- Turbo forms a bullish cup and handle pattern, aiming for $0.016 if $0.0135 breaks.

- Rising open interest and strong on-chain activity indicate bullish momentum despite volatility risks.

Turbo [TURBO] has experienced a remarkable surge, climbing 18% in the last 24 hours, capturing significant attention from traders. At press time, Turbo was trading at $0.01302.

Therefore, the key question remains: will Turbo break through the critical resistance at $0.0135 and soar to $0.016, or will it retrace to test support at $0.0095? With the current momentum and growing speculation, the next move could be decisive.

Is turbo gearing up for a breakout?

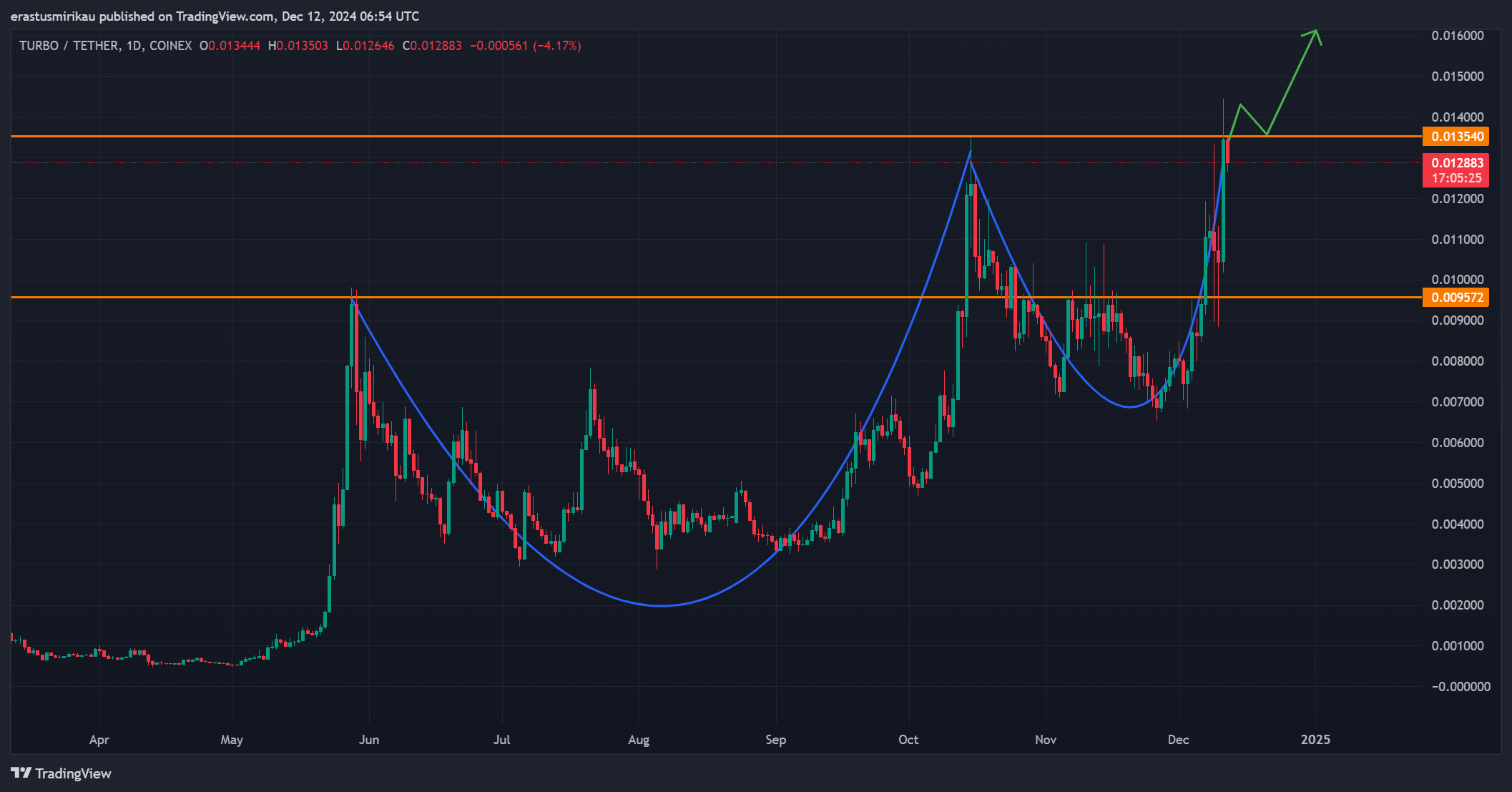

The daily chart highlights a cup and handle pattern, a bullish structure that signals a potential breakout. Turbo has already surged past the $0.0095 support level, reflecting strong buyer confidence and increasing demand.

