- Ripple’s XRP experienced its highest bullish sentiment in the past 14 months.

- XRP could see a potential reversal and may surge 25% to the $0.75 level.

The current market sentiment looks bearish as top assets have experienced significant downside momentum in the past few days.

Amid this downturn, on the 2nd of August, on-chain analytic firm Santiment made a post on X (formerly Twitter) stating that Ripple [XRP] had experienced its highest bullish sentiment in the past 14 months.

XRP reaches highest bullish sentiment in over a year

According to the post, in the current situation, traders are optimistic only about top cryptocurrencies, including Bitcoin [BTC], Ethereum [ETH], Solana [SOL], and XRP.

Santiment also noted that along with XRP, Bitcoin also experiencing its highest bullish sentiment in 17 months.

Despite this bullish outlook for top assets, investors’ eyes are on XRP as it has outperformed all these mentioned cryptocurrencies in terms of price surge in the past 30 days.

XRP performance

At press time, XRP was trading near $0.57, having experienced a price drop of 6.4% in the last 24 hours. However, over a longer period, XRP has seen a price jump of over 20%.

This 20% price surge in the last 30 days is much higher than BTC, ETH, SOL, and BNB as they have experienced a price change of 2.9%, -8.5%, 12%, and -1.5% respectively, during the same period.

Technical analysis and key levels

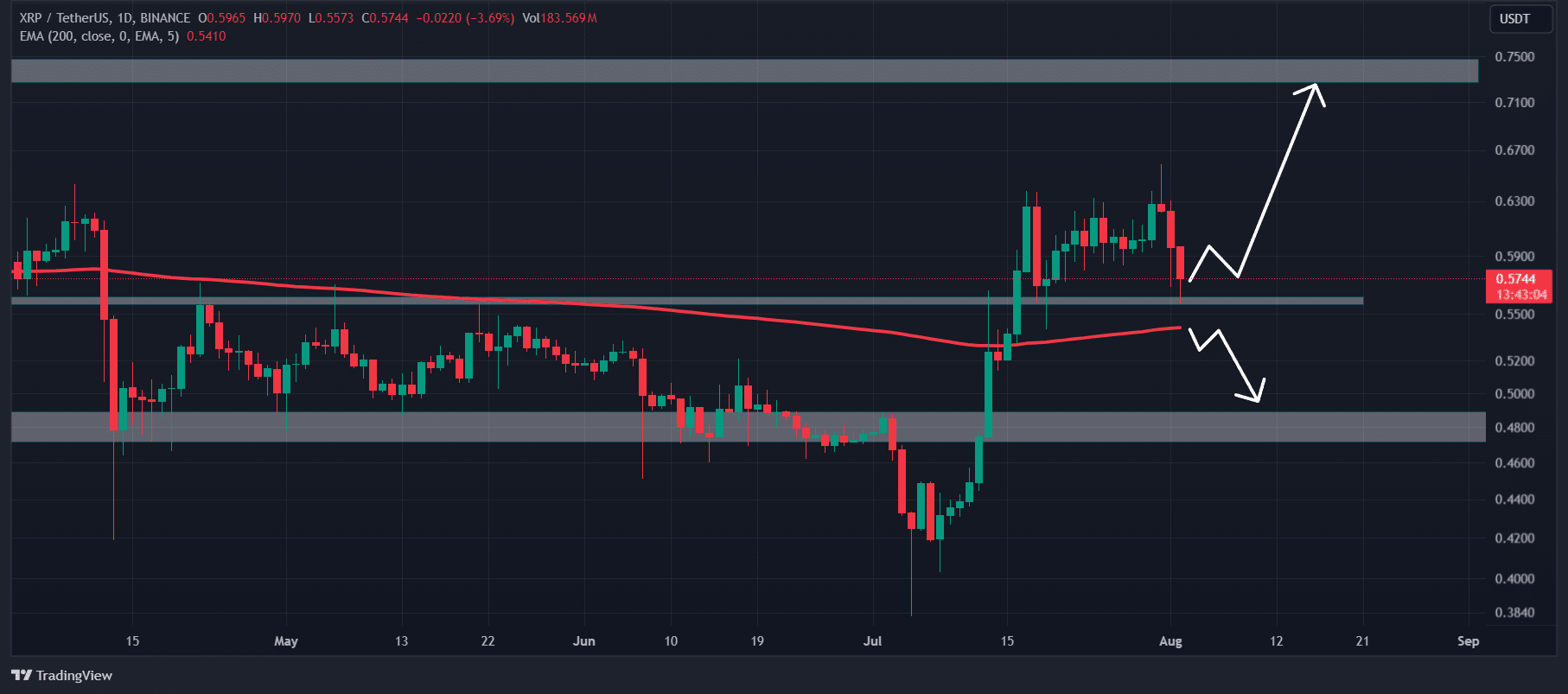

According to expert technical analysis, XRP looked bullish and may experience a price reversal from the currency level. There is also a high chance that it could soar over 25% and reach the $0.75 level in the coming days.

Source: TradingView

On daily and 4-hour time frames, XRP is trading above 200 Exponential Moving Average (EMA). The price of any asset above 200 EMA suggested that the asset was still bullish.

Additionally, XRP has recently taken support from the 200 EMA in the 4-hour time frame. Following that support, it is now experiencing an upside move.

Despite the bullish outlook, if XRP fails to maintain the current $0.57 level and gives a daily candle closing below the $0.55 mark, it could see a price drop of over 12%.

