- VIRTUAL dropped over 30% after an impressive November rally.

- What are the odds of price recovery for the AI token?

The AI agent narrative made Virtual Protocols [VIRTUAL] an instant hit in November, with over 400% gains.

However, December began on a rough patch as Bitcoin [BTC] struggled to hold above $98K, triggering a massive sell-off that hit the AI segment the hardest.

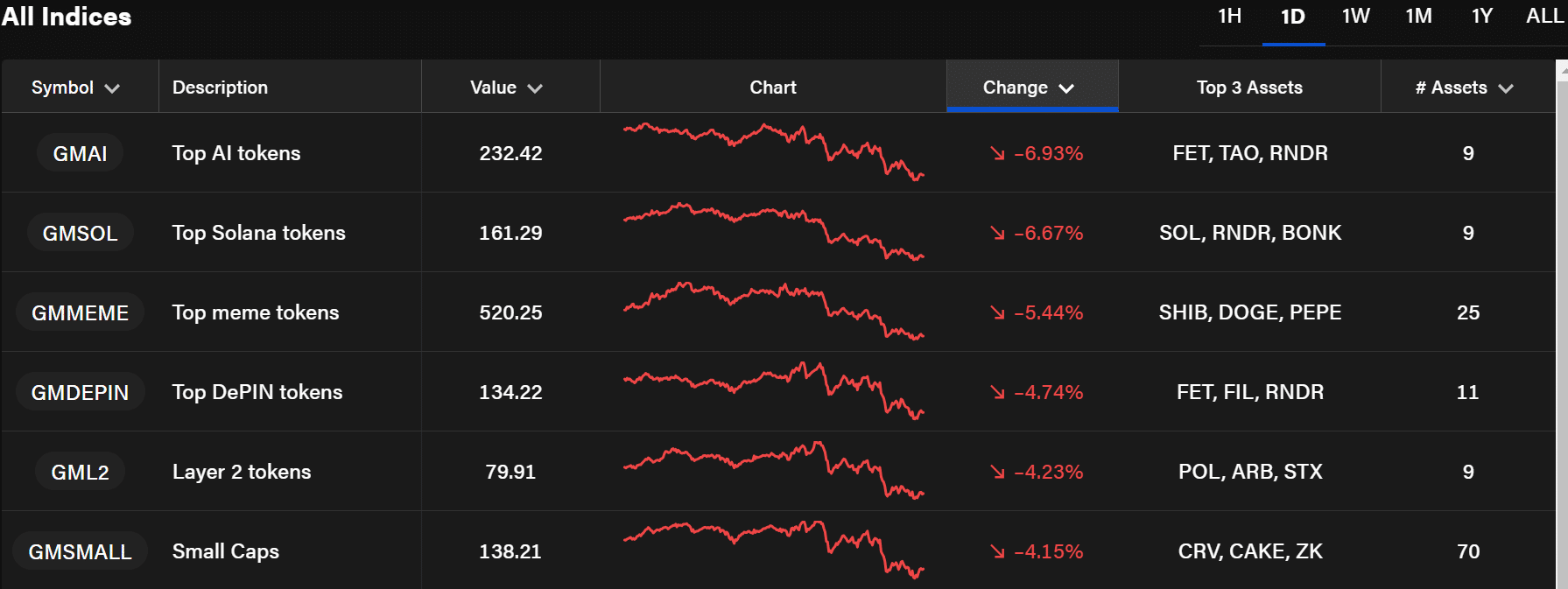

The broader AI sub-sector was down nearly 7% on the daily charts, per The Block’s AI token index, GMAI. VIRTUAL wasn’t spared.

Source: The Block

VIRTUAL price prediction

Despite leading as an AI agent incubation and distribution platform on Base, the Virtual protocol’s utility token, VIRTUAL, extended its weekend decline.

This could also be attributed to capital rotation between sectors after AI agents dominated the segment for the past two weeks. But what’s next for the AI agent unicorn?

