- Shiba Inu’s breakout and soaring burn rate signaled a potential bullish rally ahead.

- Rising transactions and active addresses supported SHIB’s bullish momentum.

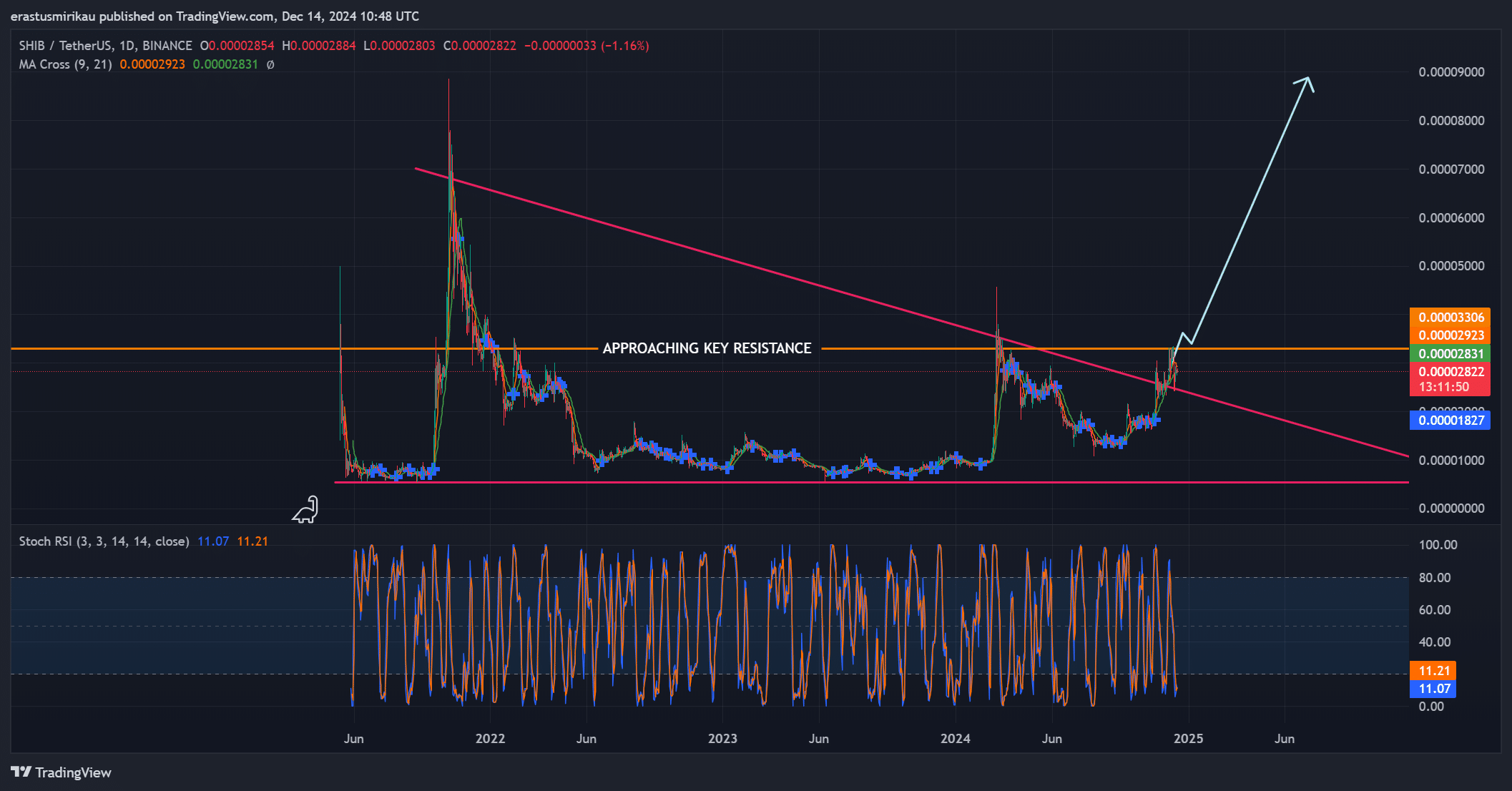

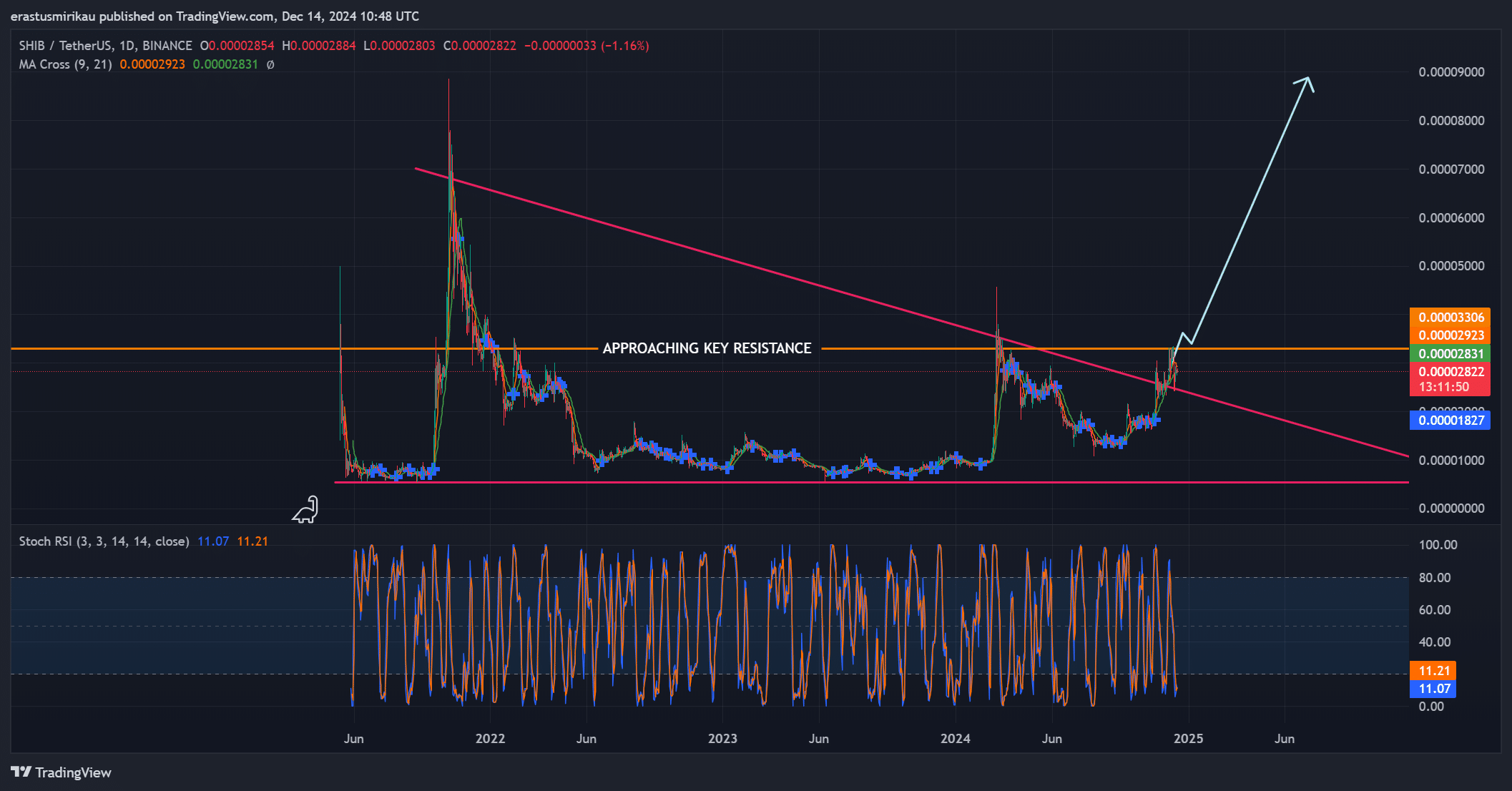

Shiba Inu [SHIB] has made significant progress by breaking out of a long-term descending triangle, positioning itself closer to its critical $0.00003306 resistance level.

This development has sparked renewed investor interest, with SHIB trading at $0.00002812, up 0.92% at press time.

Furthermore, the burn rate has skyrocketed by an impressive 1,068%, removing trillions of tokens from circulation according to Shibburn.

These factors have fueled optimism about SHIB’s potential for a strong bullish rally in the near future.

A promising breakout

Shiba Inu’s breakout from the descending triangle signaleda major shift in its market trajectory.

The token was approaching the critical $0.00003306 resistance level at press time, which, if surpassed, could pave the way for further gains.

