- SOL, at press time, was trading with a slight uptick, but remained largely bearish

- Sentiment fell into the negative zone due to its price decline

Solana (SOL) has recently seen significant price declines, with the altcoin dropping from key price levels. This downturn has also affected the derivatives market, where an increasing number of traders are betting against a price hike.

However, technical indicators seemed to suggest that traders holding short positions might be in for a surprise if SOL’s price moves in an unexpected direction.

Solana shows bearish trends

An analysis of Solana (SOL) on the daily timeframe chart showed that at press time, it was trading at approximately $139.37. This price level is near the 0% Fibonacci retracement level, indicating that SOL is at a critical juncture in its price action.

Furthermore, SOL remained below its long and short-term moving averages (blue and yellow lines), serving as resistance around $149.29 and $153.87, respectively.

A further analysis of the technical indicators revealed that SOL may be in the middle of a bearish trend too. For instance, the Relative Strength Index (RSI) had a reading of 41.43, indicating weak momentum and proximity to the oversold territory.

Additionally, the Moving Average Convergence Divergence (MACD) line was at -1.46, with the signal line at -3.67. The negative values of these indicators highlighted SOL’s prevailing downtrend, despite a minor uptick.

Where can SOL go from here?

Given the prevailing bearish indicators, Solana (SOL) is now facing crucial support and resistance levels to determine its next move on the charts.

If the decline continues, the first significant support level will be at the 23.6% Fibonacci retracement level, at around $128.88. However, if this support fails to hold itself, the price could fall further to the 50.0% Fibonacci retracement level at $116.79.

Source: TradingView

On the other hand, if SOL finds support at its current level or near $128.88 and the RSI begins to turn upwards, it could signal the start of a recovery. In this scenario, SOL might attempt to retest its resistance levels. Breaking above the short and long-term moving averages, which currently serve as resistance around $149.29 and $153.87, respectively, would be crucial for a bullish reversal.

If SOL successfully moves above these moving averages, the next significant resistance level to watch would be the 61.8% Fibonacci retracement level at $162.60. A break above this level could signal stronger bullish momentum.

SOL must target and eventually break above the 100% Fibonacci retracement level for a full bullish recovery at $185.51.

Why did Solana fall?

Well, recent analysis indicates that the decline in Solana’s (SOL) price was not due to specific developments within the Solana network. Instead, it was a reaction to the broader market’s movement.

Over the past week, the cryptocurrency market saw a significant downturn, resulting in billions being wiped off the overall market capitalization.

Major assets such as Bitcoin and Ethereum saw significant declines in value, and Solana was similarly affected by this market-wide sell-off.

