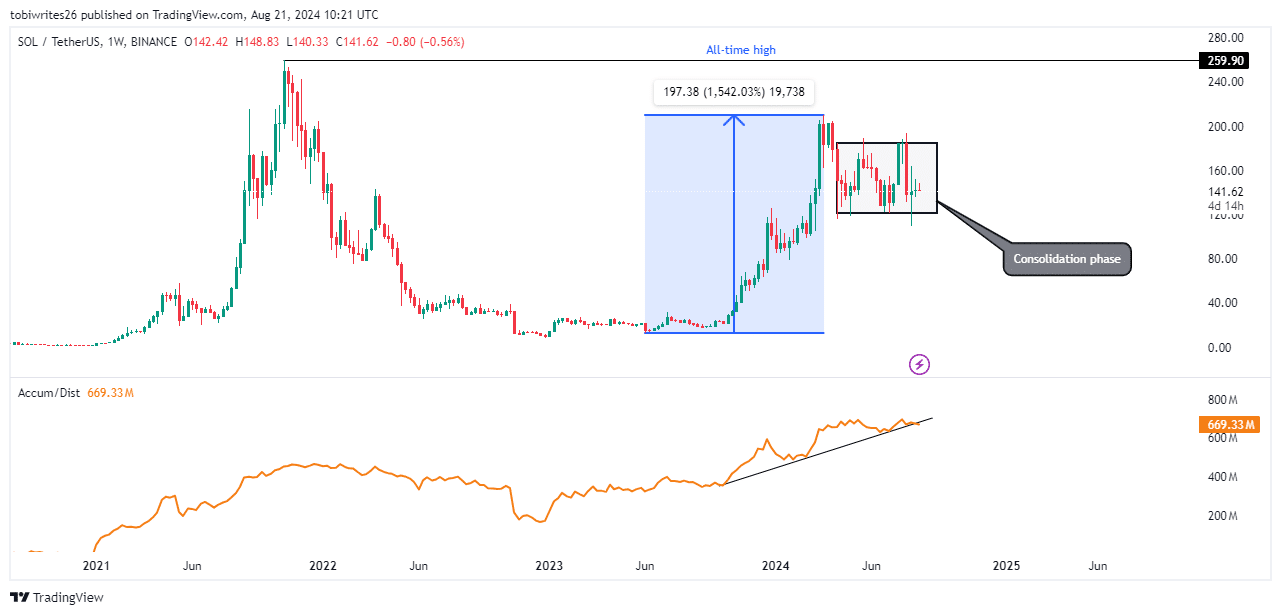

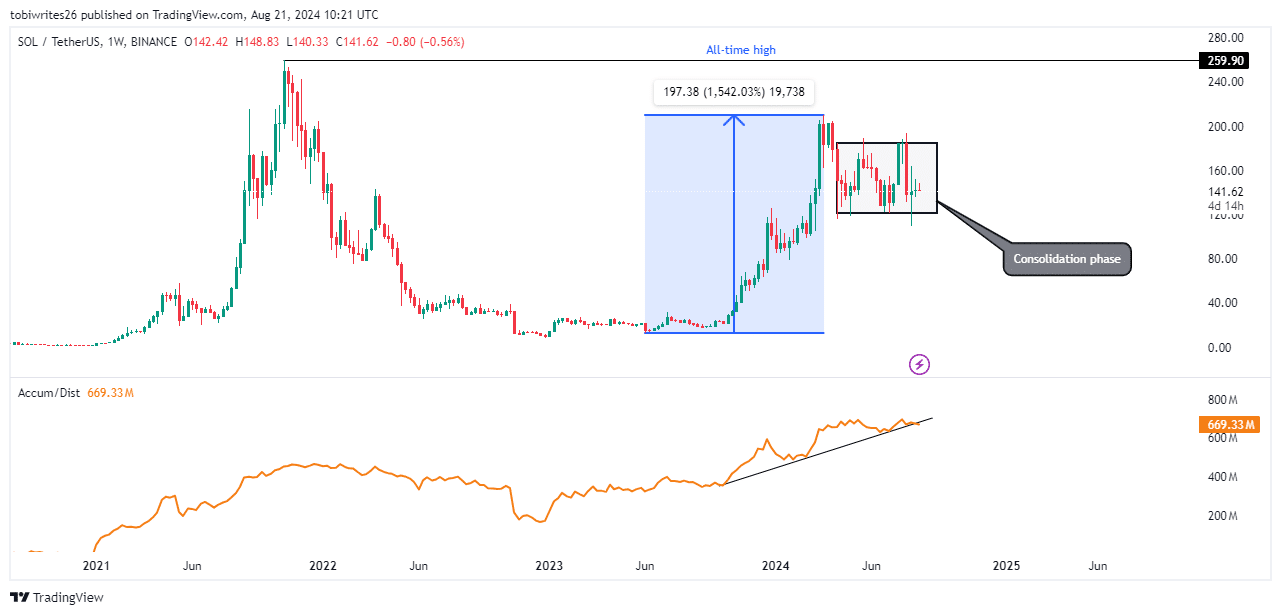

Solana looks ready!

Solana is ready for a substantial rally with the full onset of altseason. From June 2023, SOL has rocketed from a low of $12 to a peak of $210 in January 2024, a remarkable 1542% increase in just a few months.

A recent analysis by AMBCrypto highlighted that SOL had been in a consolidation phase from January to August.

This pattern suggested that whales—large-volume traders—were actively accumulating in preparation for an anticipated market upswing.

Source: TradingView

The use of the Accumulation and Distribution tool confirmed this perspective, as it revealed that Solana formed consistent higher highs against its price movements.

Read Toncoin’s [TON] Price Prediction 2024 – 2025

Such key indicators predict a significant surge in SOL’s price as demand escalates.

As altseason gains momentum, this upward trajectory is expected to catapult SOL to new all-time highs.