- XRP has emerged as a surprise winner in the “Trump pump,” making HODLing a smart move.

- The crypto space is ever-evolving, and the battle for dominance is far from over.

If there’s one coin that’s truly capitalized on the “Trump pump,” it’s Ripple [XRP]. Long-term HODLers, who endured three years of stagnation and inactivity, are finally seeing their patience pay off.

Even with the expected sell-side pressure as stakeholders lock in gains, the bulls have shown impressive resilience, fending off two pullbacks in under 10 trading days and keeping XRP steady around the $2.50 mark.

Now, with the tables turned, XRP is eyeing its next big 2025 target. Yet, the journey ahead isn’t without challenges, particularly as Bitcoin [BTC] holds its position as the “master card” in the crypto deck.

So, while XRP may have stolen the spotlight in this cycle, the question remains: Could this be the dawn of a new era for Ripple, or will Bitcoin’s gravitational pull bring it back in line?

Assessing XRP’s long-term potential in comparison to Bitcoin

The daily chart reveals an exciting shift: as Bitcoin consolidated, investors redirected funds into XRP, driving daily gains near 20% and edging it close to the $3 mark. But overheated conditions made a correction inevitable.

Just three days ago, XRP tumbled 15%, wiping out much of its election-cycle gains and hitting a $2 daily low. Yet, the rebound was swift and decisive.

Two key takeaways stand out: FOMO is powering bets on a $3 breakout, and those who were once underwater are now sitting pretty in profit – heightening the chance of a short-term pullback.

Yet, there’s a silver lining. These fluctuations are typical in the crypto market, where quick entries and exits are common.

So, what’s even more important? XRP’s growing appeal as a “solid alternative” and a “safe-haven” against Bitcoin’s high-risk volatility, hinting at a potential shift that warrants deeper exploration.

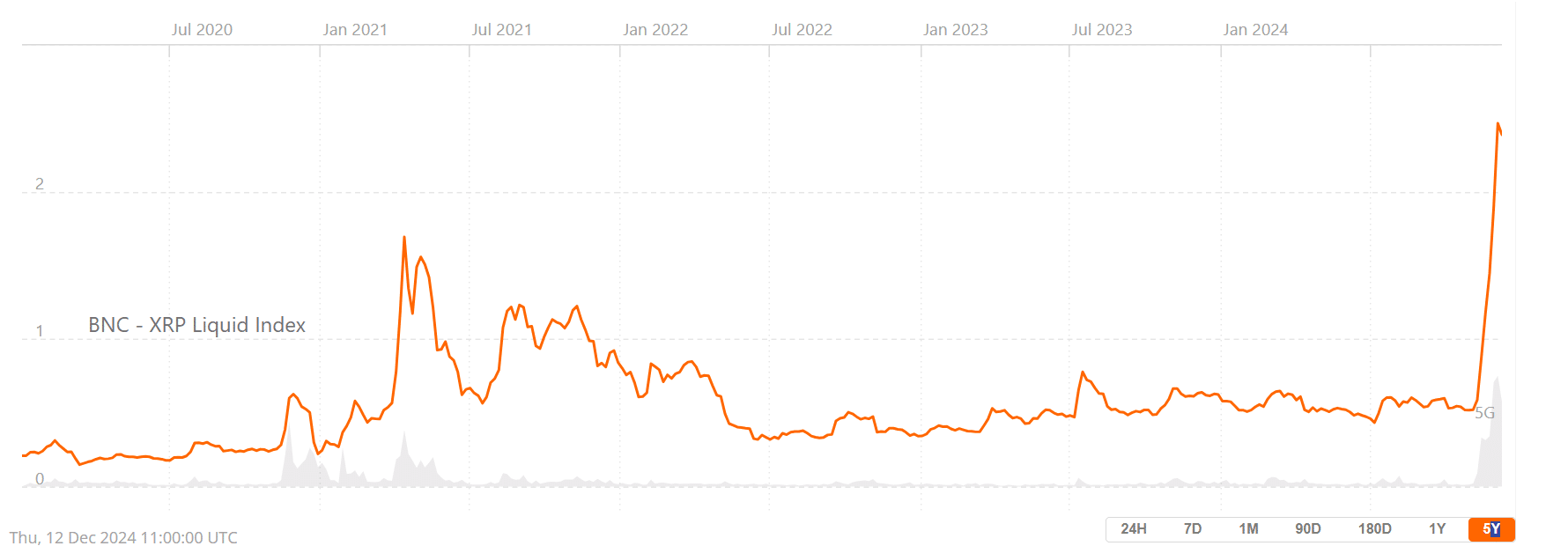

Source : BraveNewCoin

In a healthy market, high demand drives liquidity, and XRP is demonstrating this. Its liquidity index has soared to a five-year high, signaling a surge in demand for the token. This makes HODLing an increasingly logical choice for investors.

As more investors get involved, 2025 could see even more capital flowing into XRP, especially as Bitcoin’s status as a “risk-on investment” is set to grow.

With market makers speculating on a $200K all-time high for Bitcoin, XRP could benefit from increased interest as investors look for stable alternatives.

In short, 2025 could be a game-changer. This year might spark a surge in capital allocation and diversification, testing Bitcoin’s dominance and opening new opportunities in the altcoin market for both retail and institutional investors.

But, what are the odds of Ripple leading the charge?

XRP’s breakthrough above the $2 resistance couldn’t have come at a better time, laying the groundwork for investors to confidently bet on its future potential.

The psychology behind it is clear—XRP’s impressive 300% surge in just one month has catapulted it into the spotlight, positioning it as a strong contender in the crypto market.

With this powerful rally, it’s no wonder that both retail and institutional investors are placing XRP at the forefront of their portfolios.

Read Ripple [XRP] Price Prediction 2024-2025

However, the race to claim XRP’s top spot is heating up. While Dogecoin [DOGE] briefly took the spotlight, its reign was short-lived. However, this doesn’t mean the throne remains unclaimed—other rivals are lurking, eager to take their shot.

So, while current conditions are favorable for Ripple and its reputation as a safer bet during volatile times, securing its dominance won’t be easy.

To stay ahead, XRP must keep breaking key psychological barriers with every bull run. In the short term, reaching $3 could drive FOMO and maintain momentum.

However, for XRP to truly cement its place as the top investment in 2025, it needs to break through much higher levels. It needs to prove it’s here to stay, not just another passing trend.