- Only 1% of Polygon investors were in profit.

- Metrics suggested that buying pressure was rising.

Since its move from MATIC to POL, Polygon has been facing troubles when it comes to price. However, things might look up soon.

Notably, a bullish pattern has appeared on POL’s chart, which could result in massive growth.

A bull pattern on Polygon’s chart

Polygon has been witnessing major price corrections lately. According to CoinMarketCap, POL’s price dropped by over 3% last week. The bearish trend continued in the last 24 hours as its value declined by 1%.

At the time of writing, the token was trading at $0.3682 with a market capitalization of over $2.8 billion, making it the 31st largest crypto.

Because of the continued price declines, the majority investors were pushed out of profit. To be precise, only 10.3k POL addresses were in profit, which accounted for just over 1% of the total investors.

Source: IntoTheBlock

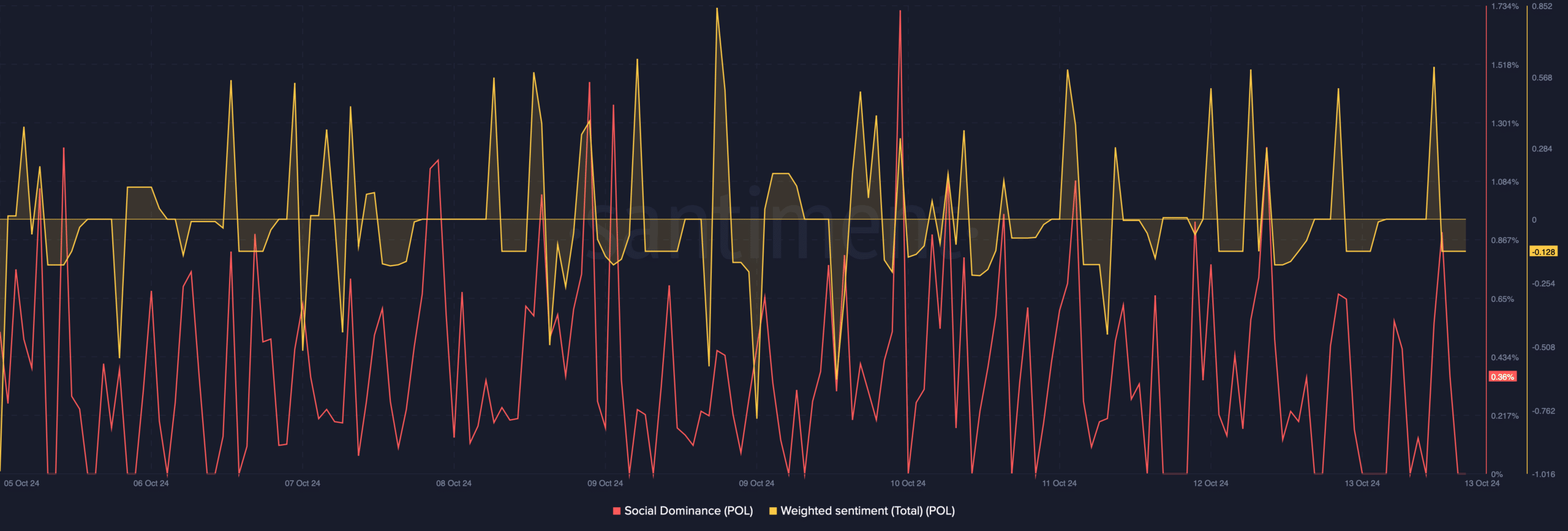

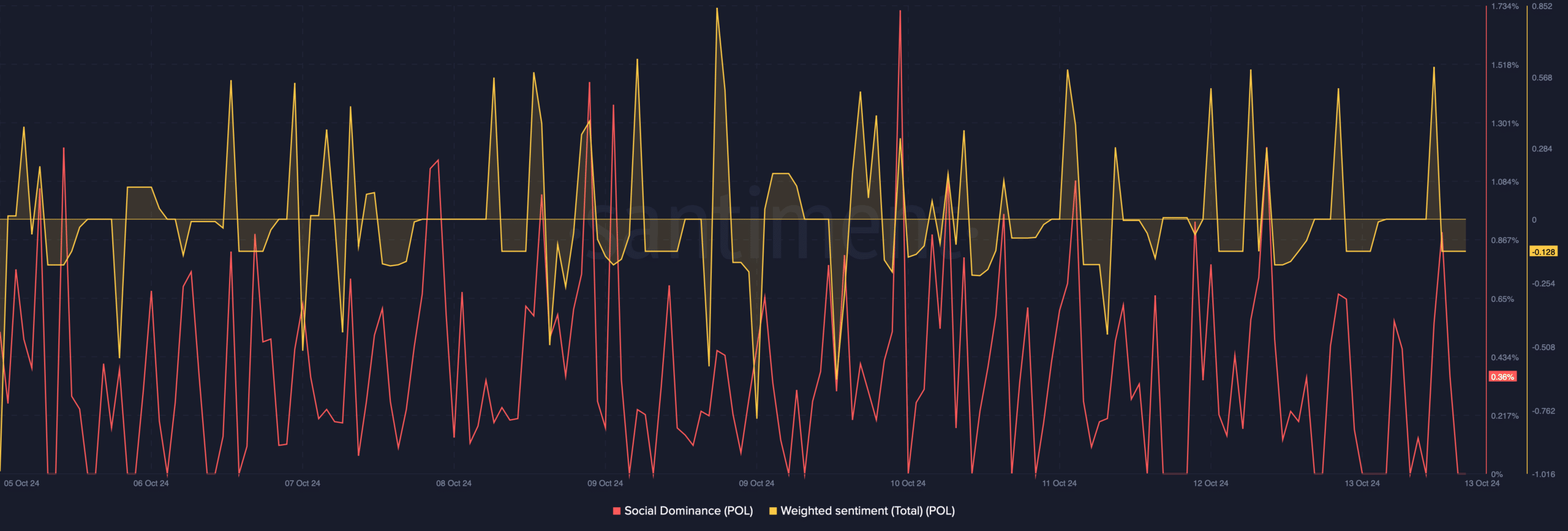

This also had a negative impact on the token’s social metrics. For instance, the token’s Social Dominance fell last week, reflecting a decline in its popularity.

The Weighted Sentiment also went into the negative zone. This meant that bearish sentiment around POL was dominant in the market.

