- SHIB’s breakout underlined bullish momentum, with key support at $0.00001722

- Positive market sentiment and short liquidations could spur SHIB’s growth potential

Shiba Inu [SHIB] is generating buzz once again, with its latest breakout from a falling wedge pattern signaling potential bullish momentum. At press time, SHIB was trading at $0.0000178, following a 5.98% hike over the last 24 hours.

Thanks to this newfound momentum, many are wondering – Can SHIB sustain this uptrend and possibly, spark a broader crypto rally?

Price action analysis

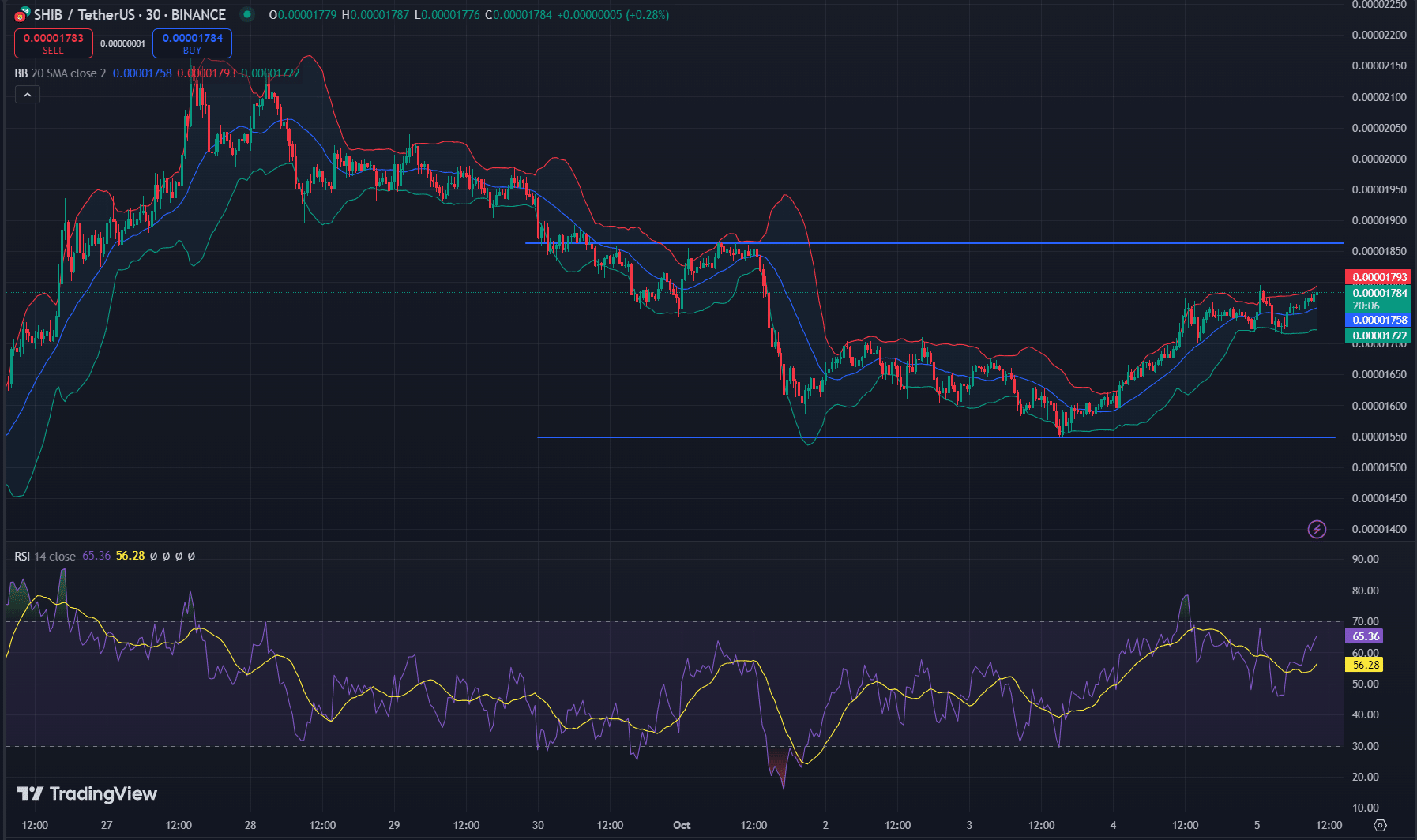

Shiba Inu’s price has been testing crucial levels, showing signs of a possible trend reversal. The Bollinger Bands (BB) on the chart indicated tightening, with SHIB trading near the upper band at $0.00001784 – A sign of increased volatility and a potential breakout.

