- Toncoin’s price slump has left 96% of holders in the red, raising concerns about investor sentiment and market stability

- On-chain metrics revealed declining activity and profitability

The cryptocurrency market has seen its fair share of turbulence lately, and Toncoin [TON] holders are feeling its weight.

According to data from IntoTheBlock, approximately 96% of TON holders are currently at a loss, highlighting the downturn’s severity. As the price continues to hover near its recent lows, market sentiment remains grim, with traders questioning whether a recovery is on the horizon or not.

96% of TON holders are underwater

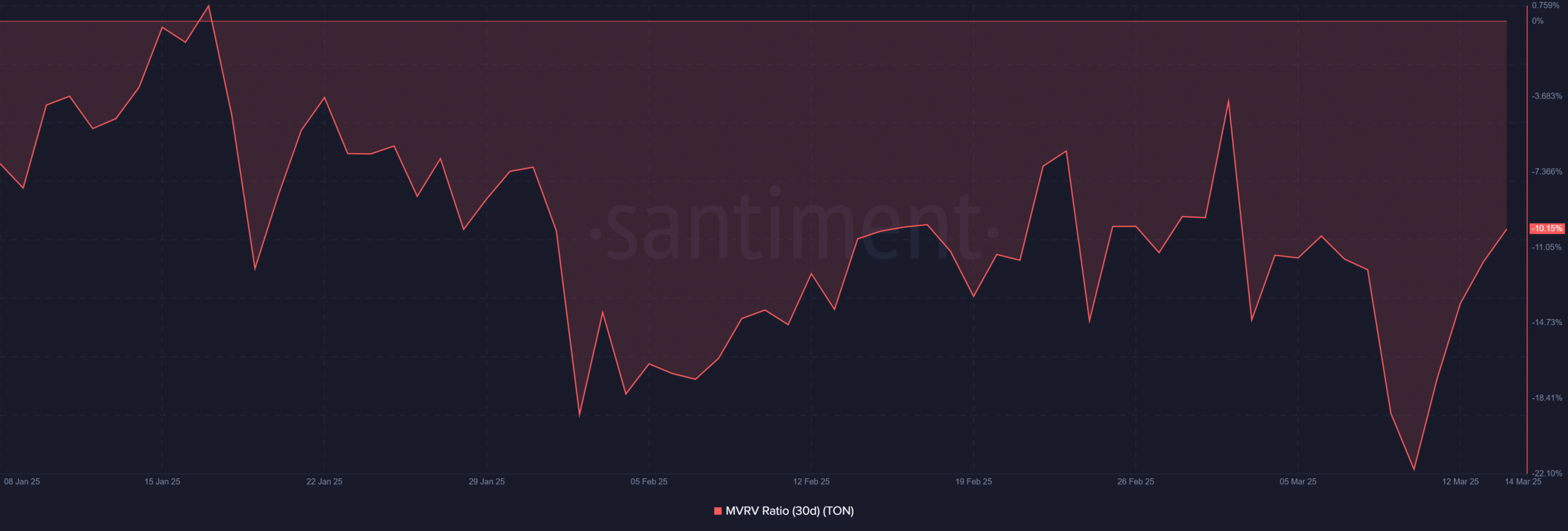

A deep dive into on-chain data revealed that nearly all Toncoin investors are now in a losing position. In fact, at the time of writing, the MVRV [Market Value to Realized Value] ratio, which tracks unrealized profits and losses, indicated that TON has been in negative territory for an extended period.

The MVRV 30-day ratio had a reading of -10.15%, confirming that most holders may be holding assets at a loss.

