- XLM topped the weekly losers list but defended a key level as support.

- Will the price consolidation above $0.4 extend amid whales’ lack of interest?

Stellar [XLM] topped the weekly losers chart on CoinMarketCap, dumping 8% after a 173% pump the previous week.

While the pullback could be a healthy retracement before another leg up, do indicators support a similar outlook?

What’s next for XLM?

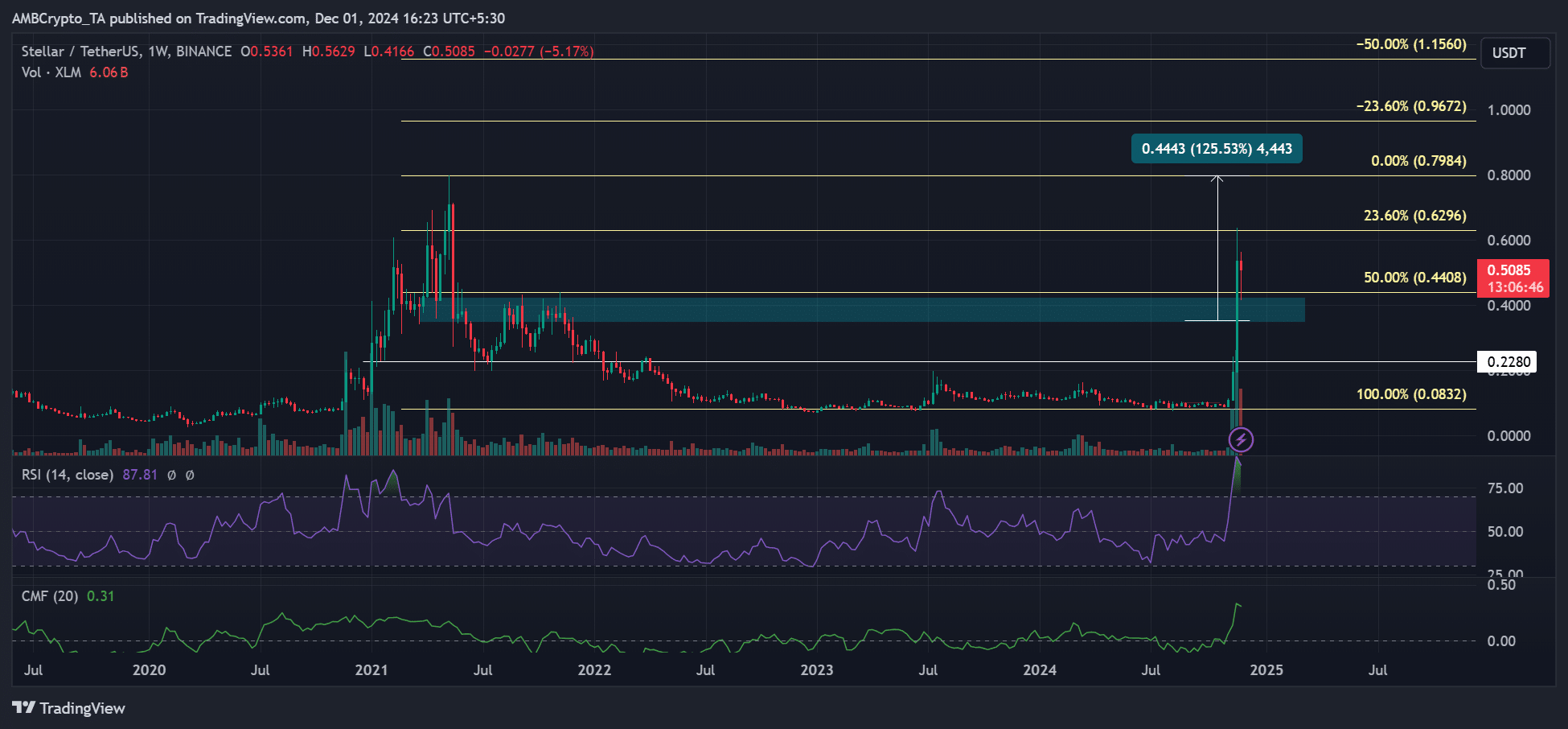

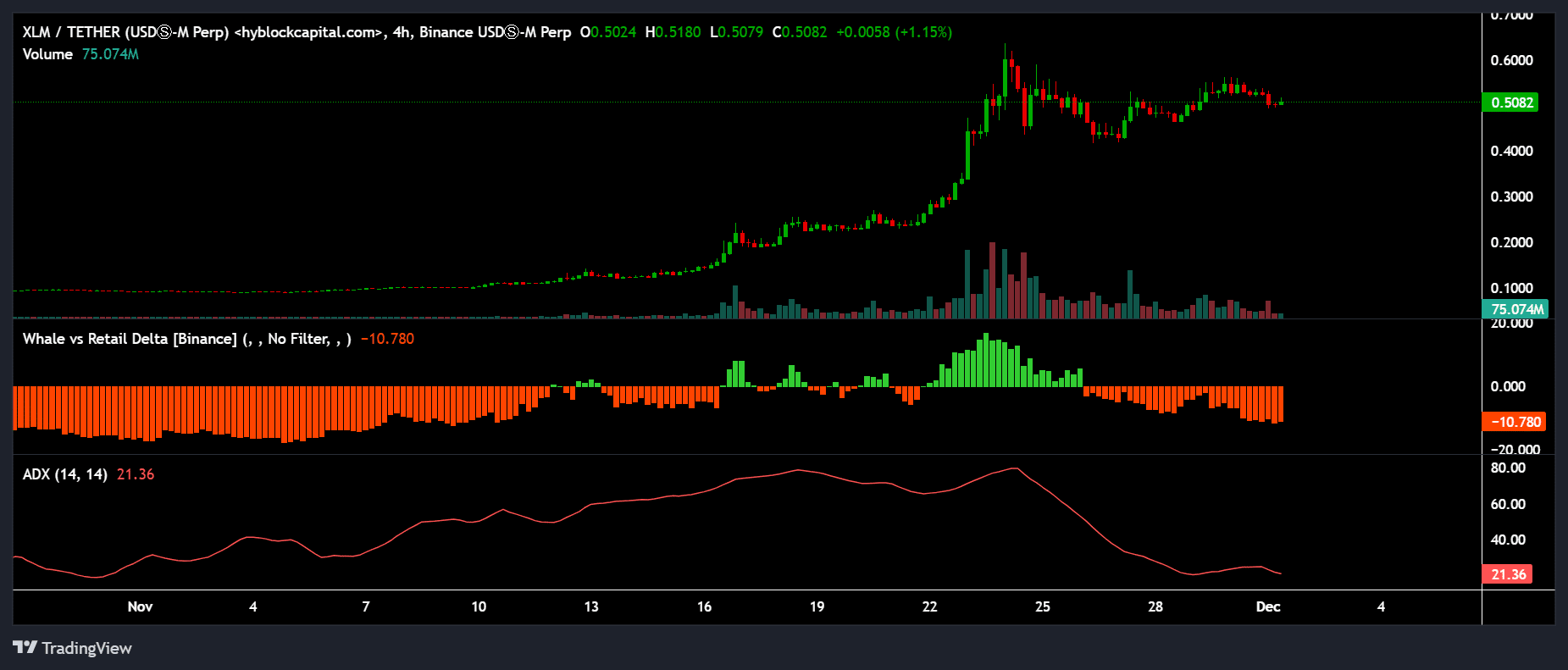

Source: XLM/USDT, TradingView

From a weekly chart perspective, XLM defended a key resistance at $0.4 as a support. This increased the odds of the altcoin eyeing its 2021 highs of $0.79 or higher.

The uptick in CMF (Chaikin Money Flow) indicated record inflows, so the uptrend could extend after building enough momentum above $0.4.

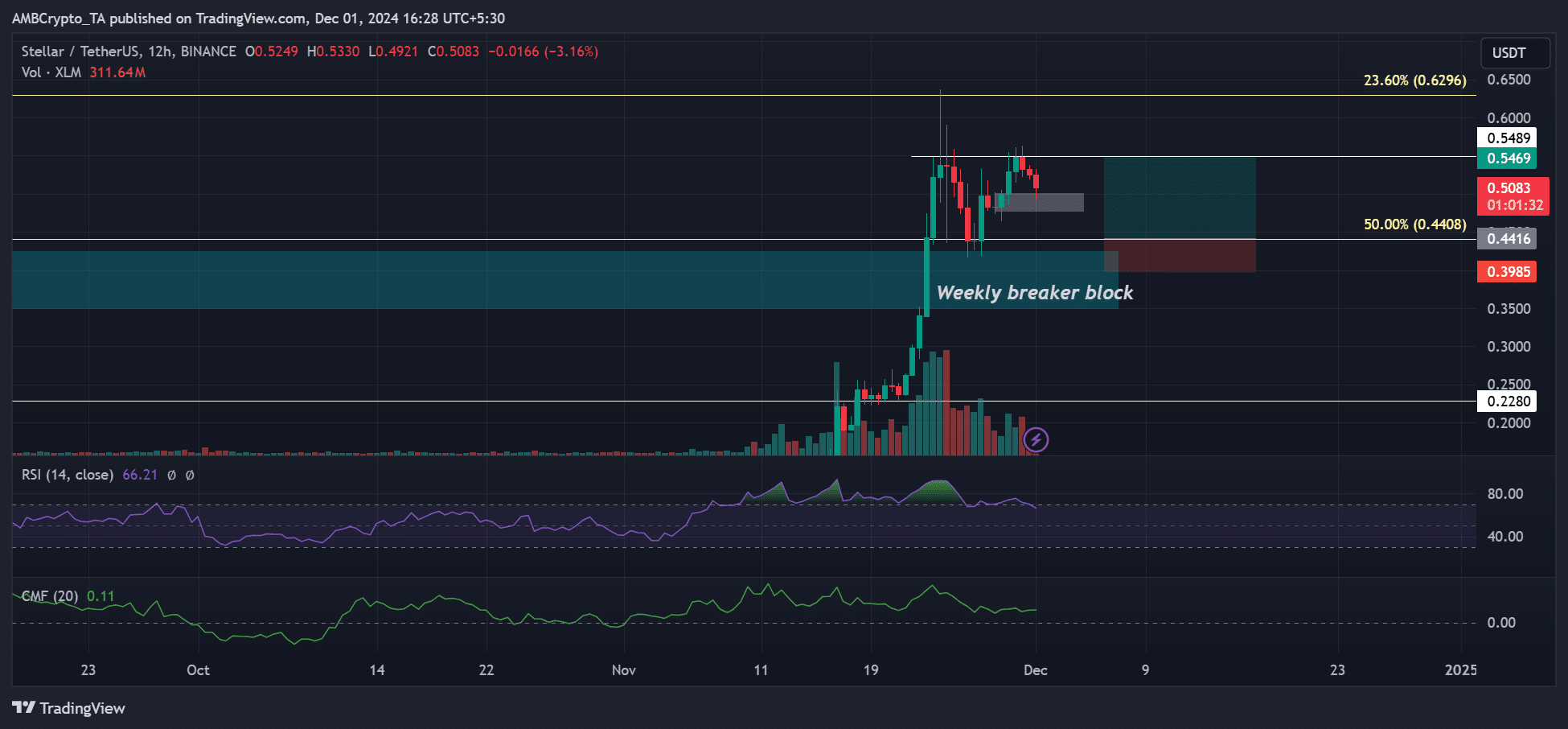

However, the 12-hour chart indicators suggested the uptrend continuation could take a while. The CMF has been flat since the 20th of November, meaning inflows stagnated and could mute any prospect of an extended rally.

The trading volume also tanked, which could push XLM to retest the support and liquidity below $0.4.

Source: XLM/USDT, TradingView

In the meantime, XLM could range between $0.40 and $0.62 before attempting a breakout, either to the upside or downside.

Whale exit long positions

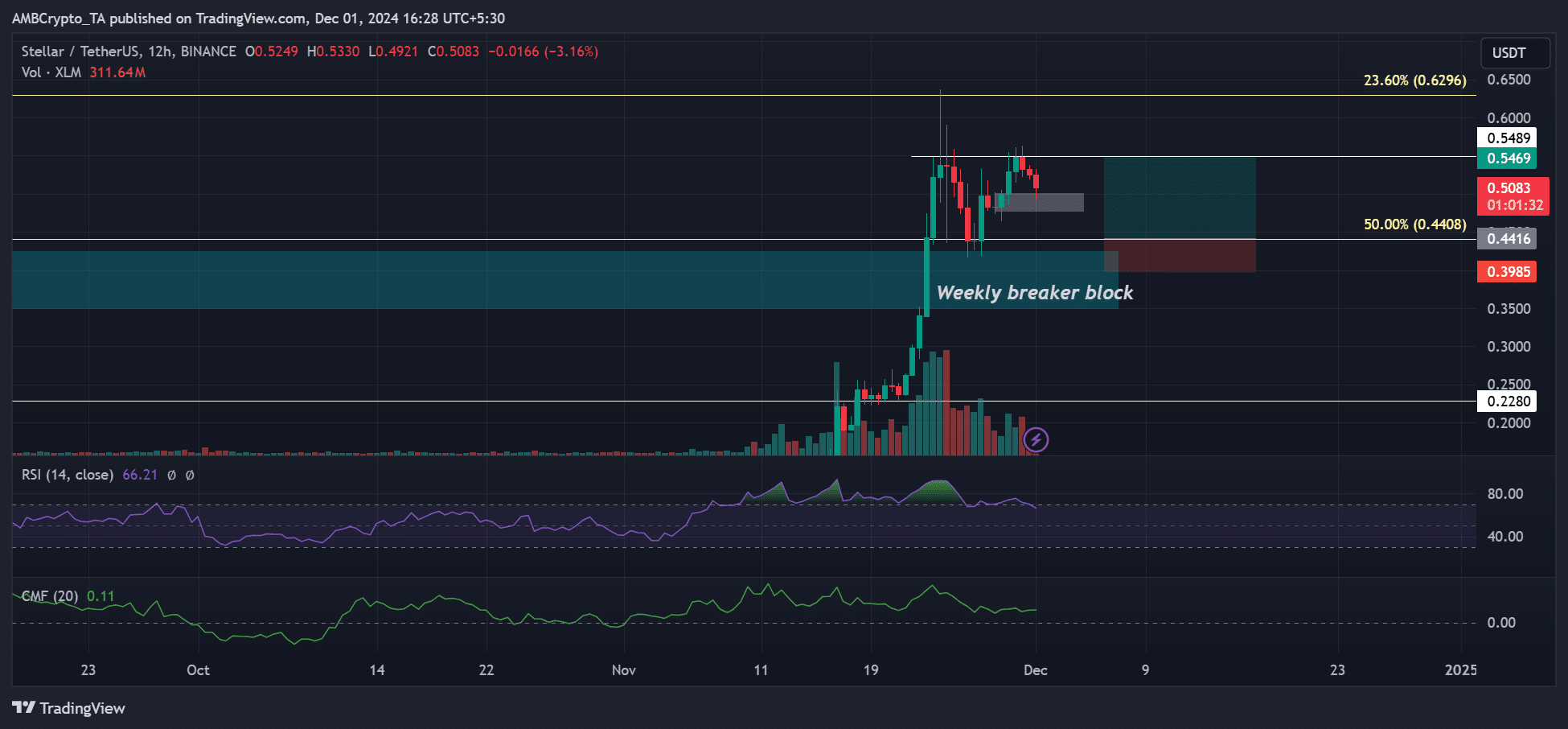

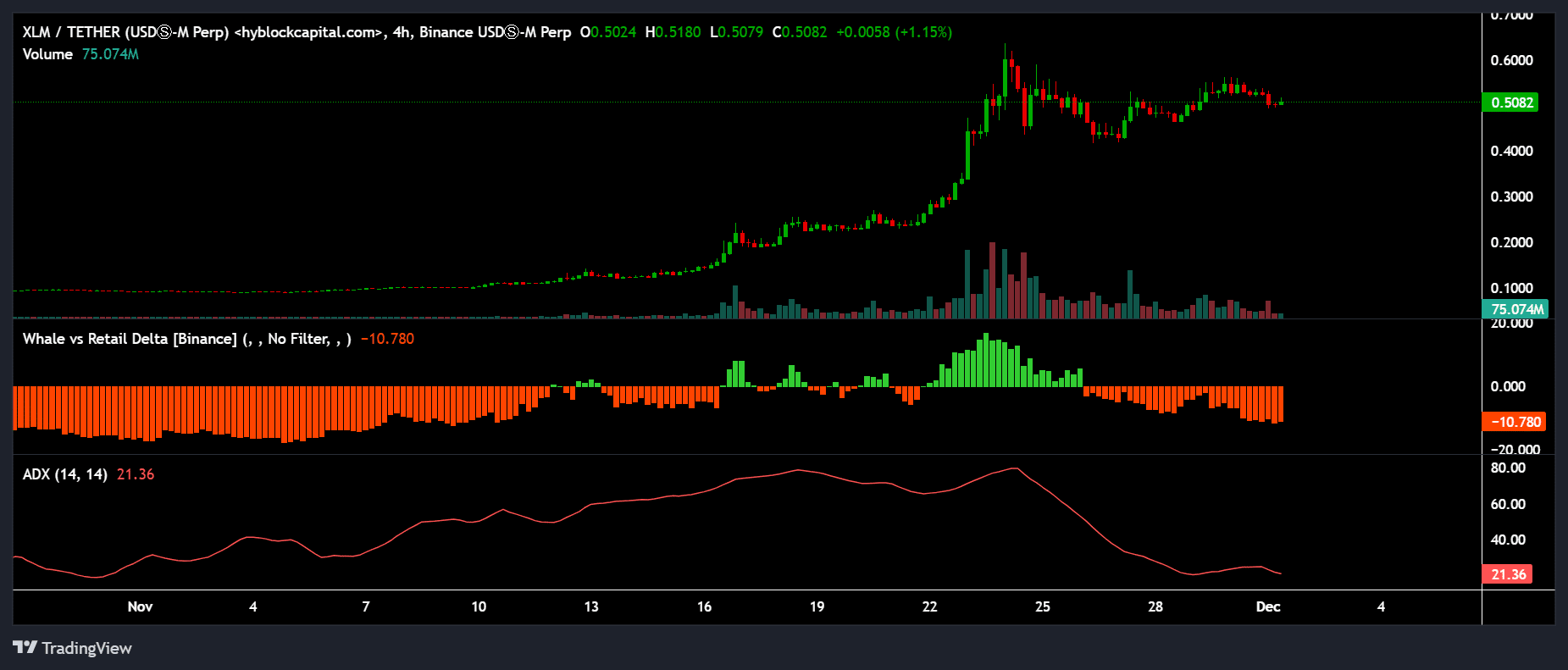

Whales’ market positioning on XLM supported the price range outlook. After taking profits last week, whales exited long positions, as shown by the Whale vs. Retail Delta turning negative.

In most cases, large players’ de-risking tends to trigger price consolidation or retracements.

Source: XLM/USDT, TradingView

Additionally, the ADX (Average Directional Index), used to gauge a token’s price trend strength, tanked from nearly 80 to 21.

Read Stellar [XLM] Price Prediction 2024-2025

Any dip below 20 would reinforce a weak trend and risk a move to open any trade position, especially for swing traders.

In short, XLM’s uptrend continuation was on the cards, but whales taking a back seat could delay such an outlook in the short term.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion