BetFury is the 1st iGaming platform that launched competitive Crypto Loans, expanding its crypto ecosystem. Every BetFury user can now create positions with a minimum permissible 50% LTV and the lowest interest rate among the leading CEXs. Uncover how to seamlessly leverage your holdings for instant liquidity without selling!

What are Crypto Loans on BetFury?

BetFury Crypto Loans – a financial service that provides users with access to liquidity in exchange for collateral. You can create fixed-term loan positions with fixed interest rates throughout the loan terms. BetFury offers isolated loan positions meaning each collateral-loan pair position holds its distinct Loan-to-Value (LTV) ratios as well as margin call and liquidation LTV levels.

Crypto Loans are helpful for those who want to use one currency instead of another without trading. If you’re confident in the growth of Bitcoin but want to keep holding it, you can borrow the most suitable currency and receive profit from this maneuver.

Leading crypto for borrowing and collateral usage

BetFury provides a diverse range of assets for loan and collateral, including USDT, BTC, and ETH. Still, the platform does not support the use of the same cryptocurrency for both collateral and loan within a single loan position. That’s why you cannot use BTC as collateral and borrow BTC in the same loan position.

Benefits of Using BetFury Crypto Loans

BetFury became a pioneer by introducing Crypto Loans into the iGaming area. Moreover, it has provided intense competition to well-known platforms. What are the main reasons for BetFury’s uniqueness in a crypto borrowing world?

👉https://betfury.io/

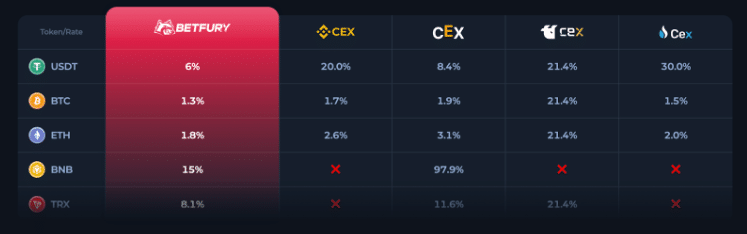

- The Lowest Interest Rate

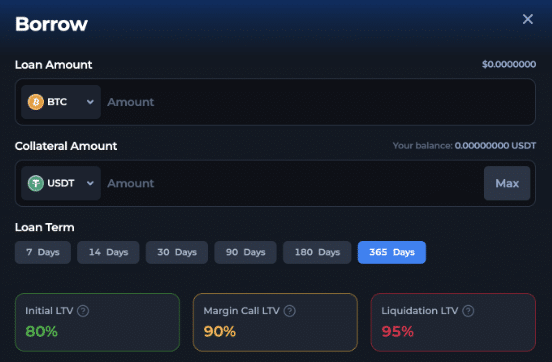

BetFury offers the lowest interest rate among CEXs. Let’s say you borrow USDT for 30 days, your annual interest rate will be only 6.6%. It’s 5-6 times less than on some well-known exchanges. - Creating Positions With LTV < Initial LTV

You can create a position with a 50% minimum possible LTV. Simply put, when you place a higher collateral amount, you will be much further away from Liquidation. - The Gap Between Margin Call LTV & Liquidation LTV

BetFury has increased the gap between Margin Call LTV and Liquidation LTV to ensure more time for users to react and stabilize the borrowing position. - Uniqueness Among Competitors

The above aspects distinguish BetFury from its direct competitors, such as other online casinos and top centralized exchanges.

How to Earn via BetFury Crypto Loans?

You can utilize the loan for various purposes, such as placing bets, engaging in crypto swaps, depositing into BetFury Earn products, or withdrawing funds from the platform. However, the collateral will remain with BetFury Crypto Loans as security for the return of the digital assets you’ve borrowed.

Here are several key aspects to keep in mind while profitably earning from Crypto Loans:

- Keep track of LTV levels: The BetFury Crypto Loans system is simple and centered around the LTV, which is the ratio (%) of the loan to the collateral amount. As one of the other perks, BetFury has a high initial LTV from 75% to 80%. The main thing when borrowing is the ability to control the LTV. This value has three levels: Initial LTV, Margin Call LTV, and Liquidation LTV.

- Earn with borrowed crypto assets on BetFury: The platform has many gainful crypto products and exclusive offers for BFG holders. If you convert BFG to unique stBFG tokens and join BFG Staking, you will double your passive income and get up to 70% APY. There’s also an earning option via crypto Futures allowing for simple earning in a new entertaining format. Explore these and more options on BetFury!

- Avoid Liquidation: Once you reach a Liquidation LTV, the platform automatically liquidates your collateral assets to repay the loan. As mentioned above, BetFury has a significant gap between Margin Call LTV and Liquidation LTV, so controlling risks will be much easier. If you follow all the rules and create effective strategies, it’ll be easier to get income using Crypto Loans.

Conclusion

BetFury Crypto Loans is a tool that provides easy access to liquidity and opens a door to the crypto world for any user. Implementation of this feature takes a solid step toward further BetFury’s growth. Who thought the iGaming platform would add competitive crypto borrowing on par with top CEXs? BetFury has once again demonstrated that it could unite crypto enthusiasts and players in one place. Therefore, borrow top currencies and fill your digital balance.

About BetFury

BetFury is an established ecosystem with crypto-earning features, iGaming, and Sports betting. The platform has a global community of 2M+ users for over four years of progress.

Multiple crypto-staking options are available on BetFury for users who prioritize competitive rewards and leading tokens for earning. When you sign up on BetFury, you receive a Welcome Pack with up to $10 500 Deposit Bonuses and 225 Free Spins.

If you prefer a team approach to gaining rewards, you can join a Referral Program. The referrer gets a $1,500 bonus and a 30% commission for the referral’s activity with an opportunity for reward. You can access all these crypto features directly on the BetFury website or use its Telegram Bot for faster platform access and boosted rewards.

Disclaimer: This is a paid post and should not be treated as news/advice.