- The TON blockchain touted a record-breaking milestone, reaching 1 billion transactional volume.

- Does this signal an impending price correction?

Toncoin [TON] has faced a downward trend since late August, dropping 28% to $4.884 due to controversy surrounding Telegram and Bitcoin’s [BTC] meltdown.

Despite this, a recent surge of 1 billion transactions on the Toncoin blockchain prevented it from testing the $4.5 support level, which AMBCrypto noted could have retracted it to its February low of $2.06.

After the pullback, TON rallied close to the $9 resistance.

As TON nears $4.5 again, AMBCrypto explores whether bulls can prevent a repeat of February’s decline or if Bitcoin will push TON into a bearish trend.

BTC volatility limits TON rebound

Amid wider market volatility, driven by Bitcoin dropping below the $57 support level, bulls may need to work harder for a TON rebound.

The TON blockchain registering 1.02 billion transactions, with half occurring in the last three months, surely reflected a surge in user engagement.

However, despite this historic milestone, the daily buying volume remained below bullish expectations.

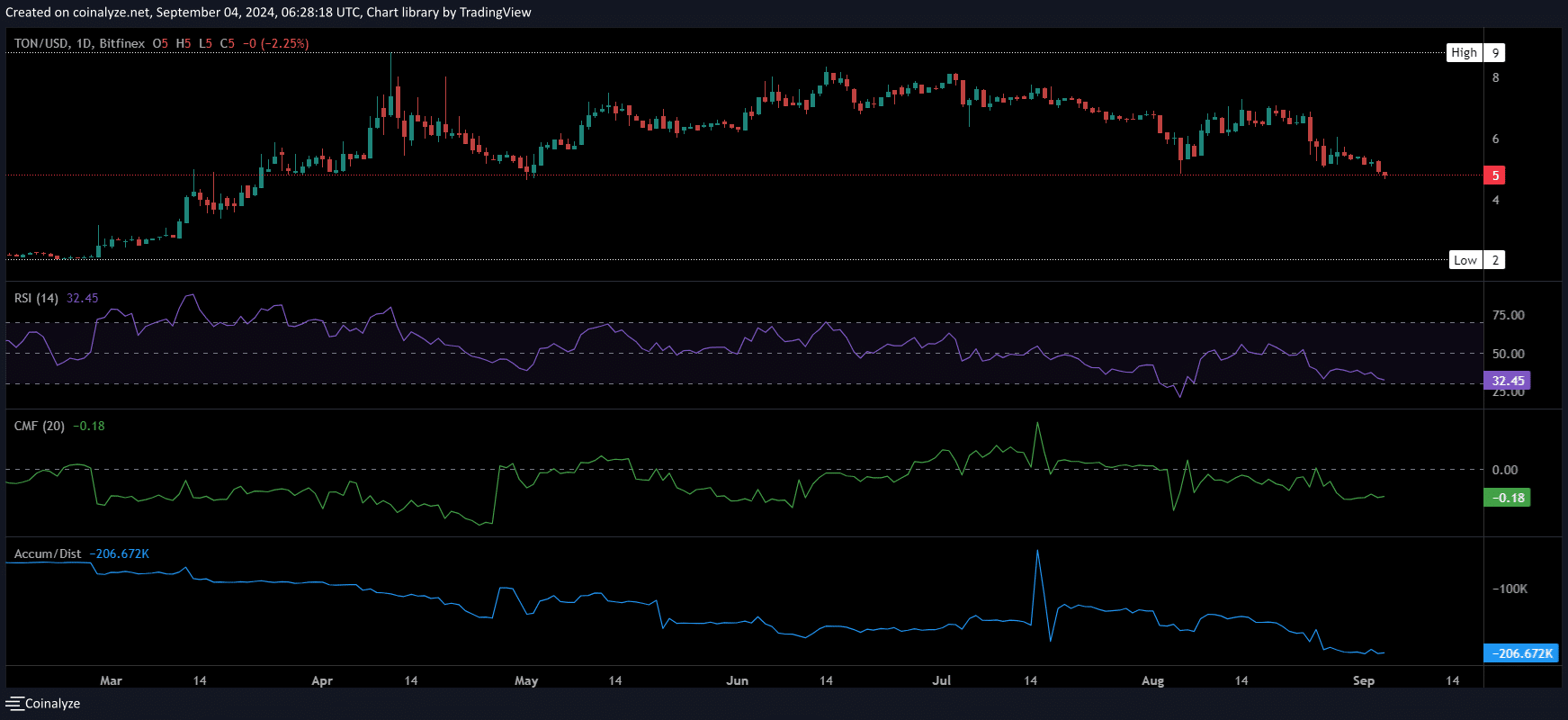

Source : Coinalyze

The chart showed a bullish rally in late February, pushing TON near $9 by mid-April, with the OBV climbing from 80K to 216K and RSI reaching 80, signaling a solid overbought condition.

