- Bitcoin miners liquidate over $27 million, sparking concerns about BTC’s ability to sustain its price momentum.

- BTC faces key resistance at $87K while miner selling pressure grows—can bulls absorb the impact?

Bitcoin [BTC] miners have been offloading significant holdings, cashing in over $27 million in realized profits. This came at a time when BTC appeared to be adjusting within a key price range.

With miners selling aggressively, questions arise regarding the potential impact on BTC’s next move. Will this sell pressure cap Bitcoin’s upside, or is the market absorbing these liquidations?

Bitcoin miners’ profits spike

According to recent data, early Bitcoin miners have realized over $27.2 million in profits as BTC hovered around the $83,000-$84,000 range.

This marked a significant liquidation phase, especially after Bitcoin’s recent pullback from its highs above $90,000.

Source: CryptoQuant

Historically, such profit-taking by miners can indicate a short-term cooling period for Bitcoin’s rally, leading to either consolidation or a potential retracement.

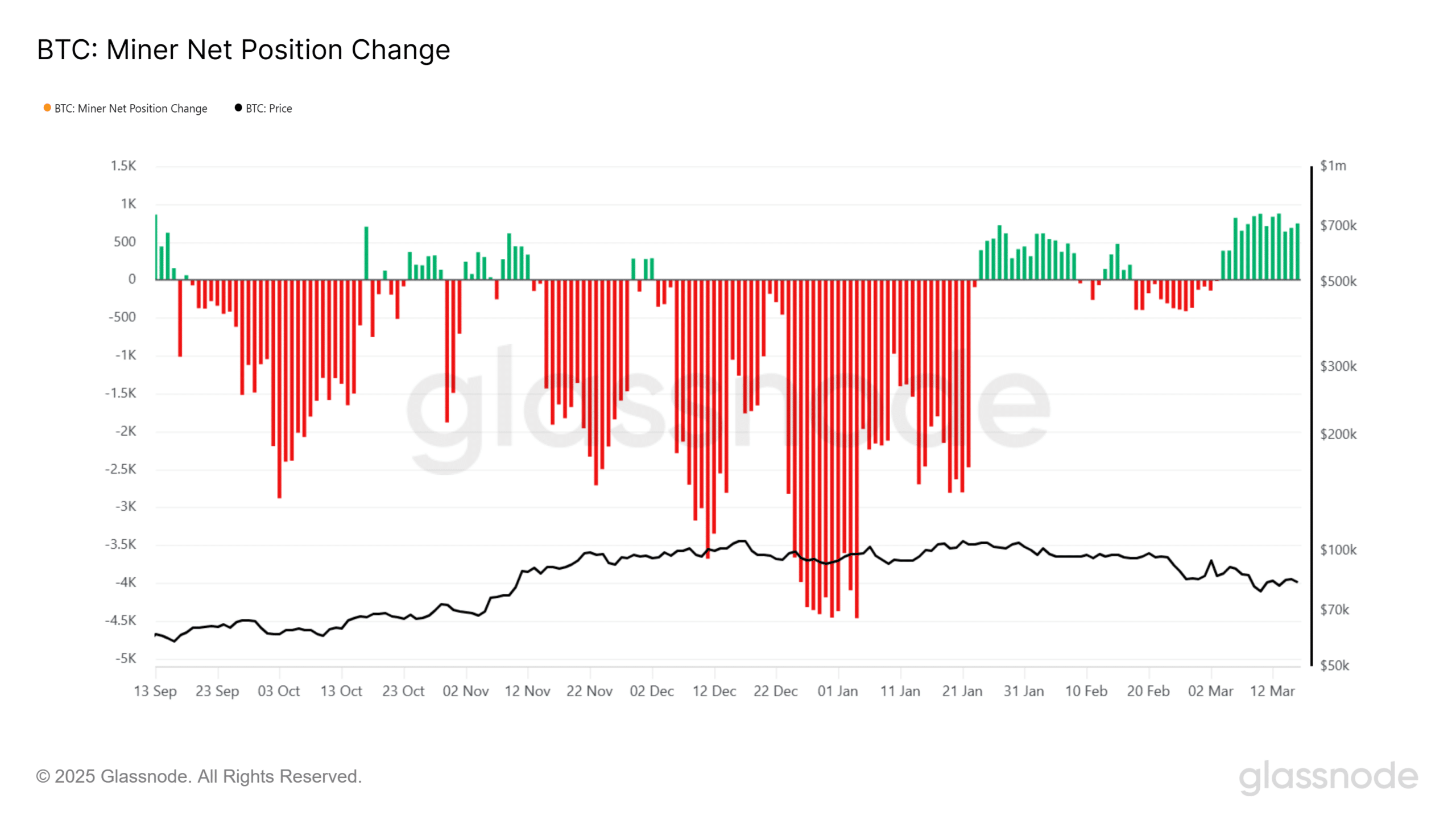

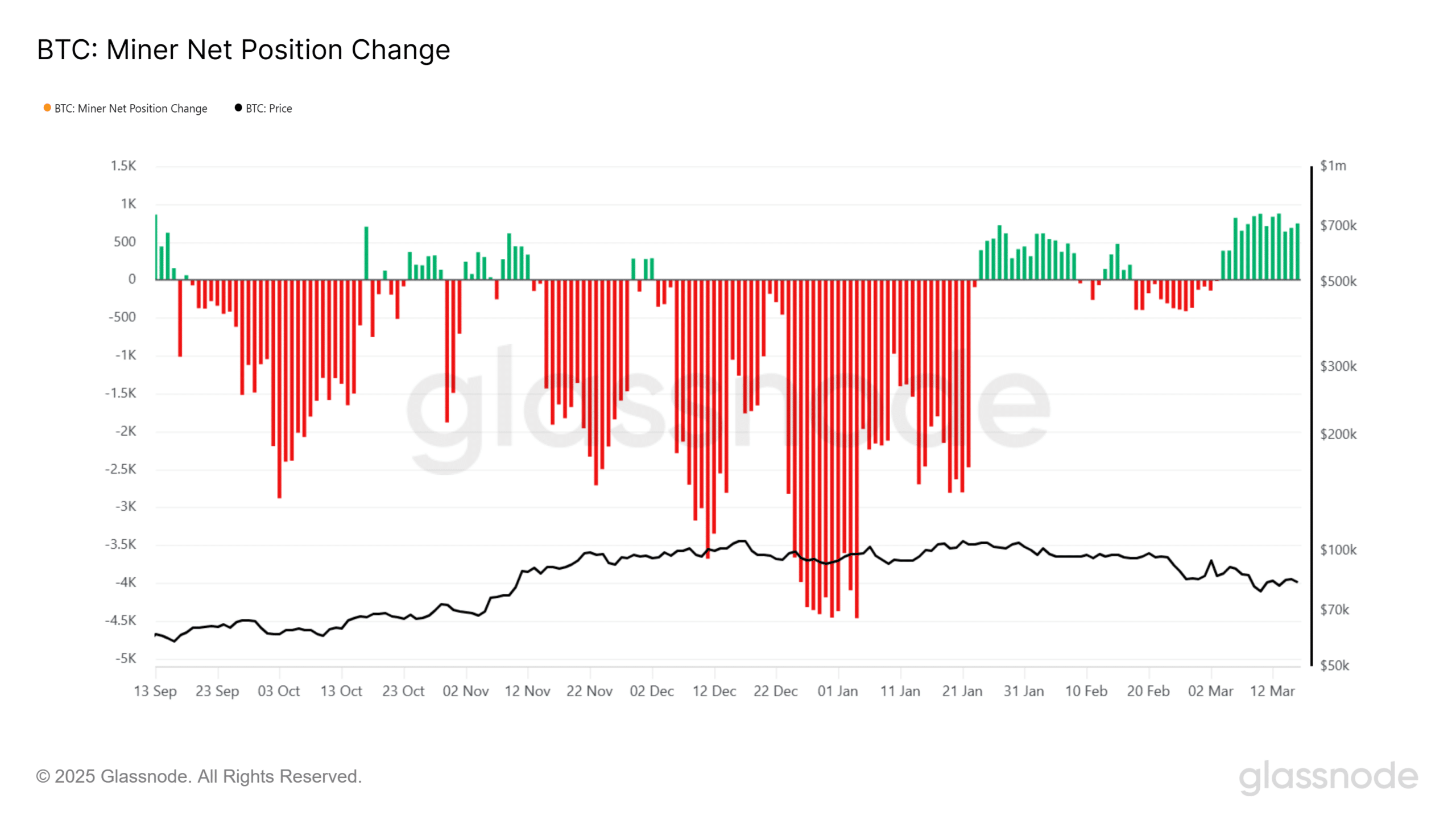

Glassnode’s miner net position change chart shows continued selling pressure, with outflows surpassing inflows.

Miners appeared to be reducing their holdings rather than accumulating, reinforcing the possibility of near-term price weakness.

How much BTC are miners still holding?

Despite the selling spree, Bitcoin miners still retain a substantial amount of BTC. However, the rate at which holdings decline signals their outlook on price movements.

The data suggests that while some miners are securing profits, others may be holding onto BTC in anticipation of another bullish leg.

Source: Glassnode

If BTC maintains its current support levels, a resurgence in buying interest could stabilize prices.

On the other hand, if miners continue liquidating, Bitcoin might struggle to break past key resistance levels, particularly near $87,000-$90,000.

Key levels to watch

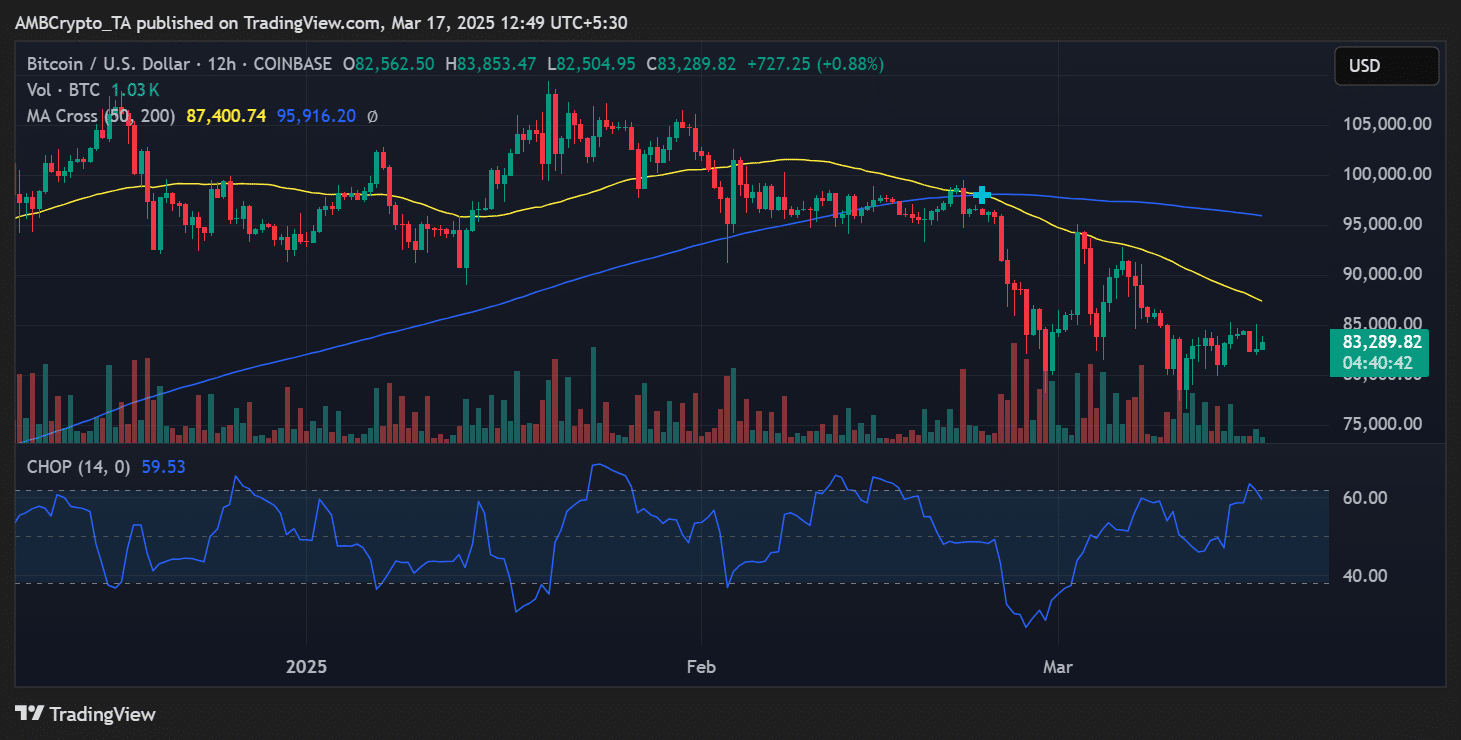