Source: Santiment

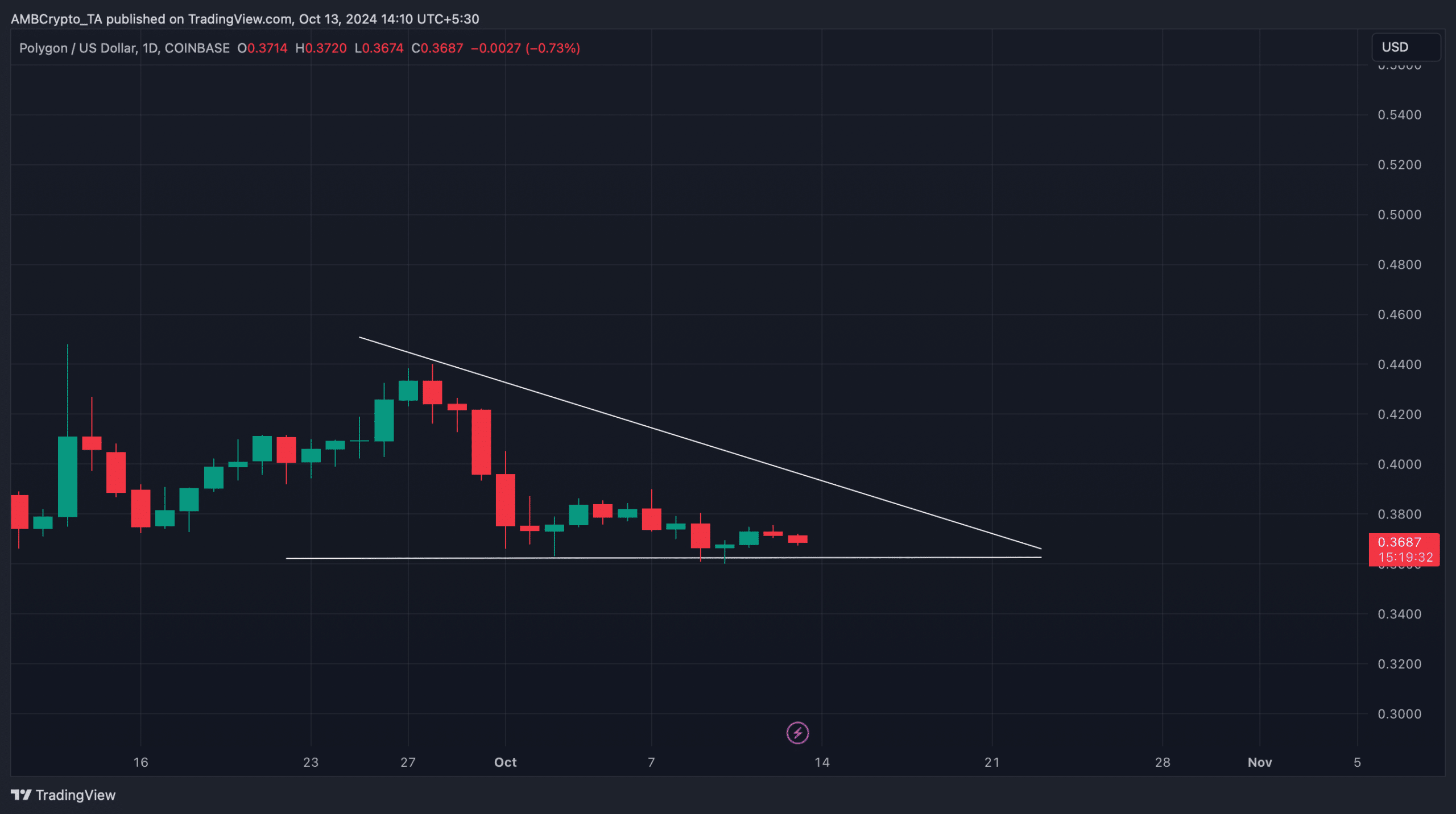

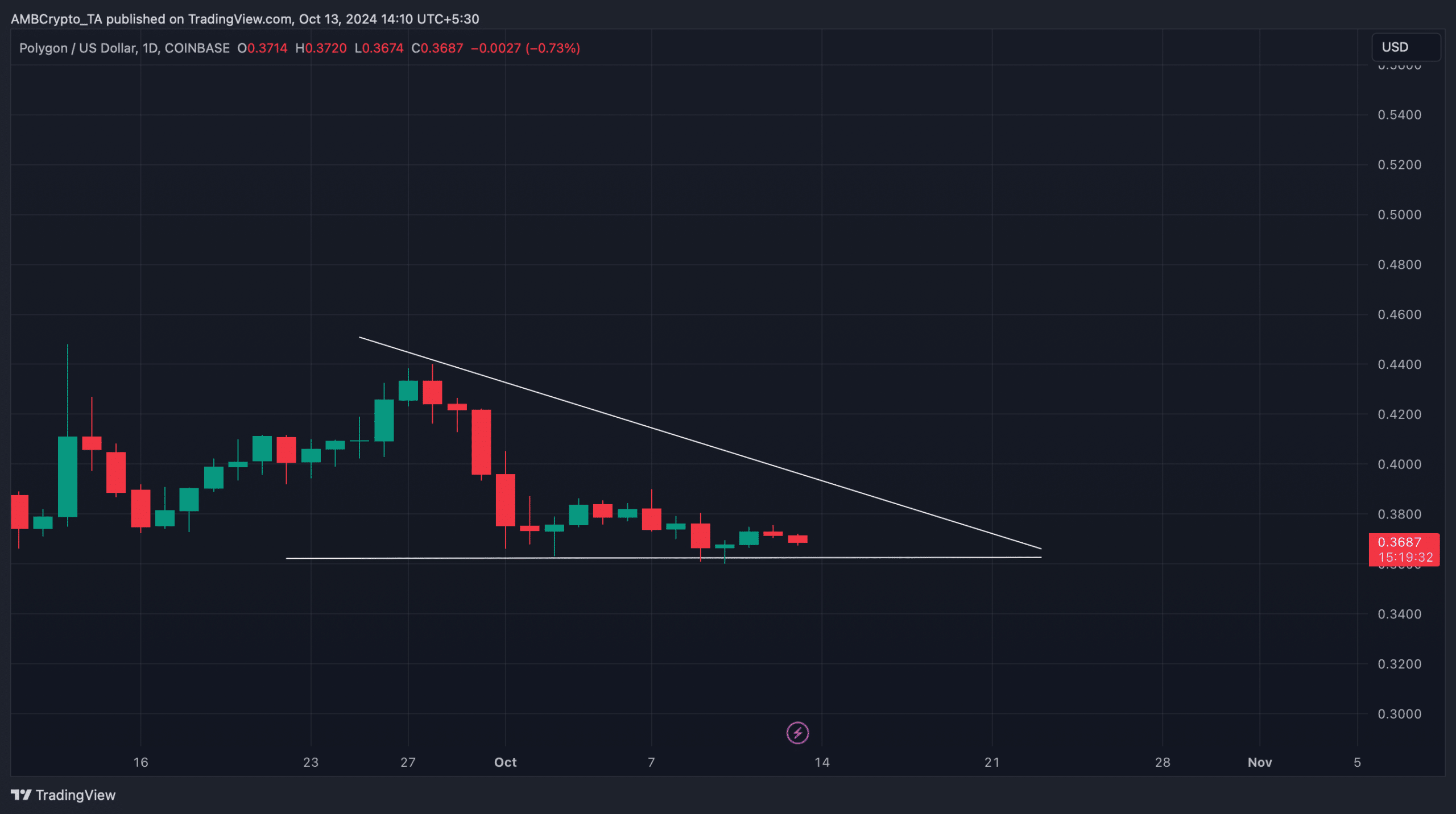

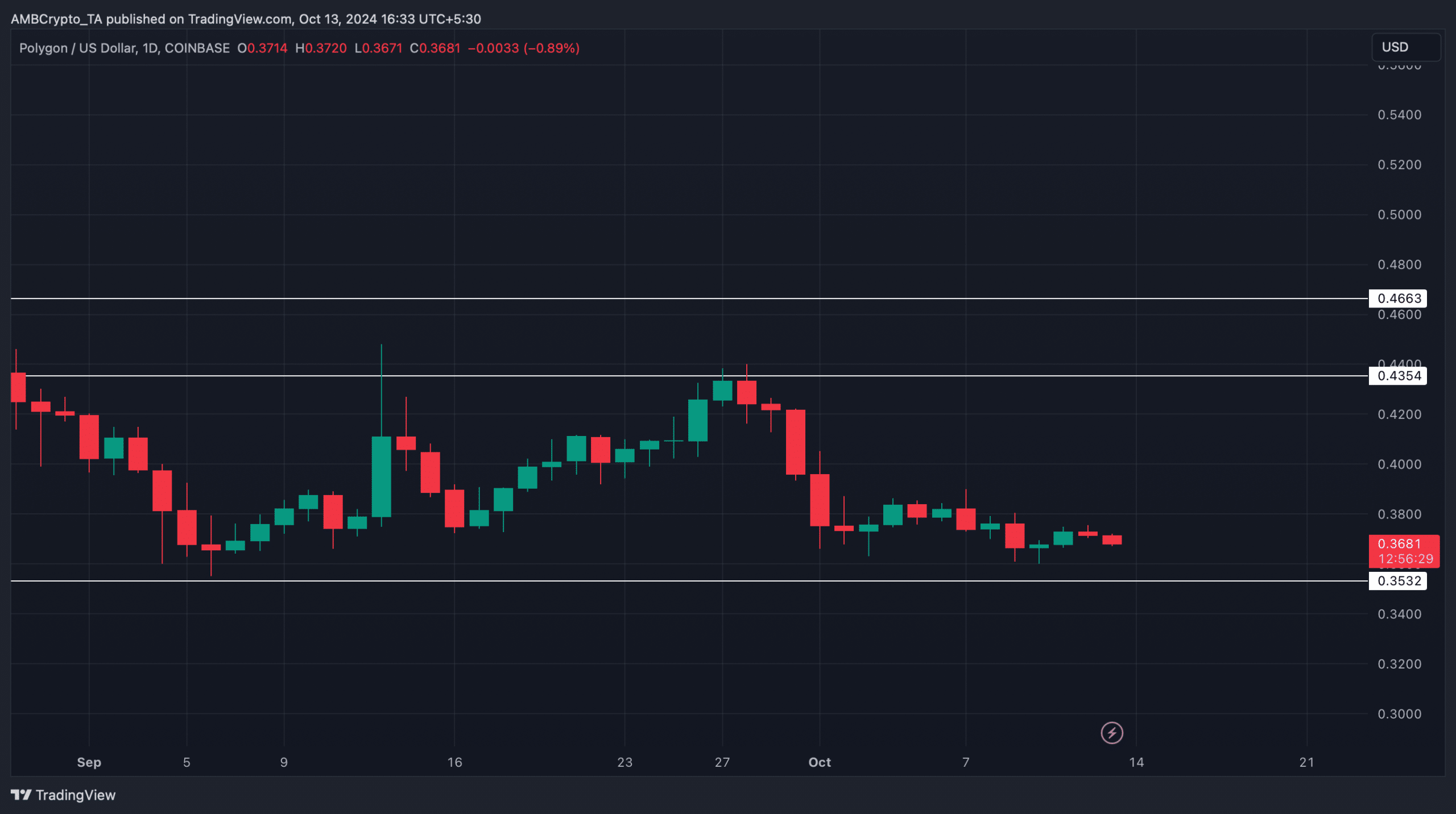

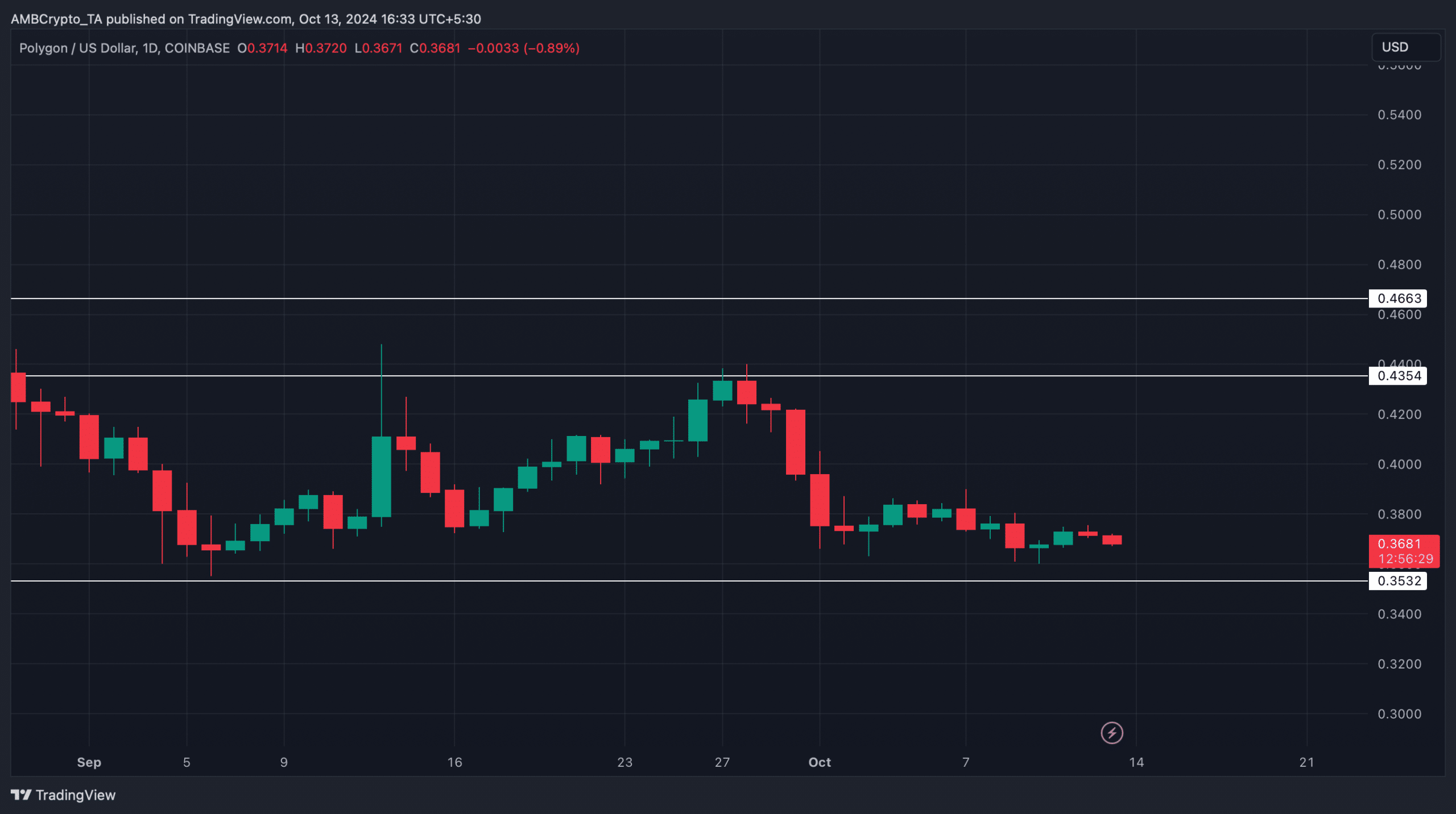

But the trend might change soon, as a bullish pattern appeared on the token’s chart. AMBCrypto’s analysis revealed that a bullish descending triangle pattern emerged on Polygon’s price chart.

It appeared in September, and since then, the token’s price has been consolidating.

At the time of writing, POL was testing its support. A successful test could push the token up towards the upper resistance of the pattern in the coming days.

Source: TradingView

What’s in store for POL?