Additionally, the STOCH RSI indicated oversold conditions, suggesting potential for a rebound.

The MA cross (9, 21) signaled sustained upward momentum, reinforcing the bullish outlook. Breaking this key resistance level remains crucial to validate a continued upward trend.

Source: TradingView

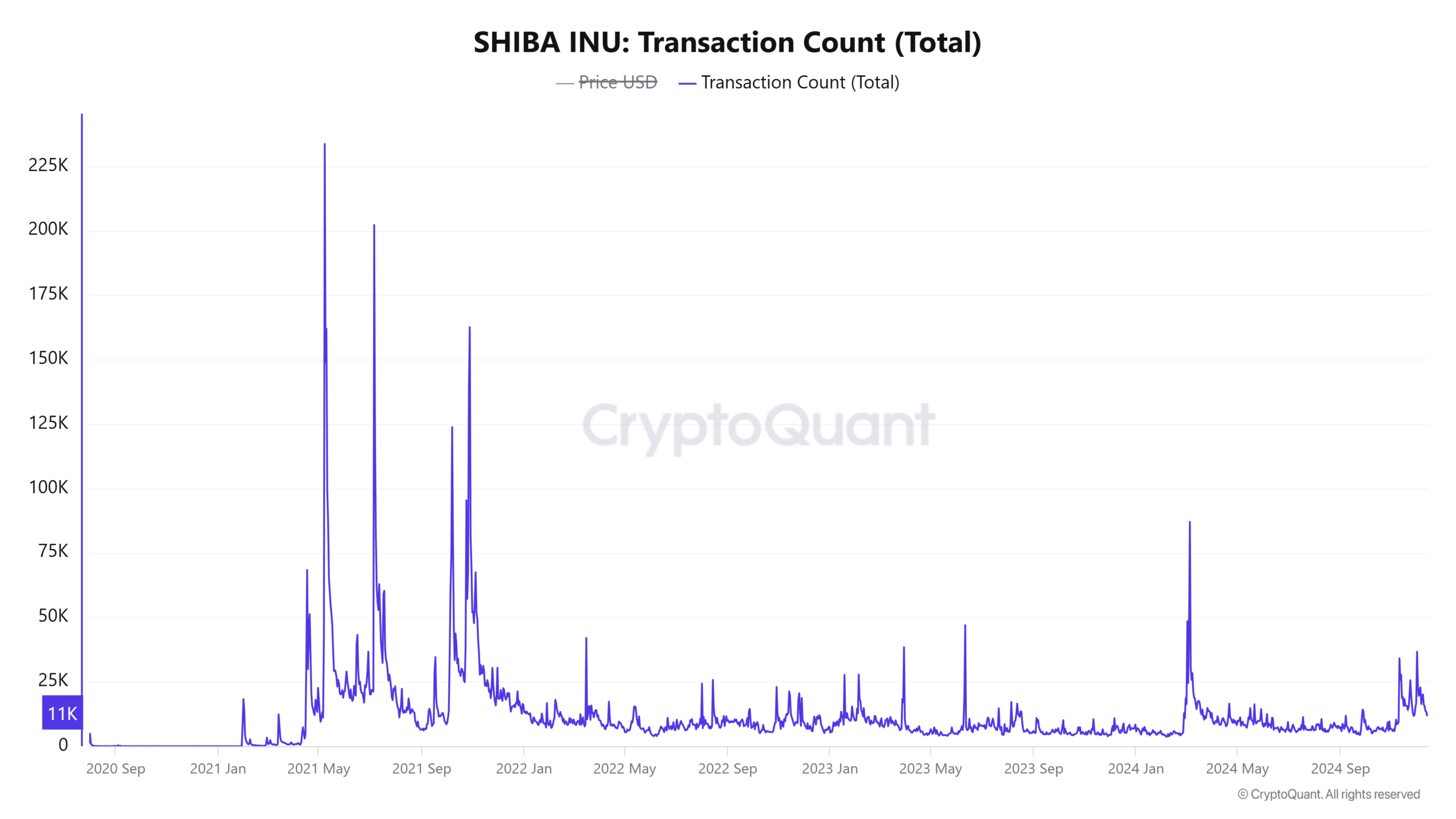

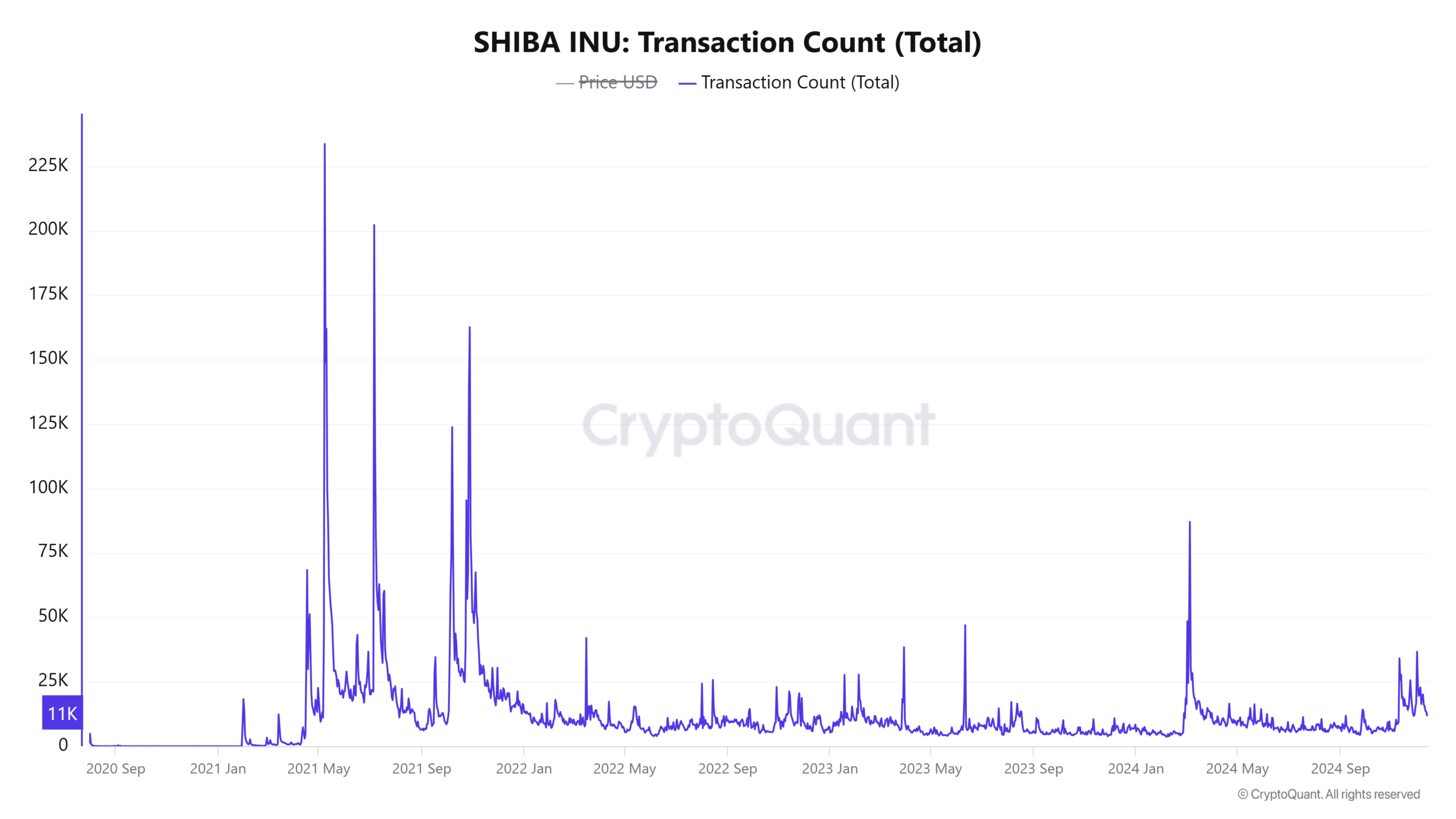

Shiba Inu’s rising engagement

SHIB’s activity underscored growing utility within its ecosystem. Active addresses increased by 1.06% in the last 24 hours, while the total transaction count rose by 1.05% to 11.87K.

Therefore, these upticks suggest heightened engagement, likely driven by improved market sentiment following the burn rate surge. The increased transactions reflected growing interest in the token’s potential rally.

