- Solana jumped 12.3%, thanks to memecoin activity and speculation around Futures contracts.

- Whales accumulated SOL as retail traders shed holdings amid transaction delays and market FUD.

Solana [SOL] has been on a tear, recording a 12.3% gain in the past 36 hours, positioning itself as one of the top-performing altcoins amid a volatile market.

A mix of memecoin activity, retail FUD (Fear, Uncertainty, and Doubt), and rumors about a potential futures contract listing have contributed to the rally.

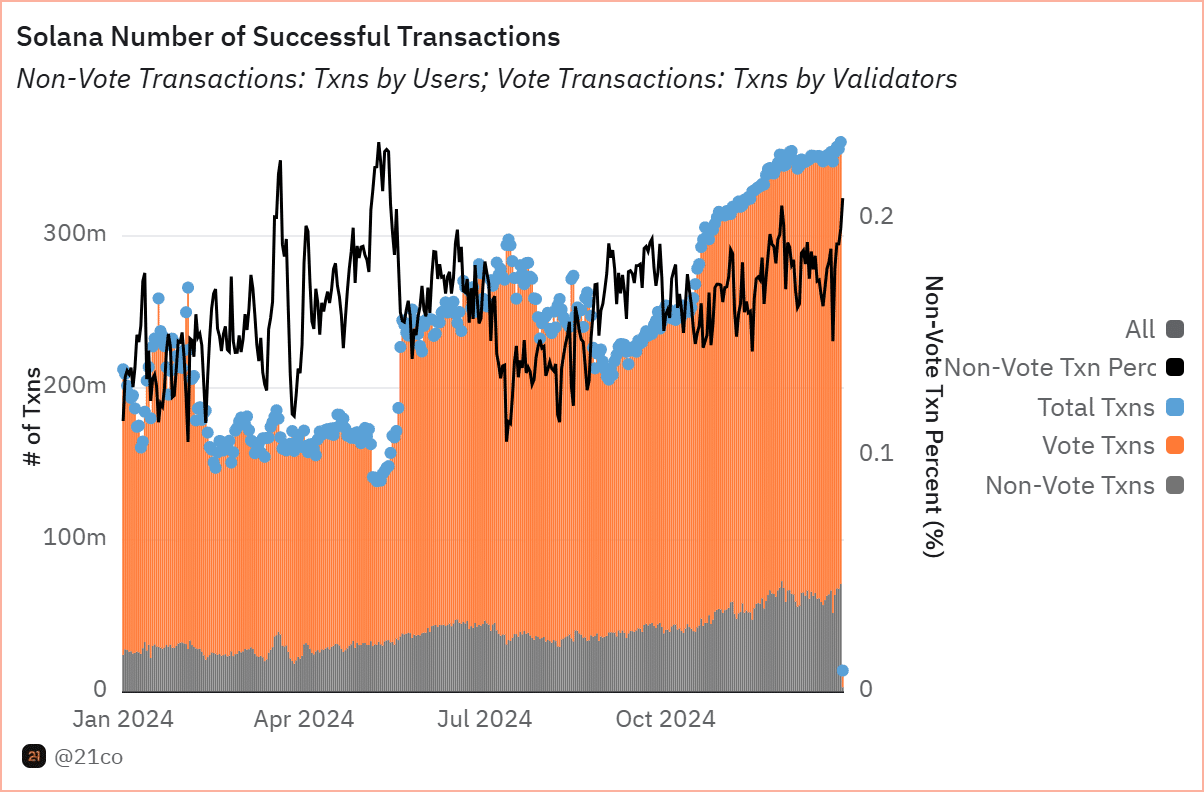

Memecoins fuel network activity and price action

One of the key drivers of Solana’s recent surge has been the growing influence of memecoins like Official Trump [TRUMP].

The explosive interest in these projects has led to a spike in Solana’s network activity, with transaction delays creating polarized opinions among traders.

While some retail investors have expressed frustration, others see it as a sign of Solana’s increasing adoption and relevance in the meme coin space.

