- Velo joined a growing list of protocols leveraging BlackRock’s tokenized short-term treasury fund for their ecosystem offerings.

- VELO was among the top losers today, down more than 22% in the last 24 hours, after a disruption to its decent run this month.

Velo Labs, the team behind Velo Protocol [VELO], is the latest crypto-native outfit to tap into BlackRock’s first tokenized fund to deliver innovative financial products to its market.

The company communicated in a blog dated the 10th of September that its USDV stablecoin is backed by an investment in BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL).

The strategic move is aims to bolster the stablecoin’s utility and its appeal as both a store of value and yield-bearing asset.

Market reaction

Velo’s announcement initially sparked interest, with many seeing it as a validation of Velo Labs’ strategic ambition to expand its market reach.

However, the price action of Velo’s utility token, VELO, following the announcement suggested a classic “sell the news” event.

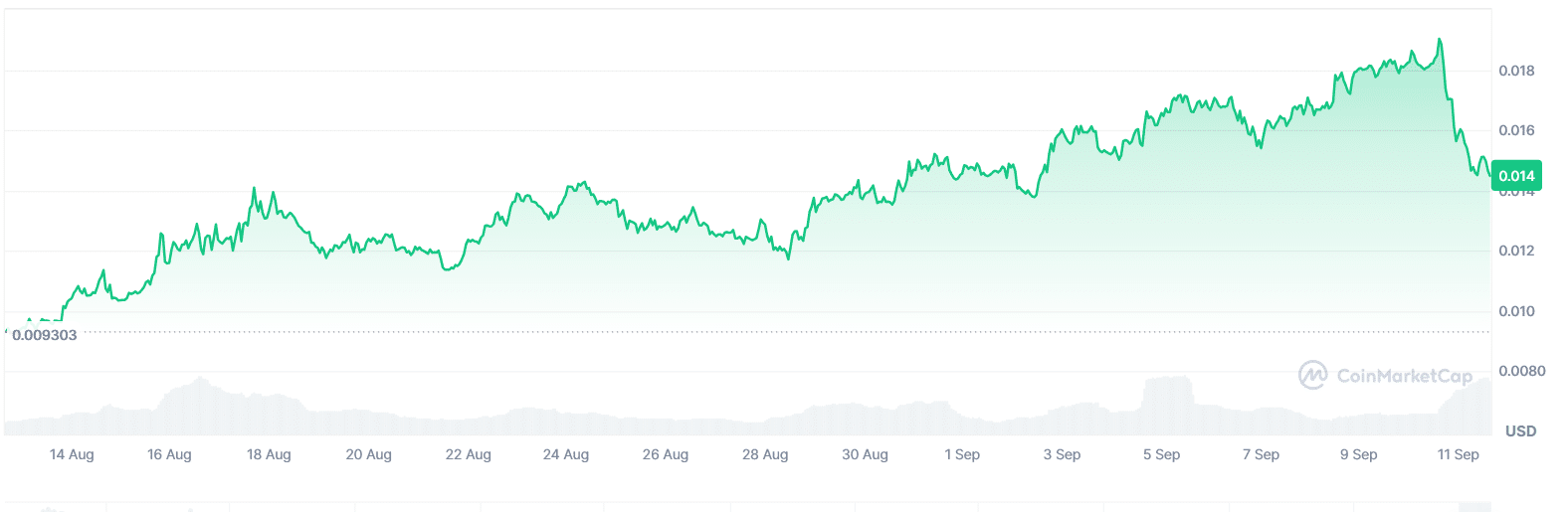

Hours after the news release, speculators quickly took profit on the prior price uptrend, halting a month-long climb that had seen VELO gain significant ground.

Source: CoinMarketCap

Notably, Velo adds to a list of crypto projects utilizing BlackRock’s tokenized fund to introduce retail-facing offerings or provide access to yield-generating opportunities.

In March, Ondo Finance revealed plans to move backing assets of its U.S. Treasury-backed token (OUSG) to the BUIDL fund.

Ondo explained that its decision to move $95 million to BlackRock’s tokenized fund will make OUSG more usable and facilitate instant settlements.

Last week, Layer 1 blockchain project Injective launched a tokenized index for the BUIDL Fund aimed at giving retail users exposure to the fund.