Traders take short SOL positions

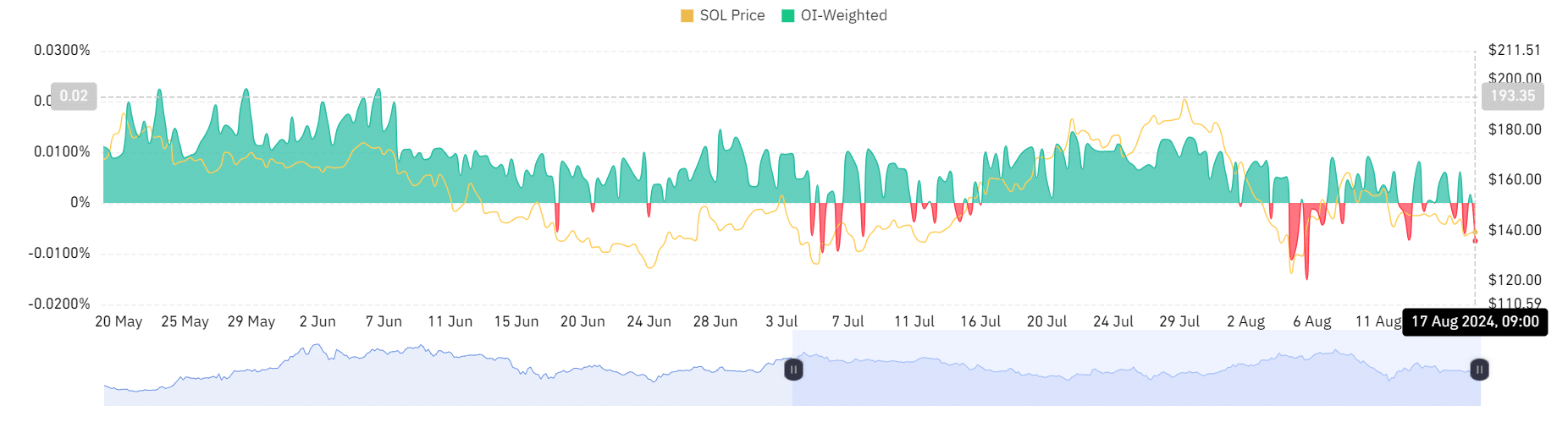

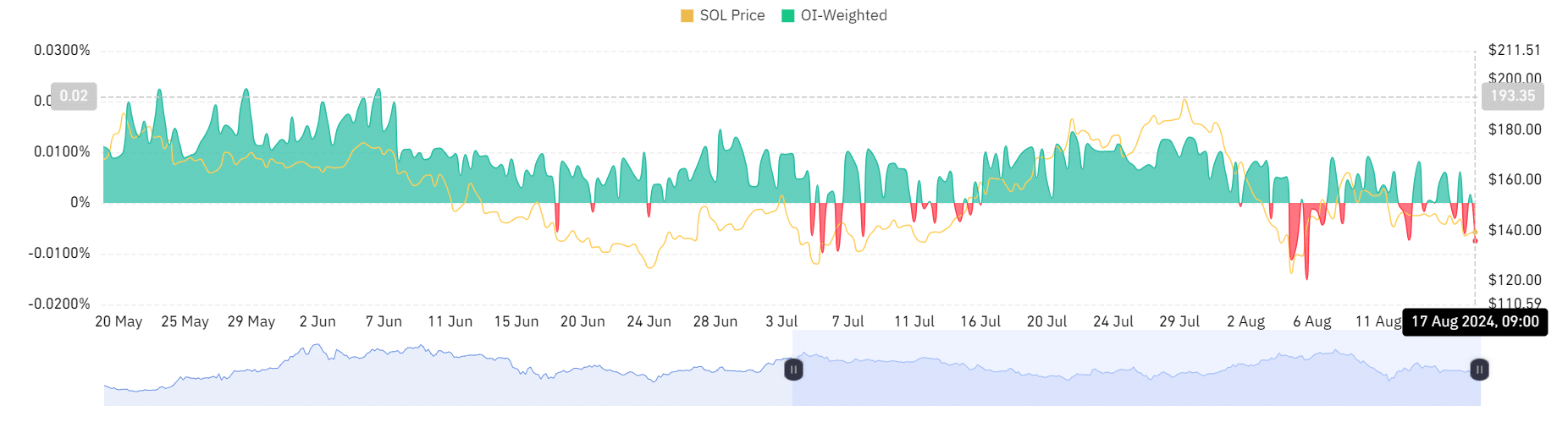

Finally, an analysis of Solana’s (SOL) funding rate on Coinglass revealed that positive sentiment has weakened over the past few weeks.

While buyers had previously dominated the market, the overall trading volume was relatively weak. At the time of writing, the funding rate had dropped below zero, at approximately -0.0075%.

Source: Coinglass

– Read Solana (SOL) Price Prediction 2024-25

This negative funding rate is a sign that sellers now dominate the market, with a growing number of traders betting on a further decline in SOL’s price. However, this bearish sentiment comes with risks.

If SOL’s price moves upwards unexpectedly, those holding short positions could face major liquidations. This could potentially trigger a sharp reversal in the market.