- SOL has declined by 14.72% over the past seven days.

- An analyst eyes a 40% move if Solana breaks above $214 or below $183.

Since reaching a local high of $223, Solana [SOL] has failed to keep up with the uptrend. As such, over the past 4 days, the altcoin has traded sideways, consolidating within a range of $184 and $193.

In fact, as of this writing, Solana was trading at $183. This marked a 1.42% decline on daily charts. Equally, SOL has declined on weekly and monthly charts, dropping by 14.72% and 18.68% respectively.

This sustained decline has left the Crypto community talking over the altcoin’s price movement. Inasmuch, popular crypto analyst Ali Martinez has suggested a potential 40% price move, citing a symmetrical triangle.

Market sentiment

In his analysis, Martinez observed that Solana is consolidating within a symmetrical triangle.

Source: X

When an asset is consolidating within this triangle, it indicates that prices are making lower highs and higher lows. This suggests the market is experiencing indecision, with both buyers and sellers struggling to gain control.

Historically, prices usually break out before hitting the apex, accompanied by a spike in volume.

According to Martinez, a breakout above $214 or below $183 could spark a 40% move. A move above $214 could see the altcoin hit $299, while a move below $183 could drop it to $109.

What SOL charts suggest

The analysis above provides a potential price movement for SOL, either to the upside or the downside. This implies that the market is at a crossroads and both sellers and buyers are attempting to retake the market.

In the short term, according to AMBCrypto’s analysis, SOL is experiencing strong bearish sentiments and the altcoin is likely to record some losses.

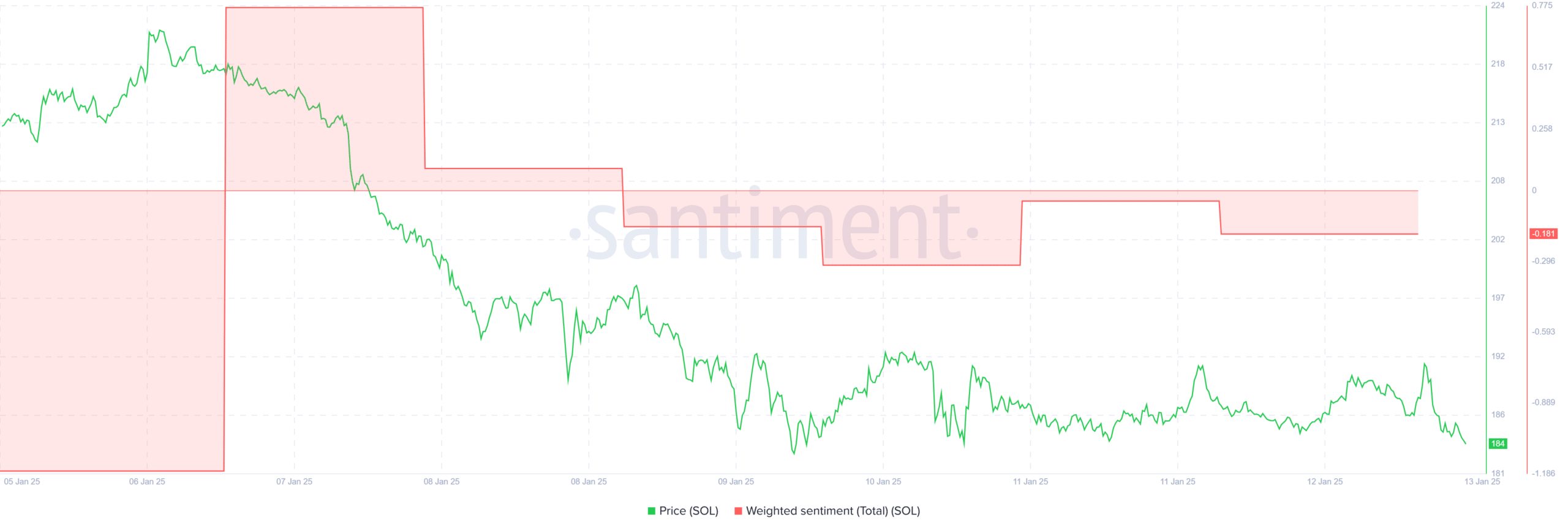

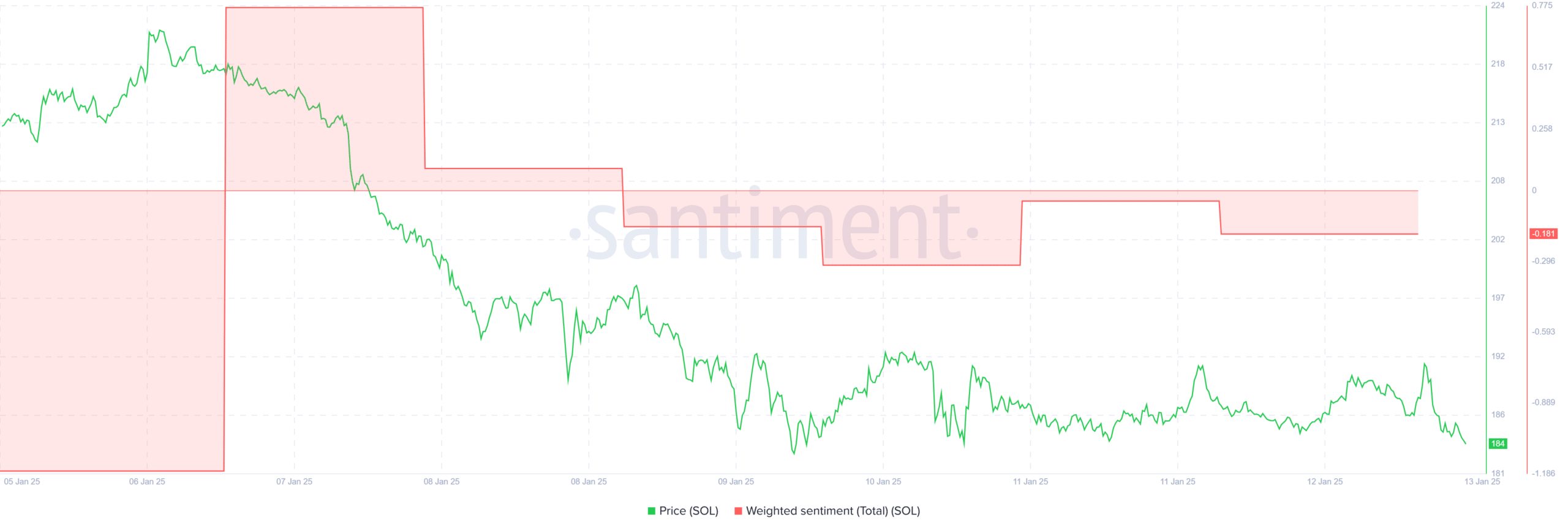

Source: Santiment

We can see this bearishness as market sentiments have remained negative over the past 4 days. As such, weighted sentiment turned negative days ago, signaling that market sentiments are strongly bearish.

Source: TradingView

Additionally, Solana’s Directional Movement Index (DMI) has pointed towards a strong downward pressure. This is evidenced as +DI has dropped to 13 while ADX continues to rise to 23 suggesting a strengthening downward momentum.

