- BTC is experiencing strong demand across all market participants.

- Whales on Binance are not selling Bitcoin, reflecting growing market confidence.

Since dropping to a local low of $74k a week ago, Bitcoin [BTC] has made a significant recovery, hitting a high of $86k.

These significant gains reflect the shift in market sentiments from market participants, especially whales.

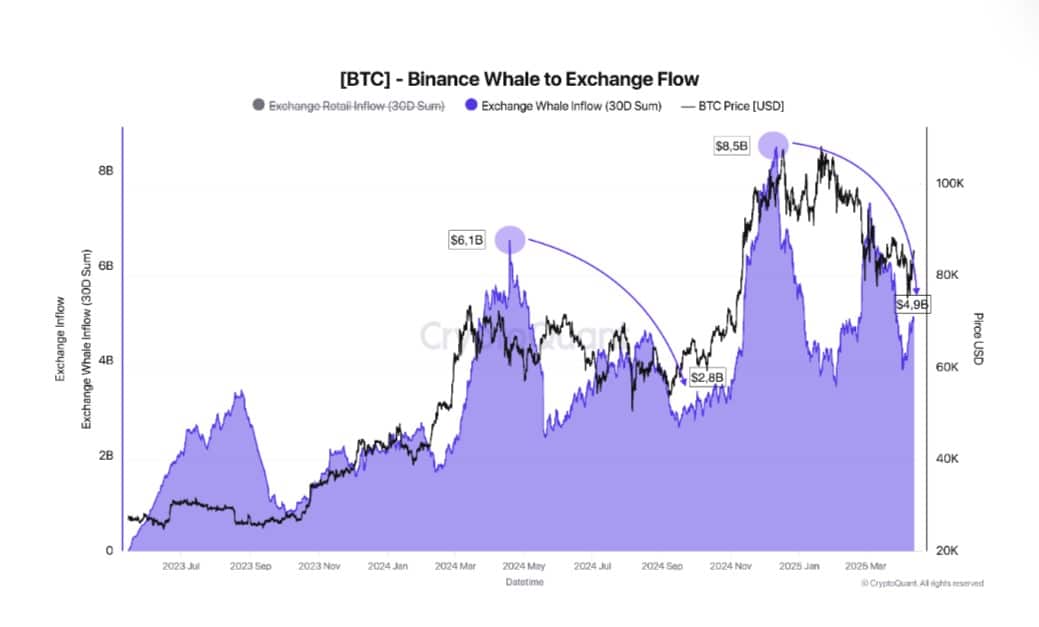

As such, whales have cooled down and are not selling as per CryptoQuant. This market behavior among large entities is more evidenced by whale activity on Binance.

Source: CryptoQuant

Over the past thirty days, whale inflow values have significantly declined, dropping by over $3 billion—similar to the previous correction in 2024. This indicates that Binance whales are maintaining composure and not showing signs of panic.

Additionally, both the Exchange Whale Ratio and whale inflows on Binance are decreasing. This change in whale behavior signals a shift in market sentiment, with confidence among large holders steadily recovering.

