- Dogecoin is the most popular memecoin- and its price action could dictate the sector’s trends.

- On-chain metrics showed a buy signal for long-term DOGE investors.

The memecoin market has shed 39.4% in market cap since the 9th of December. Over the past month, the price charts of most memecoins have been pointed downward only.

Bitcoin’s [BTC] volatility around the $100k mark has affected the altcoin market, and in turn, the memes as well.

Source: CoinMarketCap

The launch of Official Trump [TRUMP] did little to alleviate this stress. Holders were tempted to sell their other meme holdings and buy TRUMP as its price shot higher rashly.

After reaching an all-time high of $73.43 on the 19th of January, TRUMP too has been in a severe decline, falling 71% in two weeks.

Source: TRUMP/USDT on TradingView

The token has fallen below the short-term range it formed, and new lows were likely ahead. The A/D indicator did not inspire much confidence either.

TRUMP’s price action could dissuade the public from buying memecoins in the near-future.

Could Dogecoin rescue the meme market?

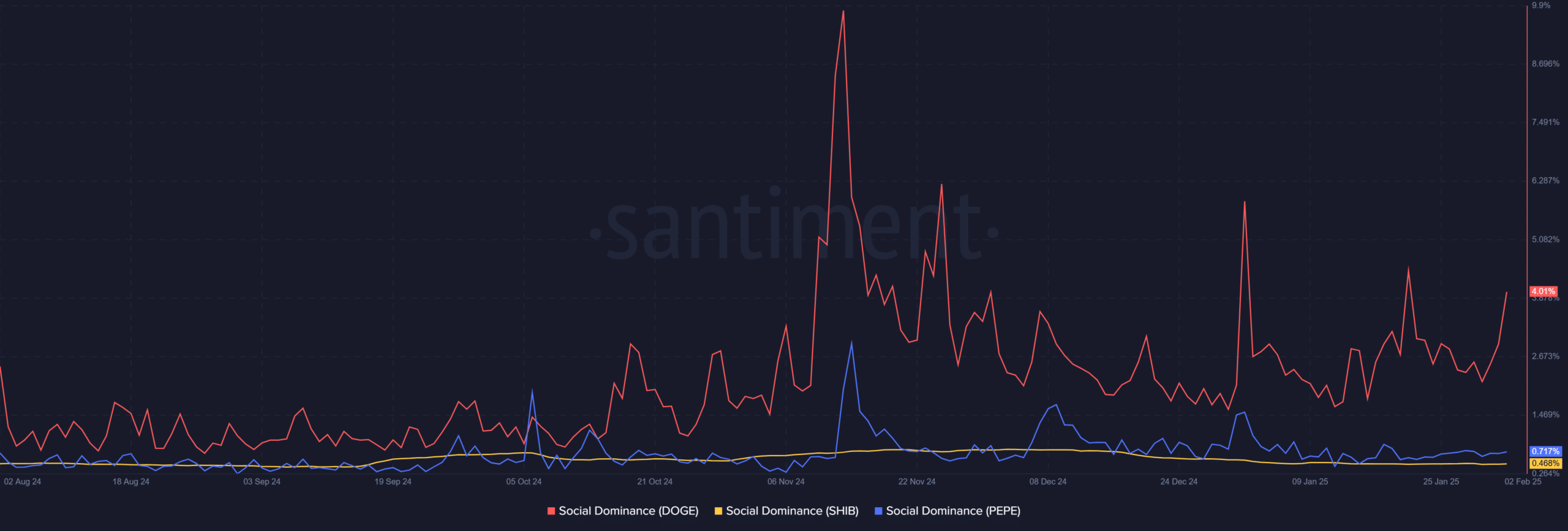

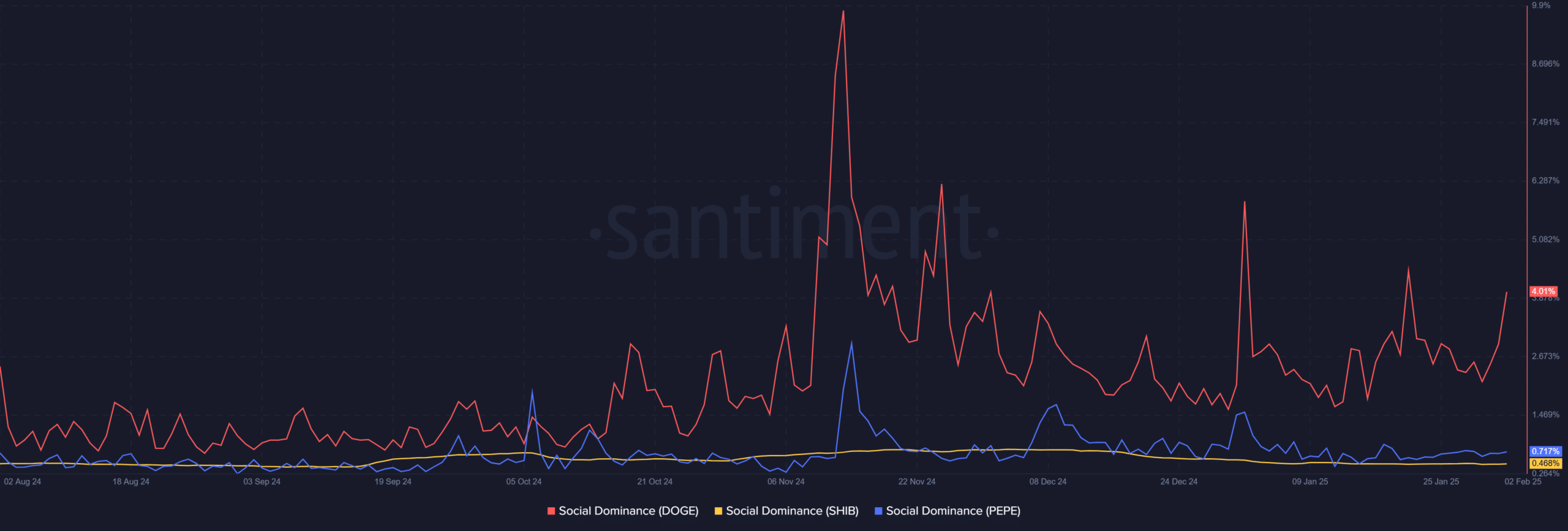

Source: Santiment

As the leading memecoin by market cap, Dogecoin [DOGE] will be a good indicator of the health of the sector at large.

At press time, it had a +0.89 correlation with Shiba Inu [SHIB], which meant that the large memecoins’ performance is closely correlated with the leader’s.

As the Santiment data above highlights, DOGE has consistently had a higher social dominance than SHIB or Pepe [PEPE].

Social dominance is the percentage share of a coin’s mentions in social media.