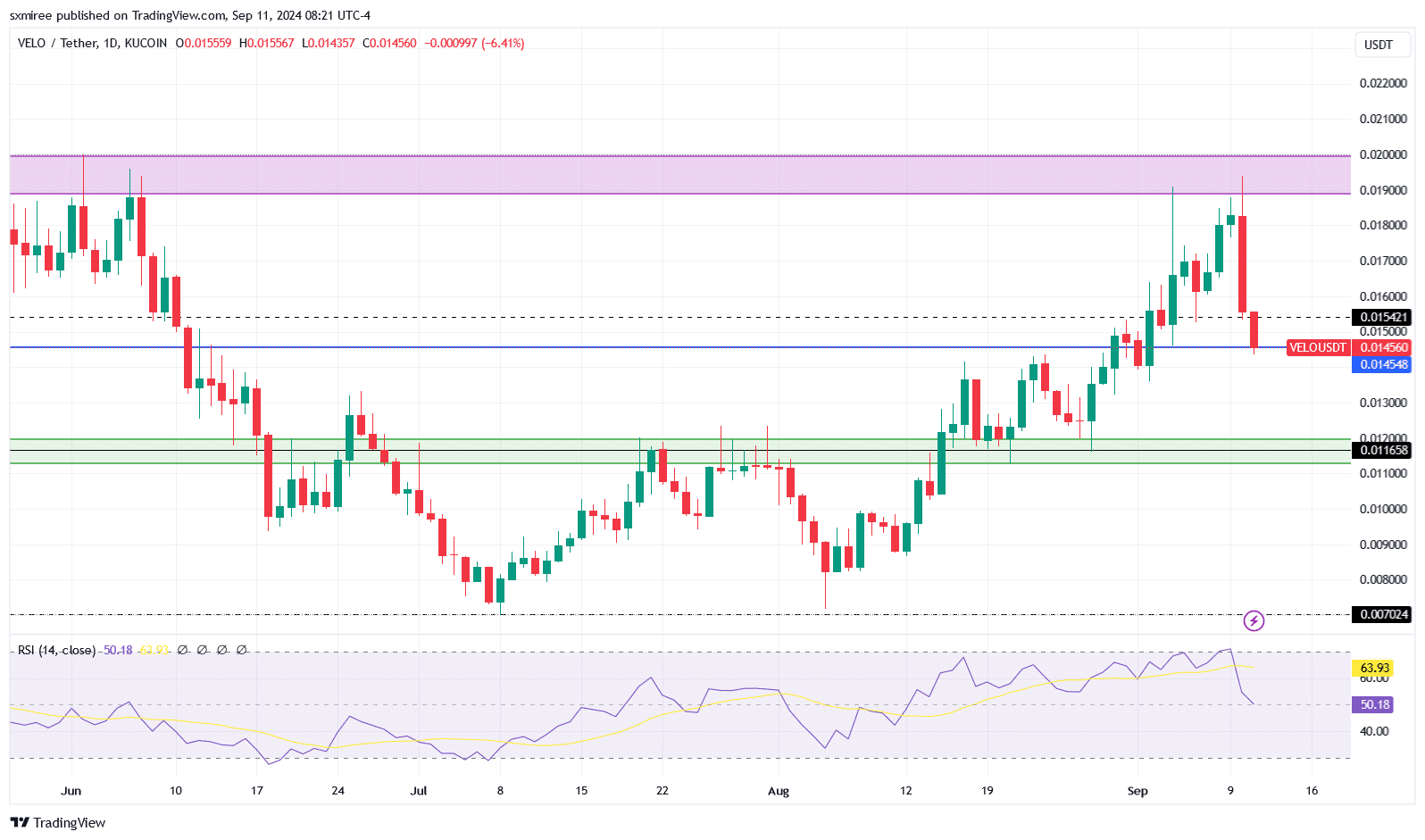

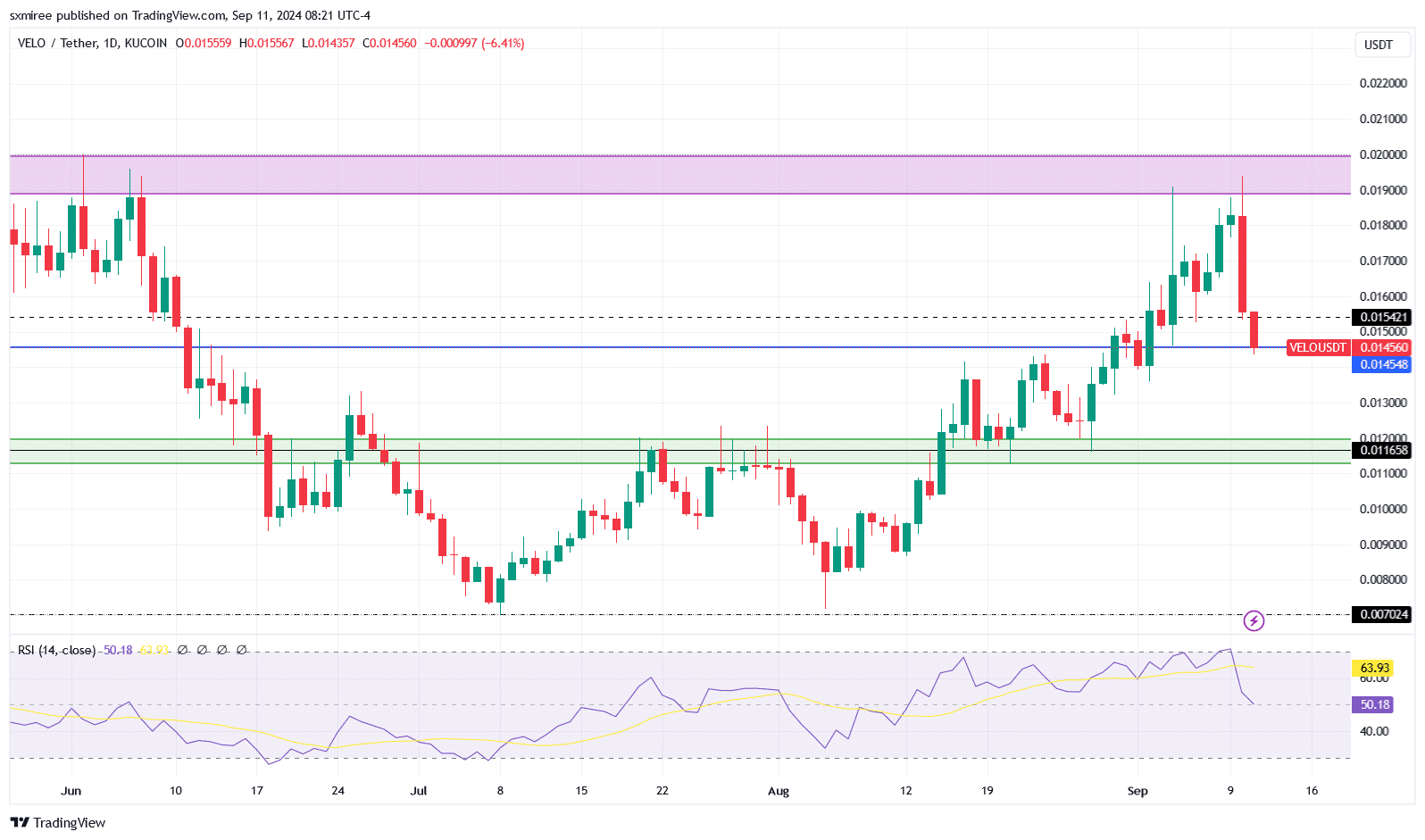

VELO/USDT technical analysis

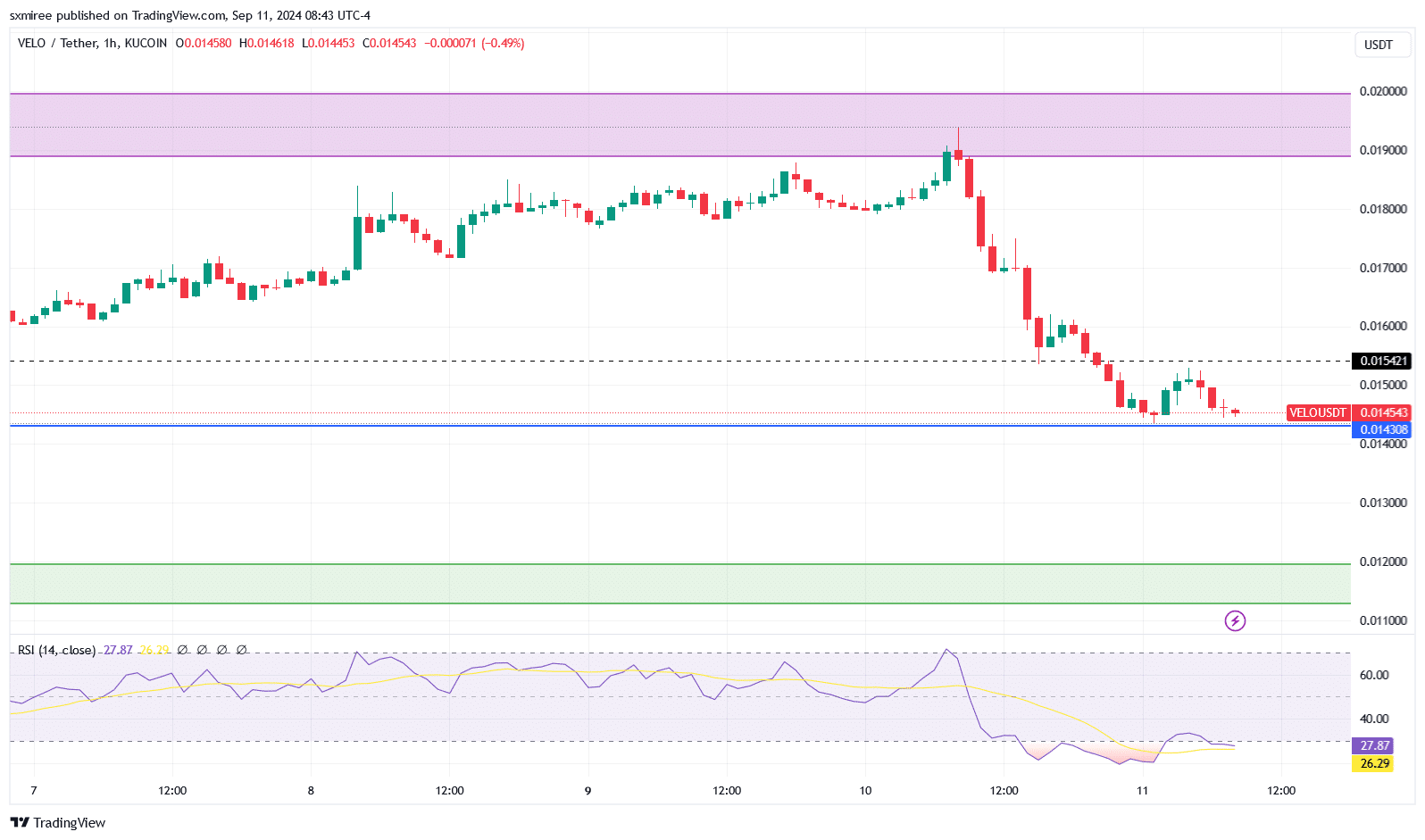

TradingView data shows VELO lost support at $0.0155 overnight, dropping to $0.01436, where it began consolidating.

Though VELO has stabilized after the sharp drop from an intraday high of $0.0193, it is still down 15% in the last 24 hours.

Source: TradingView

In the last few hours, the VELO/USDT pair has been attempting to fashion a rebound move after turning the previous resistance level at $0.0143 into immediate support.

The hourly Relative Strength Index (RSI) hovers below the oversold zone and was last pictured at 27, implying that VELO is experiencing significant bearish pressure and is deeply oversold.

Source: TradingView

Read Velo’s [VELO] Price Prediction 2024–2025

A daily close above $0.015 will suggest a potential continuation of the prior uptrend, which is threatened by the ceiling around $0.02, where VELO struggled in June.

Further losses below the current support will, however, indicate that the upward pattern is breaking and invoke the stronger support at $0.011 last tested in August.