Source: Santiment

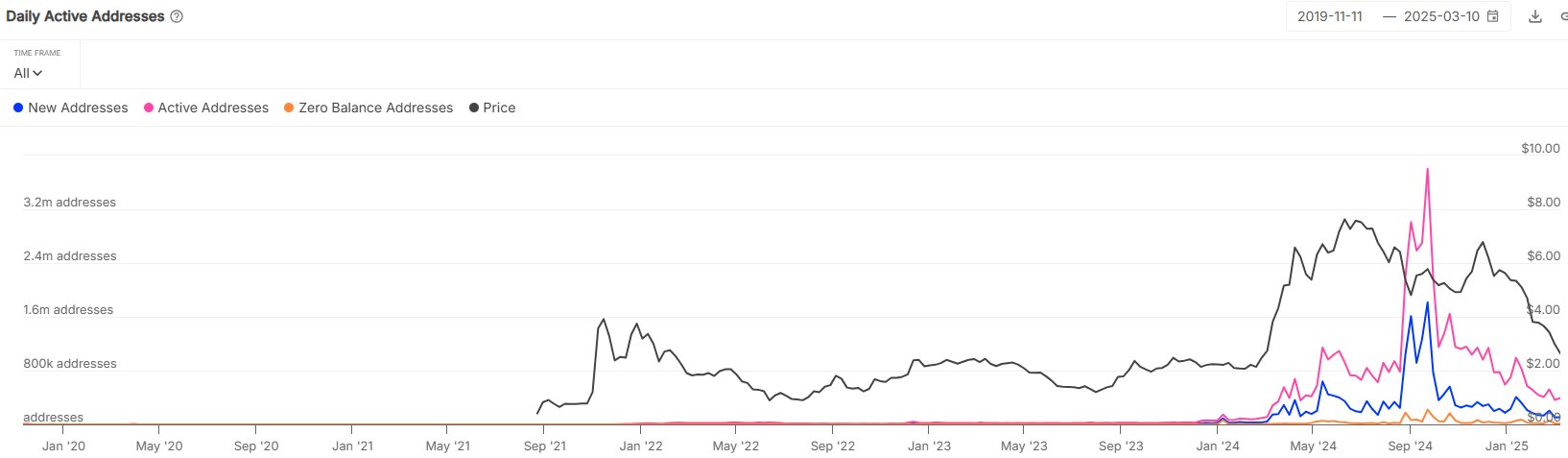

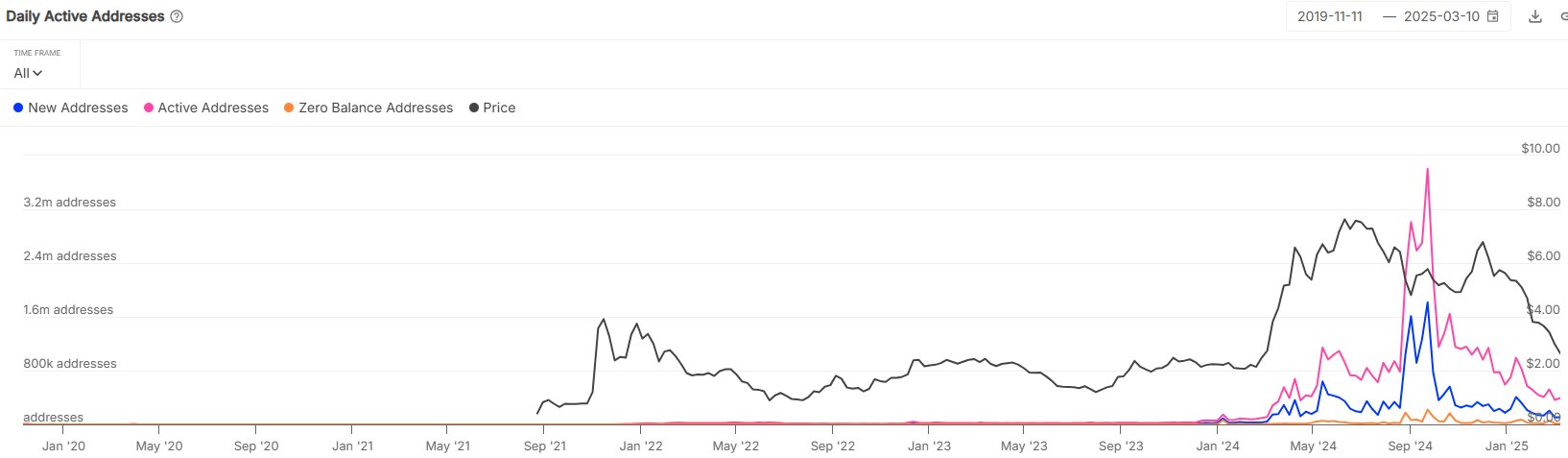

This decline was further evidenced by the daily active address chart, wherein a sharp drop in user activity seemed to align with the price downturn.

