- An analyst eyes a move to $2.4 for XRP, citing an ascending triangle.

- XRP has surged by 20.7% in seven days as demand for the altcoin recovers.

Over the past week, Ripple[ XRP] has made a strong upswing on its price charts. Over this period, the altcoin has surged from a local low of $1.6 to $ a high of $2.2.

In fact, at the time of writing, XRP was trading at $2.13. This marked a 20.73% over the past 7 days. On daily charts, the altcoin has also made significant gains.

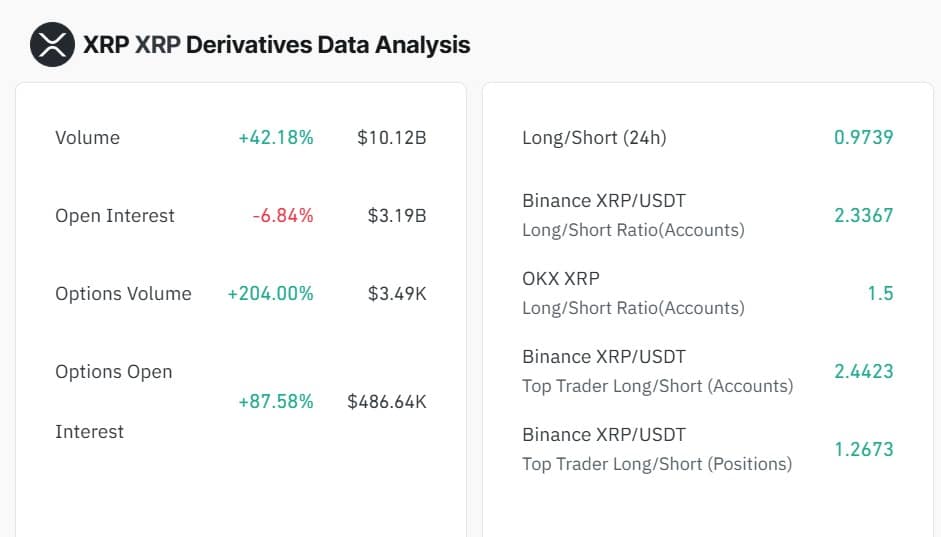

Inasmuch so, the volume has spiked by 42.18% to $10.12 billion, while options volume surged by 204% to $3.49k. Equally, the altcoins’ Options Open Interest was up by 87.5% to $486.6k.

Source: Coinglass

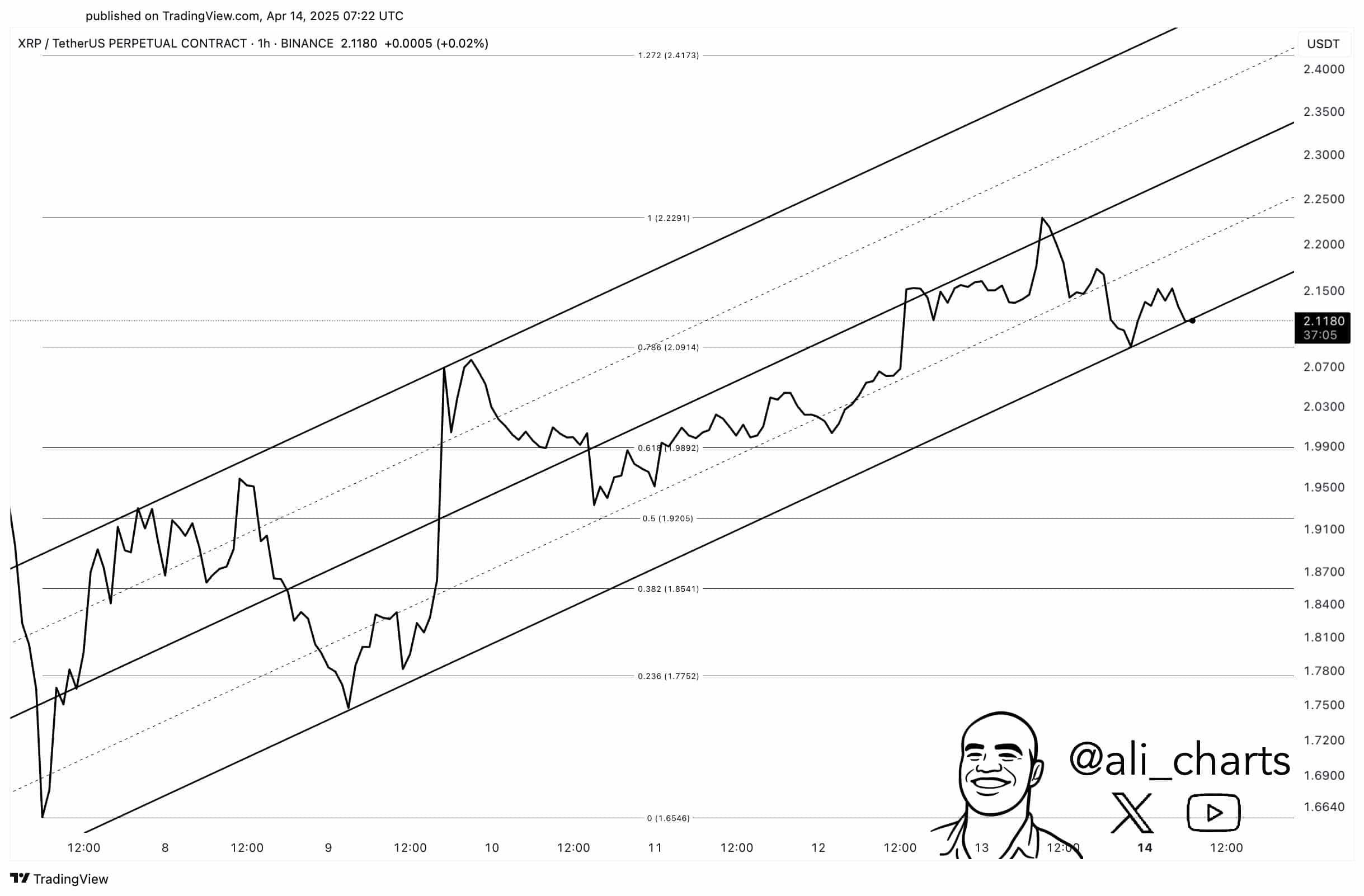

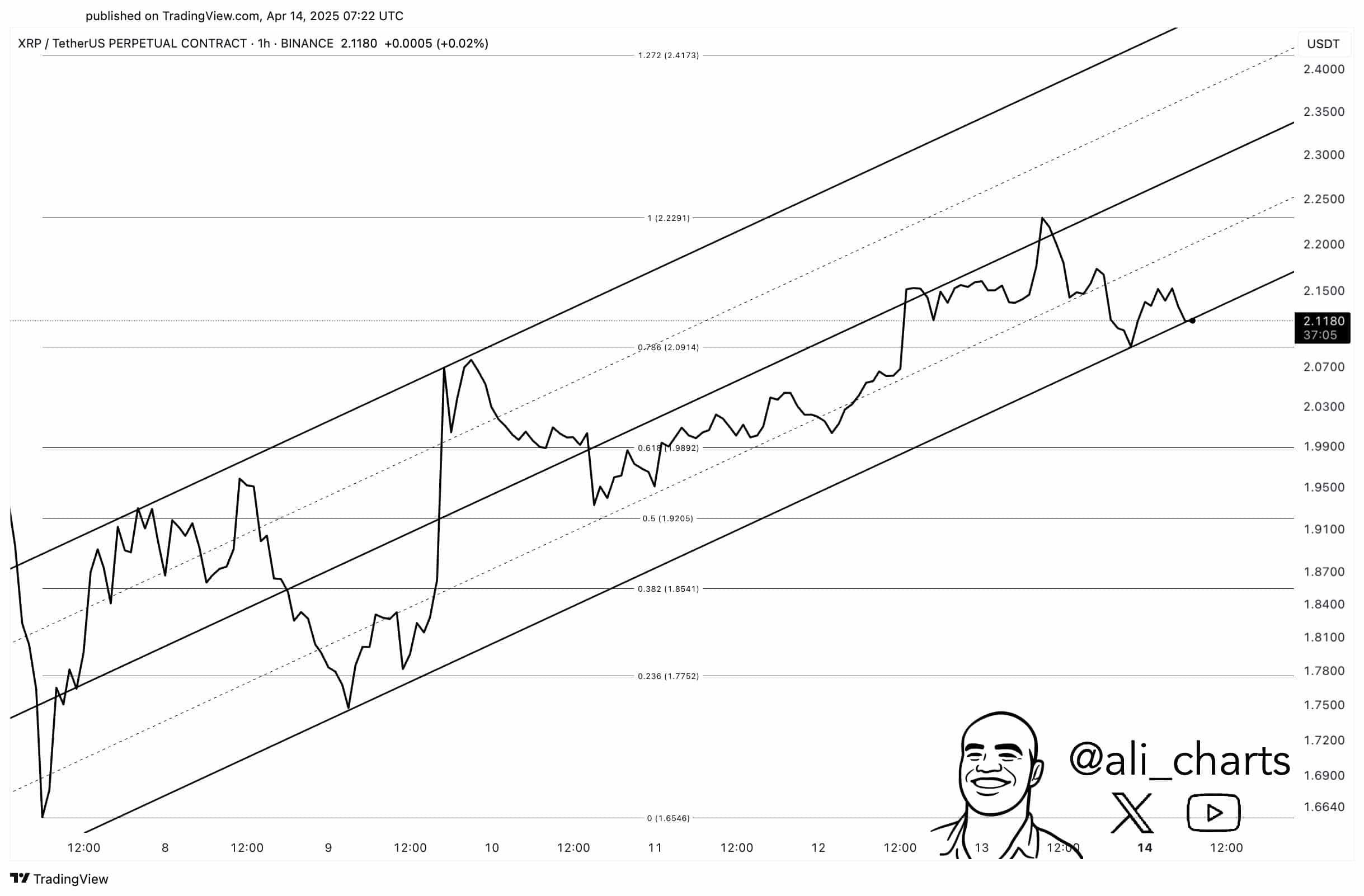

The recent price pump has left analysts eyeing a strong upward movement. Inasmuch, popular crypto analyst Ali Martinez has predicted a rally to $2.4.

Source: X

According to Martinez’s analysis, XRP is currently trading within an ascending triangle. This pattern is typically a bullish continuation signal, indicating that buyers are gradually gaining strength.

Martinez suggests that XRP will face key resistance at around $2.22. A breakout above this level could trigger a significant upward move toward $2.40.

The pressing question remains: Can XRP maintain its momentum and achieve sustained gains?

Can XRP sustain gains?

AMBCrypto’s analysis indicated that XRP was experiencing strong upward momentum, driven by growing bullish sentiment.

Despite a slight drop over the past day, the altcoin’s DEX buy-sell ratio remains above 1, standing at 1.5 at press time. This means that for every sell order, there are 1.5 buy orders, indicating higher buying pressure.

As a result, more buy orders are being executed in the market compared to sell orders, further supporting the bullish momentum.

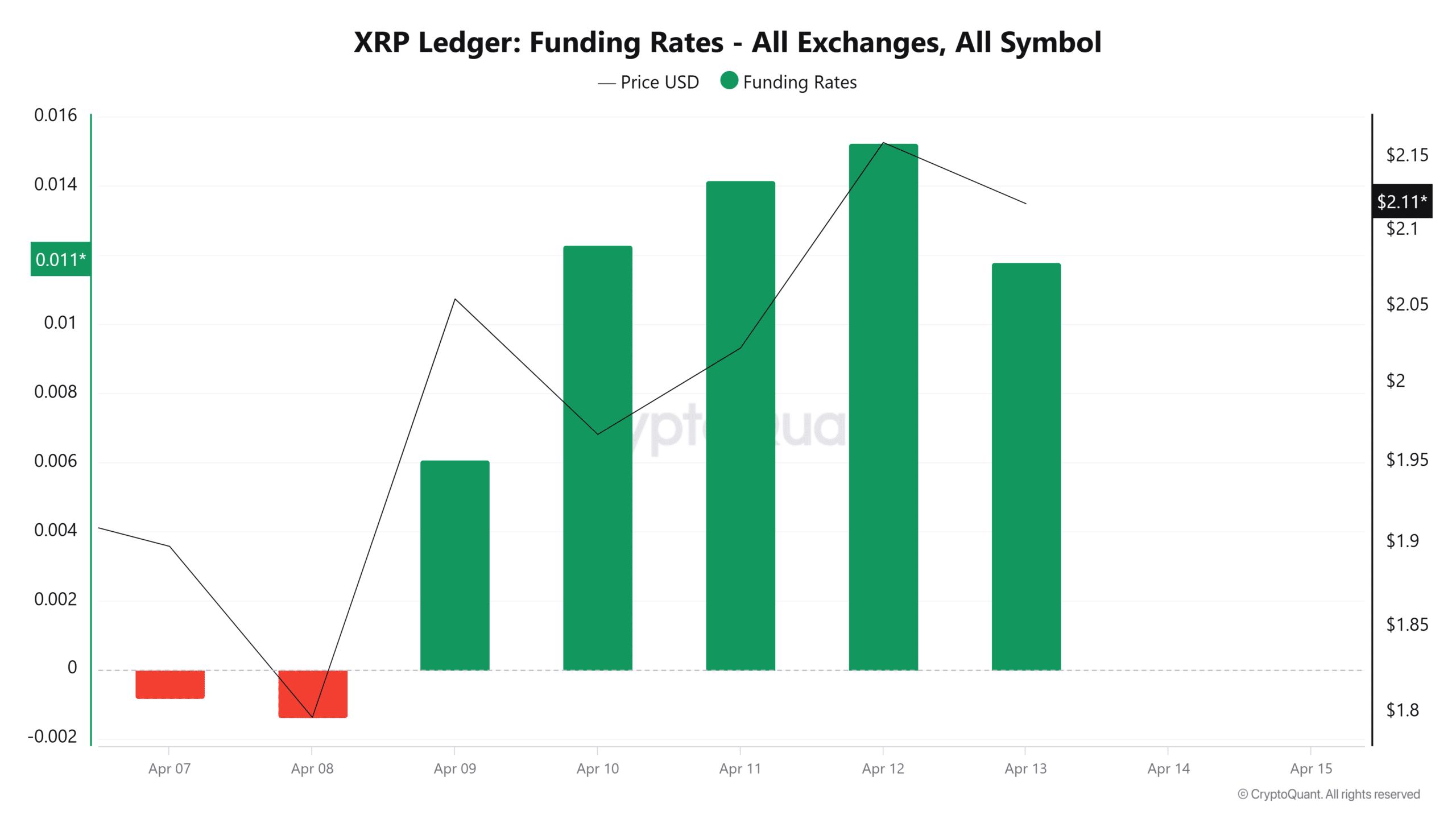

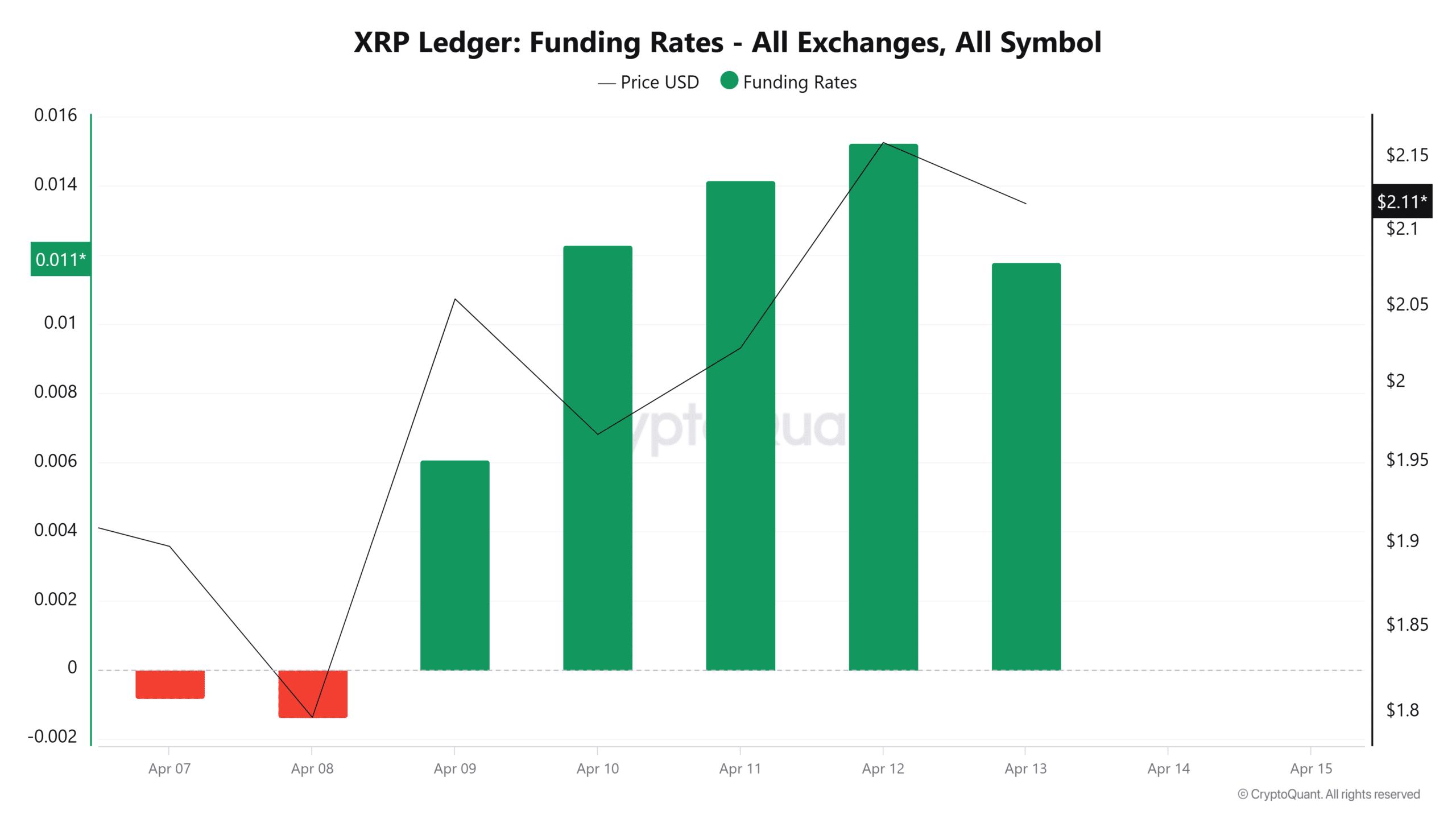

Source: CryptoQuant

Additionally, with XRP’s Funding Rate holding positive over the past five days, it suggests that investors are bullish and are going long.

As such, those buy orders and rising options volume mean market entrants are getting into the market and taking long positions, reflecting strong bullish sentiments.

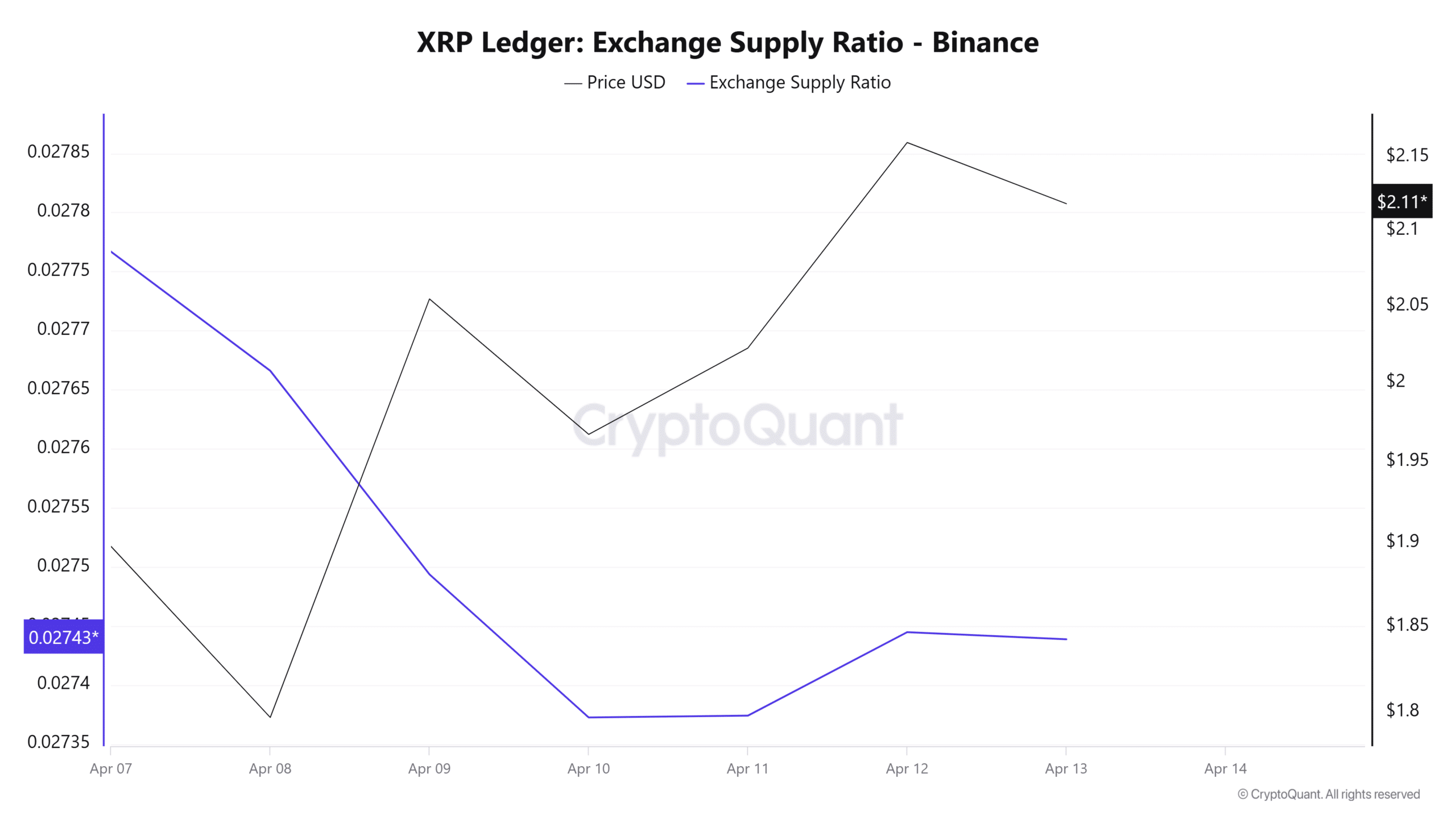

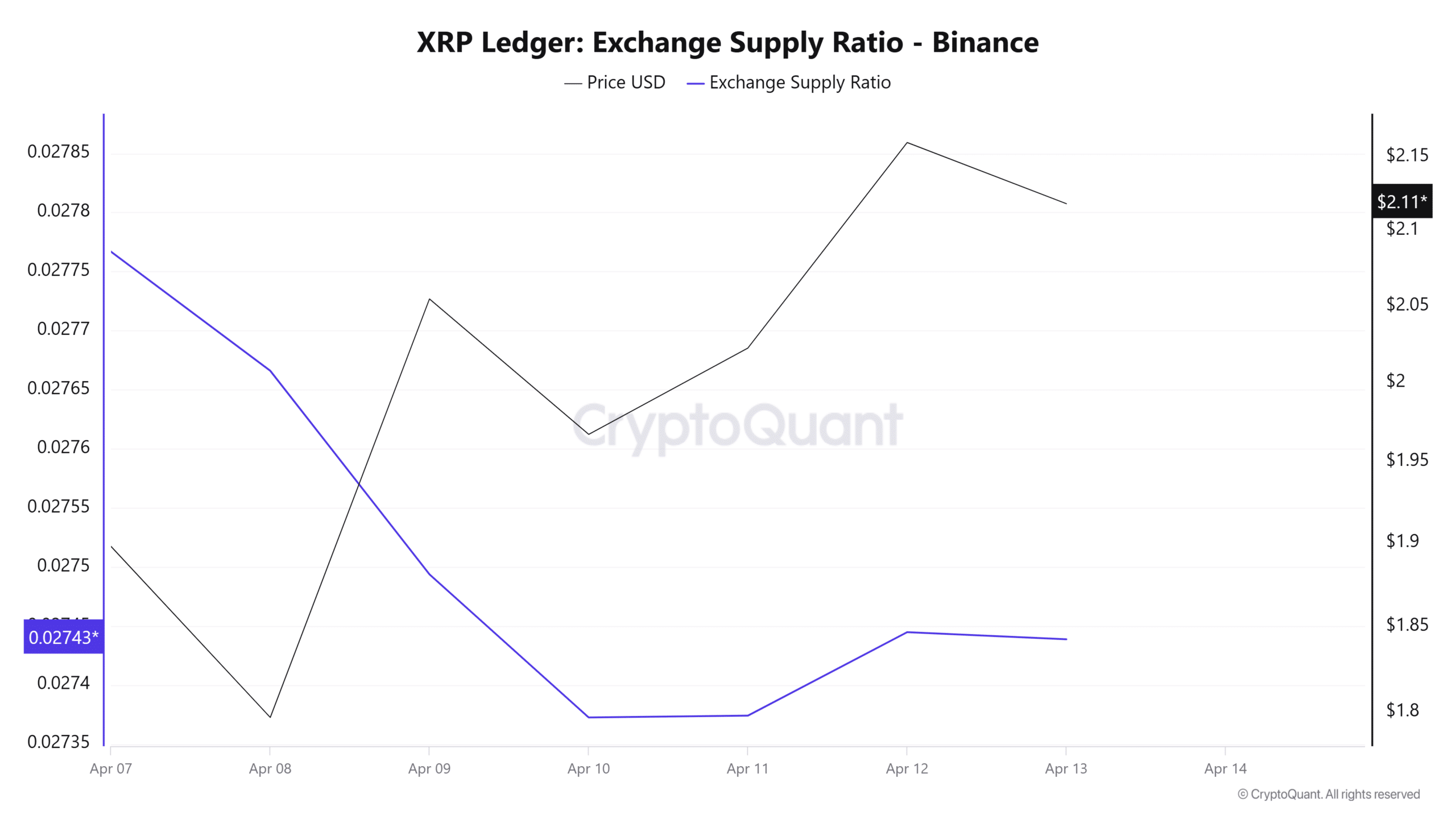

Source: CryptoQuant

Finally, XRP’s Exchange Supply Ratio has declined over the past week to 0.02743. With supply into exchange declining, it implies that investors and holding are sending fewer XRP tokens to exchanges to sell.

Usually, such market behavior reduces selling pressure, which in turn plays a key role in price stability.

Source: Cryptoquant

In summary, XRP is benefiting from favorable market conditions, positioning the altcoin for further price gains.

If the current sentiment remains strong, XRP could reclaim the $2.2 resistance level. A breakout above this level may lead to an attempt at $2.5.

However, if a pullback occurs at $2.2, XRP could retrace to $1.9.