However, the $0.0135 resistance remains a significant challenge. Breaking this level could open the door for a rally toward $0.016, which represents the next key psychological and technical target.

On the other hand, failure to surpass $0.0135 may lead to a pullback, with $0.0095 serving as immediate support and a critical fallback level. Therefore, the price action over the next few sessions will be crucial in determining Turbo’s trajectory.

Source: TradingView

What do the technical indicators say?

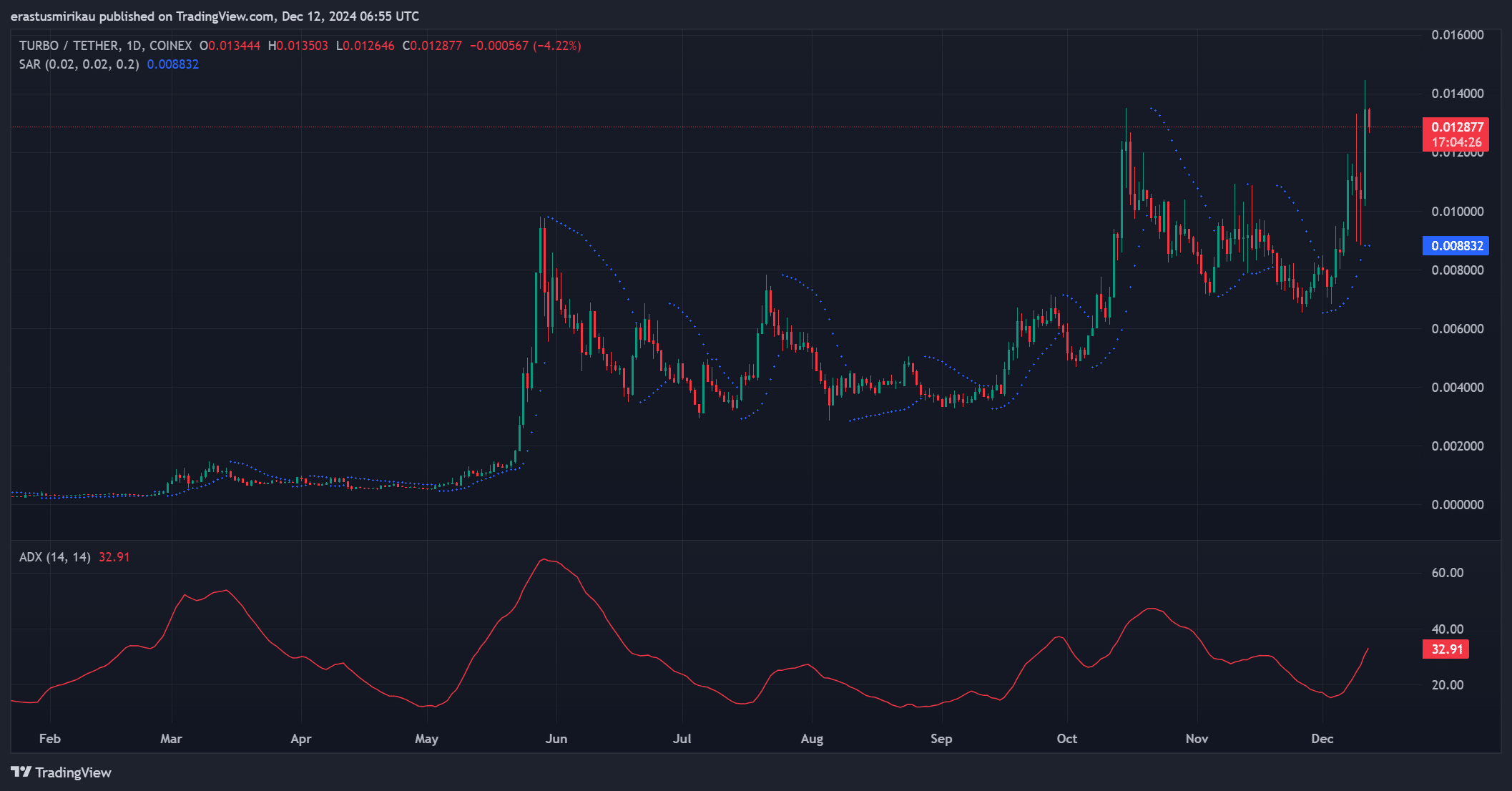

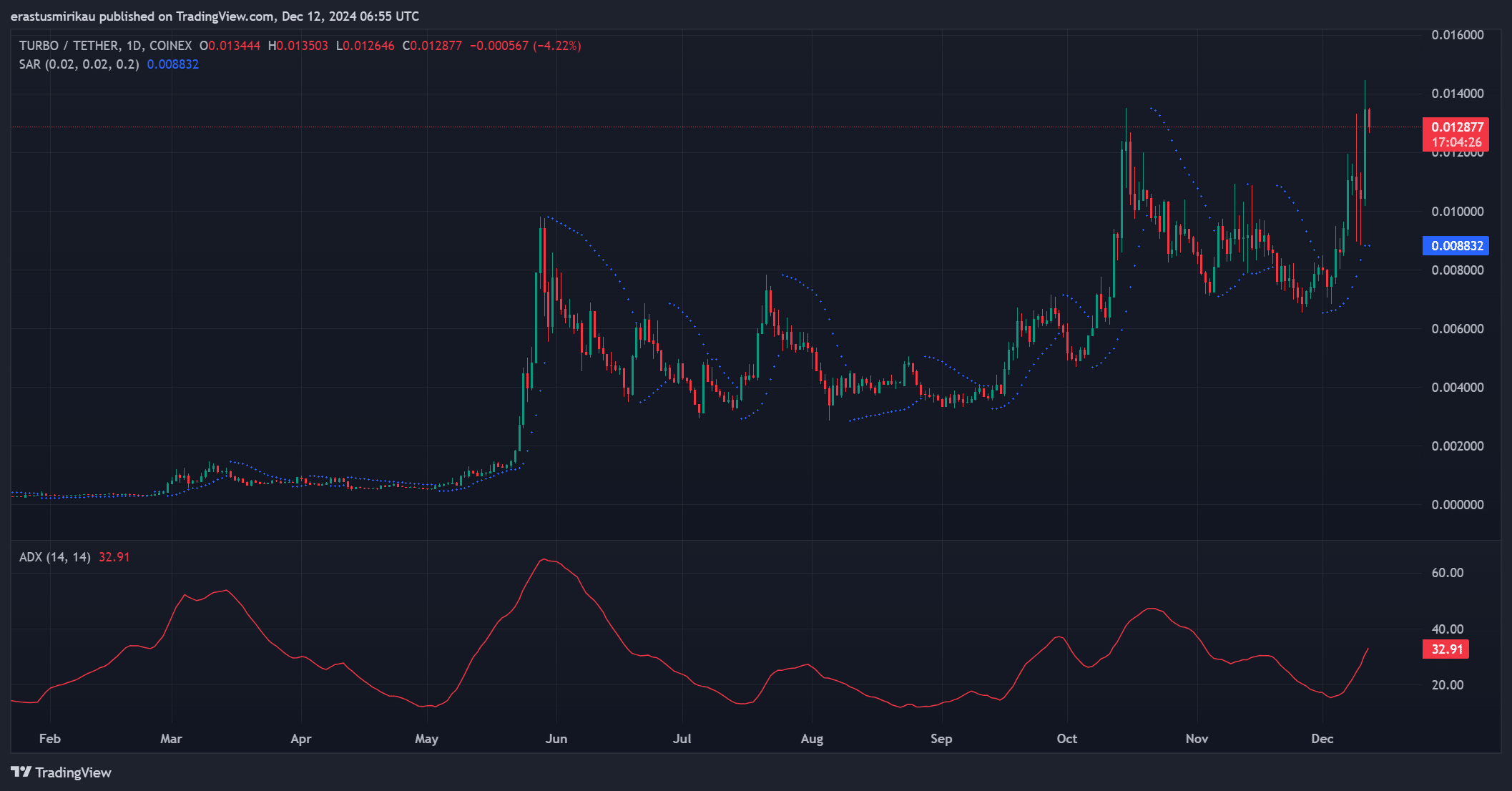

The Parabolic SAR confirms the continuation of the bullish trend, with the dotted markers remaining below the price. This indicates sustained upward momentum, which supports the likelihood of further gains.