Source: CryptoQuant

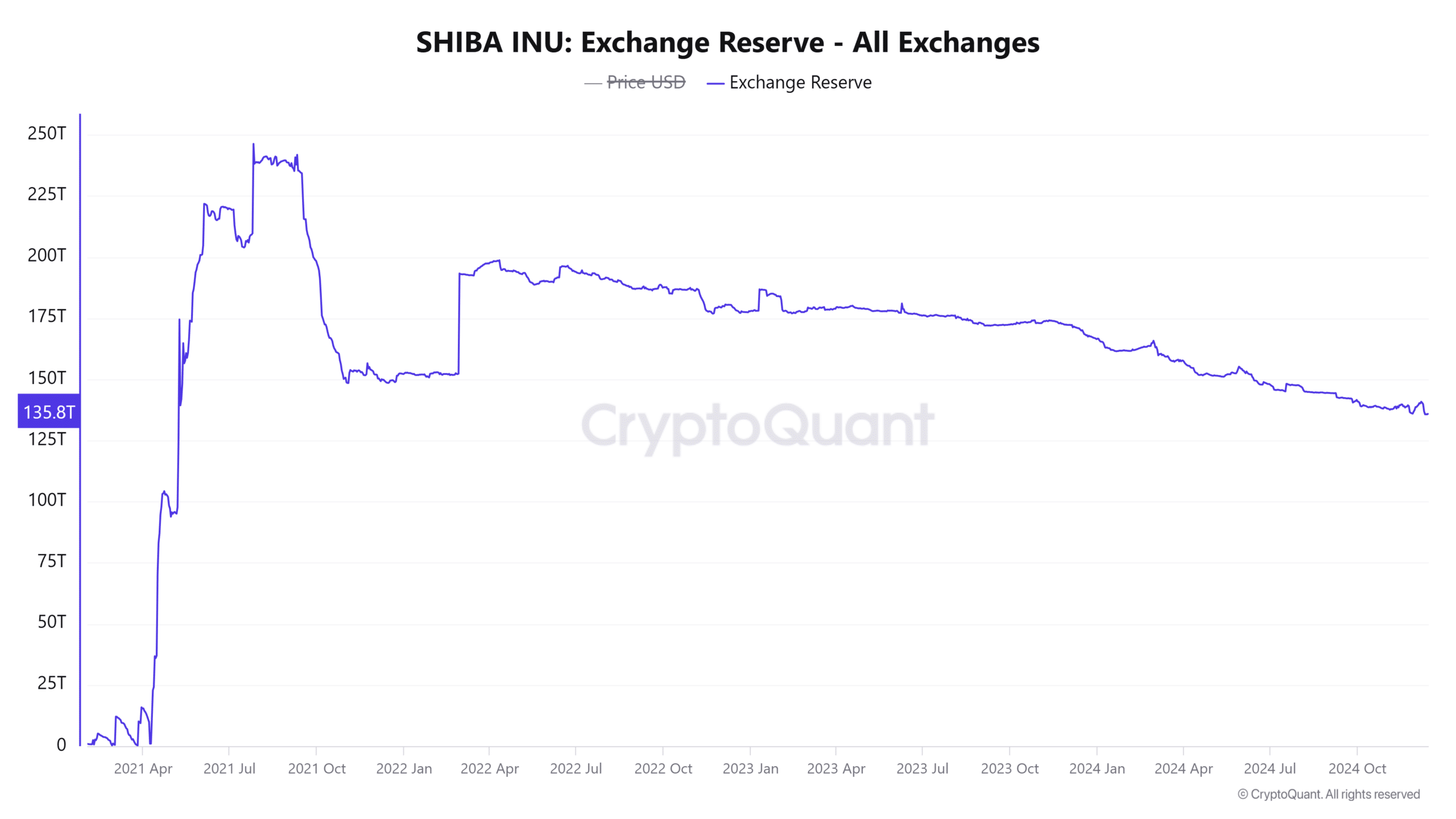

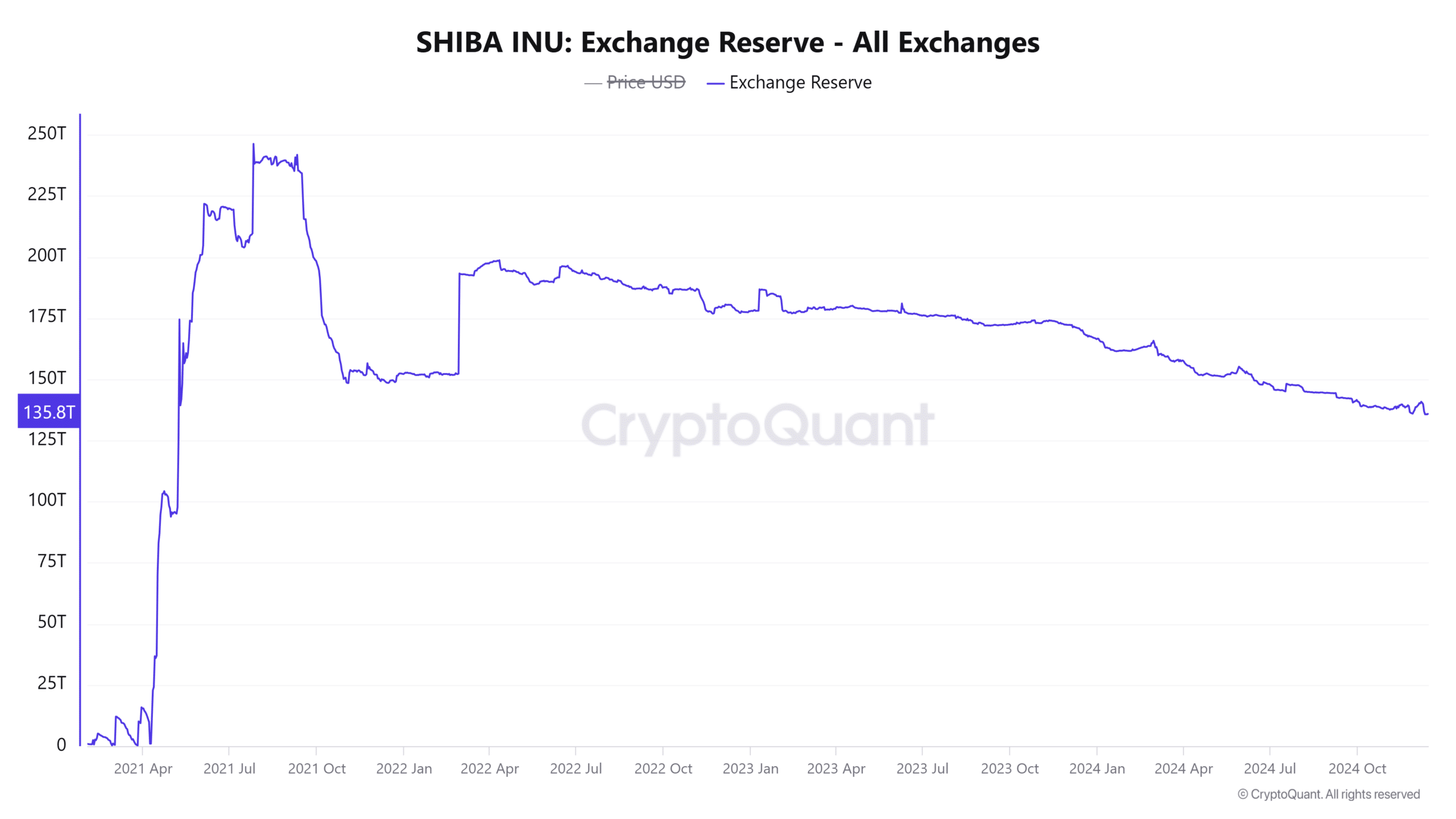

Exchange reserve hints at balanced sentiment

The exchange reserve for SHIB was 135.89 trillion at press time, marking a slight increase of 0.09%. However, this modest uptick suggested that selling pressure remained limited, atleast for now.

This balance between buying and selling activity could allow SHIB to consolidate its recent gains, maintaining the positive momentum seen after its breakout.