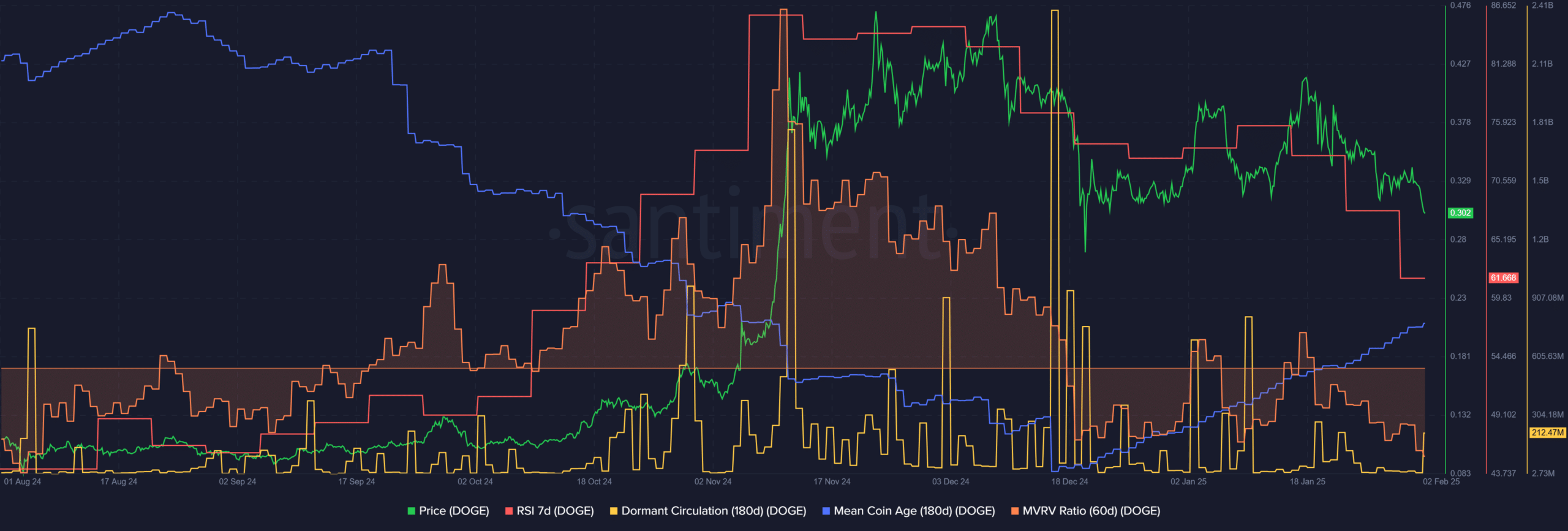

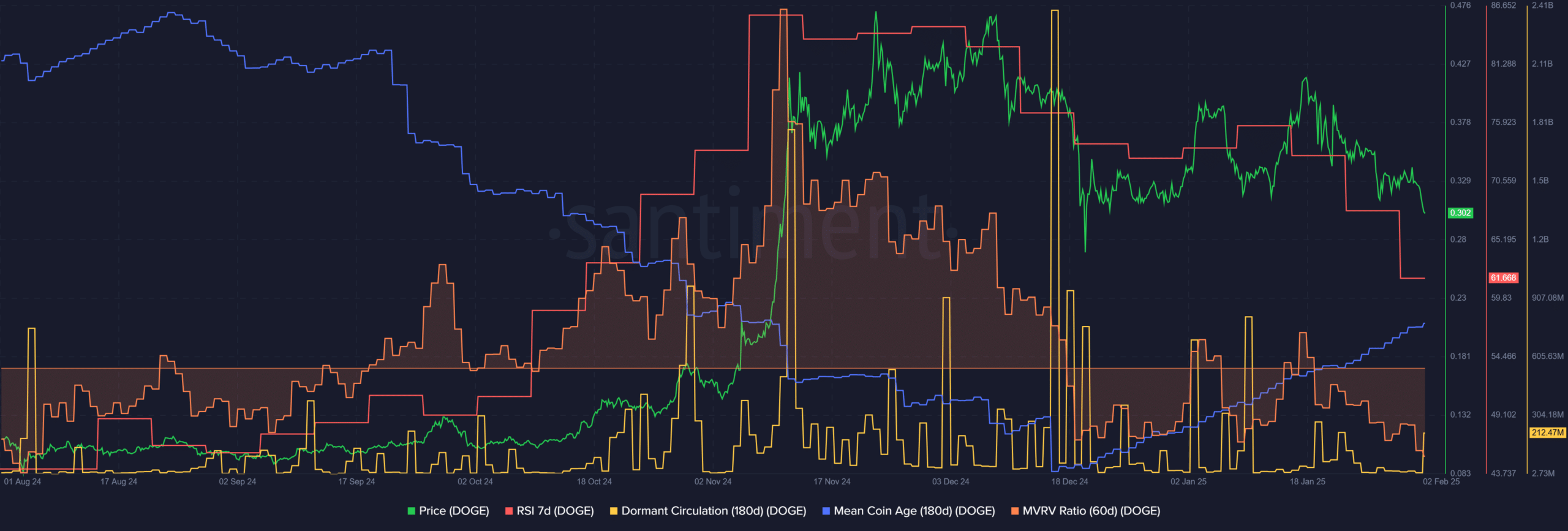

Source: Santiment

The on-chain metrics reflected bullishness. The dormant circulation did not show a flurry of token movement that generally precedes a wave of selling.

The mean coin age has been rising over the past six weeks as well, even though the price was unable to trend higher.

