- German MP Joana Cotar urged her government to reconsider selling its seized BTC holdings.

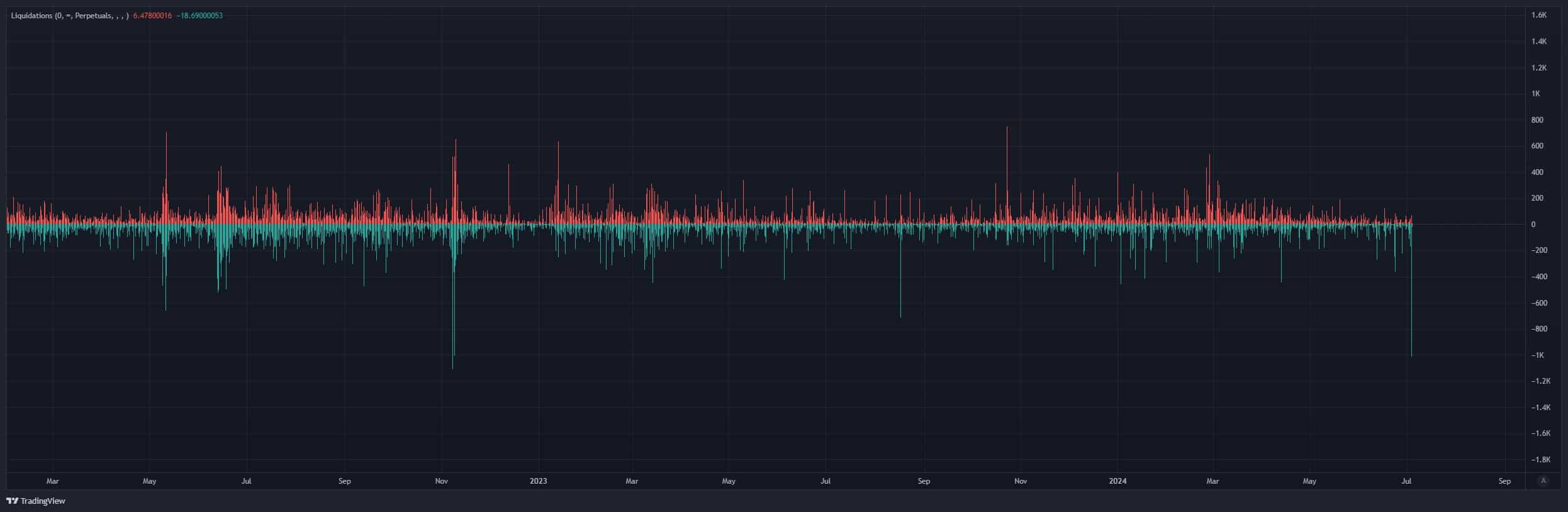

- The ongoing BTC dump has triggered the largest liquidation post-FTX crisis.

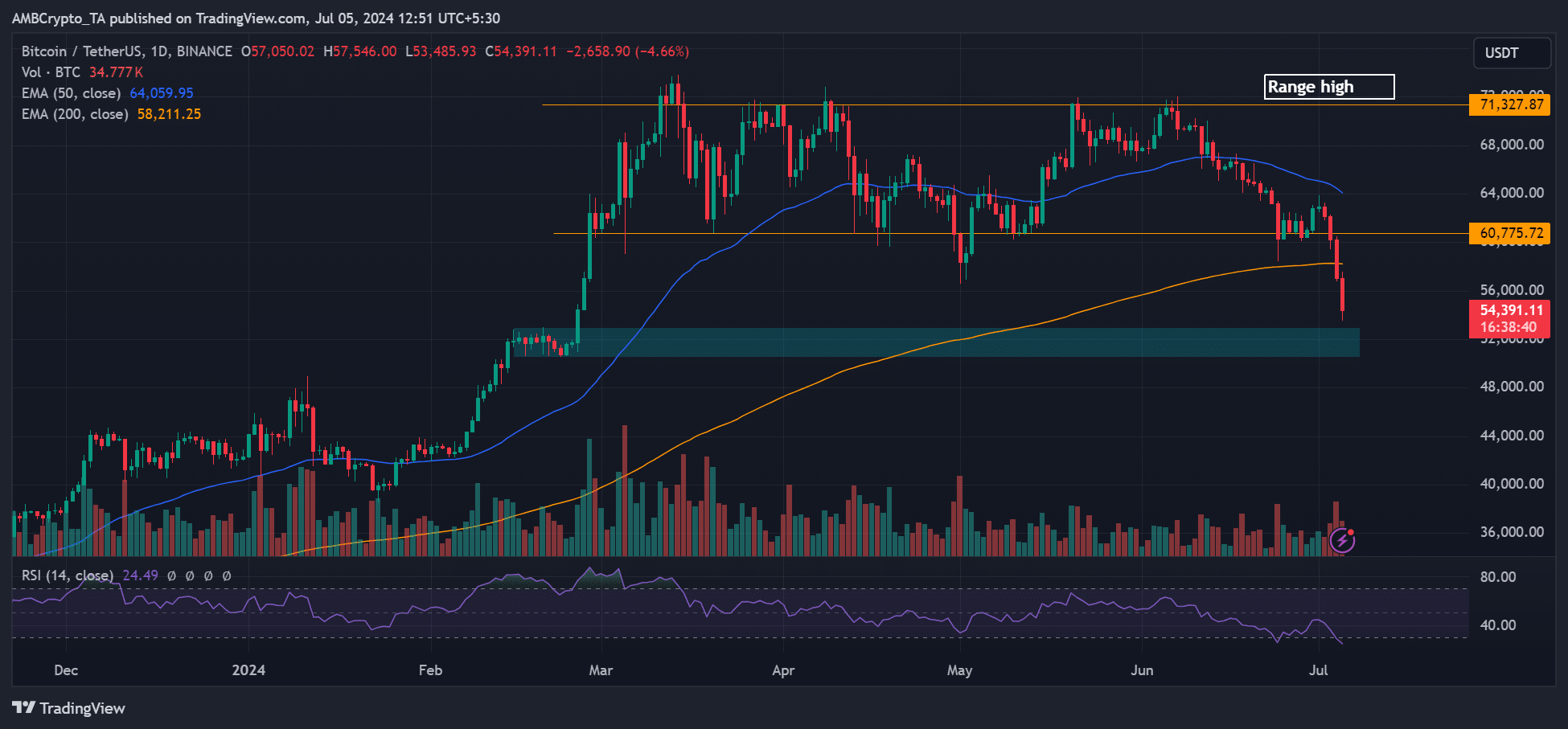

The crypto market sank lower this week as Bitcoin [BTC] dropped to $53K, the lowest level seen since February 2024.

Market sentiment has worsened amidst massive sell-side pressure from entities like the German government.

German authorities have been offloading 50K BTC seized from the illegal streaming site Movie2k.to. It moved 3K BTC on 4th July, and an extra 1.95K BTC was moved in the past 12 hours, per Arkham Intelligence data.

German Bitcoin selling sparks criticism

These were part of the BTC whale dump that lowered BTC prices and initiated a market-wide bloodbath that angered even German MP Joana Cotar.

Cotar urged her government to reconsider its sell-offs. Part of her translated statement on X (formerly Twitter) read,

“Instead of holding #Bitcoin as a strategic reserve currency, as is already being debated in the USA, our government is selling on a large scale.”

Cotar also accompanied a letter supporting arguments on why the German government should halt the BTC sell-offs.

She added that BTC presents the government with diversified state assets and long-term value preservation from currency devaluations and inflation.

In essence, she urged the government to adopt a Bitcoin strategy.

“Instead of a sale, I recommend developing a comprehensive Bitcoin strategy. This could include maintaining Bitcoin in the state treasury, issuing Bitcoin bonds, or creating a supportive regulatory environment.”

Crypto market commentator Samson Mow echoed Cotar’s argument and viewed the government BTC sell-offs as the ‘peak of idiocracy.’

In the meantime, if the selling pressure persists, the BTC dump could extend to the weekly order block and February consolidation zone of $52.9K—$50K, marked in cyan.

Source: BTC/USDT, TradingView

The extended retracement and retest of $53K have triggered massive liquidations, which have reached nearly $700 million across the whole market in the past 24 hours.

BTC accounted for $226 million of liquidations over the same period, with long positions posting massive losses worth over $180 million.

According to one market observer, the massive liquidation was the biggest since the FTX saga in November 2022.

Source: x/Honeybadger