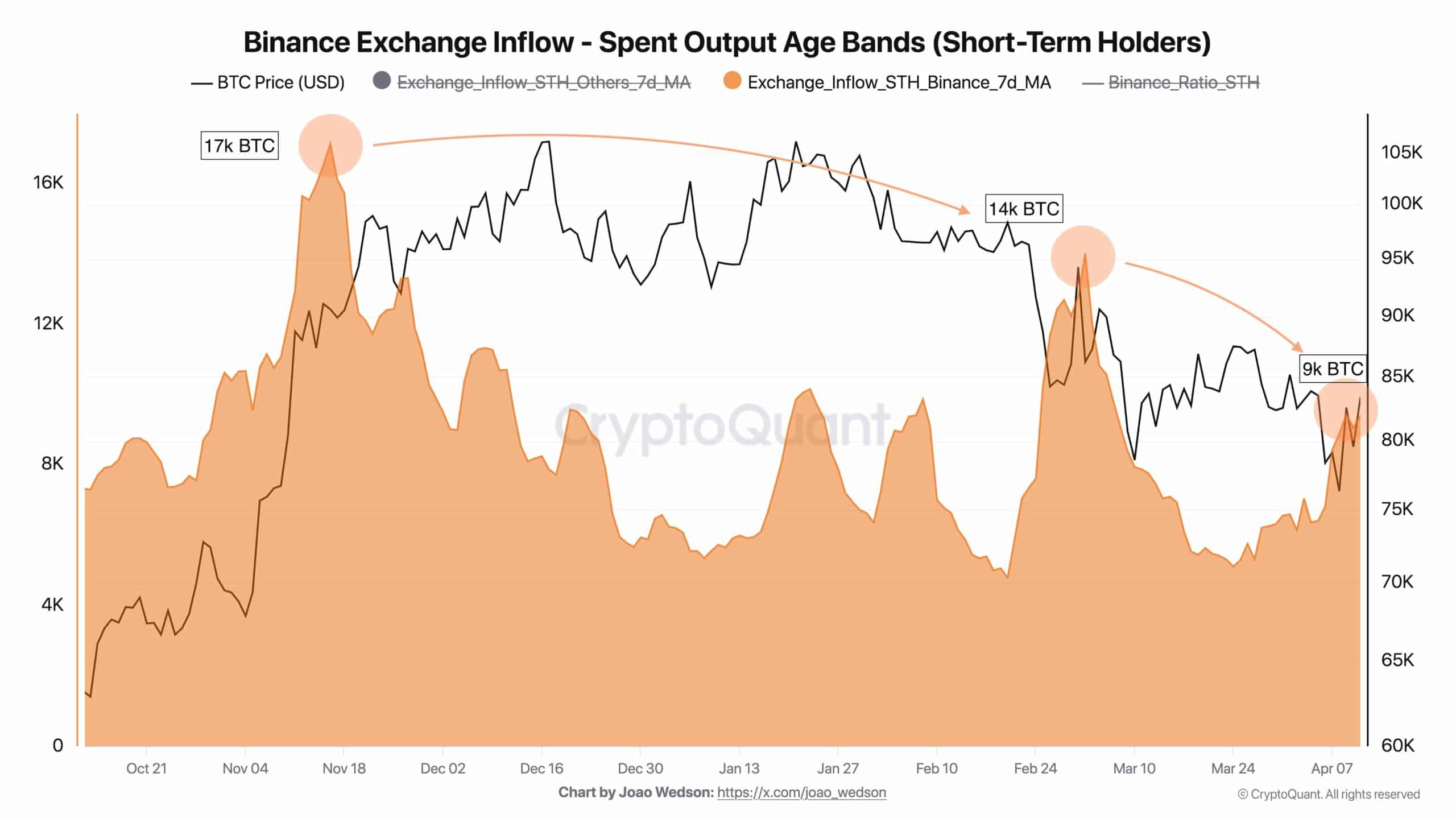

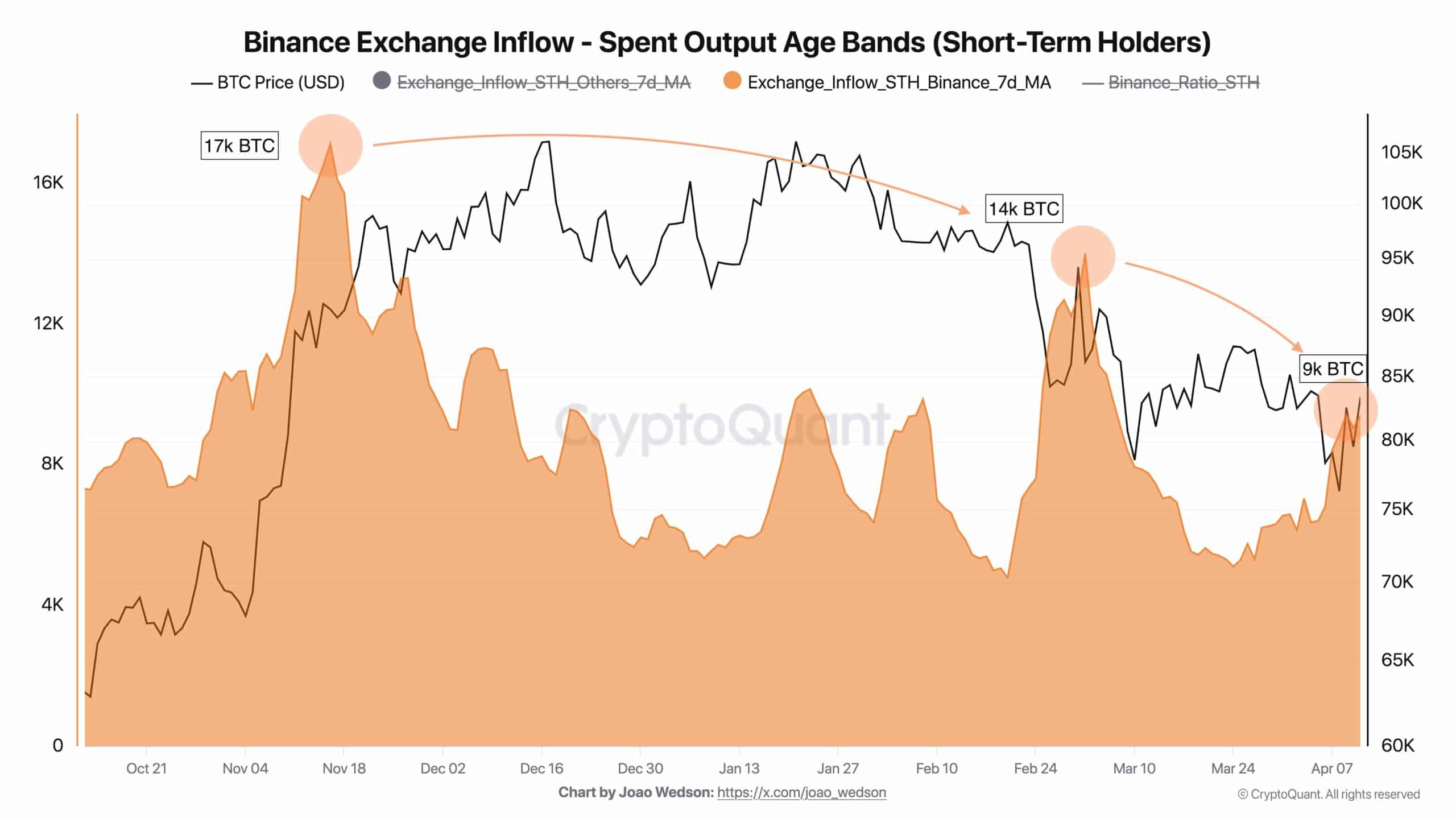

Source: CryptoQuant

This shift in market behavior is even more visible among short-term holders. As such, STH selling pressure on Binance is declining. BTC inflows (7DMA) from STHs to Binance have been steadily decreasing.

They dropped from around 17,000 BTC inflows on the 16th of November to 14,000 on the 3rd of March and are now hovering around 9,000.

This indicates that selling pressure from short-term investors on Binance is easing, which is a positive signal.

