- Shiba Inu whales have exercised caution in this market cycle by reducing their activity.

- However, a balance can still be achieved if this pressure is effectively challenged.

Shiba Inu [SHIB] has faced intense bearish pressure in the last 24 hours.

After an 8% jump to $0.00001739 to start the week following seven days of pullbacks, most of those gains have vanished, with SHIB now trading at $0.00001701.

A recent AMBCrypto report highlighted a market shift, noting that established coins are losing ground to newly created memecoins.

If this trend holds, SHIB may not become the 100x opportunity many expected to surpass Bitcoin by next year.

SHIB whales are becoming cautious

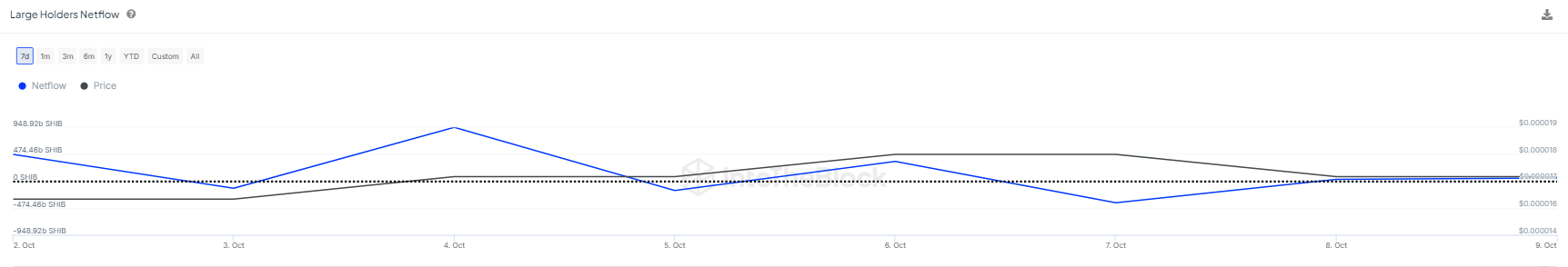

SHIB whales holding 0.1% of the circulating supply makeup around 60% of the large holders; they hold a staggering 590 trillion SHIB tokens.

However, in the last 24 hours, SHIB whale activity has dropped significantly, with large transaction volume falling by 35.41% and only 1.99 trillion SHIB moved.

Interestingly, while high accumulation often signals a market bottom, indicating dip-buying opportunities, the reduced whale activity could point to a market top as their confidence in SHIB’s short-term outlook wanes.

Source : IntoTheBlock

Confirming this, large cohorts have sent 90 billion SHIB to exchanges in the past two days, contributing to a 6% price drop.

While whale caution has had an impact, the broader trend might not yet confirm an imminent pullback, as…