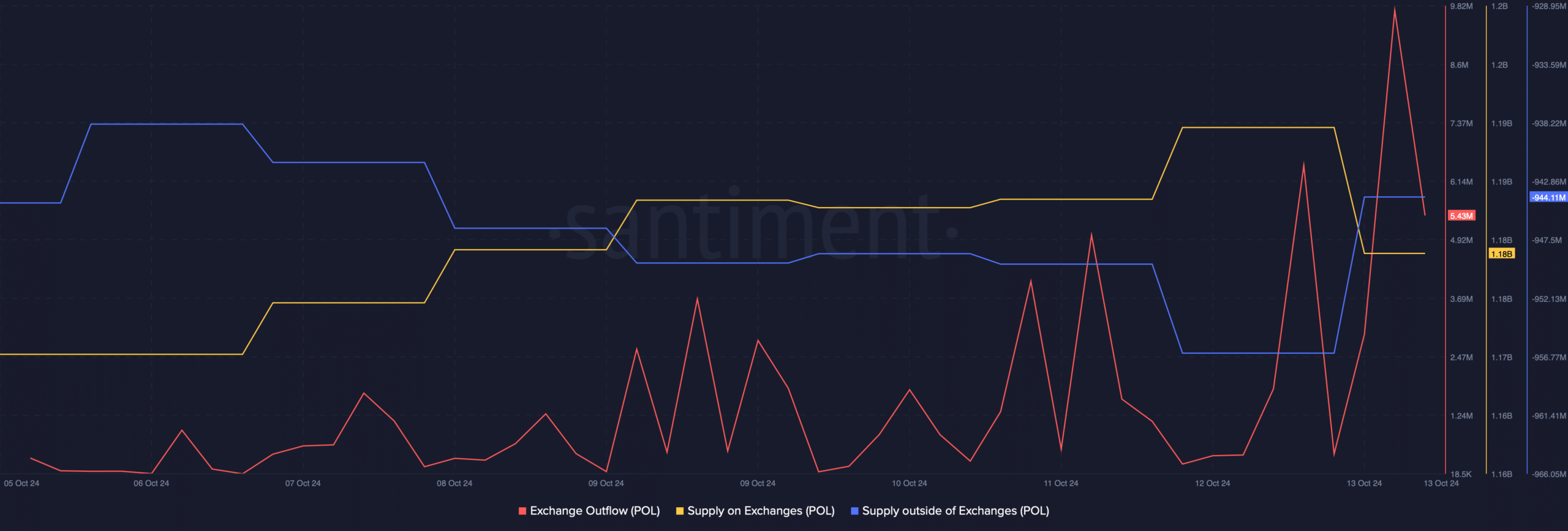

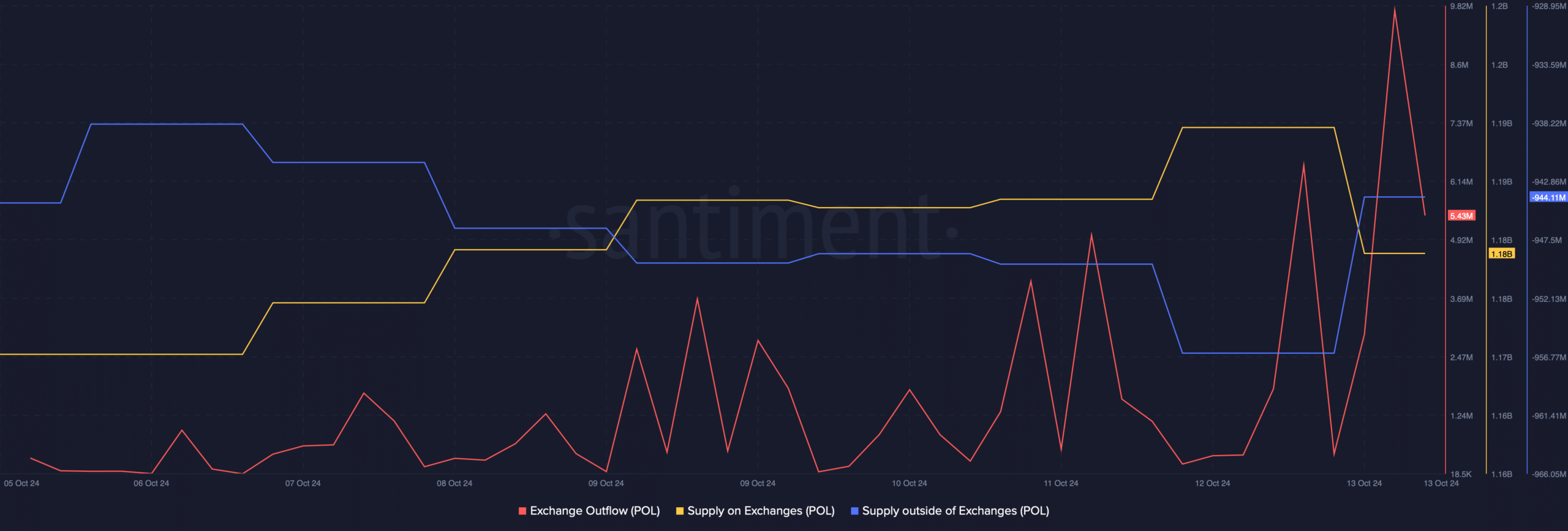

AMBCrypto then checked the token’s other datasets to find out the likeness of POL successfully testing the support. As per our analysis, POL’s exchange outflow increased.

Polygon’s supply on exchanges dropped, while its supply outside of exchanges increased. All three of these metrics indicated that buying pressure was high.

Whenever that happens, it hints at a possible price rise in the coming days.

Source: Santiment

Is your portfolio green? Check out the POL Profit Calculator

We then checked Polygon’s daily chart to find out upcoming targets. If the buying pressure results in a price hike, then it won’t be surprising to see the token moving towards $0.43 again.

A jump above that could push the token further up to $0.46. However, if the bearish trend persists, Polygon might drop to $0.35.

Source: TradingView