Source: CryptoQuant

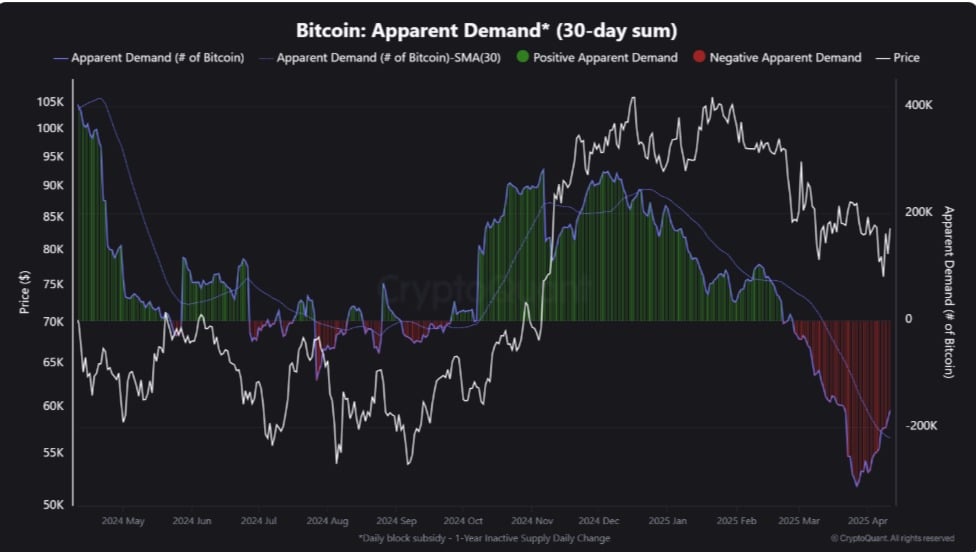

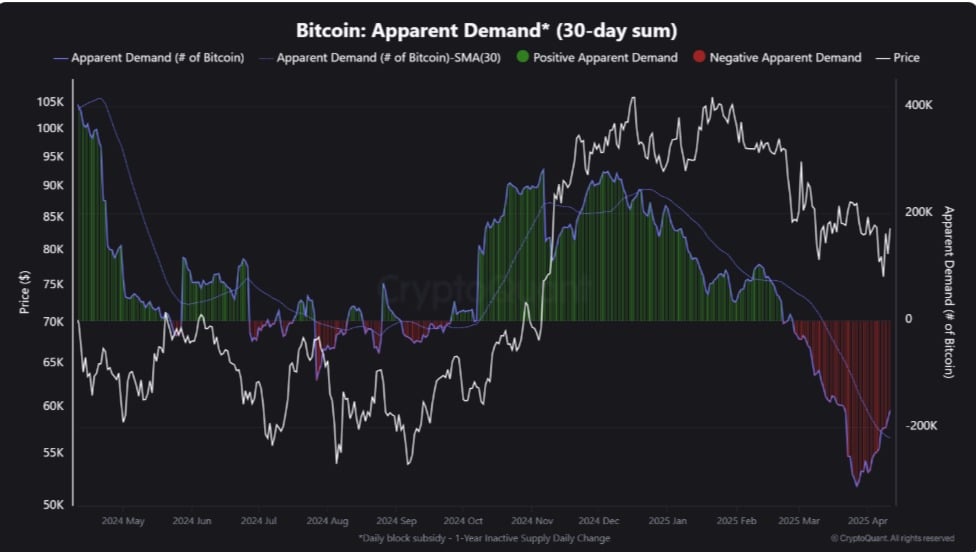

With whales and short-term holders on Binance reducing selling activity, it reflects the rising demand for Bitcoin.

As such, Bitcoin’s Apparent Demand (30-day sum) has recently started to bounce from deeply negative territory, hinting at a possible shift in market behavior.

Source: CryptoQuant

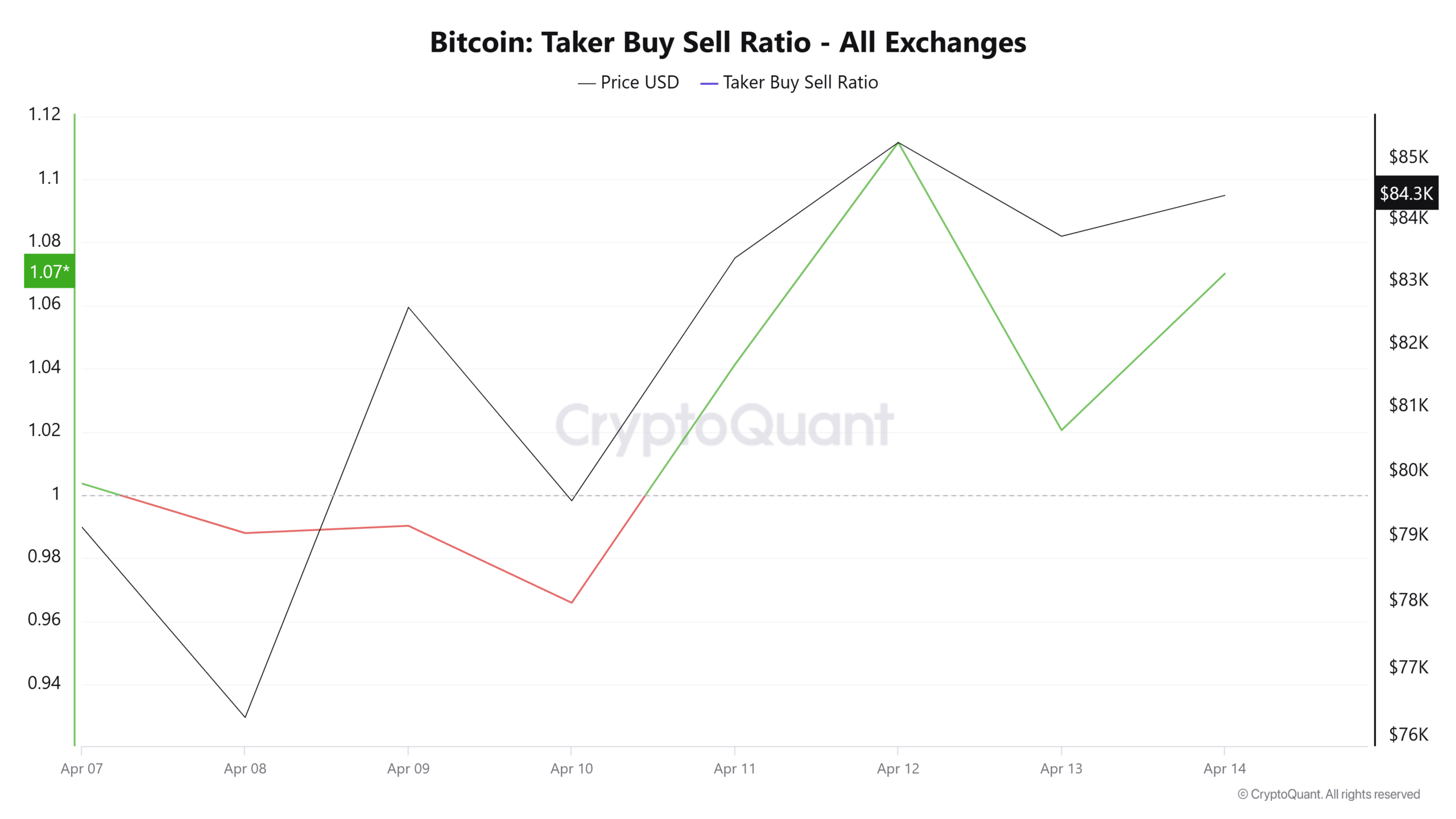

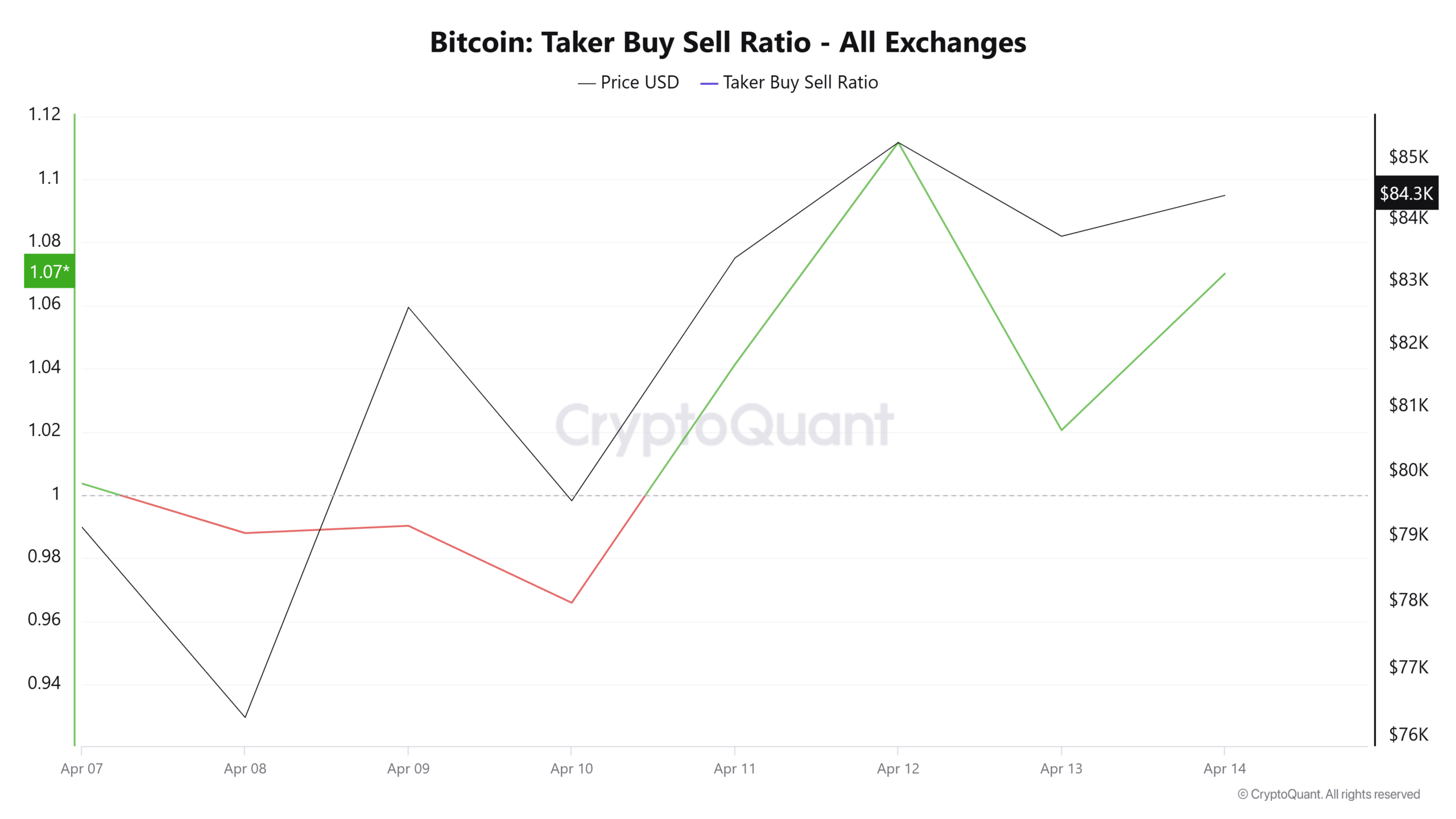

AMBCrypto observed this shift in demand as buyers have taken the market back. This shift in dominance is evidenced by the recent spike in the Taker Buy Sell Ratio, which has reached 1.07.

When the Taker Buy Sell Ratio surpasses 1, it suggests that buyers are now dominant in the market, reflecting higher demand as investors accumulate. The rise in demand means a pause in selling pressure, suggesting a potential shift in momentum.

What it means for BTC

A reduction in short-term holder activity and whale selling suggests a shift in market direction, with bulls gaining control.

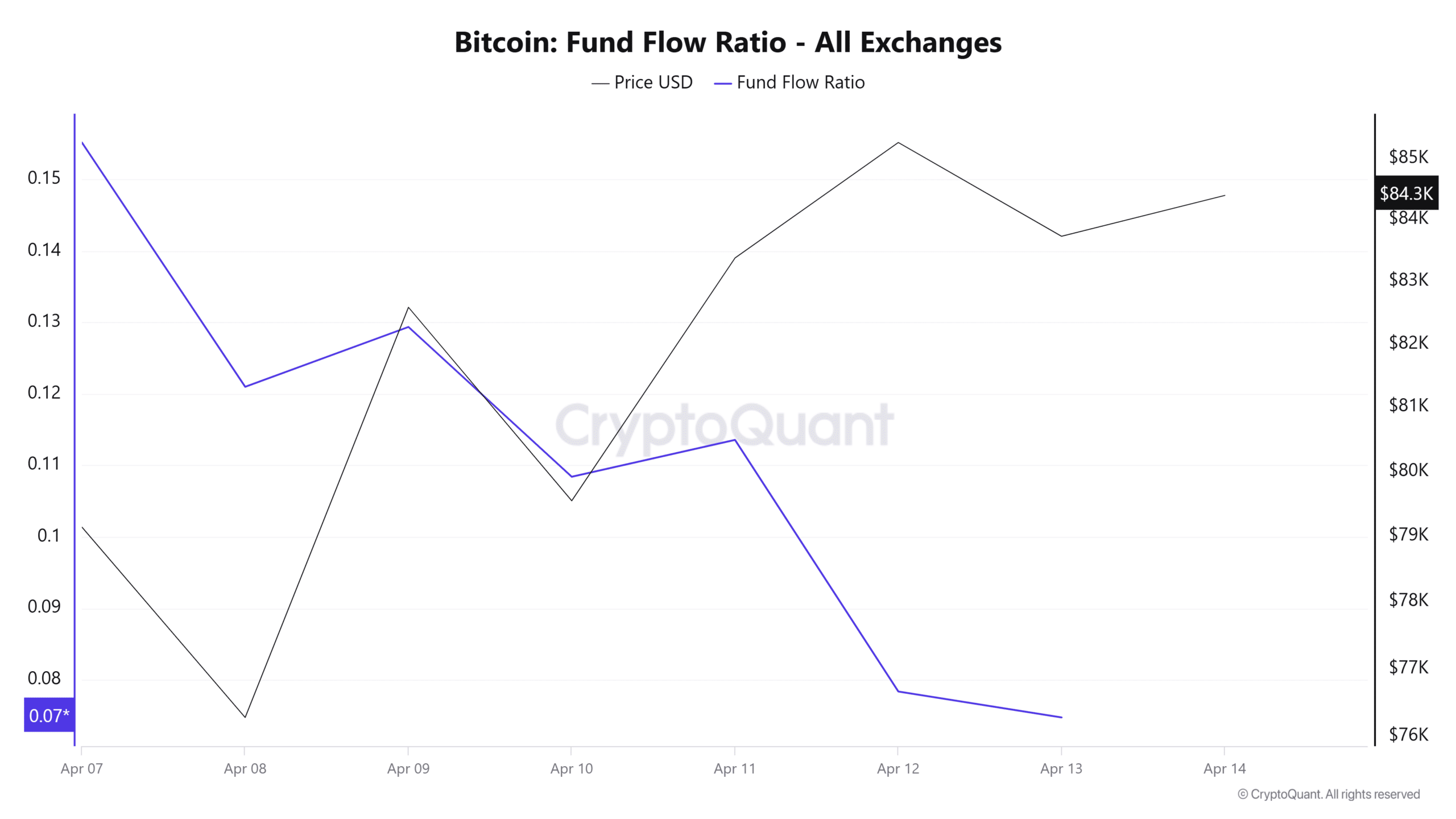

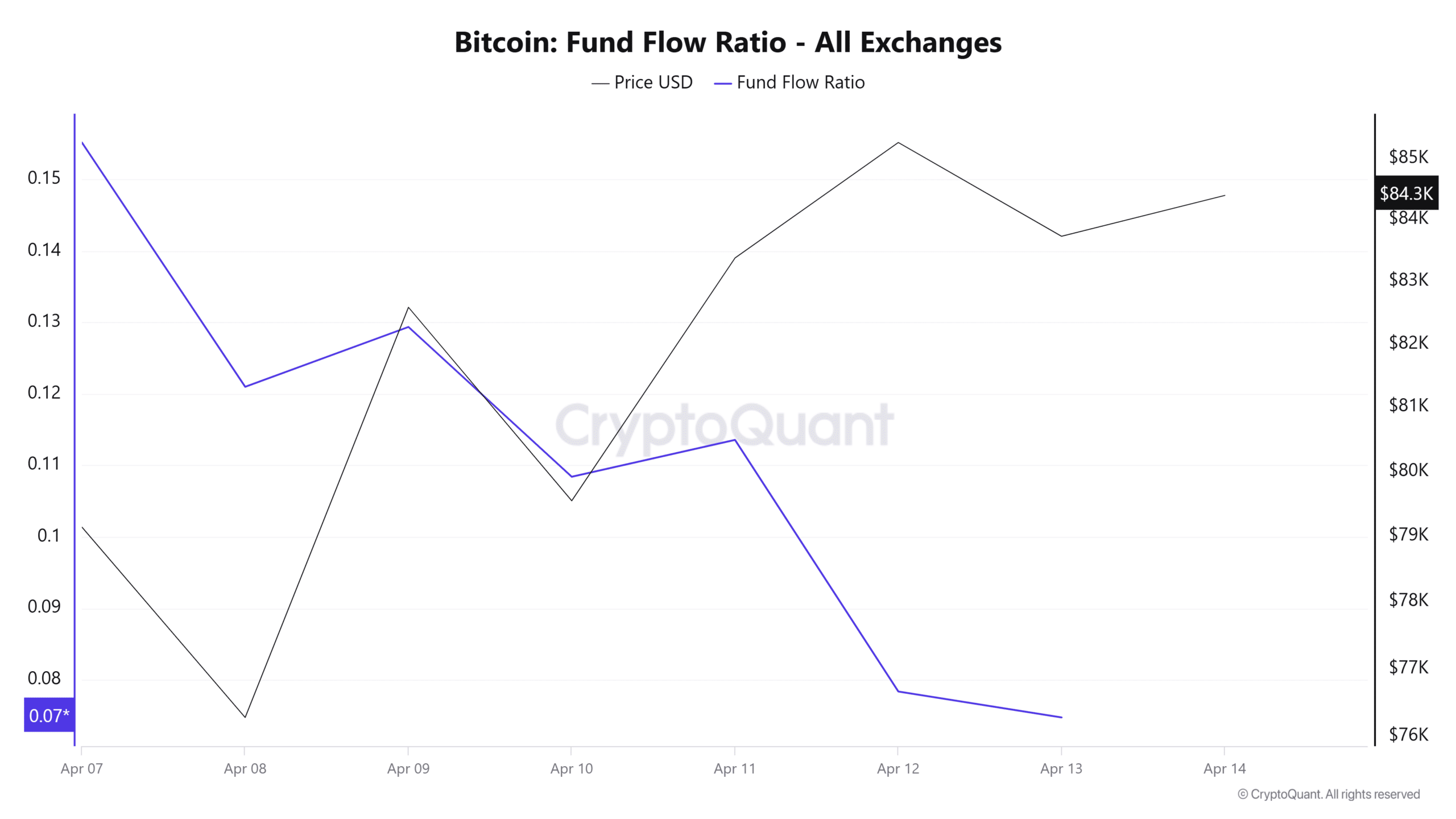

Bitcoin is showing signs of a potential trend reversal, setting the stage for sustained gains. The Fund Flow Ratio indicates limited engagement with exchanges for selling.

Over the past week, the fund flow ratio has steadily decreased to 0.07, highlighting that holders are refraining from aggressive selling.

Source: CryptoQuant

With reduced selling activity and increased demand, the outlook for BTC appears promising, positioning the cryptocurrency for sustained recovery. Historically, low selling pressure combined with rising demand has often led to price increases.

If current market conditions remain stable, BTC could reclaim key resistance at $87,167 and potentially aim for $88,600. However, if volatility intensifies and sellers regain control, BTC may face a correction, dropping to $82,460.