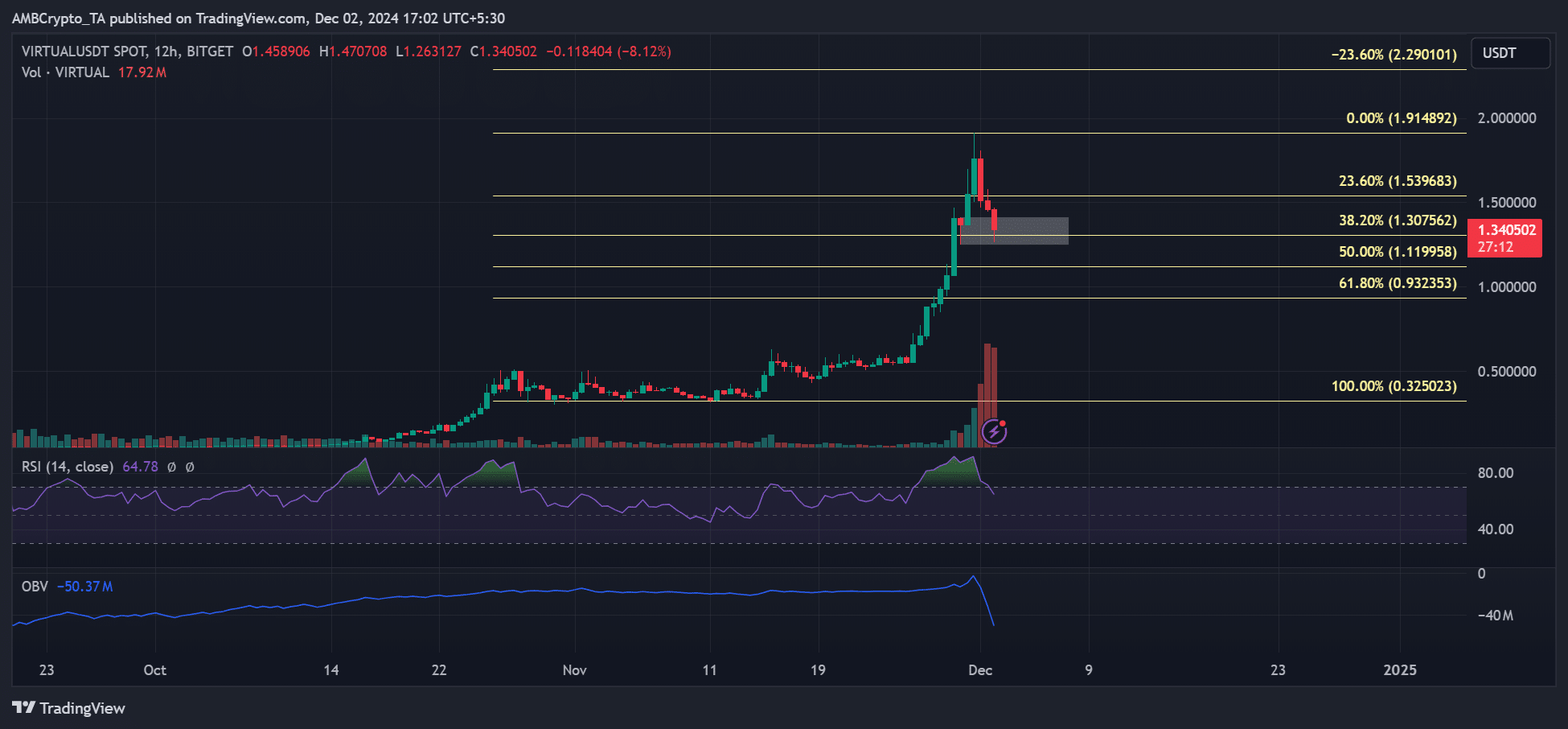

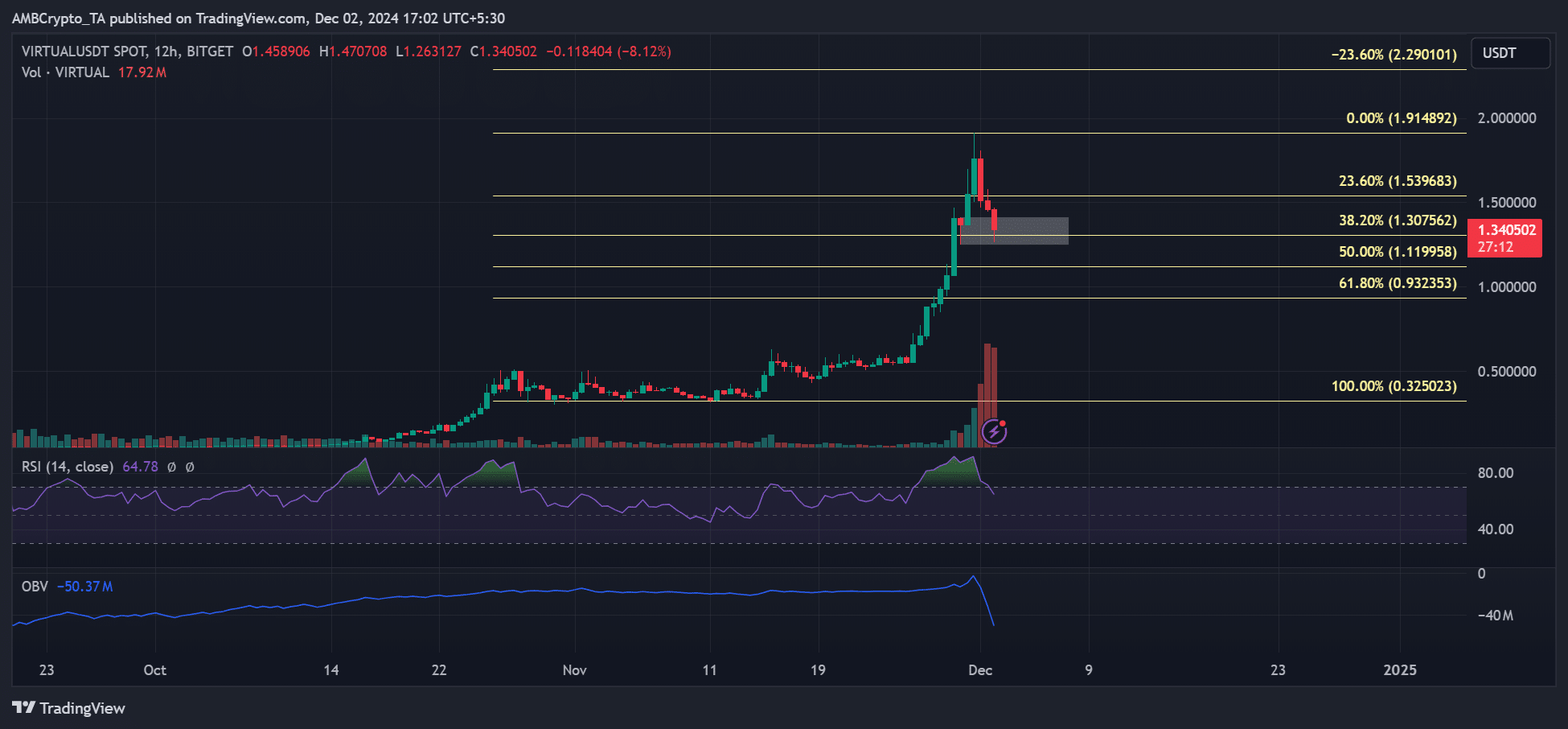

Source: VIRTUAL/USDT, TradingView

On the 12-hour price chart, VIRTUAL’s 11% decline hit the bullish order block (OB), white at $1.3. Usually, the bullish OBs act as support and could help trigger a recovery.

In VIRTUAL’s case, the odds of holding $1.3 were slim, given the sharp drop in OBV (On Balance Volume). It meant the trading volume (spot demand) had declined massively and could undermine a strong price recovery prospect.

If so, even the RSI could retreat towards the median level before attempting a reversal. In such a scenario, a price recovery could be confirmed by reversal of RSI at the 50-mark.

In short, VIRTUAL could extend its decline to the golden zone of 61.8% Fib level ($0.93-$1.11), especially if BTC drops below $95K again.

Given the strong AI narrative, every dip could offer a discounted scoop for VIRTUAL investors and a long position entry for traders.