In early August, despite a bearish start, a surge in OBV and CMF drove a sharp two-week spike in TON before BTC disrupted it.

In short, bulls have repeatedly pushed TON for a price reversal, supported by strong volume data and the high transaction volume on the TON blockchain.

However, AMBCrypto noted that BTC-induced market volatility has made investors cautious, as shown by an oversold RSI, leading to reduced capital inflow despite these bullish efforts — So, is a rebound off the charts?

Recent whale activity

Interestingly, whales hold 68.88% of the large TON holdings, totaling approximately $3.24 billion.

The remainder is split between retail and institutional investors, with the latter holding 26.53% of the remaining large TON holdings.

For approximately five months, large holders have predominantly consolidated their holdings, moving them infrequently.

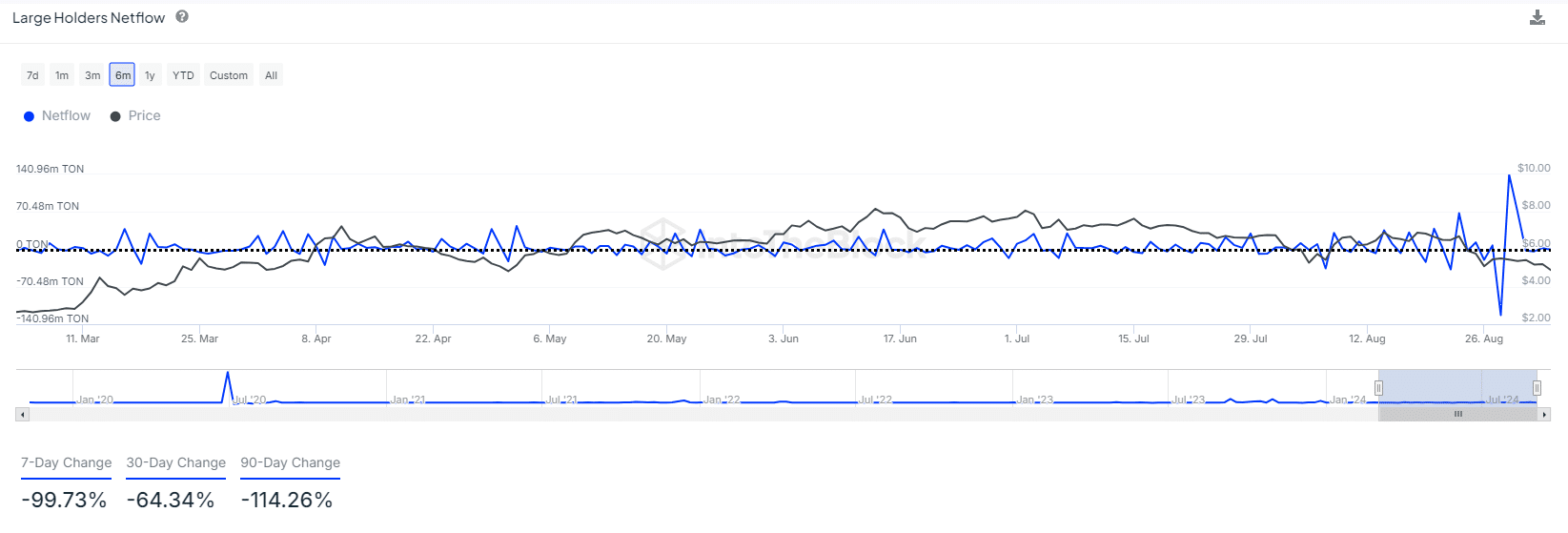

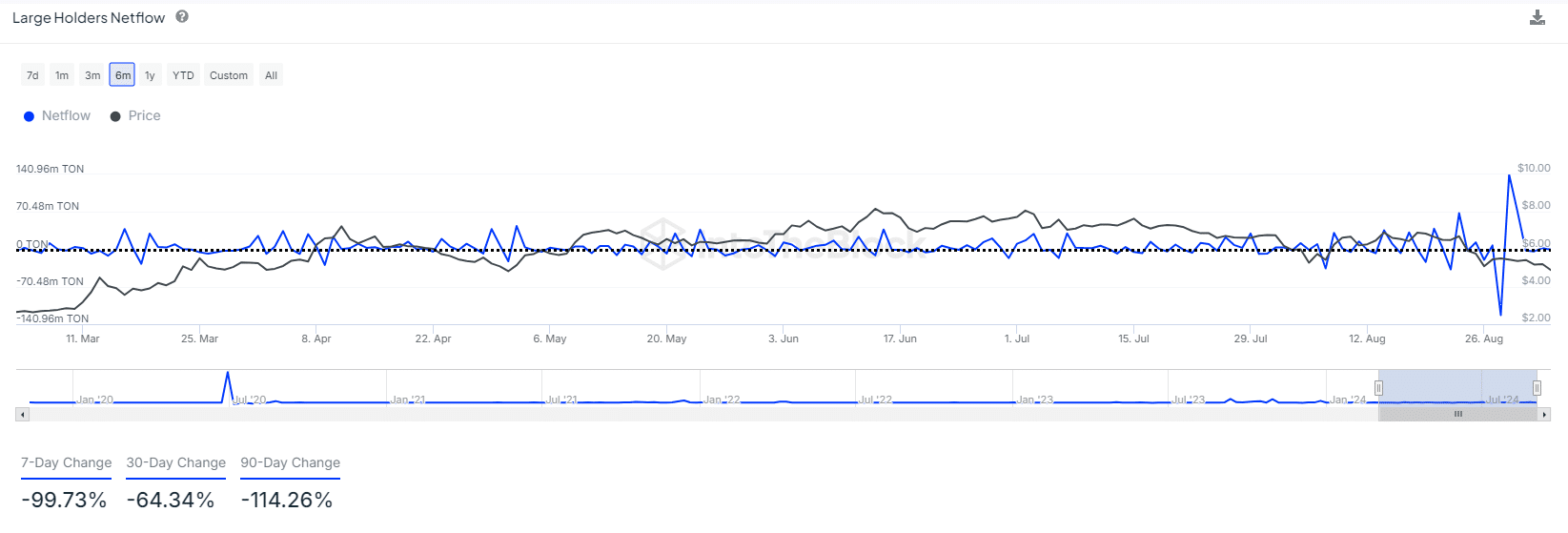

Source : IntoTheBlock

However, the chart revealed striking activity on the TON blockchain in the last few days of August.

On the 29th of August, large holders deposited approximately $140 million worth of TON into exchanges, causing a price plunge of more than 2% the following day.

AMBCrypto noted that these net outflows coincided with BTC’s recent downward swing and the general perception of September as a particularly volatile month.

In short, the 1 billion transactions on the TON blockchain were overshadowed by overall market volatility, forcing large holders to exit before it was too late.

Moreover, if the market remains unstable, bears may solidify their control, pushing TON below the $4.5 support level – Whom are the odds favoring?

