- Surge in XRP’s NVT ratio hinted at a hike in whale activity, suggesting potential volatility

- XRP’s consolidation within a symmetrical triangle pointed to an imminent breakout or breakdown

A massive transfer of 150 million XRP, valued at over $380 million, recently took place between two unknown wallets. As expected, this has sparked significant curiosity across the crypto market.

This whale activity has caught the attention of many traders and analysts too, many of whom are now questioning whether this will trigger a major price shift or if it is simply a routine transaction.

At press time, XRP was trading at $2.36, following a 4.97% decline over the last 24 hours. This has added to the uncertainty surrounding its short-term outlook.

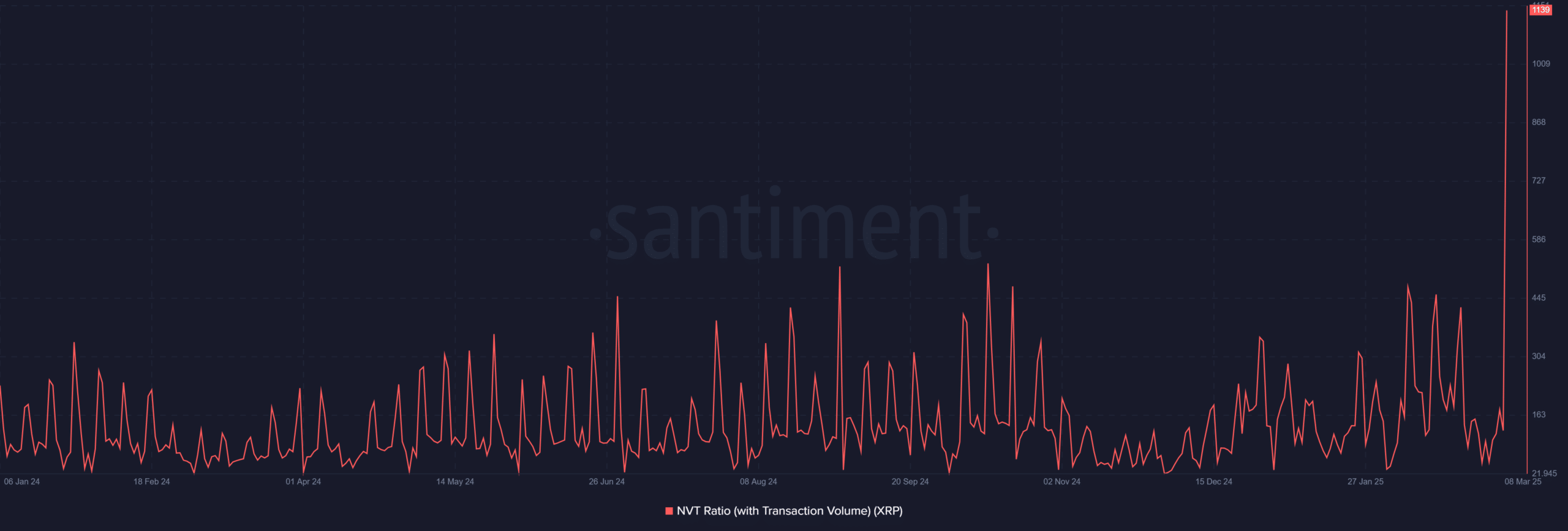

XRP surge in NVT ratio – What does it mean for the market?

XRP’s Network Value to Transaction (NVT) ratio registered a sharp hike, spiking to 1139.75 on 8 March from just 176 a day prior.

This massive uptick seemed to hint at a surge in transaction volumes relative to XRP’s market cap. Consequently, this alluded to heightened activity and potentially larger movements.

Therefore, such a significant jump could indicate that whale activity is influencing the price – A sign of possible upcoming volatility.

