- TURBO is testing a descending trendline; a breakout could initiate strong bullish momentum.

- Open interest is rising, signaling growing speculation, but elevated NVT and bearish onchain signals suggest caution.

Turbo [TURBO] is testing a crucial descending trendline that has acted as a strong resistance barrier in recent sessions. At press time, the token was trading at $0.007741, reflecting a 3.22% increase over the last 24 hours.

This trendline has consistently acted as resistance, keeping the token’s price suppressed in recent sessions.

Now, traders are closely watching for a potential breakout that could unlock an 11%-15% rally. With increased speculation, this breakout moment could be a defining move for TURBO. But will the momentum hold?

Turbo chart analysis: A critical trendline to break

The 2-hour chart shows TURBO locked beneath a descending trendline that has defined its recent downtrend. This trendline resistance stands as a major hurdle for the token.

If TURBO manages to break and close above it, it could trigger a rally toward potential upside targets around 11-15% higher. However, without a confirmed breakout, the trendline could continue to keep the price under pressure.

A breakout would likely encourage further bullish momentum, setting the stage for a possible rally to key price levels. This trendline break is therefore crucial; it could change the market’s sentiment and bring in additional buying interest.

However, if TURBO fails to break the trendline, it risks sliding back into consolidation or even a pullback.

Source: TradingView

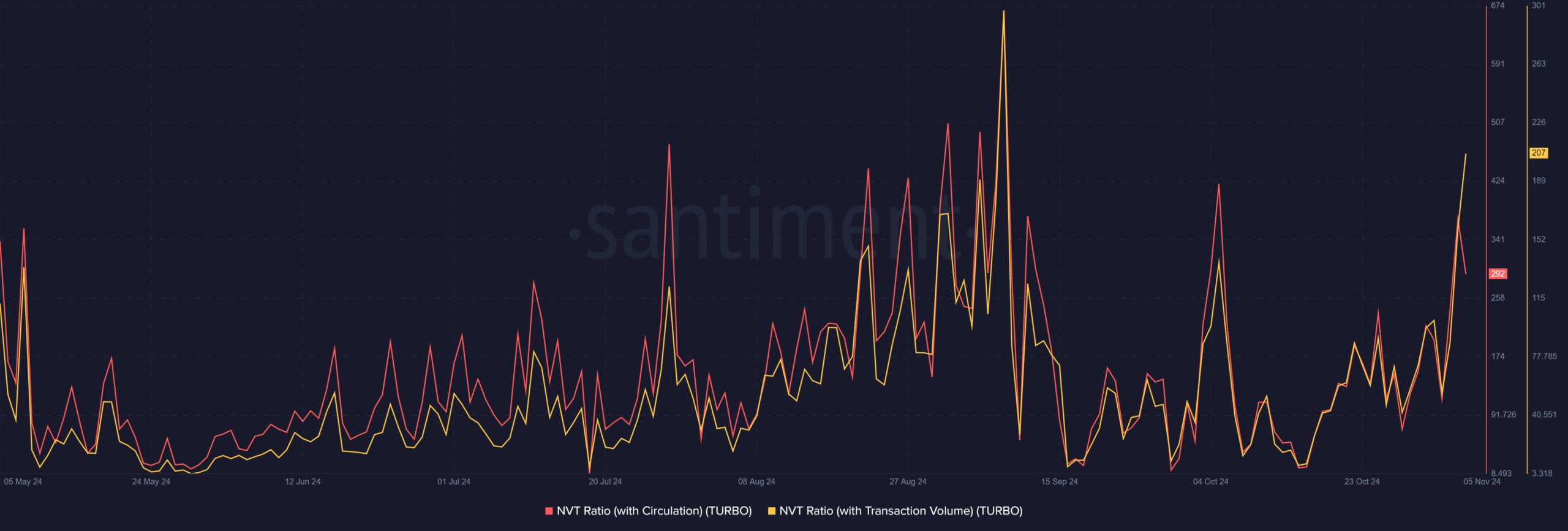

Elevated NVT ratio signals overvaluation risk

However, while technical indicators lean bullish, the Network Value to Transactions (NVT) ratio suggests caution. Currently, TURBO’s circulation-based NVT is at 292.54, and its transaction volume-based NVT is 207.15.

These elevated values imply the asset may be overvalued relative to its underlying network activity.

The high NVT ratio indicates that while the price is near a breakout, on-chain activity might not be robust enough to sustain long-term gains. Therefore, traders should balance optimism with careful consideration of the potential for overvaluation.