With new addresses flashing weak growth, investor confidence may be waning as well.

Source: IntoTheBlock

Price performance and key resistance levels

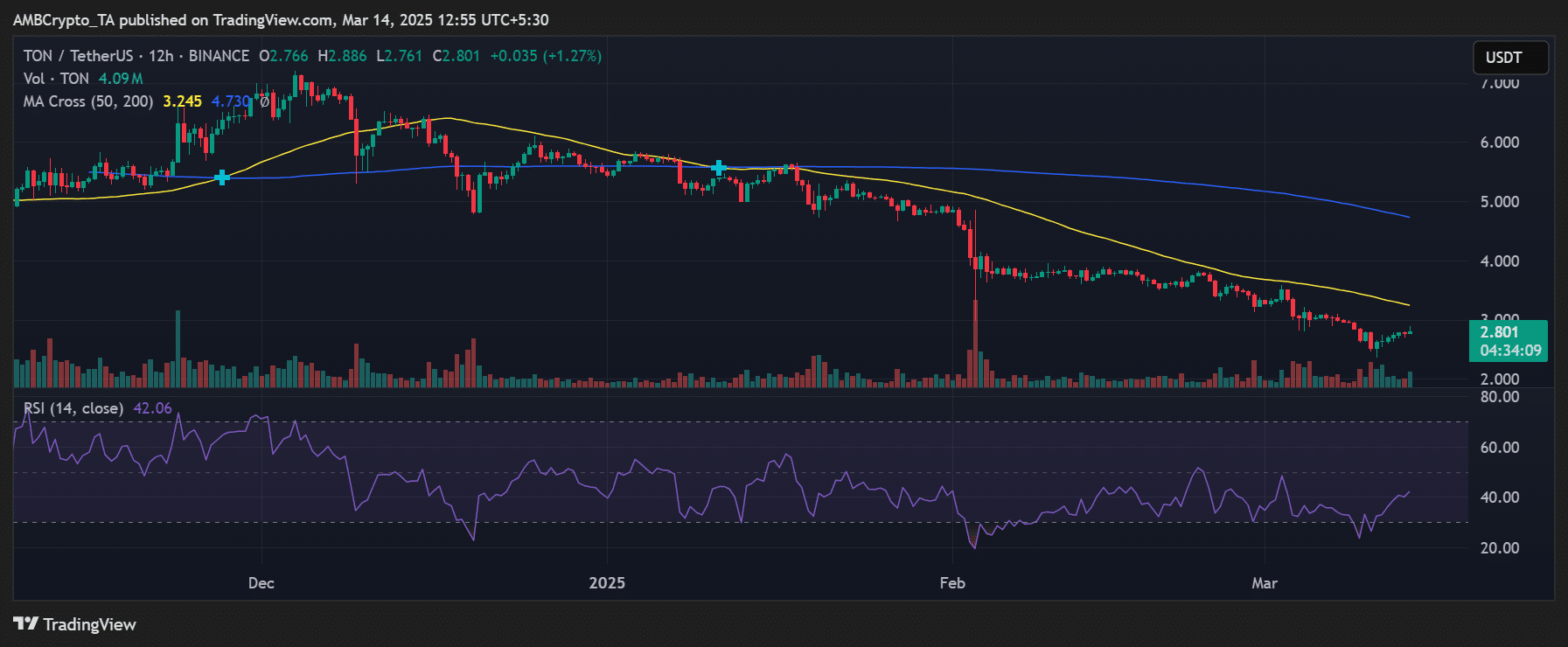

Toncoin’s price has been on a prolonged downtrend, struggling to reclaim its previous highs.

