- Toncoin’s price rose 3.6% to $6.39, but network activity, including swaps and active addresses, declined.

- Analysts linked price trends to decentralized exchange engagement.

Toncoin [TON] is experiencing a notable recovery after hitting a recent low of $5.53 on the 10th of December.

The cryptocurrency, which had faced a downward trend in recent weeks, has surged by 3.6% in the past day, trading at $6.39 at the time of writing.

Despite this uptick, TON remained down by 3.3% over the past week and nearly 3.9% in the last two weeks.

This fluctuating performance has caught the attention of analysts, who have revealed factors driving TON’s price movements.

A CryptoQuant analyst recently shared insights into TON’s network activity, highlighting a decline in decentralized exchange (DEX) engagement.

The analyst noted a decrease in the number of swaps and available liquidity pools on TON’s DEX platforms, including Stone.FI and DeDust.

Historically, increased activity on these DEXs has been directly correlated with rising TON prices, while decreased engagement has accompanied price corrections.

This trend suggests that TON’s price volatility, particularly the fluctuation between $7.20 and $5.20, has led to reduced interest in decentralized trading and liquidity provision.

Mixed signals emerge

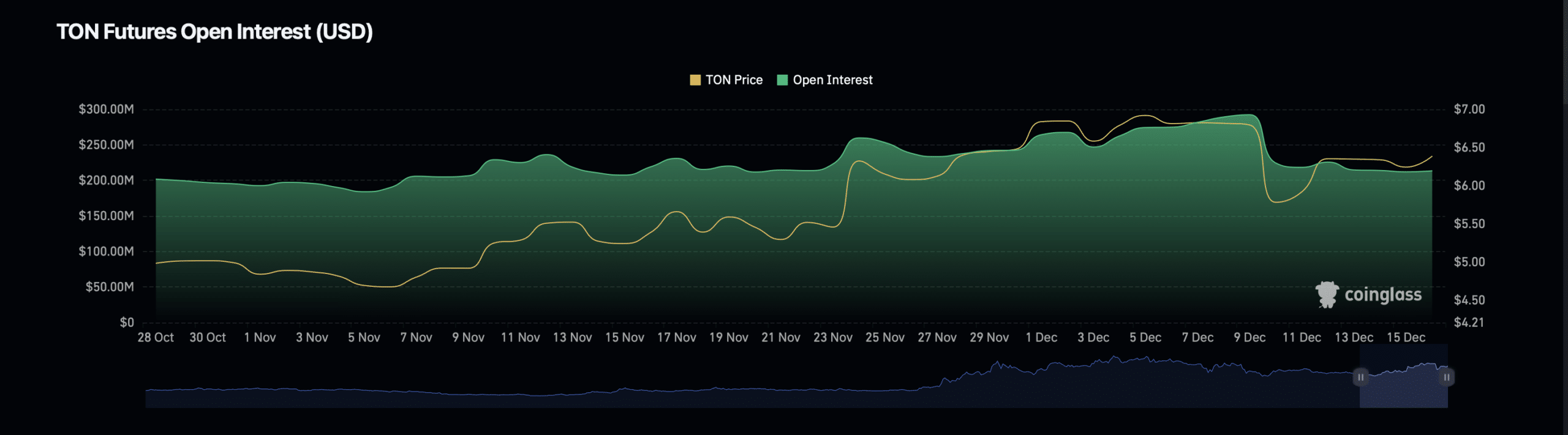

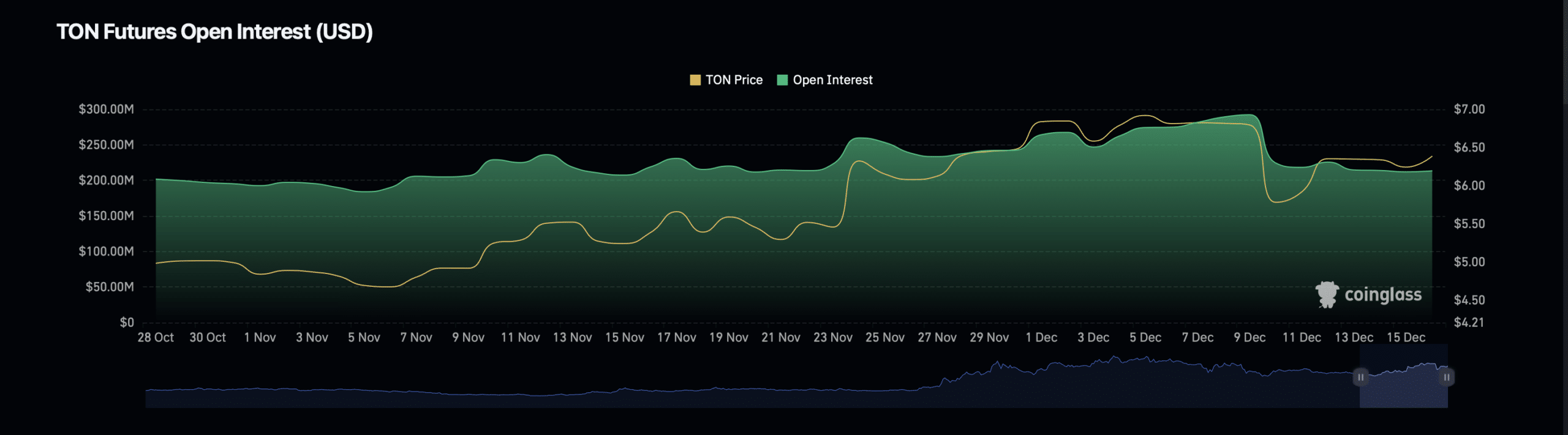

Despite the observed decline in DEX activity, TON’s Open Interest—a measure of the total value of outstanding derivative contracts—has shown positive momentum.

Data from Coinglass indicated that TON’s Open Interest has increased by 2.77%, reaching $214.07 million. Similarly, the Open Interest volume has risen by 7.10%, now valued at $169.73 million.

Source: Coinglass

These metrics suggest renewed interest from traders and investors in TON’s derivatives market, potentially signaling a more optimistic outlook for the cryptocurrency.

However, data from Glassnode painted a less favorable picture. Notably, TON’s active addresses, which indicate the number of unique users engaging with the network, have been on a consistent decline.

Source: Glassnode

Active addresses have dropped from 3.8 million in late October to just 1 million as of the 15th of December.

Read Toncoin’s [TON] Price Prediction 2024–2025

This significant reduction reflects waning user engagement, which could pose challenges for sustaining price momentum in the long term.

The drop in active addresses may indicate a decrease in retail participation or overall interest in the TON ecosystem, potentially limiting network growth and adoption.