- WIF, at the time of writing, was caught in a ‘tug-of-war’ with its price movement hinging on a few key factors

- A breakout can happen if certain conditions are met

Compared to the market’s leading altcoins, memecoins have seen modest monthly gains, with Dogecoin [DOGE] leading the pack with a 130% hike.

However, dogwifhat [WIF] has underperformed, particularly in comparison to its Solana-based counterparts, some of which have recorded impressive four-digit gains.

Despite this, it might still be too early to write off WIF as one of the biggest losers. Right now, there’s a ‘tug-of-war’ between high-cap and mid-cap tokens as they compete to pull capital away from Bitcoin.

As the fourth-largest high-cap memecoin, WIF might be poised for a breakout after two weeks of consolidation, with $4 now in its sights.

If it reclaims this level, FOMO could take hold, potentially setting WIF up for a new all-time high – But only if investors resist the allure of mid-caps.

WIF needs the loyalty of big players

In mid-November, WIF surged by over 4% in a day, marked by a long green candlestick, nearing its March bull run peak of $4.85.

This level seemed to present strong resistance. And, breaking through could position WIF for a new all-time high, potentially surpassing $5 by Q4’s end.

Optimism was evident on the price chart too as WIF has been consolidating within the $3–$4 range, offering a silver lining for investors awaiting a breakout. Especially with the RSI holding in neutral territory – A sign of potential upside.

And yet, the possibility of a correction still looms, as big players appear to be entering a distribution phase, either locking in profits from previous dips or lacking confidence in a rebound.

Their hesitation to break WIF past $4 could raise concerns among investors, making it crucial to monitor their actions closely.

Low and mid-caps presents another obstacle

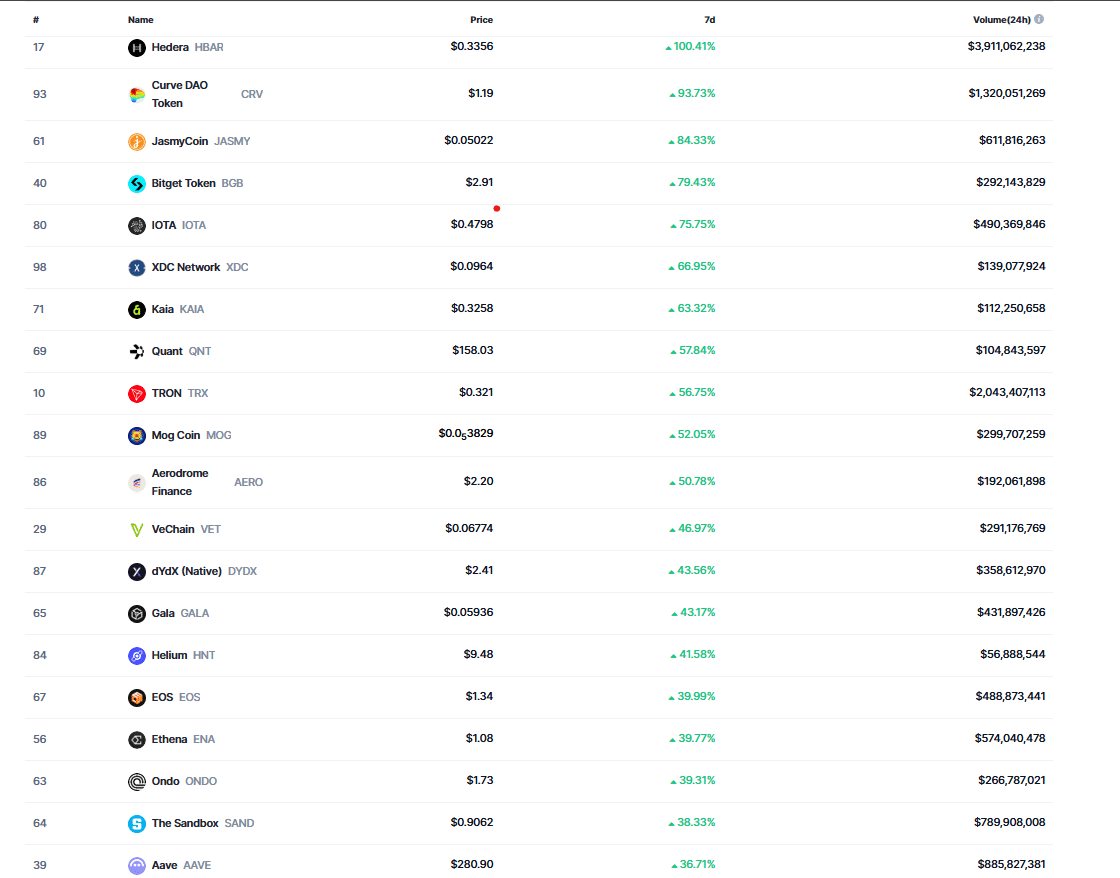

To gauge investor sentiment, analyzing the past week’s token performance is essential as it sets the tone for December and signals the end of the Trump-pump.

Source : CoinMarketCap

While this doesn’t quite spur a bearish outlook for WIF, it highlighted a shift in investor attitude. One where many seem to prefer the stability of these lesser-known tokens which are less prone to volatile movements, unlike memecoins.

That being said, there’s still potential for WIF to break past $4. Especially with its market cap rising by over 9% to $3.62 billion. However, it still remains a highly speculative asset.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

Given the current market dynamics, with big players breaking even, WIF’s chances of a rebound are weak. Especially as the coin remains heavily reliant on these players to form a solid bottom.

Unless this trend reverses—where whales see the current price band as a buying opportunity and more capital flows into speculative assets—WIF will likely struggle to break $4 to achieve a parabolic run to a new all-time high.