The 60-day MVRV was negative, showing short to medium term holders were at a loss. Together, the metrics presented a buy signal.

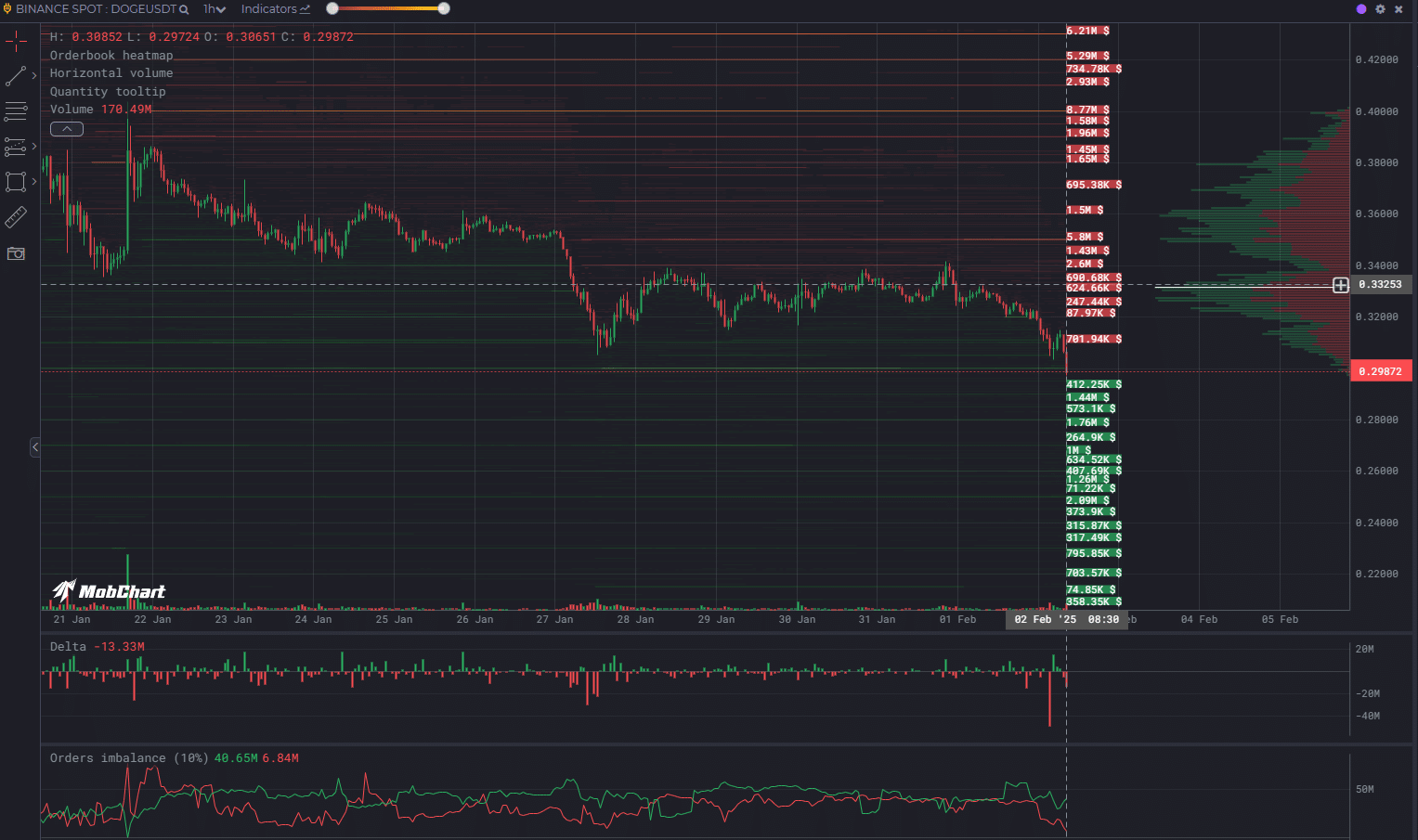

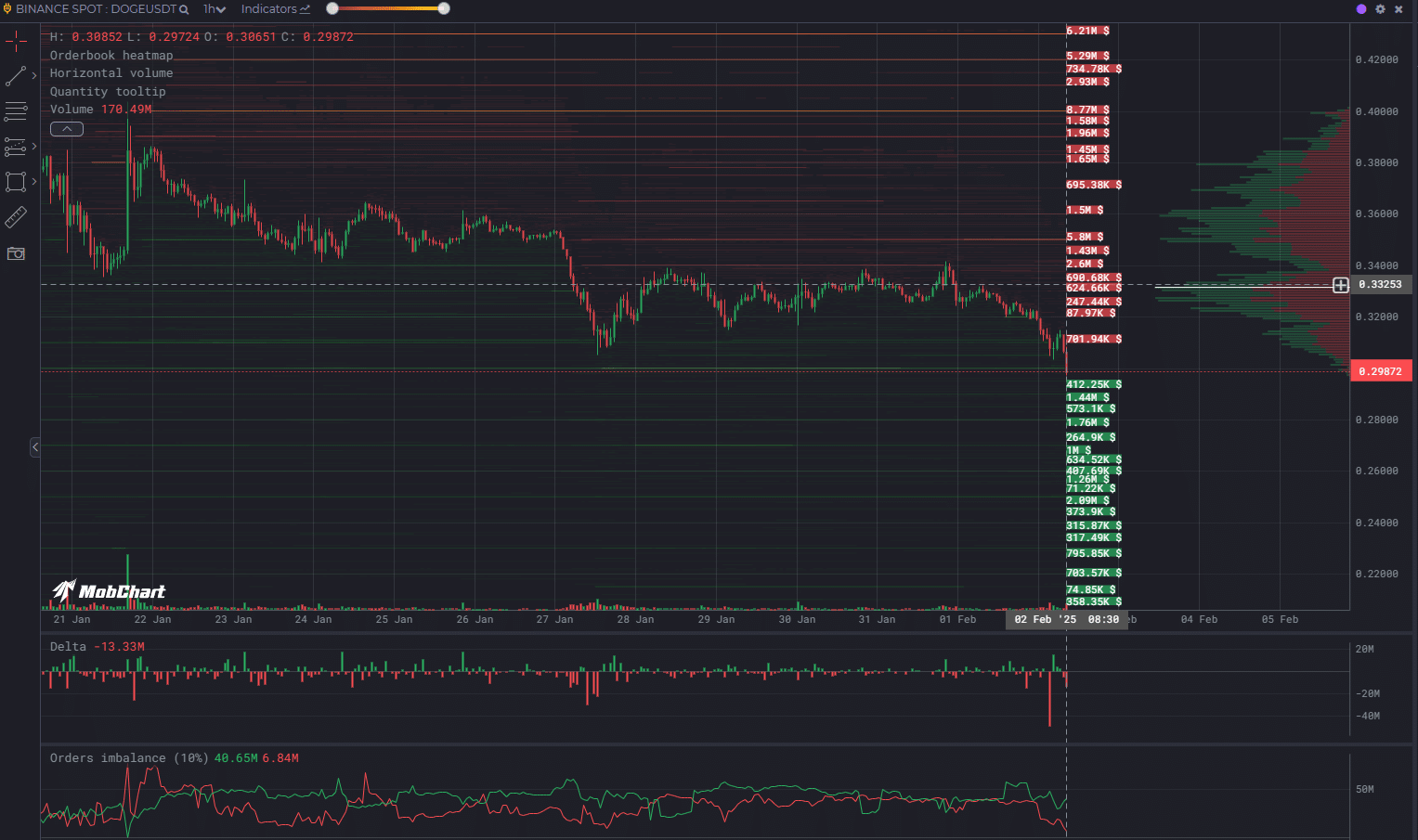

Source: MobChart

Read Dogecoin’s [DOGE] Price Prediction 2025-26

The orderbook data outlined the key support resistances for the coming days. The concentration of limit buy orders at the $0.28, $0.27, and $0.26 round numbers showed that price could gravitate to these levels before a reversal.

The orders imbalance was skewed toward the buyers in the 10% space around the current price, embellishing the idea of a bullish short-term reversal.