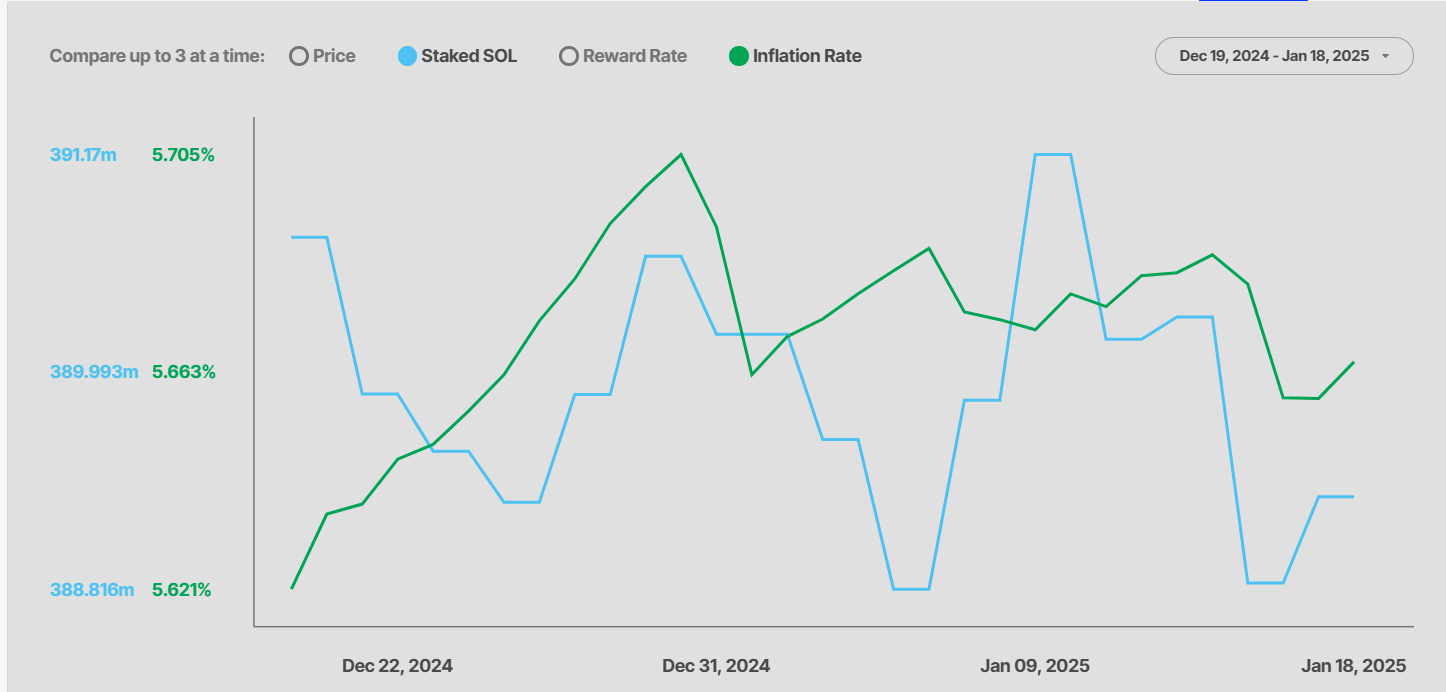

- Solana has proposed to reduce the inflation rate from 5.7% to 1.5%

- Stakers are worried that the proposal would cut their yields

The Solana [SOL] community has proposed slashing the network annual inflation rate (token emission) to 1.5%, driven by market conditions. Tushar Jain, Managing Partner at Multicoin Capital, made the proposal and faulted the current inflation model.

In a recent interview on the Lightspeed podcast, Jain summarized the proposal as,

“Our idea is to make emission rate driven by market forces. Right now, we emit the same amount of SOL tokens no matter the market conditions. We’re proposing a smart emission schedule that would dynamically incentivize participation/staking. “

Jain added that the current model emits “more than necessary” SOL tokens to secure the network. He believes this should be reduced to a minimum.

More reasons to address SOL inflation

For context, the primary inflation pressure comes from validator staking or locking up users’ SOL to secure and run network operations. In return, stakers earn a fee in the form of SOL tokens, which adds to the supply.

Jain said that about 100 million SOL has been added to supply since 2021. Out of the total supply of 592.4 million, 391 million tokens are locked in staking, translating to 66% of the overall supply.

Source: Staking Rewards

The proposal eyes 50%-66% staked SOL, stating any more than 67% doesn’t help network security.

“Beyond 67% incremental staked SOL does not add any incremental security guarantees because a supermajority of all SOL has voted on any given block and a long-range attack is impossible.”

However, anything below 33% could expose the Solana network to security risk. Worth pointing out though that the proposal’s benefits go beyond market efficiency. It would also reduce selling pressure as validators may be forced to sell their tokens to pay their tax obligations.

Additionally, it would improve SOL’s optics as high inflation would deter others from holding the tokens to devaluation.

Worth pointing out, however, that not all members seem happy with the proposal. A pseudonymous DeFi analyst, Ignas, noted that the yield from staking SOL would drop if the proposal is adopted. He said,

“To be honest, I don’t want the $SOL Inflation Reduction Act to pass. I know it will but I was really happy with my 20% to 30% APY on $SOL multiply pools in Kamino.”

According to MC, the current model only benefits stakers and diluted non-stakers. If inflation is reduced, even non-stakers could benefit as their stash wouldn’t be devalued. Additionally, Multicoin Capital believes that it could spur DeFi activity in the ecosystem.