Source: CryptoQuant

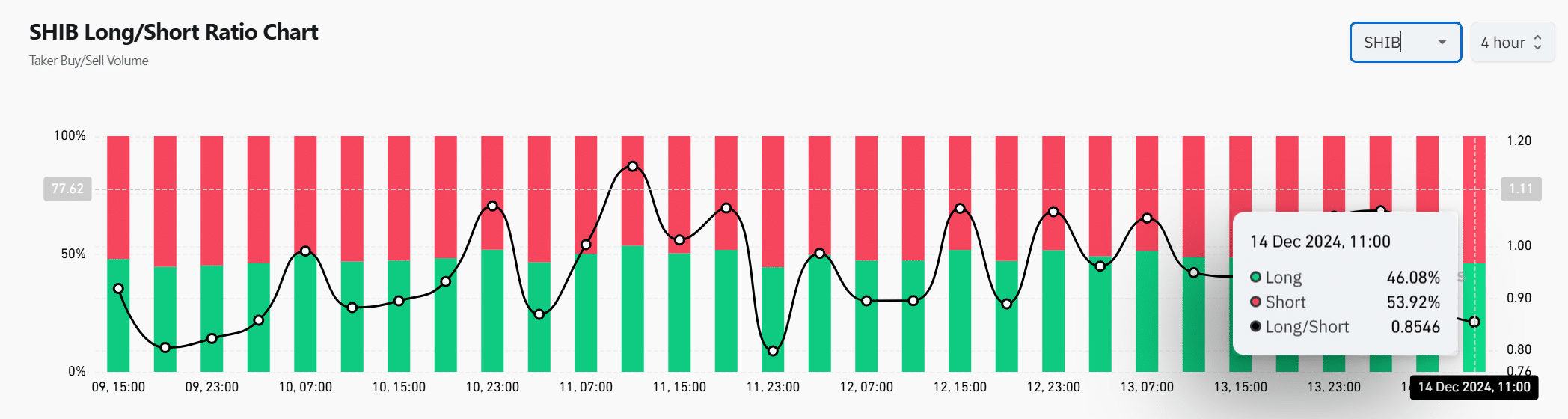

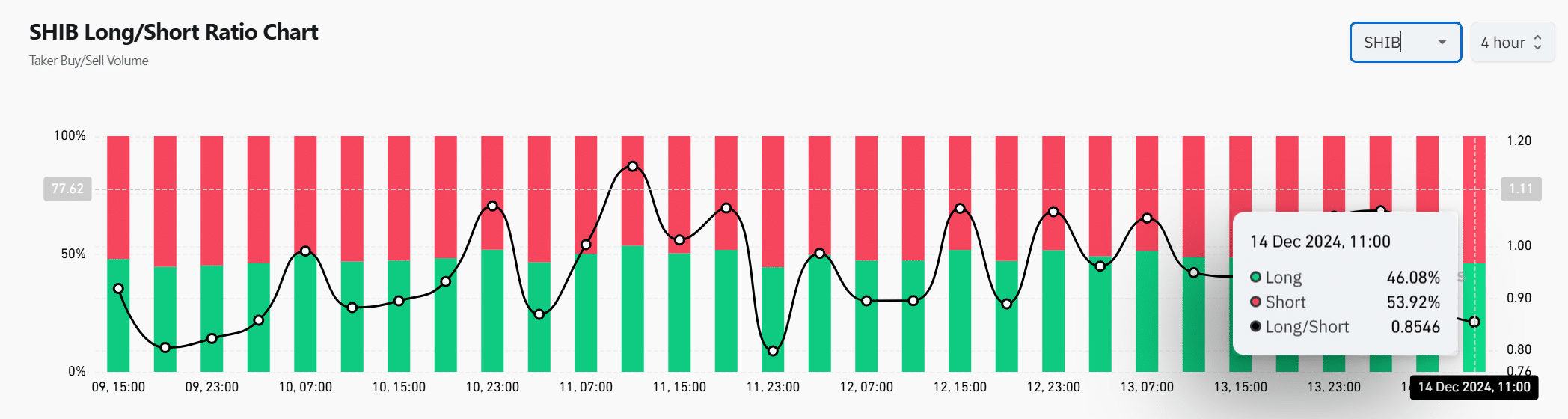

Long/Short Ratio reveals cautious optimism

SHIB’s Long/Short Ratio showed 46.08% long positions versus 53.92% shorts, highlighting cautious market sentiment.

However, despite the bearish lean, SHIB has displayed resilience, with buyers gradually gaining control as it nears the critical resistance.

This dynamic indicated a potential shift in favor of bulls if buying pressure continues to build.

Source: Coinglass

Is your portfolio green? Check out the Shiba Inu Profit Calculator

Shiba Inu’s breakout, combined with rising burn rates and increased engagement, points to a promising outlook.

Therefore, if SHIB can surpass the $0.00003306 resistance, a strong bullish rally is highly likely. The token’s momentum suggests it is well-positioned for further gains in the near term.