- SOL was showing a positive trend for the first time in three days.

- LTHs have held despite the recent declines.

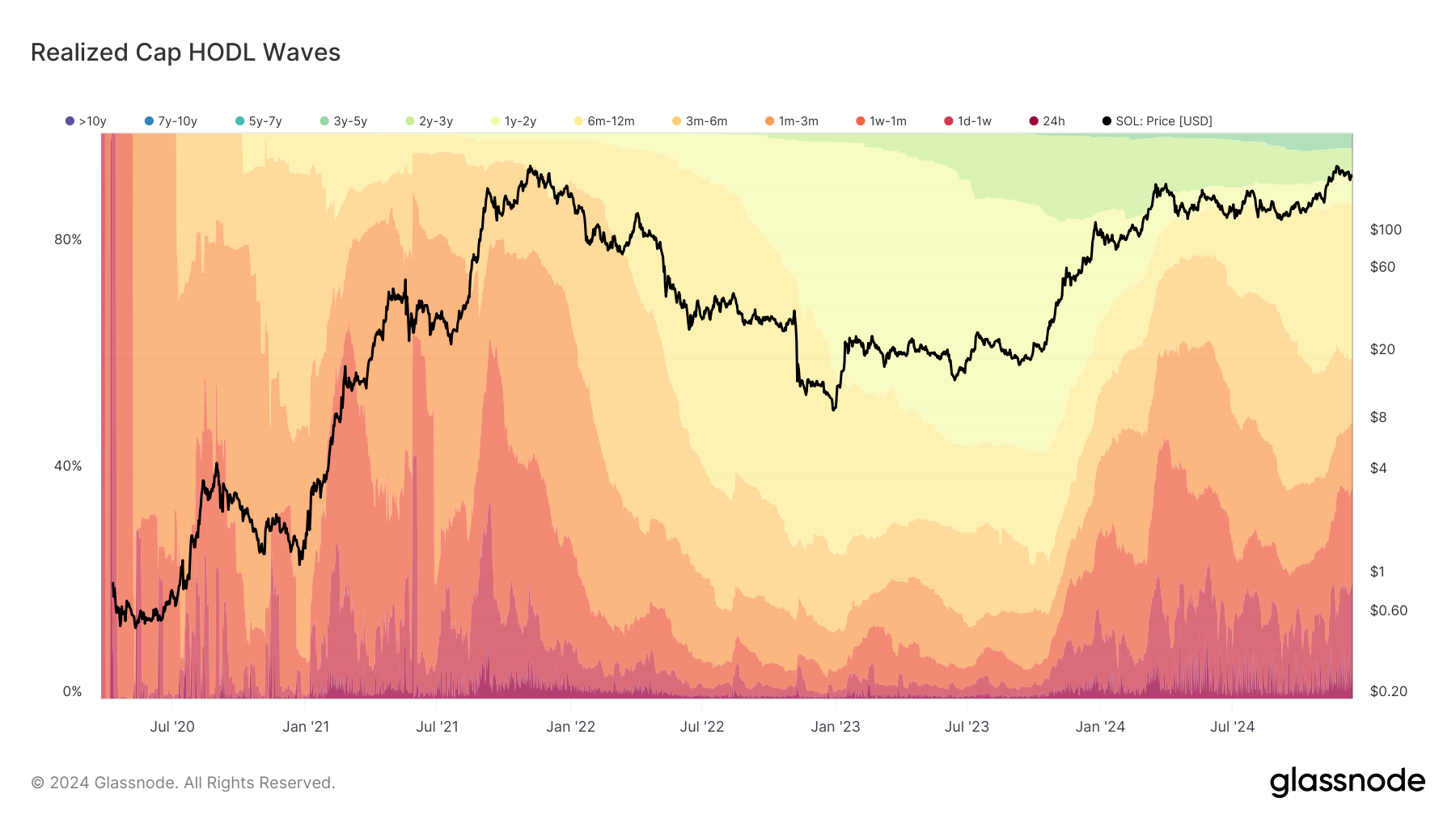

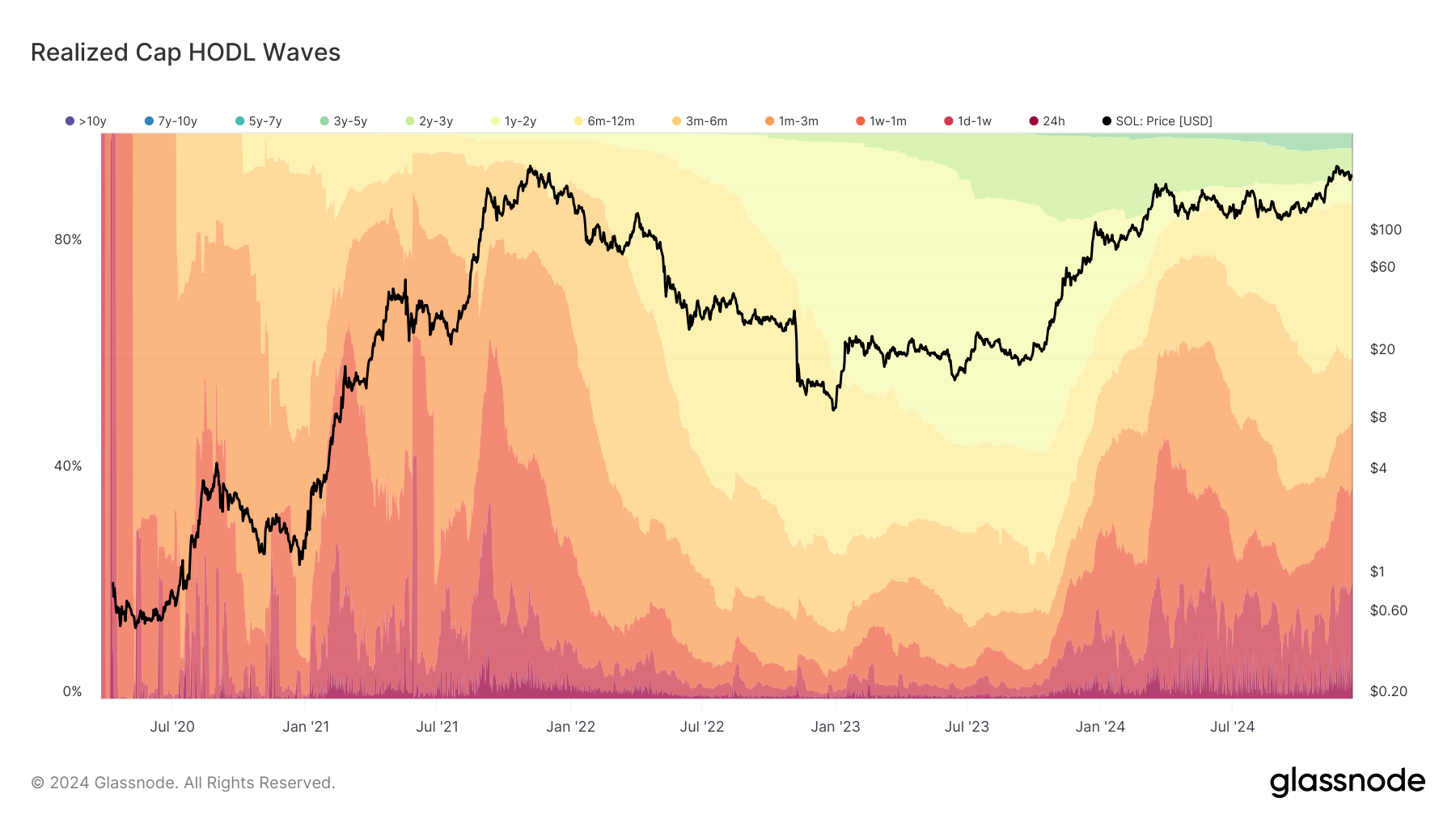

Solana[SOL] is witnessing a surge in long-term holder activity, according to data from Glassnode. This rise reflects growing investor conviction, even as SOL trades near $230.

Paired with increased network activity and a surging Total Value Locked (TVL) of $9 billion, these trends show the asset’s strong trend and potential for sustained growth.

Analyzing Solana’s HODL waves

The recent rise in Solana’s price is supported by significant activity in its HODL waves. According to Glassnode data, the 6-12 month cohort now holds 27% of the total supply, reflecting strong conviction among buyers from Solana’s 2024 rally.

This trend suggests that investors are resilient, opting to hold their assets rather than liquidate at current levels. This is a bullish signal for the network’s overall health.

Source: Glassnode

The HODL waves illustrate how long-term holders have consistently increased their share of wealth locked in the Solana ecosystem, particularly as SOL’s price approaches the $230 range.

This data underscores the trust and optimism among investors despite market fluctuations. The increase in long-term holders is often associated with reduced selling pressure, potentially paving the way for sustained price growth.

Solana price tests key resistance levels

At the time of writing, Solana was trading at $226 after testing a high of $227. SOL comfortably traded above its 50-day and 200-day Moving Averages, signaling strong bullish momentum.

The Relative Strength Index (RSI) was at 49.62, suggesting neutral market conditions with no immediate signs of overbought or oversold status.

Source: TradingView

The upward trajectory indicates that SOL is consolidating before a potential breakout. A strong push above the $230 resistance level could propel the cryptocurrency to higher targets, with $250 as the next psychological barrier.

On the downside, the $215 level represents a key support area, backed by increased buying interest during recent dips.

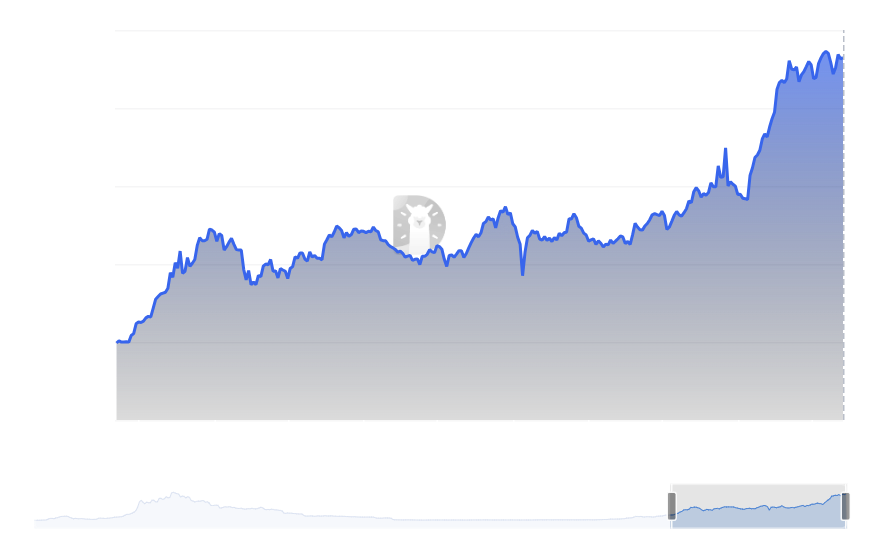

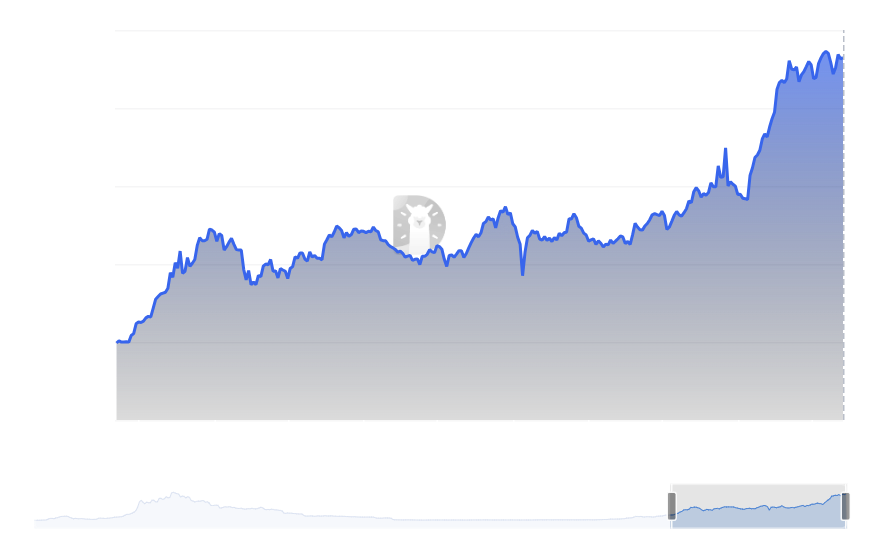

TVL correlation: Growing network activity

Data from DeFiLlama reveals that Solana’s total value locked (TVL) has surged to nearly $9 billion, marking a significant uptick in network activity.

This rise in TVL highlights increased user engagement and confidence in the Solana ecosystem, especially among decentralized finance (DeFi) participants.

Source: DefiLlama

The correlation between rising TVL and HODL waves suggests that long-term holders are not just holding SOL for speculative purposes but are actively utilizing it within the network.

Increased TVL often correlates with stronger price trends, which signifies greater utility.

What lies ahead for Solana?

Solana’s growing HODL waves, strong TVL, and bullish price action signal a robust outlook for the asset. The rise in long-term holder activity suggests reduced selling pressure, while the network’s expanding TVL underscores its increasing adoption and utility.

– Is your portfolio green? Check out the Solana Profit Calculator

With key resistance levels in sight, Solana appears poised for further gains, provided market conditions remain favorable. Investors should watch for a breakout above $230 to confirm the continuation of its upward momentum.