Additionally, the ADX (Average Directional Index) reads 32.91, a strong indication of a well-established trend. Together, these indicators suggest that Turbo’s price is more likely to push higher than reverse.

However, traders should watch for any potential shifts in these signals, as a loss of momentum could trigger a correction.

Source: TradingView

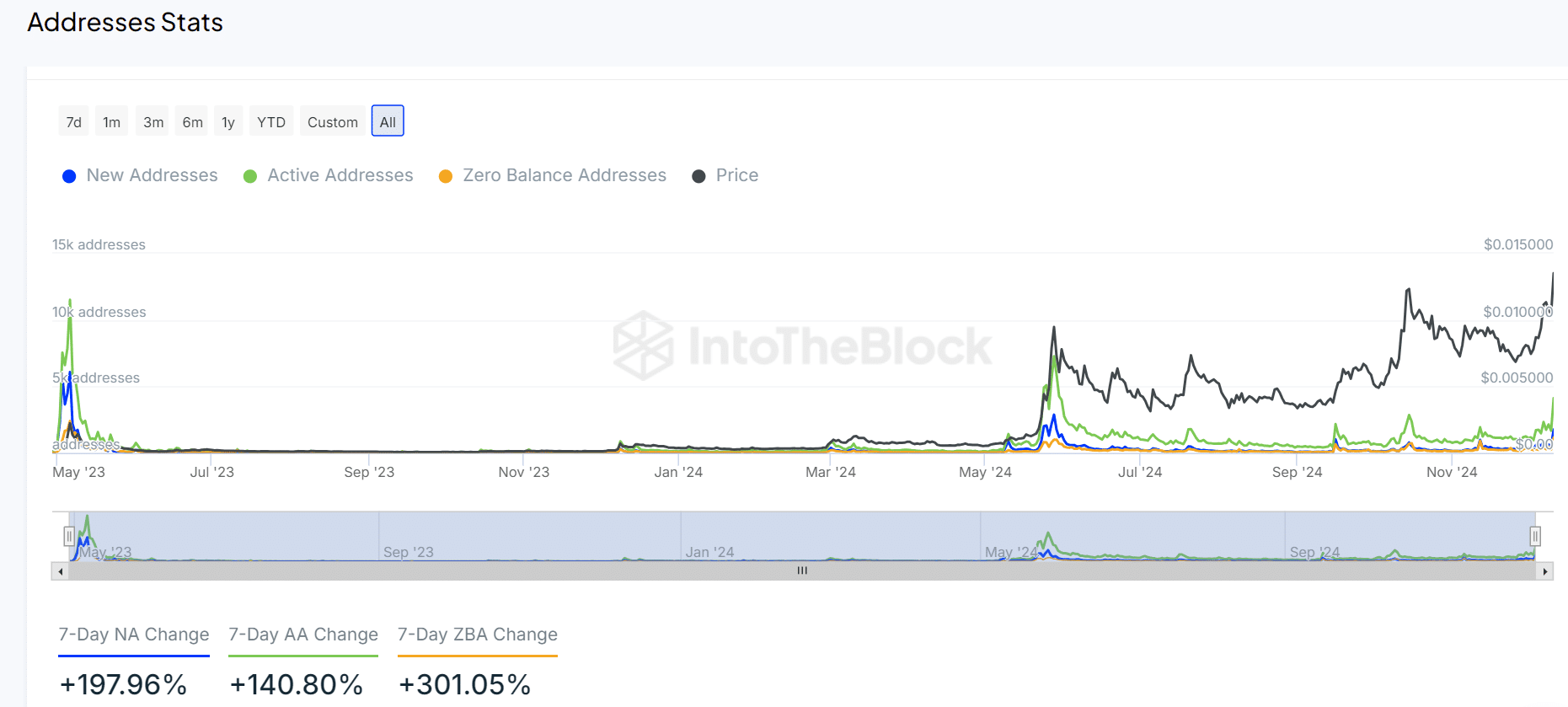

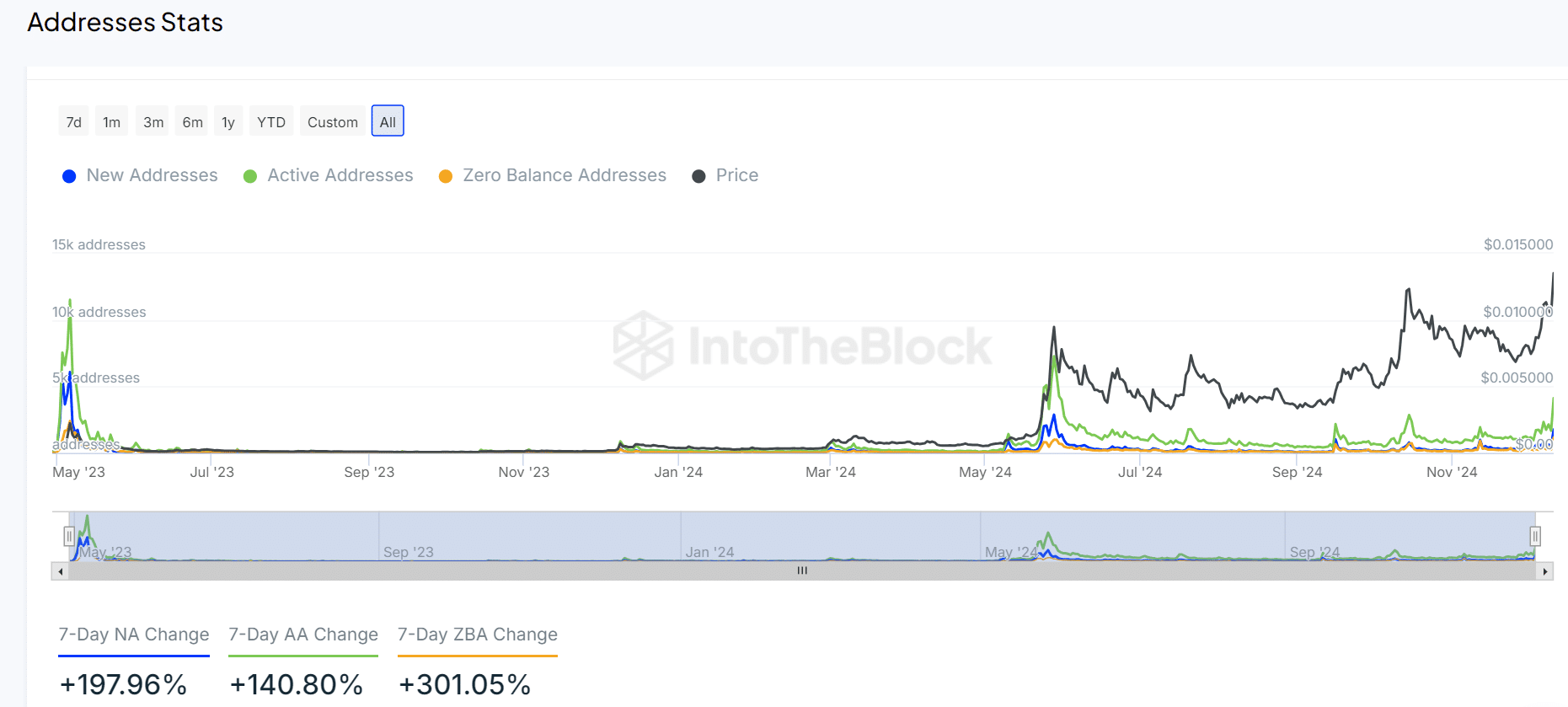

On-chain metrics reveal bullish demand

On-chain activity further supports the bullish outlook, with significant growth in user engagement. New addresses have surged by 197.96%, while active addresses have increased by 140.80%, reflecting heightened interest in Turbo.

Moreover, zero-balance addresses have risen by 301.05%, indicating the creation of new wallets, possibly driven by speculation. These metrics demonstrate strong demand, aligning with the bullish price action and reinforcing the case for an upward move.