Spooked by the delays, retail traders began offloading their SOL holdings, leading to a wave of whales and sharks accumulating SOL at discounted prices.

This trend is supported by recent on-chain data showing larger wallets capitalizing on the sell-offs, positioning themselves for potential long-term gains.

Source: Dune Analytics

Solana Futures listing rumors add fuel

Adding to the momentum, a leaked screenshot of a beta page for XRP and Solana (SOL) Futures contracts surfaced on X (formerly Twitter), sparking speculation that an exchange might list these investment vehicles as early as the 10th of February.

While reports suggest the screenshot could be a mock-up with no confirmed decision yet, the market has reacted positively to the news.

Solana’s price jumped on the back of the rumors, reflecting traders’ anticipation of increased institutional interest.

Futures contracts could offer broader exposure to Solana, providing another boost to its already active market.

Shifting sentiments

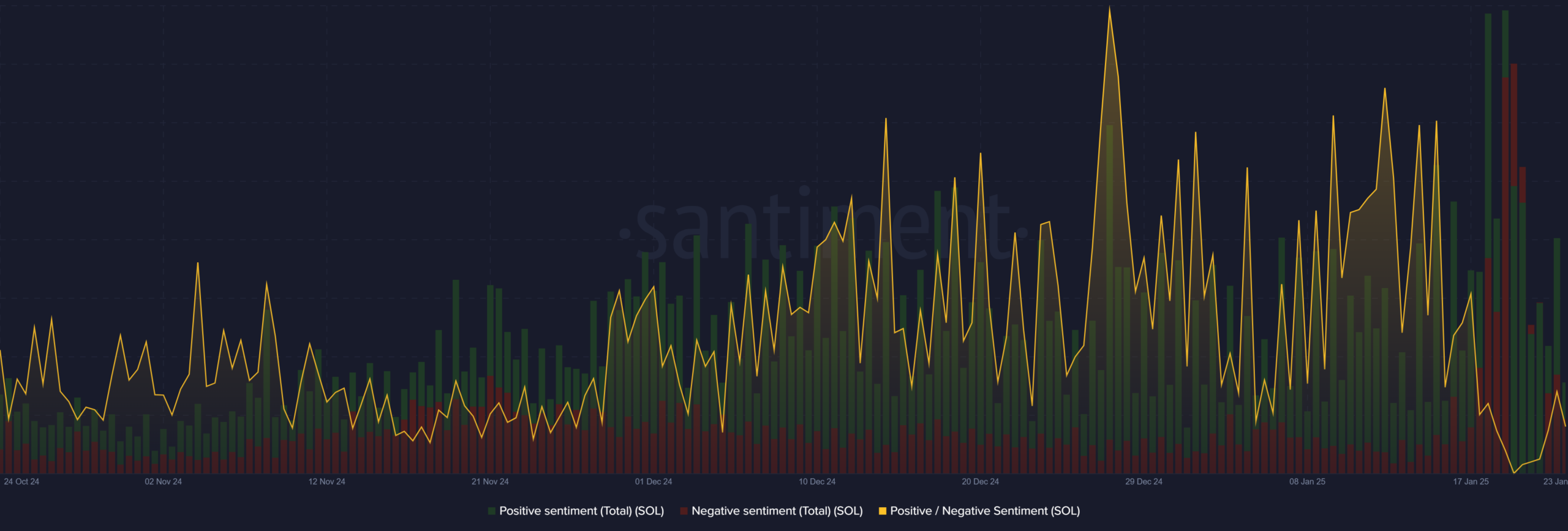

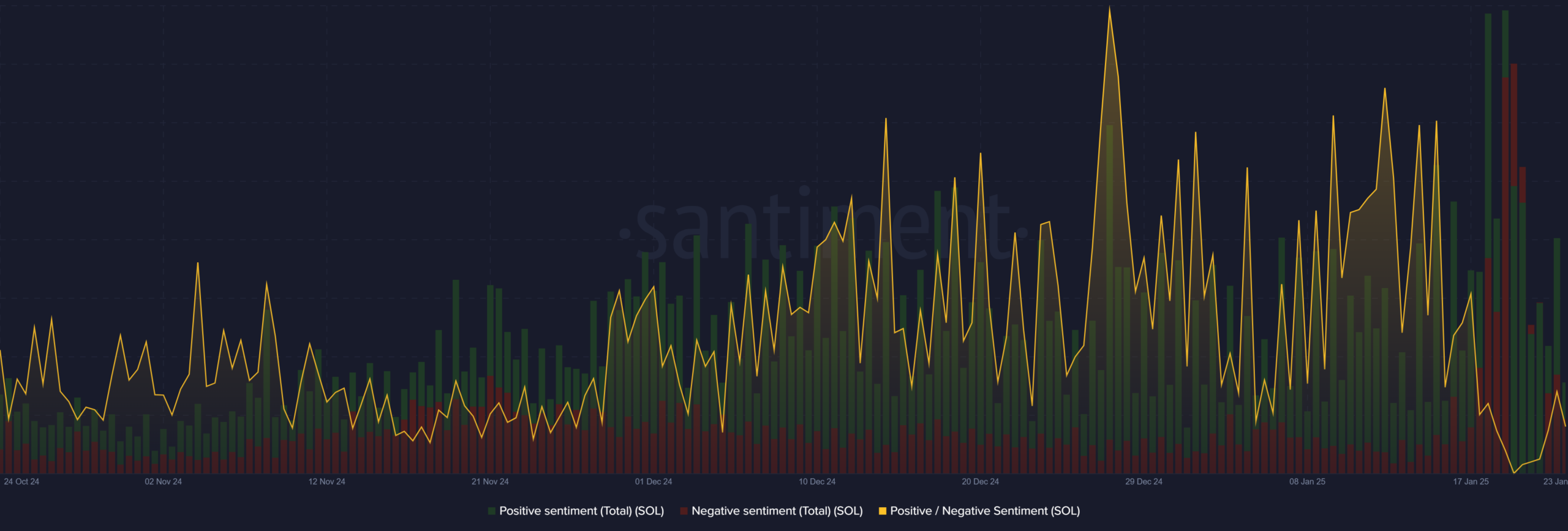

The sentiment analysis chart painted an intriguing picture of Solana’s community dynamics as well.

Over the past month, a noticeable rise in positive sentiment has been indicated by the spikes in green bars, which coincide with the meme coin frenzy and rumors about Futures contracts.

Source: Santiment

Interestingly, the negative sentiment has also been significant, suggesting a divided community.

However, the net sentiment has remained positive, reinforcing the notion that traders are optimistic about Solana’s long-term potential despite short-term challenges like transaction delays and FUD.

