- Exchanges have recorded $3.5 million worth of UNI inflows.

- UNI could decline by 20% to reach the $11.10 level if it closes a daily candle below the $14.60 level.

Uniswap [UNI] appeared to be in trouble at press time, as whales’ interest in the token appeared to be fading.

This notable shift in investor interest followed a broader sentiment across the cryptocurrency market, which was moving into a correction phase.

Whale sells $16.73 million UNI tokens

On the 10th of December, whale transaction tracker Lookonchain noted that professional trading firm, Cumberland, had dumped a significant 989,520 UNI tokens worth $16.73 million.

These substantial tokens were offloaded across various centralized exchanges, including Binance, Coinbase, OKX, and Robinhood.

Additionally, Cumberland began depositing its holdings as the UNI price dropped by 10%. This dump during the short-term price correction has created fear among investors and traders.

At press time, UNI was trading near $15.65 after a price decline of over 11% in the past 24 hours.

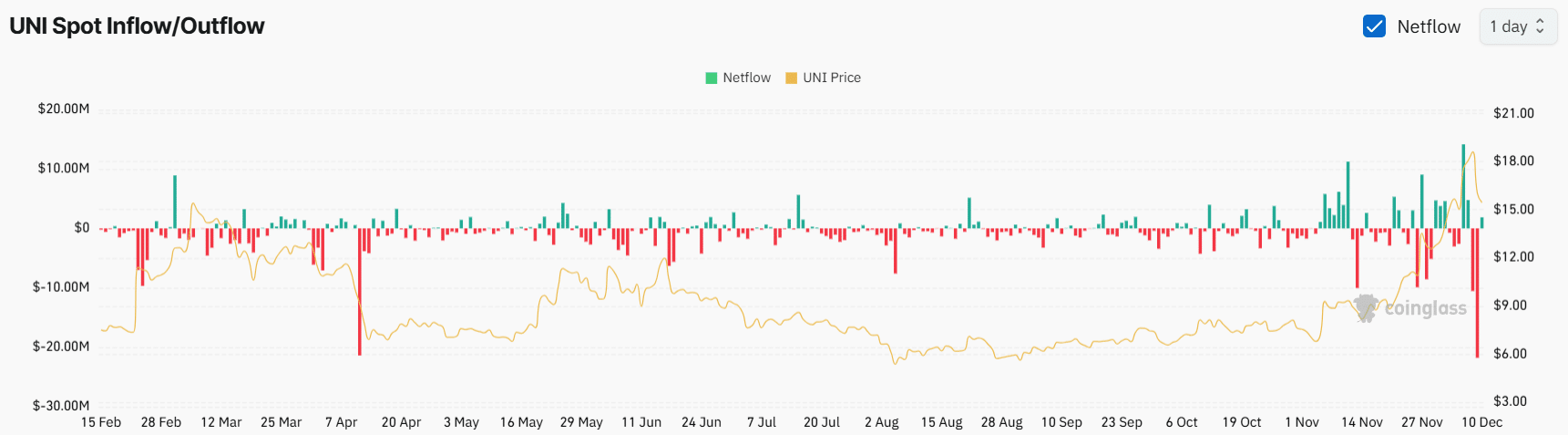

AMBCrypto’s examination of Coinglass data noted that other whales and institutional investors have started moving their wallets to exchanges, potentially for sell-offs.

Also, per the Spot Inflow/Outflow, exchanges have recorded a modest $3.5 million in asset inflows.

Source: Coinglass

In the cryptocurrency context, “inflow” refers to the transfer of assets from wallets to exchanges, which typically indicates a potential sell-off and hints at a future price decline.

However, the amount of asset inflow into exchanges over the past three days was significantly lower than the outflow.

This suggested a strong possibility that these long-term holders are supporting UNI for the long term, which could prevent further price declines.

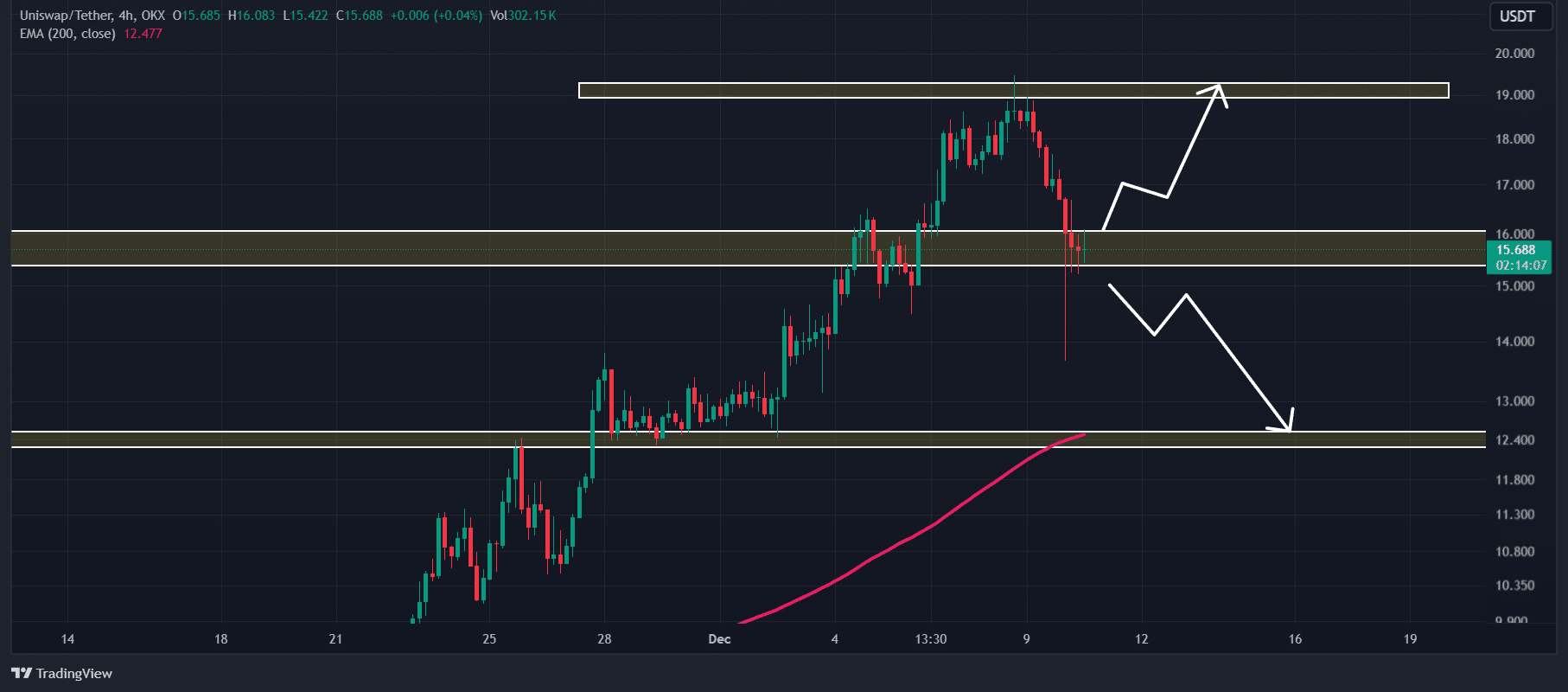

UNI technical analysis and key levels

According to AMBCrypto’s technical analysis, UNI has reached a crucial support level of $15.30 following the recent price decline. This level has created a make-or-break scenario for the altcoin.

Source: TradingView

Based on recent price action, UNI currently faces two possibilities, it could either rally or experience further decline.

Read Uniswap’s [UNI] Price Prediction 2024–2025

If the altcoin sustains itself above the $15.50 level, there is a strong possibility it could soar by 30% to reach the $20.50 level in the near future.

Conversely, if UNI fails to hold this support level and closes a daily candle below $14.60, there is a strong possibility it could decline by 20%, potentially reaching the $11.10 level in the coming days.