Bulls are regaining control

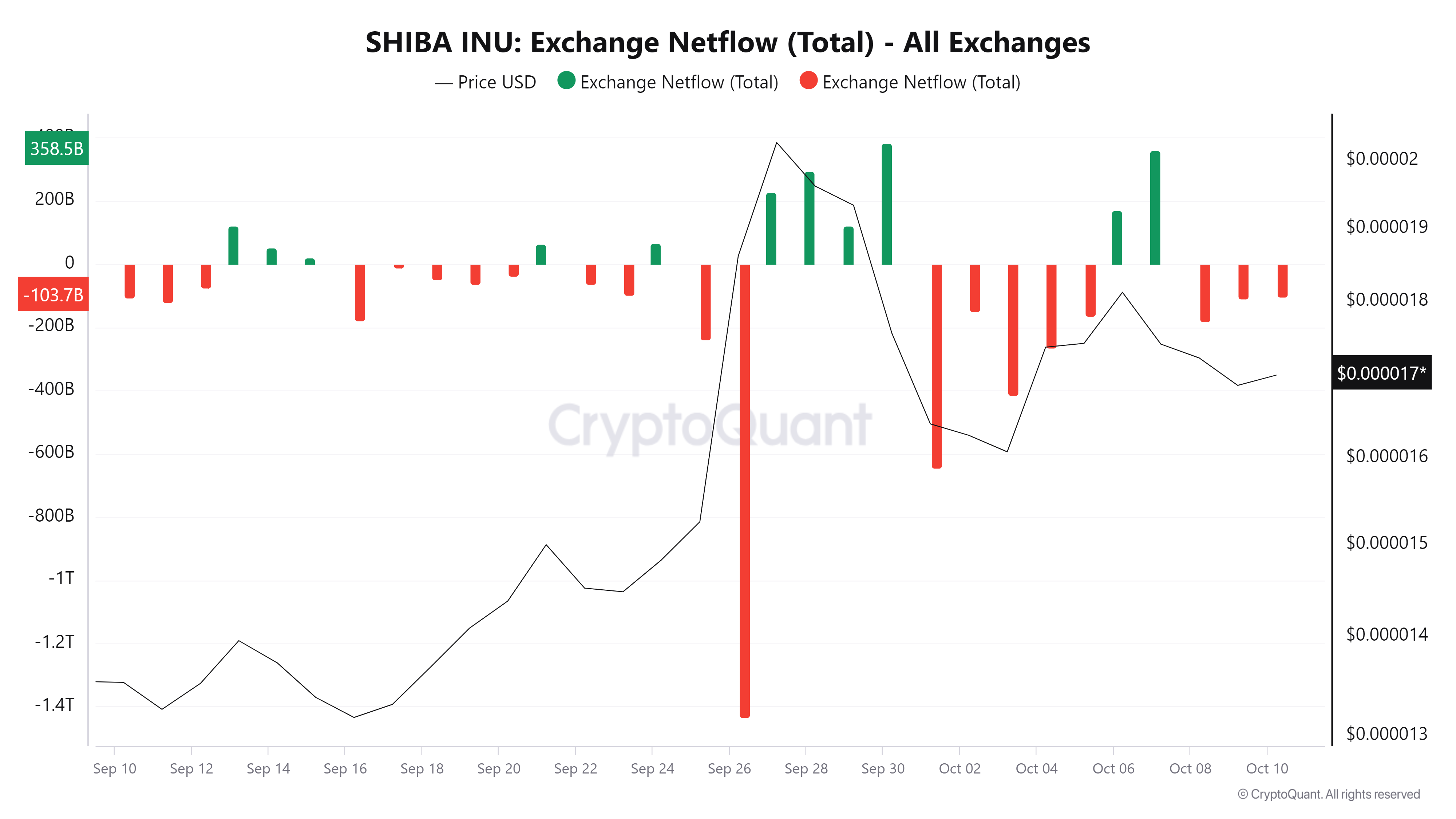

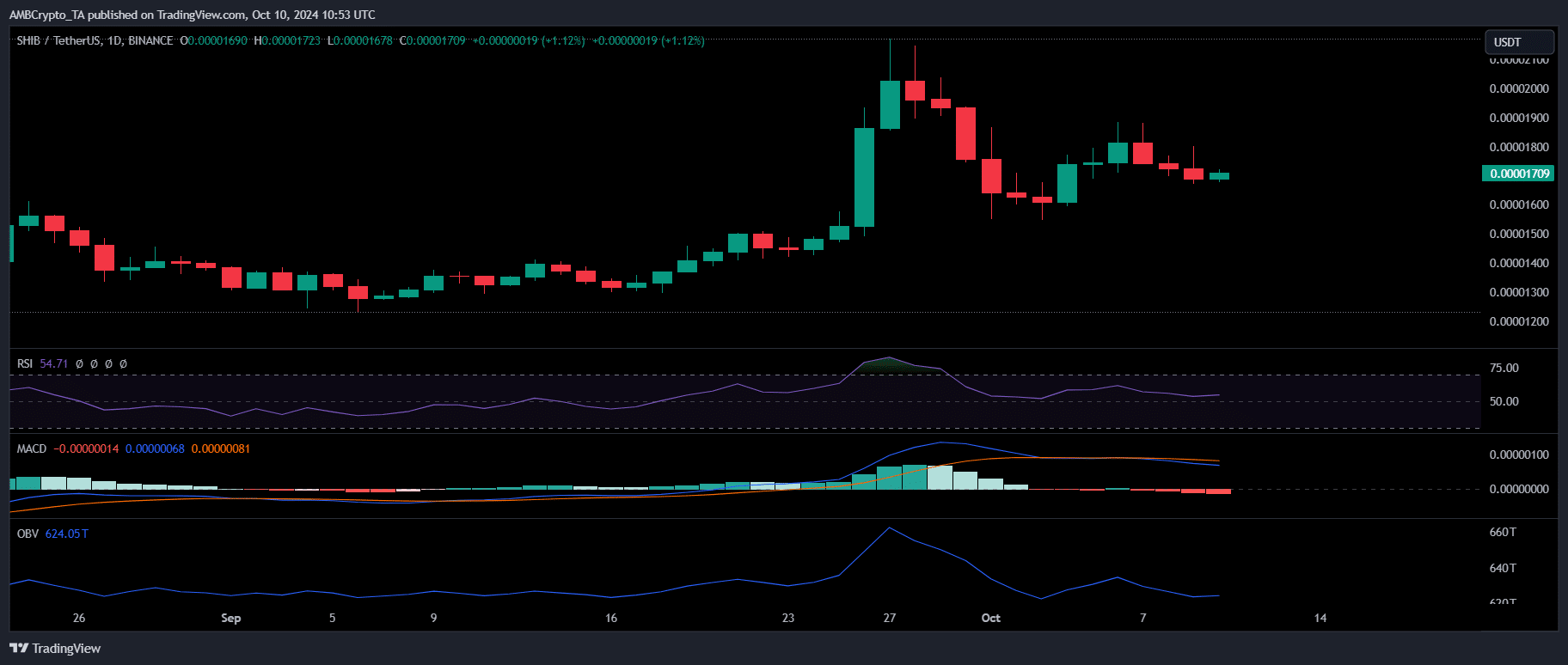

On the daily price chart, a bearish MACD crossover coincided with the drop as large Shiba Inu whales trimmed their positions.

However, since then, the aggregate net flow has flipped to negative, suggesting that bulls are stepping in and absorbing the pressure by allocating capital into SHIB.

CryptoQuant

This marks a pivotal moment for recovery. Recent activity by SHIB whales has caused its value to drop, pushing many investors into a net loss.

Yet, if the bulls maintain their support, it could restore confidence among those in loss positions and incentivize holders to back SHIB’s price correction – an essential step for an impending reversal.

There is still room for growth

From a basic economic standpoint, an increase in supply coupled with strong demand can lead to price equilibrium.

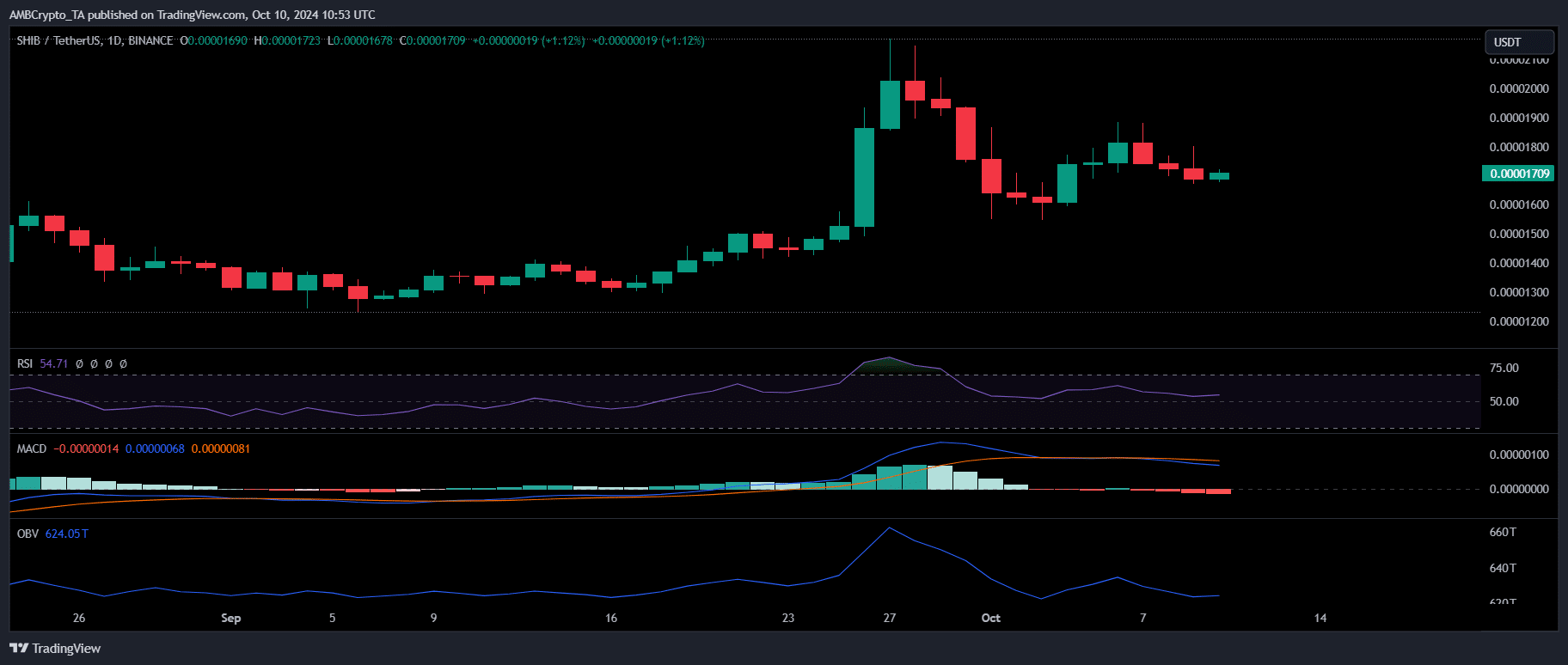

Recent net outflows of SHIB point to bullish sentiment, indicating substantial potential for aggressive buying. This is further supported by the RSI, which is currently in a neutral phase.

Source : TradingView

However, the key factor is a consistent upward trend, which largely hinges on how holders position themselves following the sell-offs by SHIB whales.

Read Shiba Inu’s [SHIB] Price Prediction 2024–2025

If bulls successfully counter the selling pressure through aggressive buying, a reversal could push SHIB closer to its previous rejection level at $0.000020, a critical point for a potential breakout.

Conversely, given the overall market volatility and the increasing allocation of capital from SHIB to newly established memecoins, consolidation within the $0.0000175 to $0.0000160 range seems more likely.