- MicroStrategy, Mara, and Riot stocks saw a surge in price as BTC hit $107K.

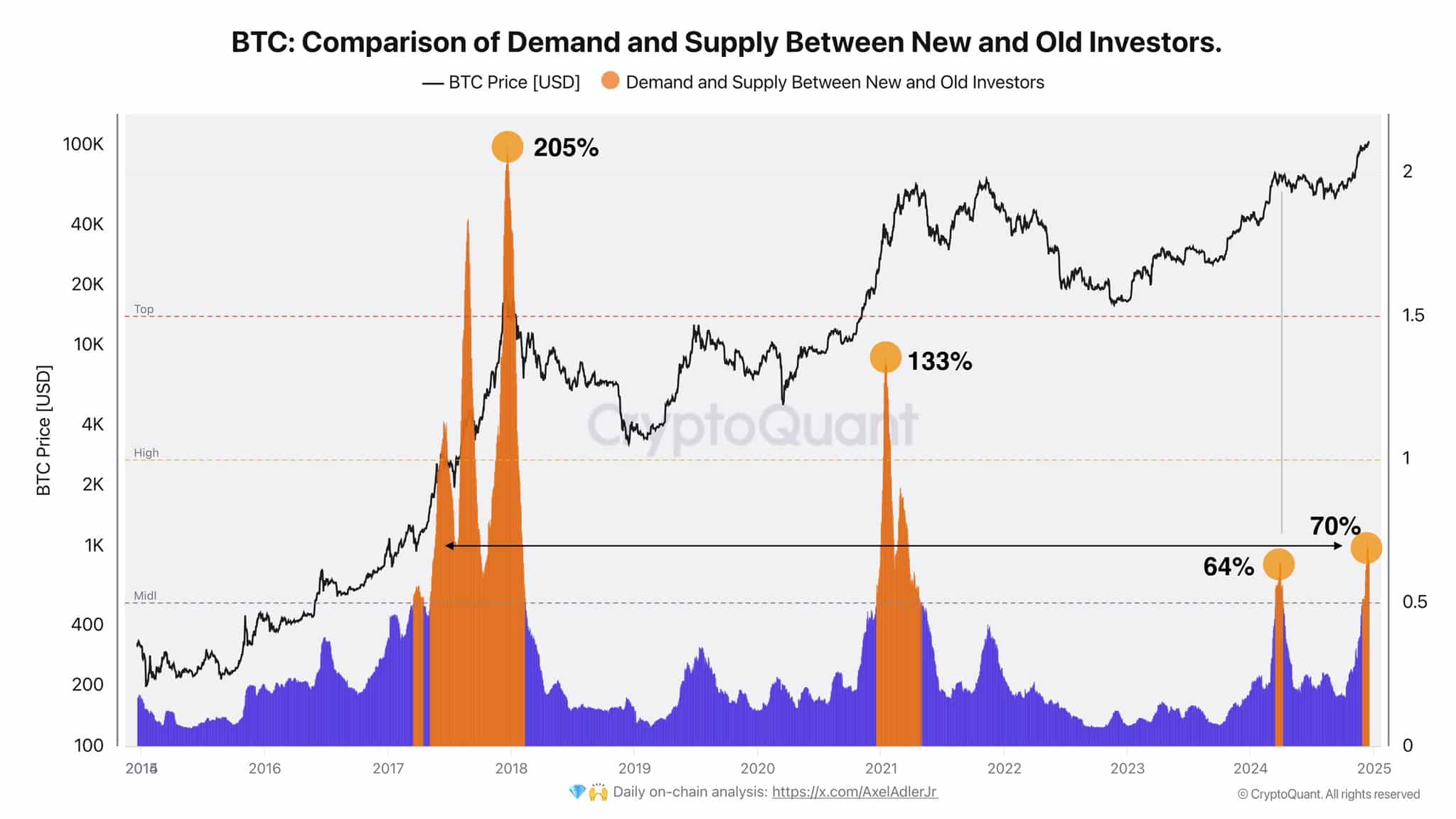

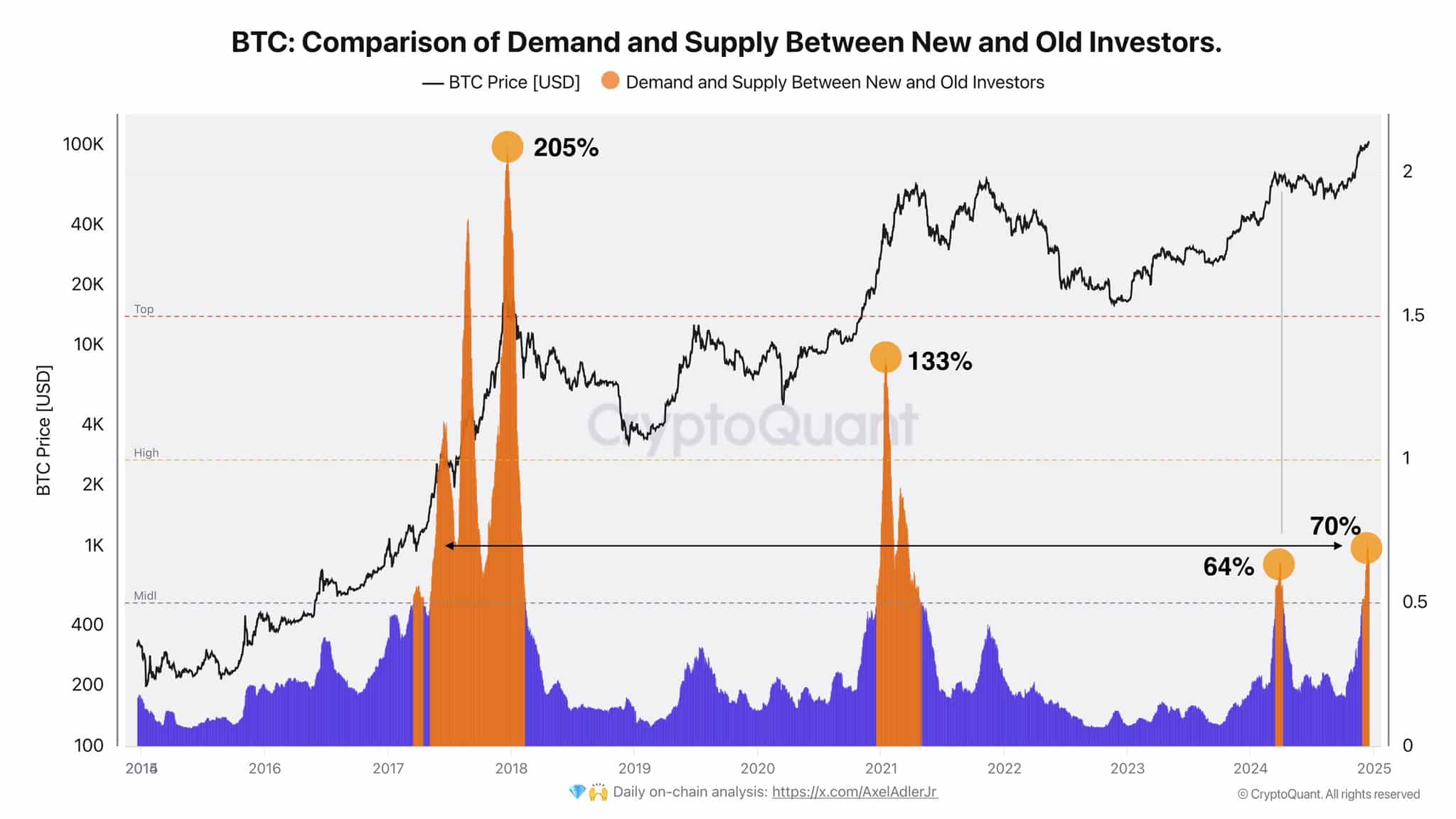

- BTC’s demand from new investors exceeds the March demand at the $70K level by 4%.

MicroStrategy aggressively acquired 15,350 Bitcoins [BTC] at an average price of $100.3K, raising their total holdings to 439,000 BTC. These were purchased for $27.1 billion at an average of $61,725 each.

This strategic accumulation is reflected in their reported BTC yields of 46.4% for the quarter and 72.4% year-to-date.

CEO Michael Saylor’s comments on X (formerly Twitter) emphasized a long-term view on digital assets by comparing Bitcoin investment to historical valuations of Manhattan.

His advocacy for a Digital Assets Framework and a Bitcoin Strategic Reserve, alongside MicroStrategy’s inclusion in the Nasdaq 100, highlighted their pivotal role in shaping the financial space.

The MSTR approach could suggest future trends in corporate asset allocation and the broader integration of digital assets in financial strategies.

Other crypto stocks were up

MARA Holdings’ stock climbed 11% in response to Bitcoin’s ascent to a new all-time high of around $107K.

This upswing in MARA’s stock price paralleled gains across crypto-linked equities, highlighting the market’s increasing interdependence with crypto performance.

MARA utilized proceeds from its zero-coupon convertible notes offerings to buy 11,774 BTC. The $1.1 billion acquisition at $96K per BTC yielded a return of 12.3% for the quarter and 47.6% year-to-date.