Additionally, the RSI sat at 65.36 at press time. This suggested that while SHIB may be approaching overbought territory, it still has room for upward movement. If the memecoin’s price holds above the midline, bullish momentum may continue to build.

Source: TradingView

SHIB’s on-chain activity – A sign of growing interest?

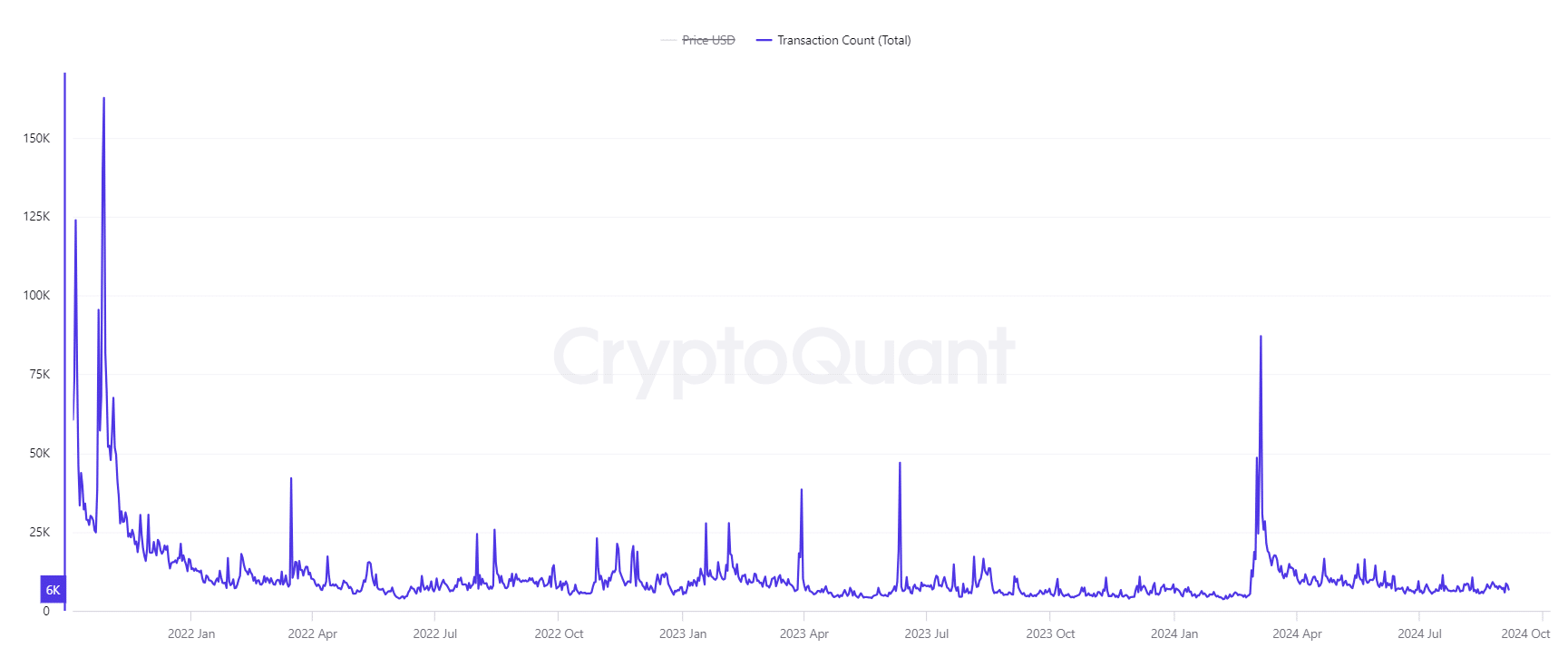

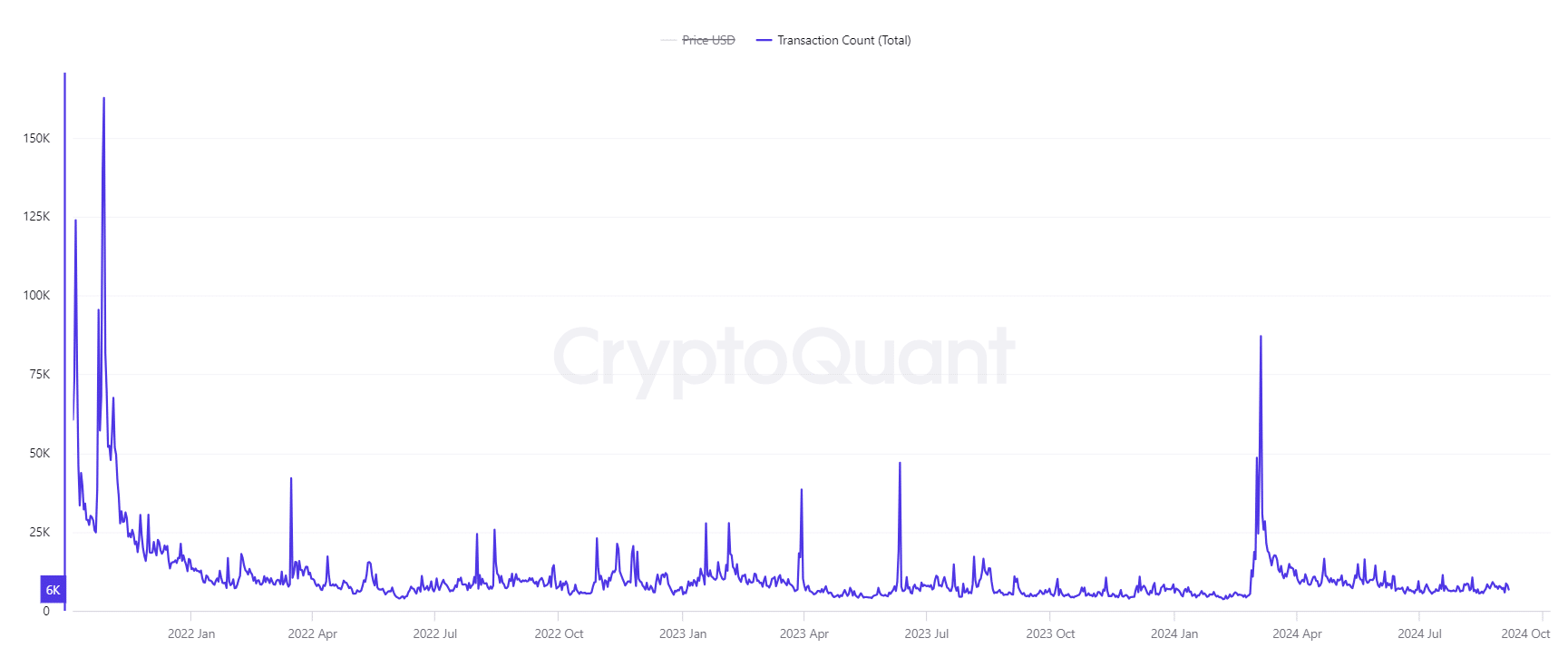

A price hike alone isn’t enough to fuel a sustainable rally. Therefore, it’s essential to consider on-chain activity and, SHIB’s data showed some promising signs. Over the last 24 hours, for instance, SHIB’s active addresses rose by 1.1%, hitting 267 at press time according to CryptoQuant.

Additionally, the transaction count also climbed by 1.1%, bringing the total to 7.41k transactions. This uptick in both active addresses and transaction volume pointed to growing interest in SHIB – A positive indicator for its long-term prospects.