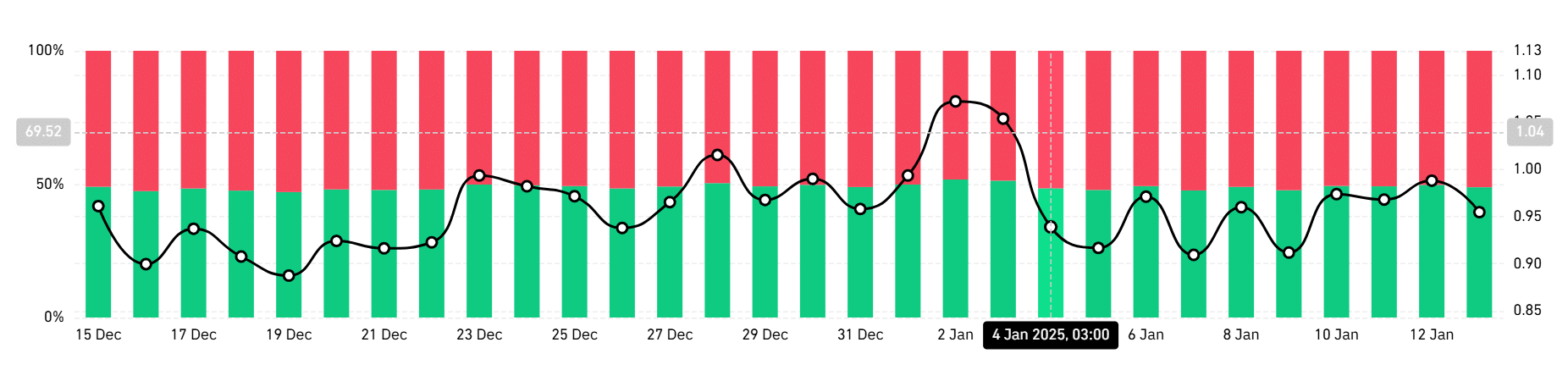

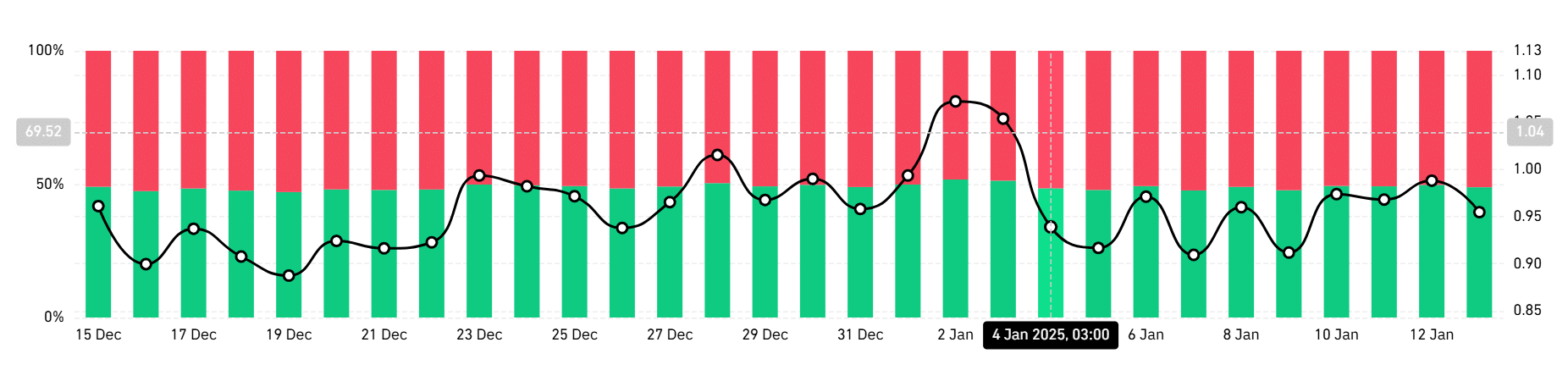

Source: Coinglass

Looking further, most market participants are going short. Currently, 52% of accounts are taking short positions, while 48% are taking long positions. With short positions dominating, it suggests that most investors are bearish and expect prices to decline.

Read Solana’s [SOL] Price Prediction 2025–2026

Simply put, SOL is experiencing a strong bearish sentiment. Therefore, the altcoin is likely to break below $183.

If it drops below the consolidation range, it will find support around $175. Conversely, a move above this range will see Solana reclaim the $220 resistance level.