Source: IntoTheBlock

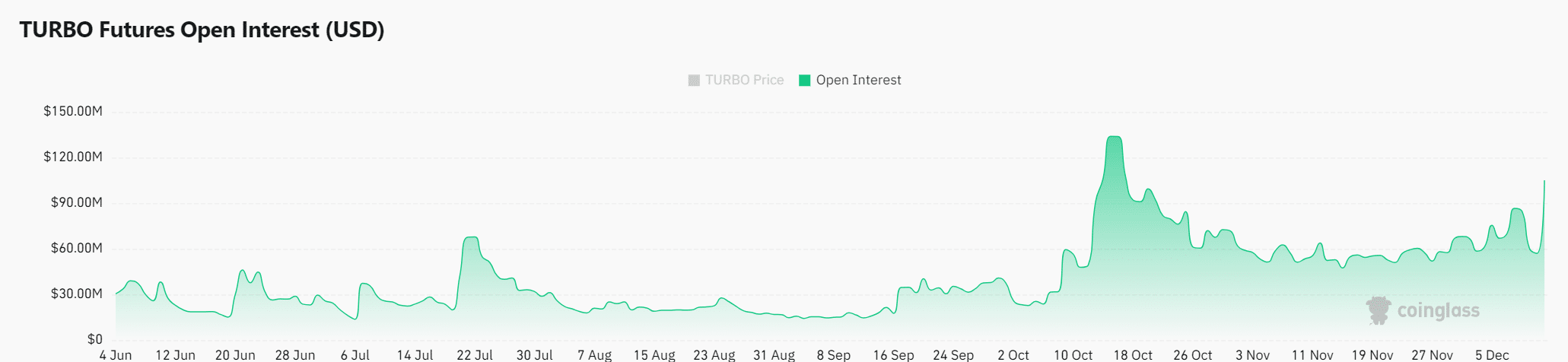

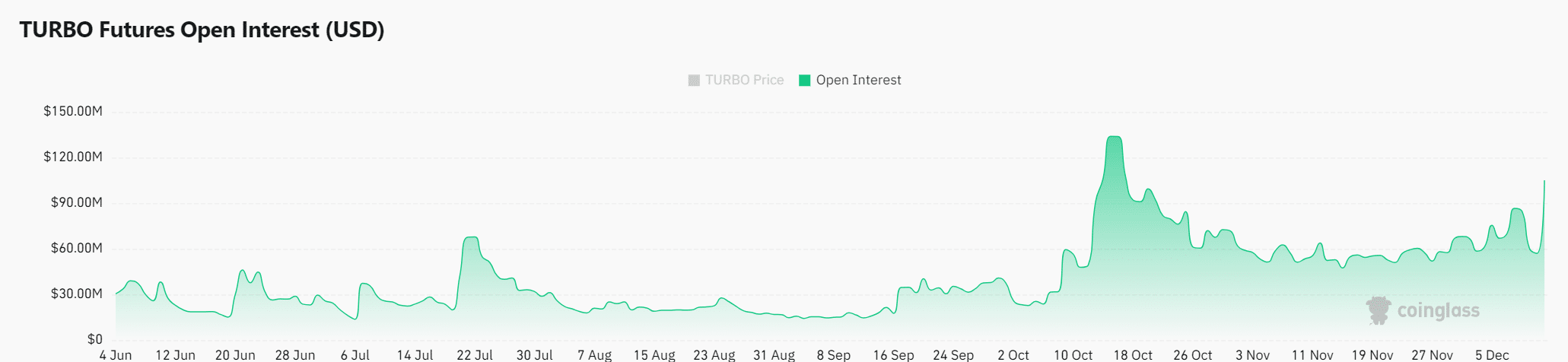

Rising open interest signals momentum

Open interest for Turbo has surged by 43.74%, reaching $91.50M. This sharp increase reflects growing speculative activity, which often precedes large price movements.

While this strengthens the case for a breakout, it also introduces potential risks if leveraged positions begin to unwind. Therefore, traders should monitor market behavior closely, as heightened volatility is expected.

Source: Coinglass

Realistic or not, here’s TURBO’s market cap in BTC’s terms

Will turbo soar or stumble?

Turbo is highly likely to break the $0.0135 resistance and target $0.016 and beyond. Strong technical indicators, rising on-chain activity, and surging open interest all point to sustained upward momentum.

While a pullback to $0.0095 is possible, the evidence overwhelmingly supports a bullish breakout in the near term.