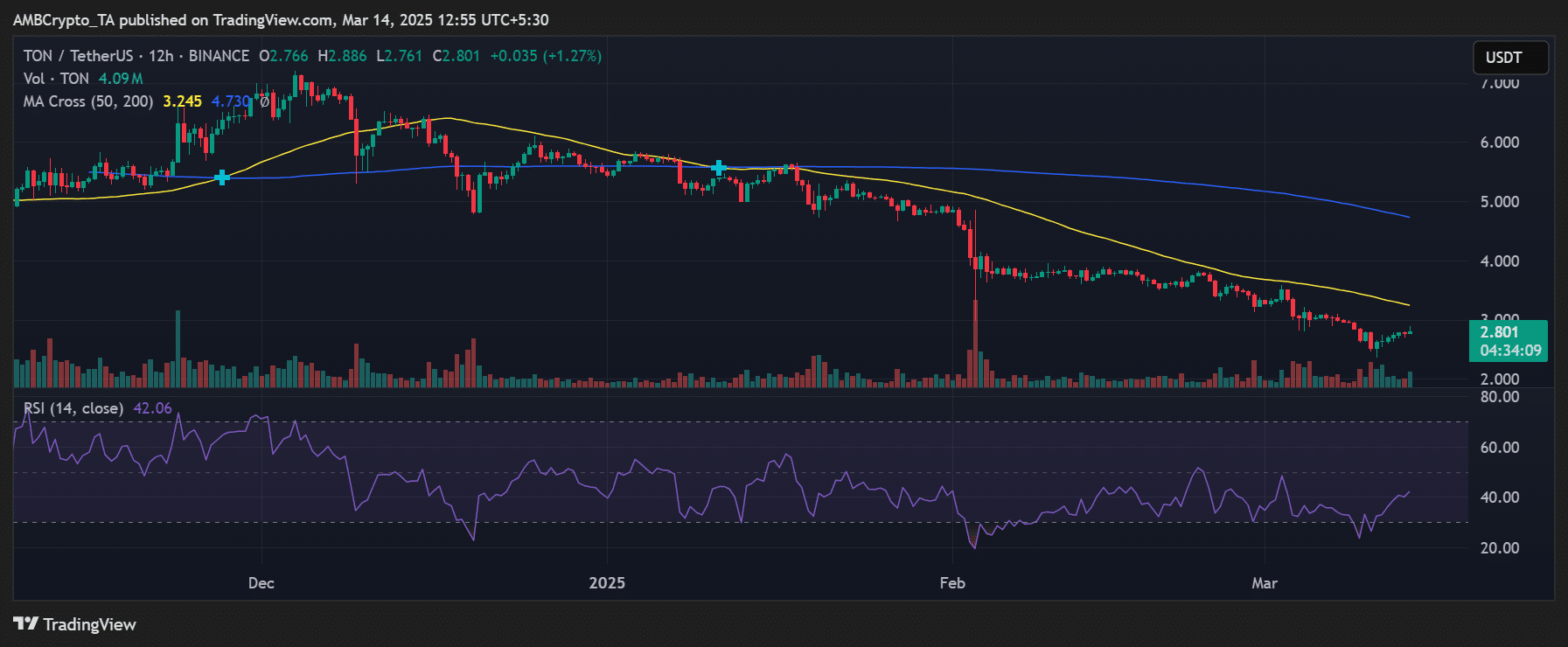

At press time, it was trading at $2.80, having faced consistent rejection at the $3.24 resistance level – Consistent with the 50-day moving average. A failure to break above this level could see TON’s price spiral further, testing the $2.50 support zone.

Source: TradingView

Despite the bearish outlook, technical indicators hinted at a potential relief bounce on the charts.

The RSI [Relative Strength Index] was at 42.06, showing that TON may be approaching oversold conditions. If buyers step in, a short-term rebound could push the price towards the $3.00-$3.25 range before another possible decline.

What’s next for Toncoin?

Toncoin’s recovery will depend on a shift in market sentiment and renewed demand. The lack of bullish momentum, combined with low MVRV readings, suggested that accumulation is still in progress. If Toncoin reclaims key support levels and witnesses an uptick in active addresses, it could pave the way for a more sustained recovery.

For now, investors must remain cautious as TON continues to trade in a weak structure. With nearly all holders underwater, the selling pressure could persist unless a strong catalyst drives demand back into the market.