Source: Santiment

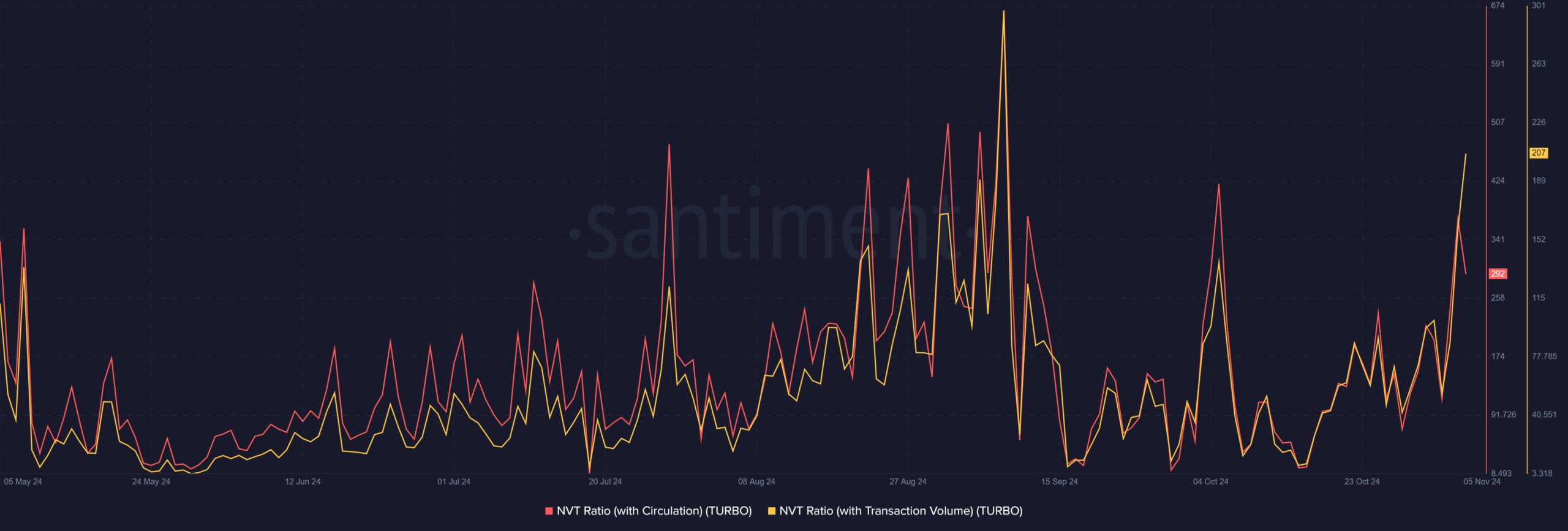

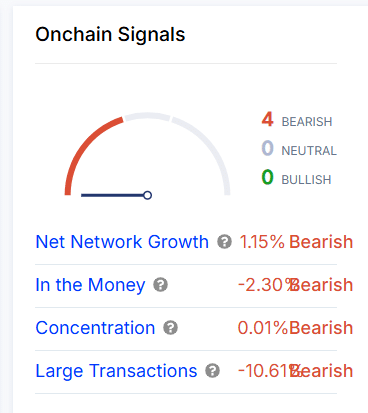

Onchain signals add bearish pressure

TURBO’s onchain metrics reveal a generally bearish sentiment, compounding the cautious outlook. Net network growth shows a minor 1.15% increase, which remains relatively low.

The “In the Money” metric is down by 2.30%, indicating fewer holders are in profit — a factor that may dampen investor enthusiasm.

Additionally, large transactions have dropped by 10.61%, pointing to reduced interest from high-net-worth investors or institutions. These bearish signals suggest that, while a breakout could generate short-term gains, the broader onchain sentiment remains weak.

Source: IntoTheBlock

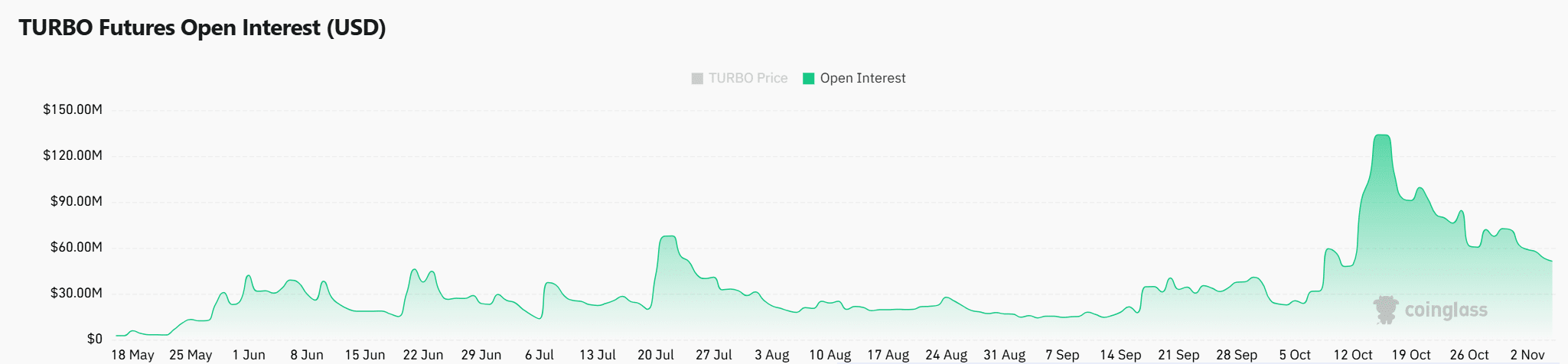

Open interest points to rising speculation

In contrast to the bearish onchain metrics, open interest in TURBO has risen by 2.33%, totaling $53.45 million. This increase indicates growing speculative interest as traders position for a possible trendline breakout. Typically, rising open interest reflects an anticipation of major price movement.

Therefore, this rising interest could drive additional volatility, especially if TURBO manages to break above the trendline.

Source: Coinglass

Realistic or not, here’s TURBO’s market cap in BTC’s terms

TURBO poised for a breakout but with caution

As TURBO nears a critical trendline, a breakout appears possible, with an 11-15% rally potential. However, elevated NVT and bearish onchain metrics signal caution, suggesting that while a breakout could ignite short-term gains, sustaining momentum might be challenging.

Traders should keep a close eye on the trendline and balance the bullish potential with the risks posed by weak network support.