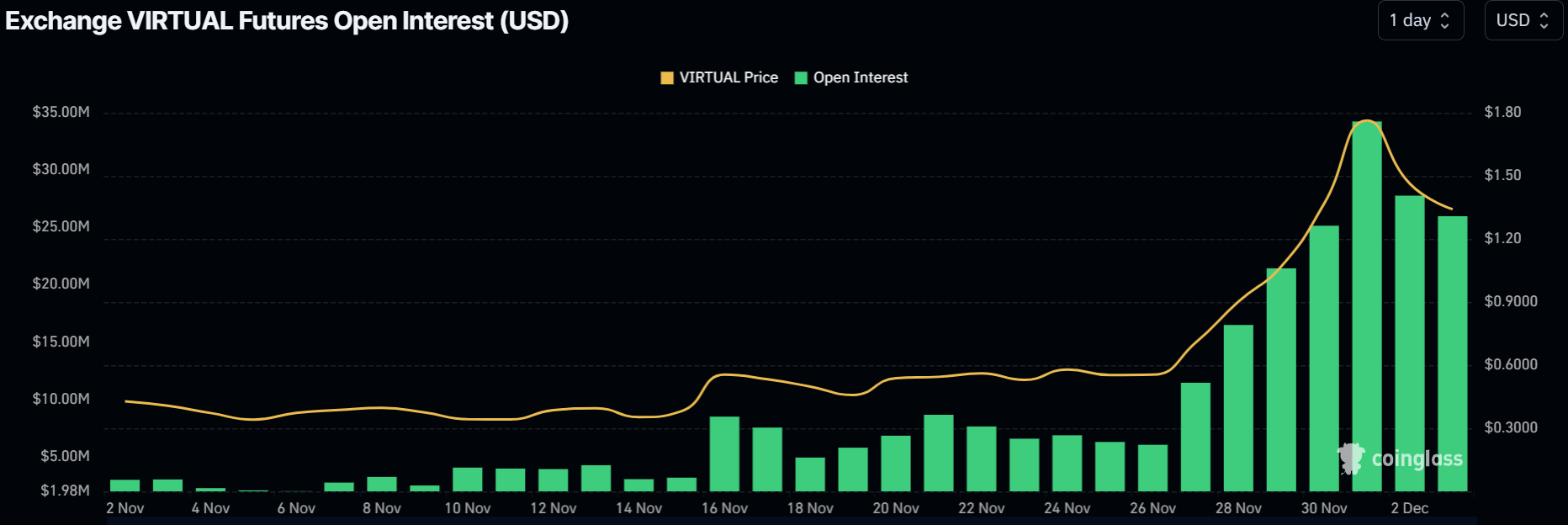

Open Interest slides

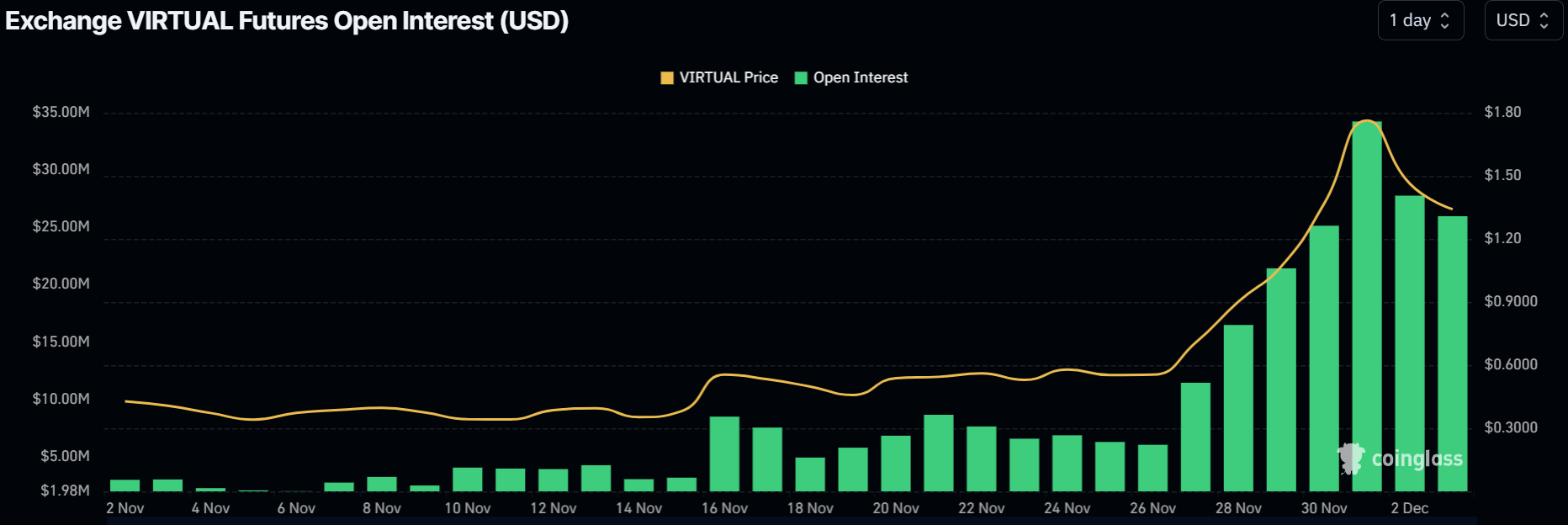

Source: Coinglass

Read Virtual Protocol [VIRTUAL] Price Prediction 2024-2025

VIRTUAL’s price pullback was also marked by reduced market interest in the Futures segment.

The Open Interest (OI) rates dropped from $34M to $25M, a nearly $10M decline in two days. This reinforced a bearish sentiment that could change if BTC eyes $100K again.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion