- Solana’s daily active addresses increased sharply over the last 30 days.

- SOL’s price action remained bearish, but was testing a key support level.

Solana [SOL] has been in the limelight for quite some time now, primarily because of its meme ecosystem. At the same time, the blockchain’s network activity surged substantially on a key front.

Will this achievement soon reflect on SOL’s price action?

Solana’s network activity is rising

Coin98 Analytics, a data analytics platform, recently posted a tweet revealing Solana’s latest achievement.

As per the tweet, Solana topped the list of blockchains in terms of DEX transactions over the last 30 days by a huge margin, reaching 435 million.

The network was followed by Base and BNB Chain, whose numbers stood at just 41 million and 31 million, respectively.

Sine the news of this development broke, AMBCrypto planned to take a closer look at Solana’s network activity.

Our analysis of Artemis’ data revealed that SOL’s daily active addresses increased last month and reached 3.5 million on the 30th of August.

However, it was surprising to note that despite the substantial rise in daily active addresses, the blockchain’s daily transactions dropped during the same time.

Source: Artemis

Things in terms of captured value also didn’t look in the blockchain’s favor. Our analysis clearly pointed out that SOL’s fees dropped last month. Thanks to that, the blockchain’s revenue fell.

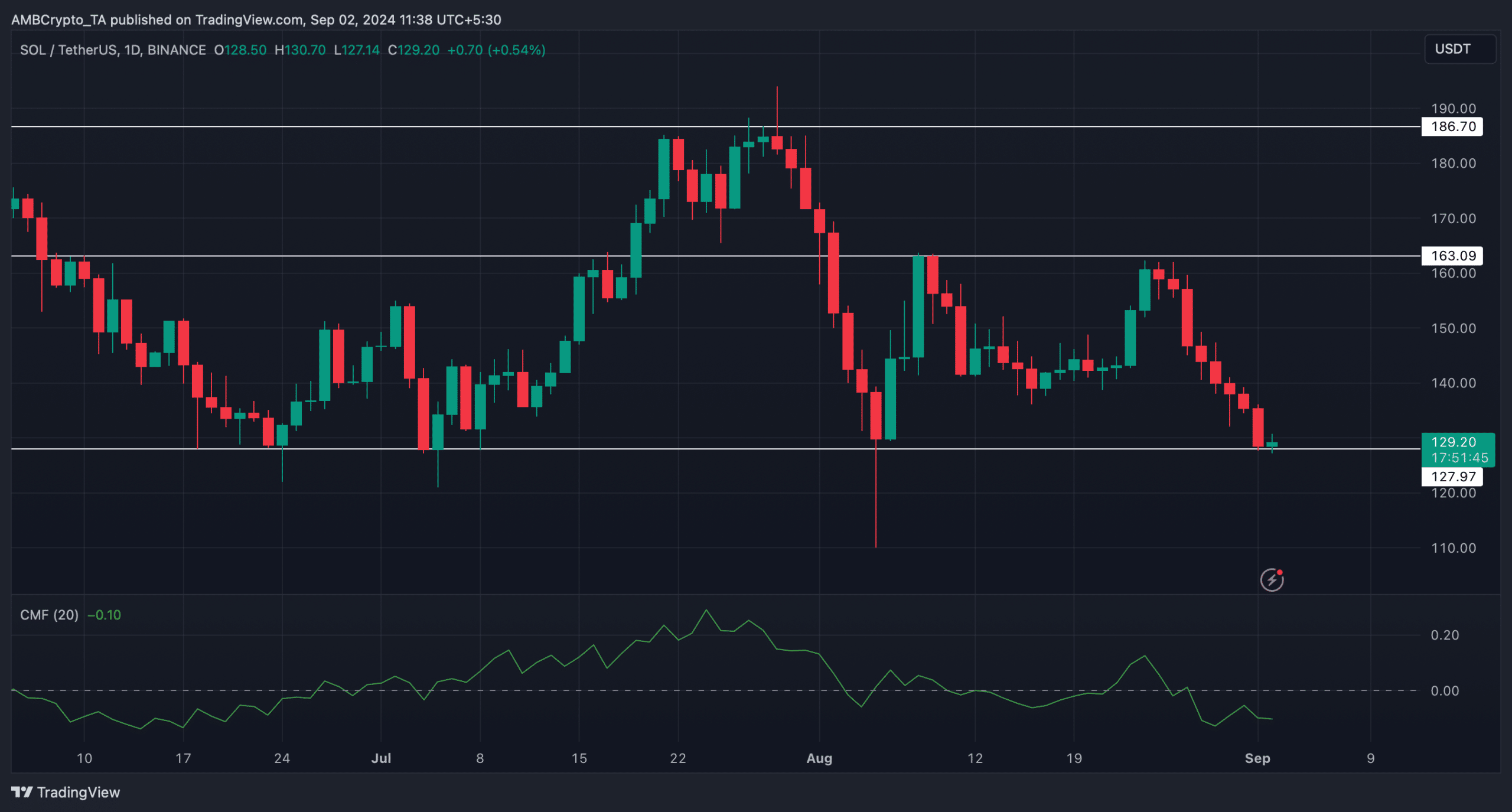

SOL remains bearish

While a lot happened in the Solana network, SOL’s price turned bearish. According to CoinMarketCap, SOL’s price dropped by nearly 20% in the last seven days.

In the last 24 hours, the token witnessed a nearly 2% drop as well. At the time of writing, SOL was trading at $129.67 with a market capitalization of over $60.5 billion.

A possible reason behind this dip could be a rise in selling pressure. As per our analysis of DeFiLlama’s data, SOL’s inflows increased and touched $47 million on the 1st of September, reflecting an increase in selling pressure.

Source: DeFiLlama

We then checked other metrics to see whether SOL could recover anytime soon. Coinglass’ data revealed that SOL’s Long/Short Ratio declined. This meant that there were more short positions in the market, which was a bearish sign.