Source: Santiment

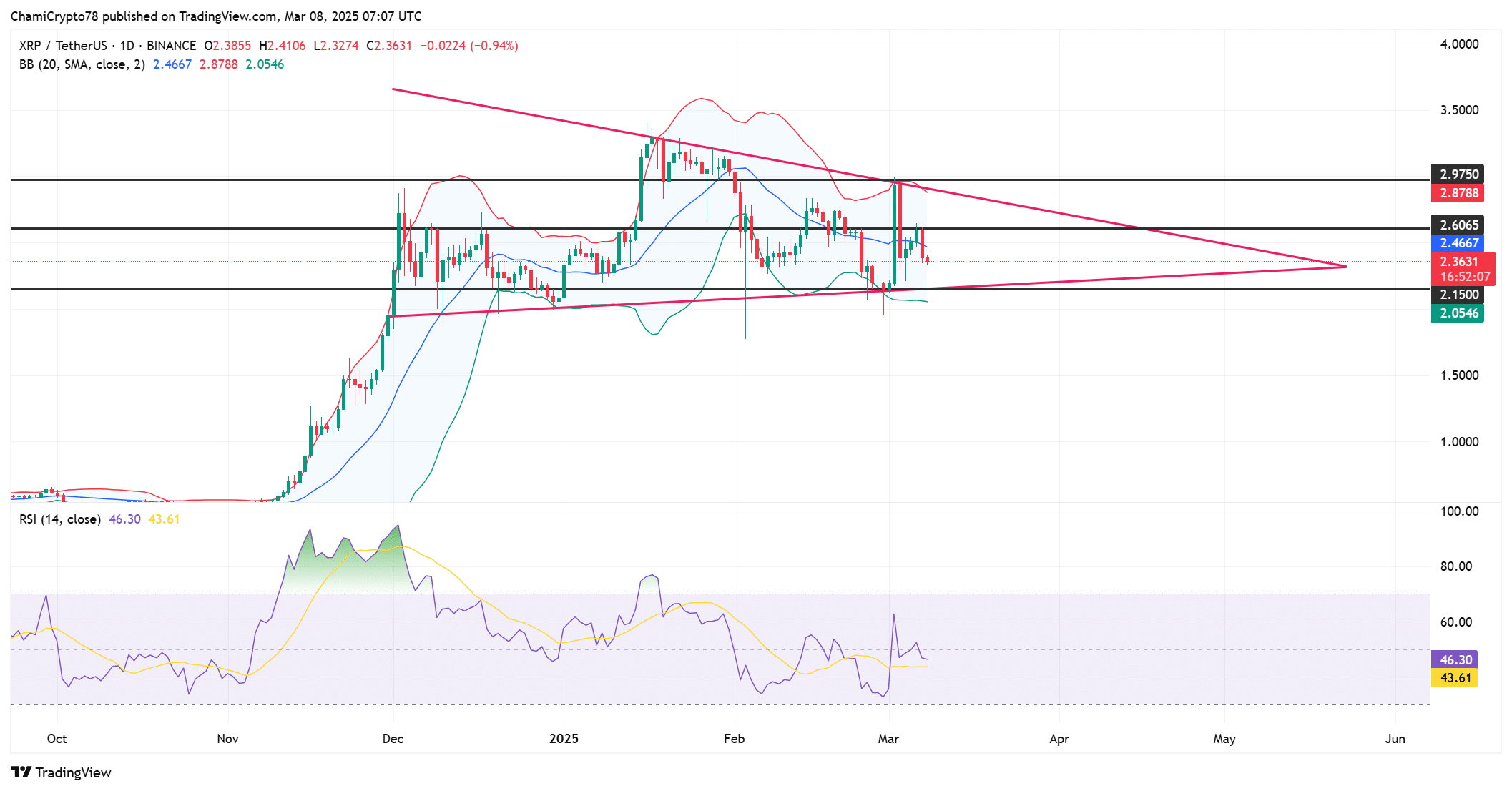

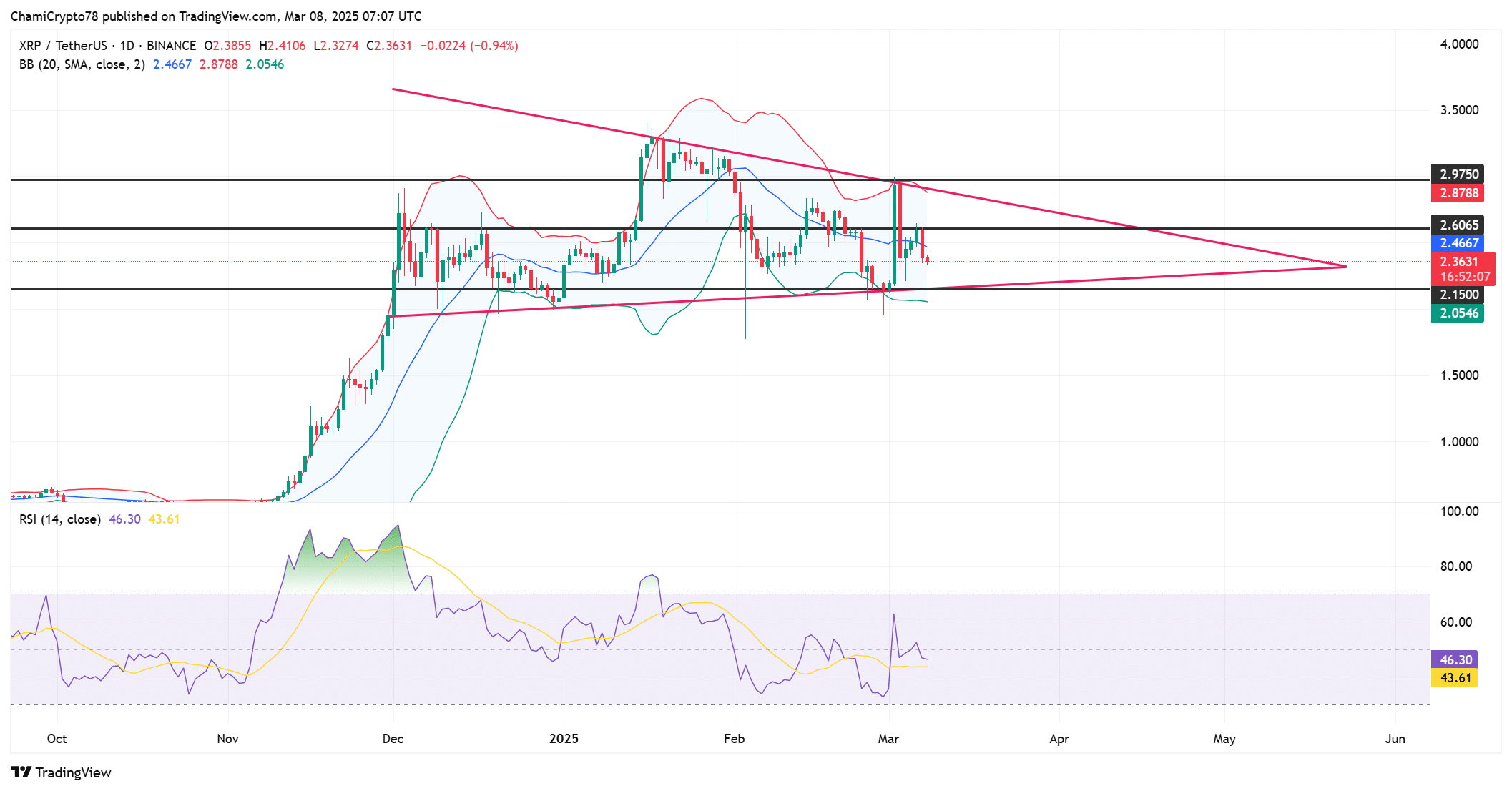

Symmetrical triangle consolidation – Is XRP ready for a breakout?

XRP’s price chart revealed that the asset has been consolidating within a symmetrical triangle pattern. Such a consolidation typically precedes a breakout, making it crucial to observe the key levels in play.

XRP’s immediate support lay at $2.36, with resistance around $2.60. Additionally, the Bollinger Bands seemed to have tightened, reflecting low volatility, while the Stochastic RSI was sitting at the neutral level of 46.30.

Therefore, XRP could see significant price movement once the price breaks out from the triangle, either to the upside or the downside.

Source: TradingView

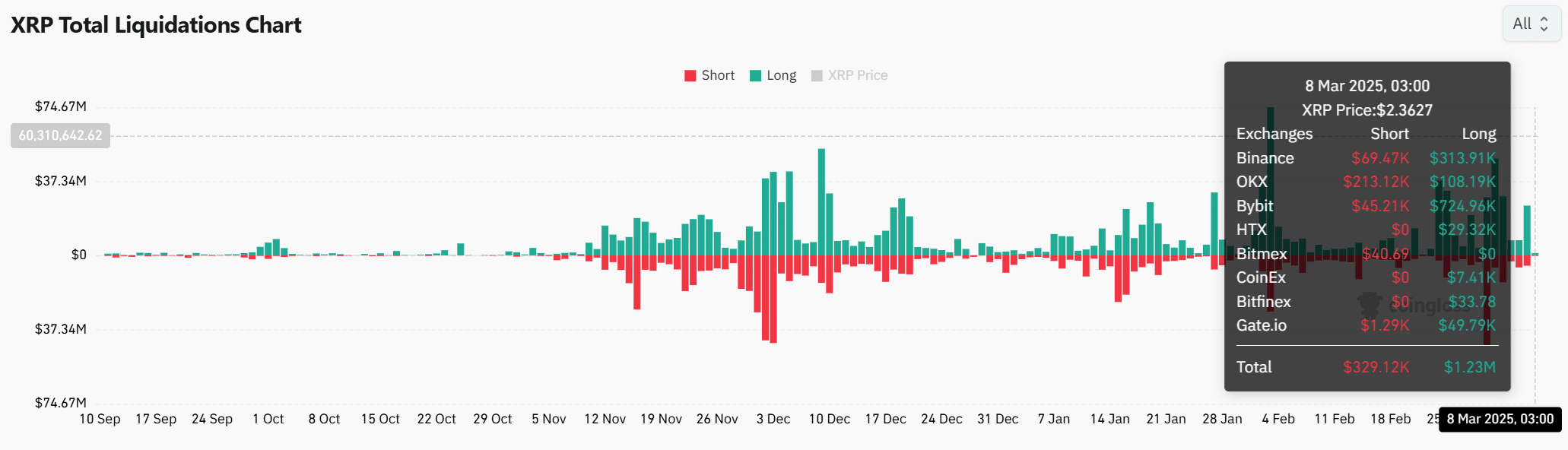

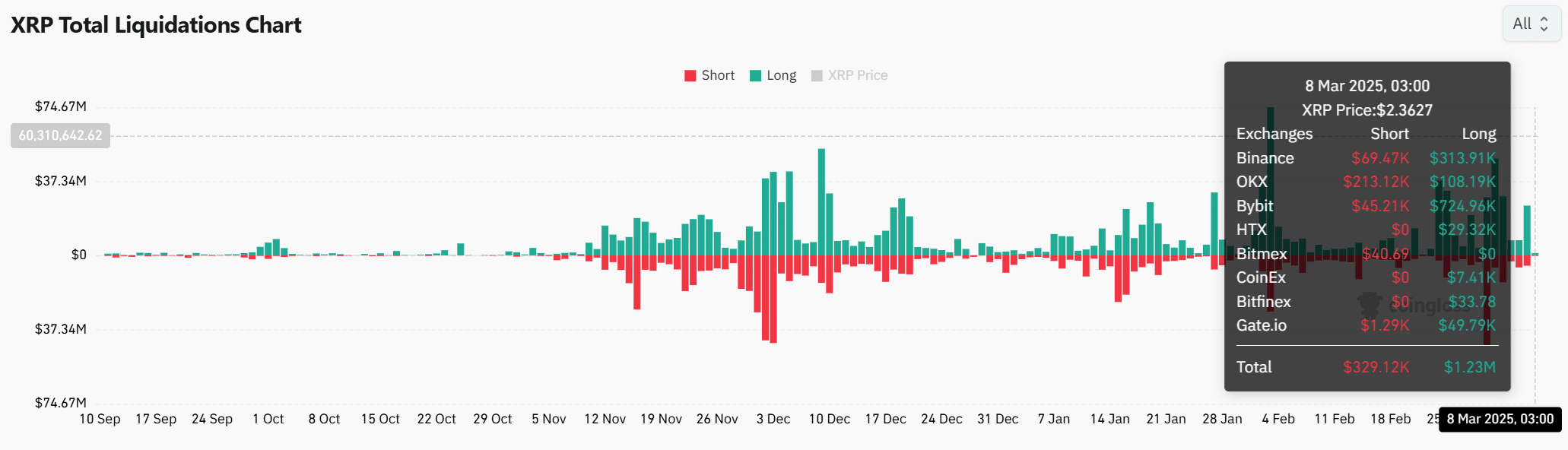

Long and short liquidation analysis – What do the liquidations reveal?

The long and short liquidations data highlighted notable fluctuations in market sentiment. In fact, the value of total liquidations recently climbed to $329.12 million, with long positions accounting for $1.23 million of that total.

Binance led the liquidation volumes, with $313.91k of long positions liquidated. This indicated a market that is uncertain about XRP’s direction, with traders betting on both bullish and bearish moves.

Source: Coinglass

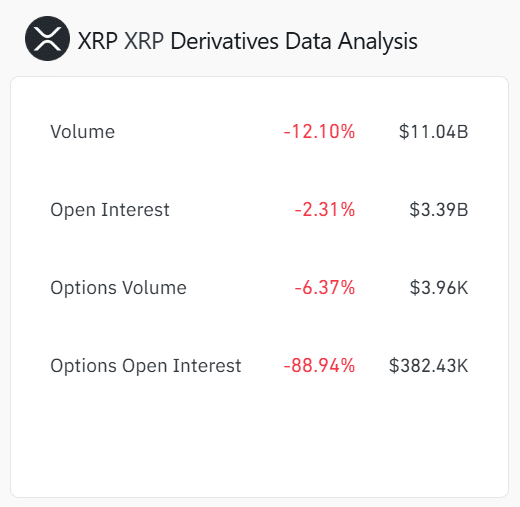

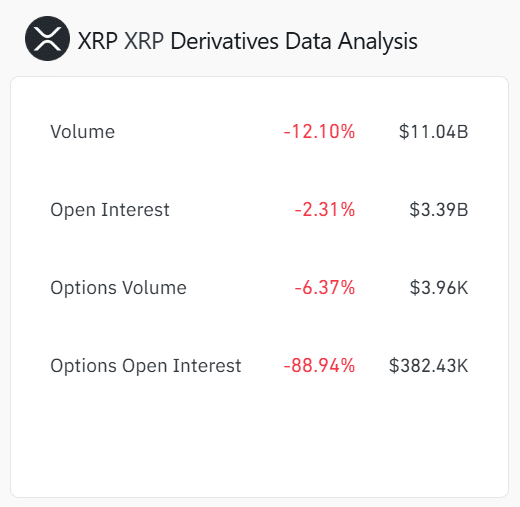

Derivatives data analysis – Cooling off or preparing for a move?

The latest derivatives data alluded to a cooling-off trend across XRP’s market. In fact, the trading volume dropped by 12.10%, with the same flashing figures of $11.04 billion at press time. Similarly, the Open Interest fell by 2.31% to $3.39 billion.

Notably, Options Open Interest fell by a staggering 88.94%. This suggested that market participants are less confident about its near-term price action. Therefore, while these figures hinted at a temporary lull, they also highlighted cautious sentiment among traders.

Source: Coinglass

Is XRP heading for a breakout or a slump?

Given the ongoing whale activity, a surge in the NVT ratio, and the ongoing technical consolidation, XRP may be poised for a potential breakout.

However, the cooling off in derivatives data and the neutral momentum on the charts suggested that any major movement could take some time to materialize. Therefore, XRP may break out soon, but it remains uncertain whether it will go bullish or fall further.