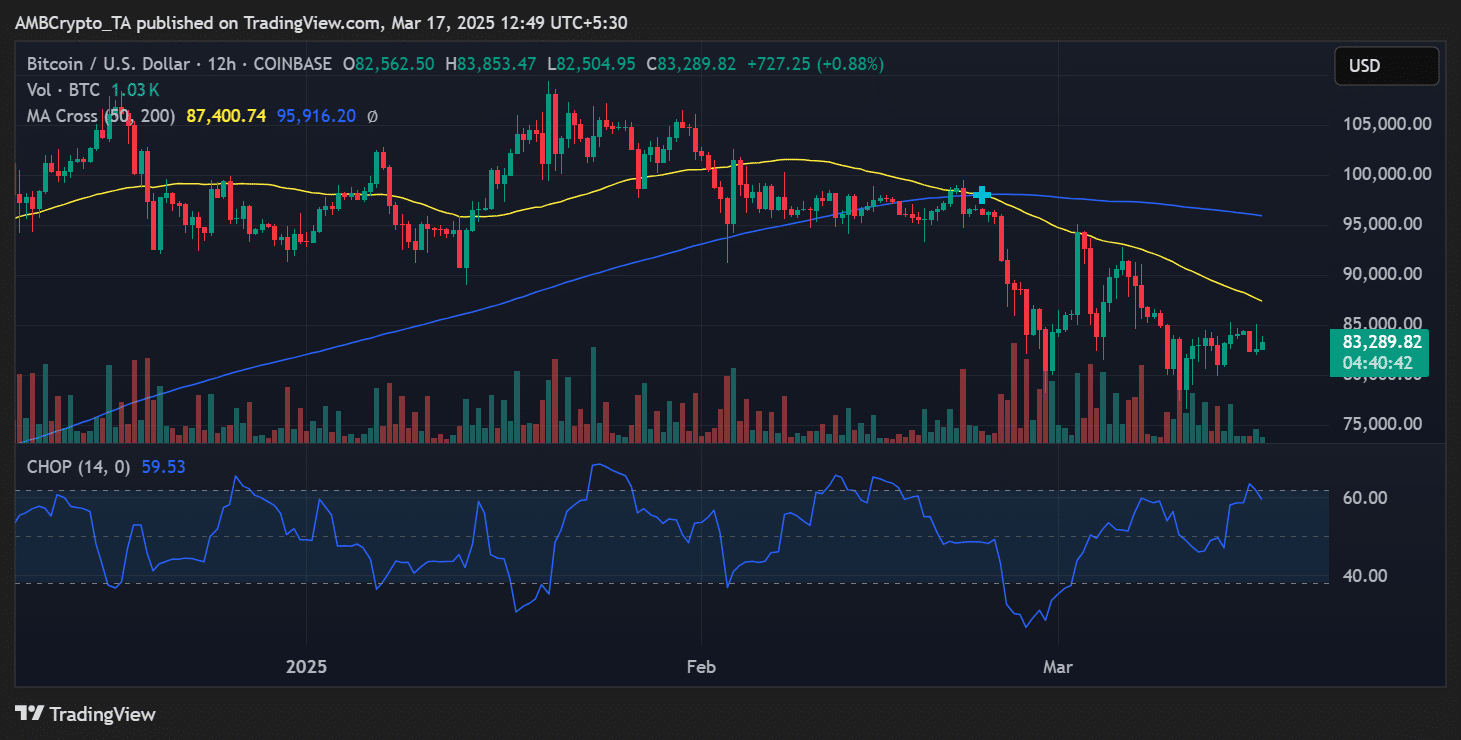

Bitcoin was trading around $83,289 at press time, with the 50-day moving average positioned at $87,400 and the 200-day moving average near $95,916.

These levels serve as critical resistance points that BTC needs to surpass to reclaim bullish momentum.

Immediate support was at $82,500. A breakdown below this level could open the doors to further declines toward $80,000.

Key resistance stood at $87,000. A decisive move above this mark could trigger renewed bullish momentum.

Source: TradingView

With miner selling ramping up, BTC’s ability to hold its ground will be crucial in determining its next move.

Traders should watch for shifts in miner behavior, as continued sell-offs could stall Bitcoin’s upside, while stabilization might pave the way for a rebound.