MARA’s Bitcoin holdings now stand at 40,435 BTC, valued at $3.9 billion. The corresponding price action has its stock poised to hit $45.

Source: TradingView

Additionally, Riot Blockchain capitalized on its increased funding from an upsized $594 million convertible bond issue, purchasing 667 BTC at an average of $101,135 each.

This strategic move expanded Riot’s holdings to 17,429 BTC, valued at $1.8 billion. Throughout the year, both acquisitions and mining operations contributed to the company’s financial performance.

Source: X

Consequently, Riot reported a substantial Bitcoin Yield Per Share, achieving 36.7% for the quarter and 37.2% year-to-date.

This financial maneuver demonstrates Riot’s robust position in leveraging market dynamics to enhance shareholder value, highlighting its adept strategy in the evolving cryptocurrency landscape.

Bitcoin demand on the rise

Furthermore, the current cycle’s demand from new investors has exceeded the previous March peak, when Bitcoin reached $70K, by 4%.

Although significant, this level of demand is more moderate compared to prior cycles, where demand peaks surged to 205% and 133%. This moderation could suggest a shift in dynamics or investor sentiment at these prices.

Source: CryptoQuant

Historically, these peaks often preceded substantial market movements, indicating that Bitcoin could experience further significant changes in valuation.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Anticipation of potential volatility or growth based on historical patterns has aligned expectations with emerging market behavior.