Source: CryptoQuant

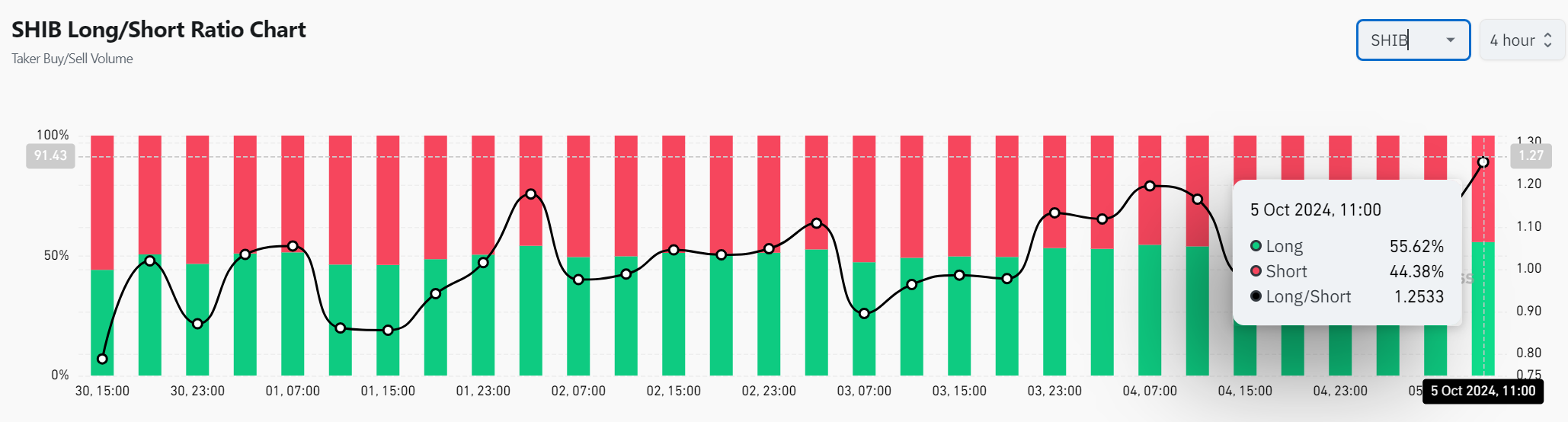

Long vs. short – Bullish sentiment dominates

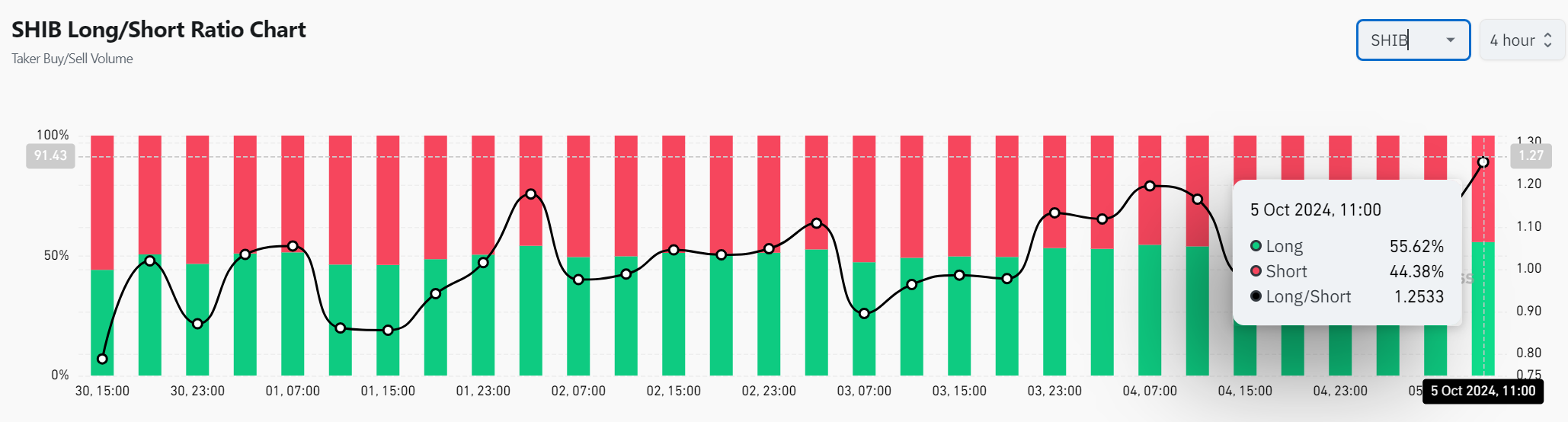

Additionally, analyzing SHIB’s long/short ratio revealed more bullish sentiment. At the time of writing, 55.62% of positions were long, with only 44.38% short. The long/short ratio sat at 1.2533, indicating that traders have been largely betting on SHIB’s upward trend.

Therefore, this positive sentiment could further strengthen SHIB’s price movement. Especially if more traders continue to open long positions.

Source: Coinglass

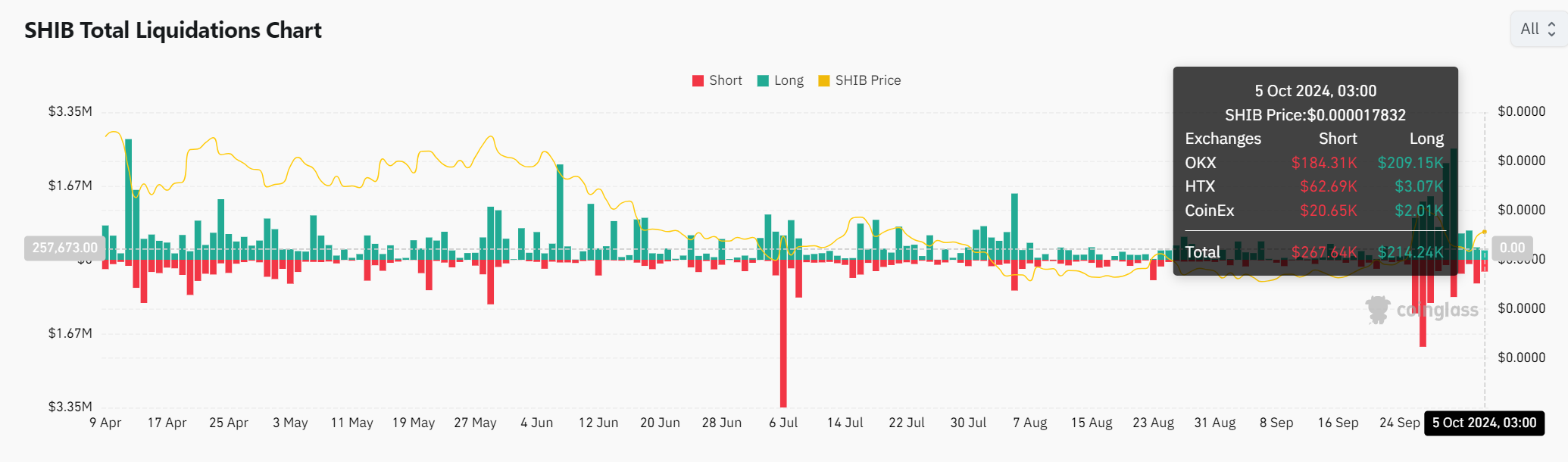

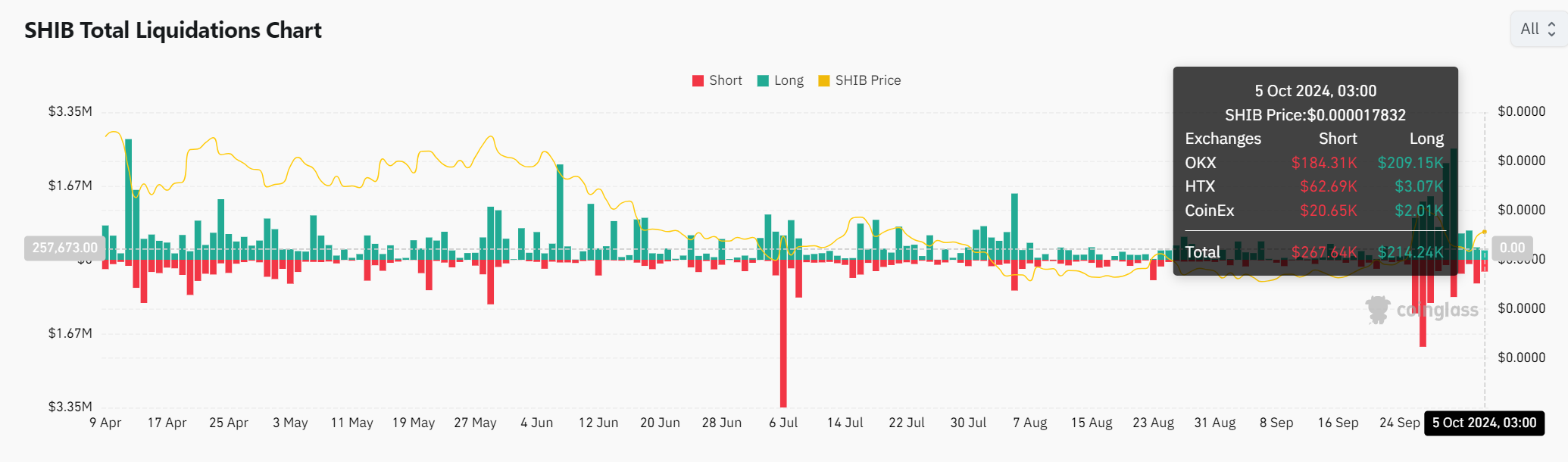

Liquidations – Can they fuel the next move?

Finally, examining liquidation data adds another layer of insight. SHIB saw $267.64k in short liquidations over the last 24 hours, compared to $214.24k in long liquidations.

Consequently, this means that short sellers have been facing increasing pressure. This could force them to exit their positions and drive SHIB’s price even higher.

Source: Coinglass

Realistic or not, here’s SHIB’s market cap in BTC’s terms

Owing to the aforementioned factors, a sustained rally could be next for Shiba Inu. This will be accelerated if the wider crypto market, led by Bitcoin, rallies too.

While there are no certainties in the market, SHIB’s prevailing market trend suggested a favorable outlook for sustained growth in the near future.