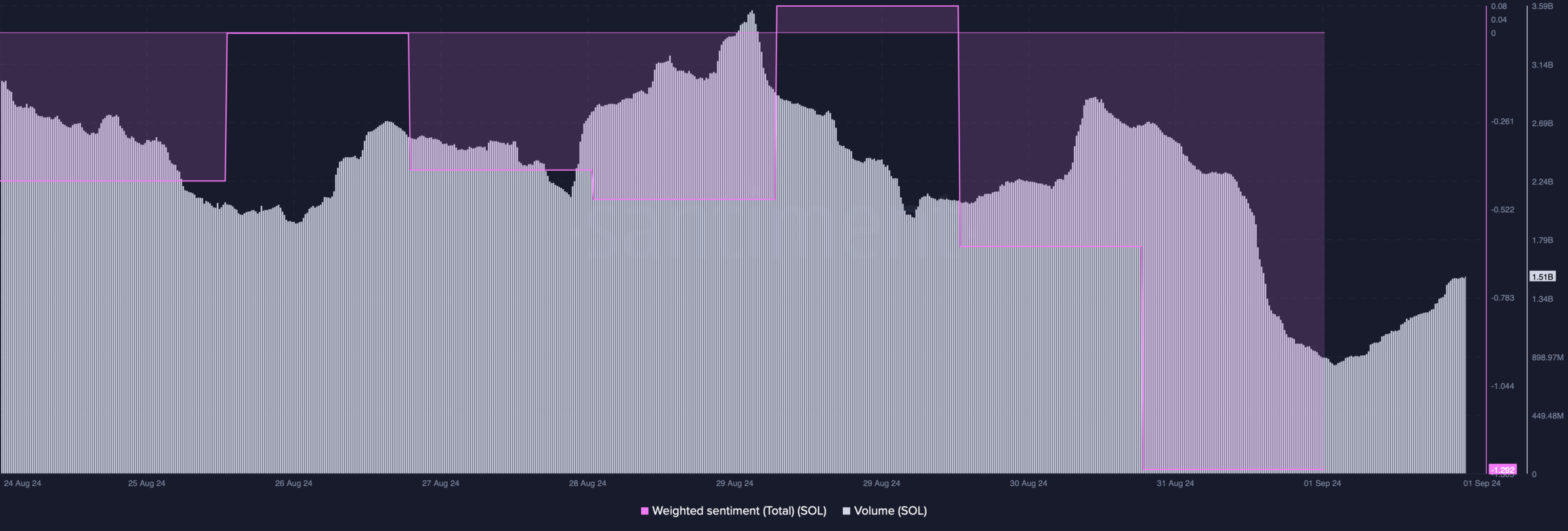

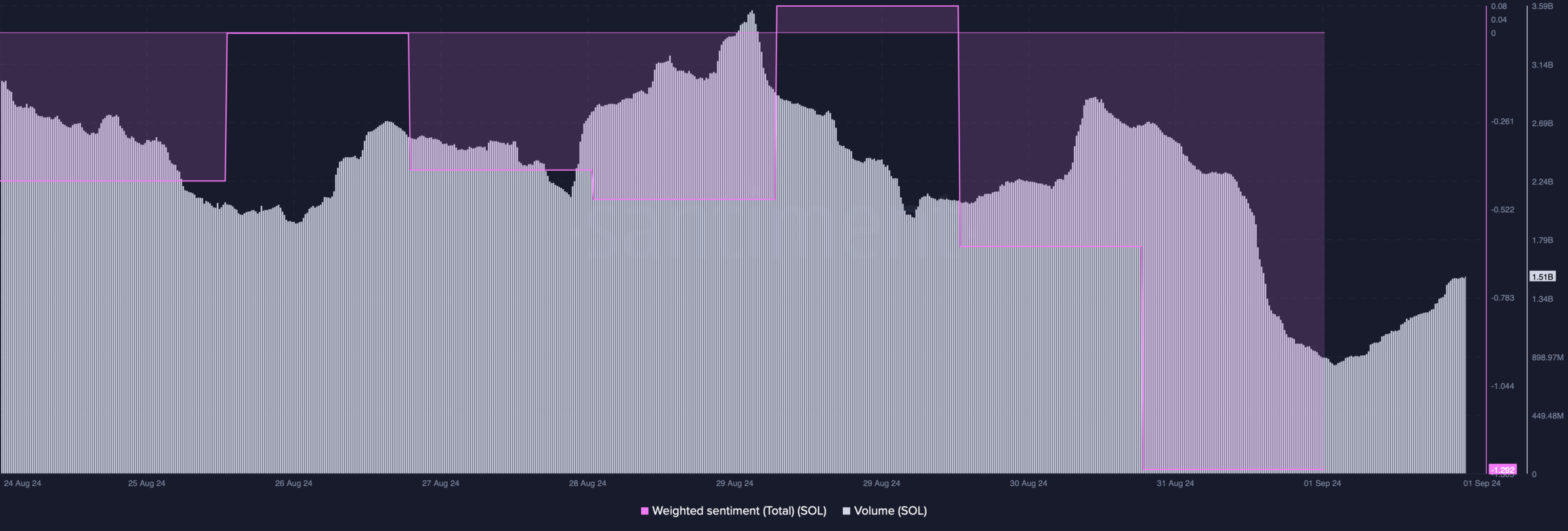

Additionally, Solana’s Weighted Sentiment dropped, suggesting that bearish sentiment was dominant. However, its trading volume dipped, indicating that there were chances of a trend reversal.

Source: Santiment

Read Solana’s [SOL] Price Prediction 2024-25

At the time of writing, SOL was testing a crucial support level. If the bulls manage to test that level, then SOL might begin its recovery journey towards $163.

However, the token’s Chaikin Money Flow (CMF) registered a decline, which hinted that SOL might witness more price corrections.

Source: TradingView