TON blockchain volatility favors short positions

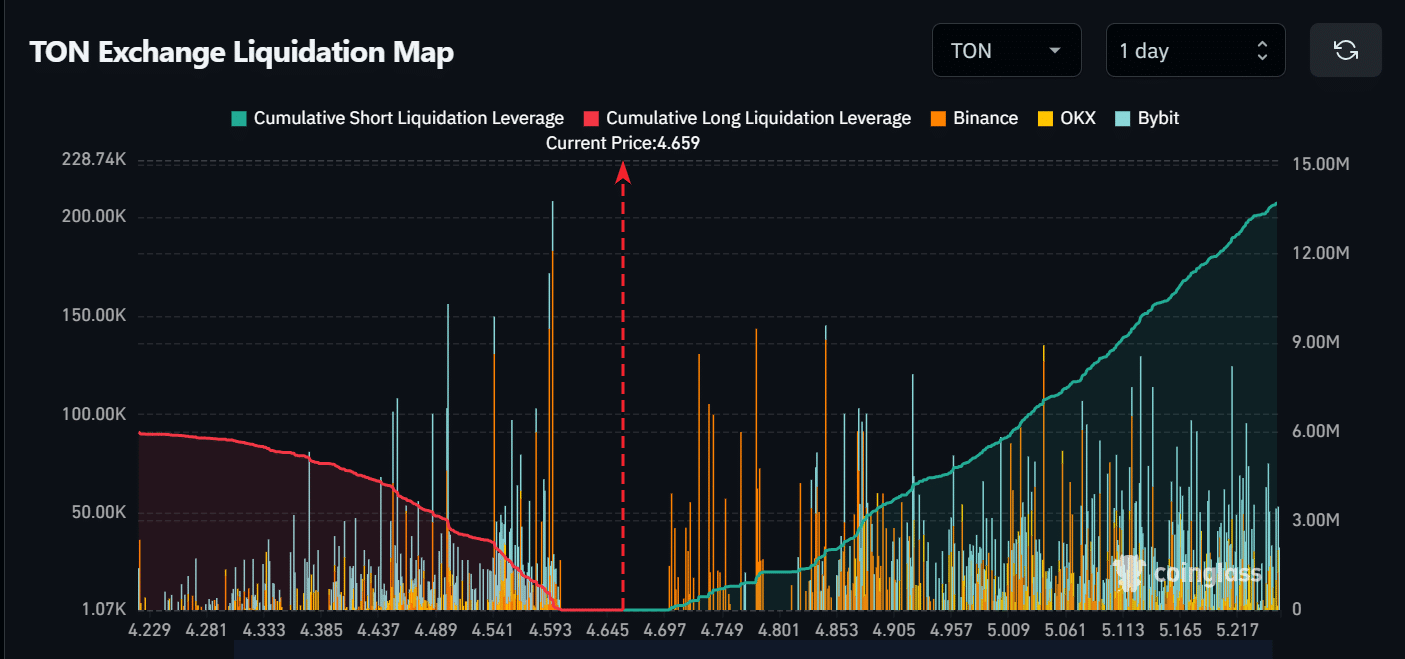

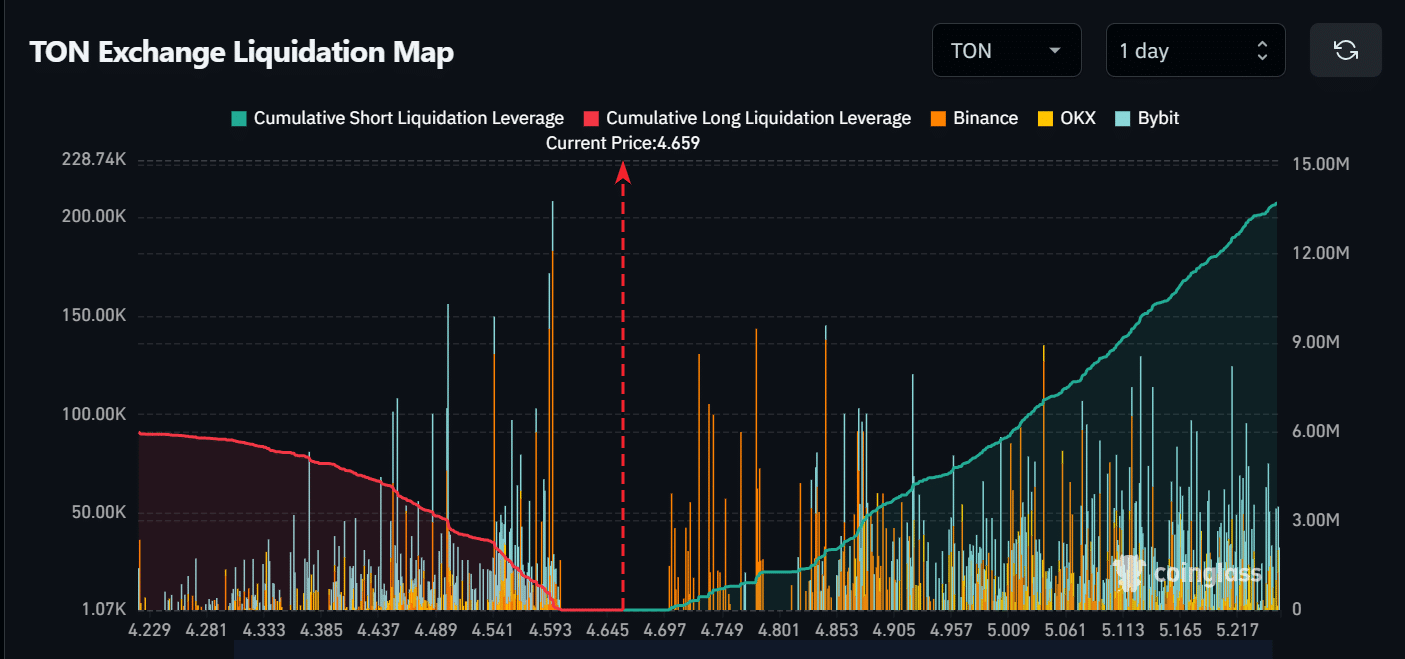

AMBCrypto’s analysis of the chart below revealed that if TON continues to decline, despite record-breaking transactions on the TON blockchain, $332K in long liquidations could occur when it tests the $4.5 support line.

Source : Coinglass

Realistic or not, here’s TON market cap in BTC’s terms

In short, if long-term market volatility persists, a TON recovery will be challenging. If bulls succeed, TON might reach the $5.2 ceiling; otherwise, it could retrace to the $4.2 range.

Currently, the odds seem to favor short position holders.