Crucial levels for XRP

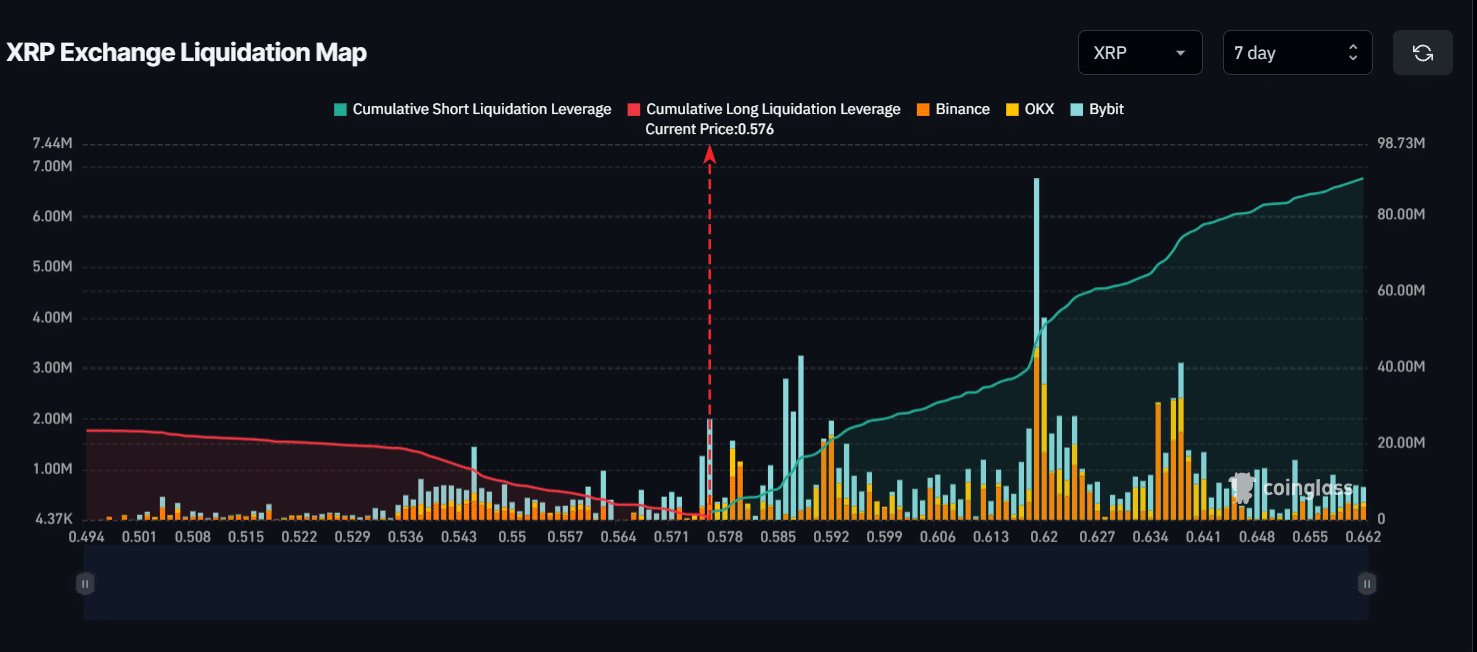

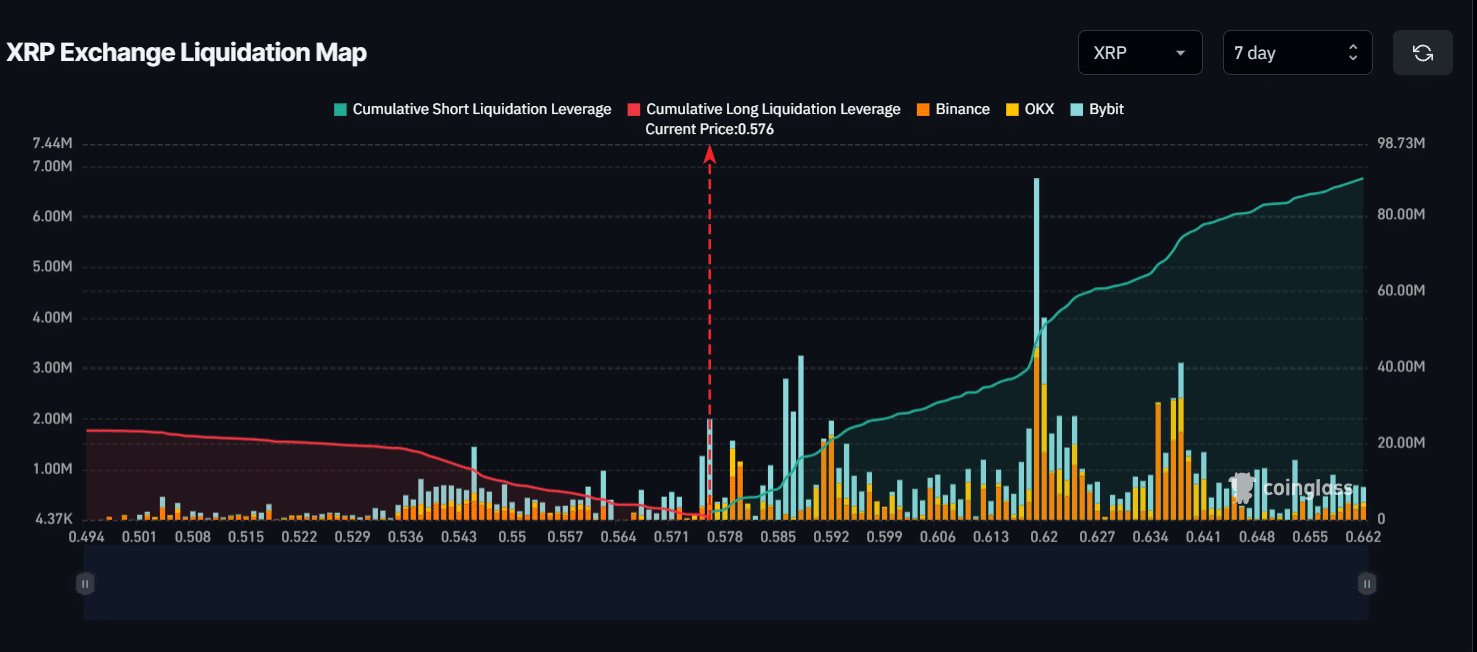

As of now, the major liquidation levels are at $0.619 on the higher side and $0.545 on the lower side, according to an on-chain analytic firm Coinglass.

If the market sentiment remains unchanged and XRP falls to $0.545, nearly $13.03 million of the long position will be liquidated.

Read Ripple’s [XRP] Price Prediction 2024-25

Conversely, if sentiment changes and the XRP price soars to $0.619, nearly $46.98 million of short position will be liquidated.

Source: Coinglass

In the last 24 hours, XRP’s Open Interest (OI) has dropped by 12.5%, signaling lower interest from investors and traders.