Key levels to watch

Solana’s price was $247.71 at press time, down 3.70% in the latest session after peaking at $258.35. The price chart showed a clear upward trend, with SOL maintaining its position above key moving averages.

The 50-day moving average of $211.08 has provided strong support, suggesting sustained bullish momentum.

The 200-day moving average of $177.55 remained far below the current price, reinforcing the strength of Solana’s recovery.

The volume of over 552,000 SOL traded in the last session highlighted increased market activity, likely driven by memecoin-related transactions and Futures rumors.

Source: TradingView

A crucial support level lies at $244, which Solana must hold to avoid slipping back into a consolidation phase. On the upside, breaking above $260 could trigger further gains, potentially targeting the $280-$300 range.

Navigating the hype and speculation

Solana’s recent performance shows its resilience and ability to navigate volatile market conditions. However, it also faces notable challenges.

The memecoin-driven hype, while beneficial in the short term, carries risks of speculative bubbles and volatility.

Additionally, the Futures listing rumors being debunked could lead to a short-term correction as speculative traders exit their positions.

Is your portfolio green? Check out the Solana Profit Calculator

On the flip side, whale accumulation and growing network activity signal long-term confidence in Solana’s ecosystem.

If Futures contracts are officially announced, Solana could see increased institutional participation, further bolstering its market position.