XRP network activity surges despite price dip

Source: X

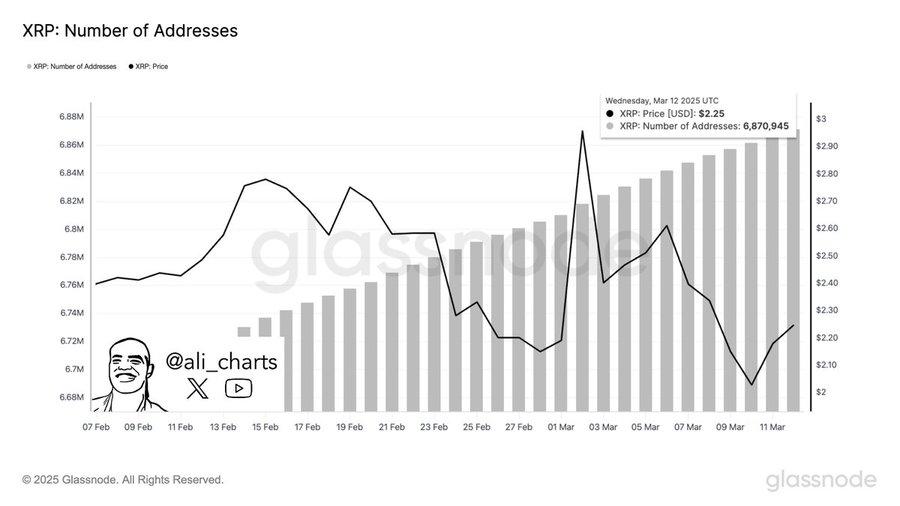

XRP’s price may be cooling down, but on-chain data tells us a different story.

For example – The number of XRP addresses steadily climbed to 6.87 million by 12 March, signaling growing user adoption. This, despite the price dropping from $2.90 to $2.25.

Source: Santiment

More notably, Santiment’s data revealed a surge in daily active addresses between March 1-8, peaking just as the price began to slide. This divergence hinted at heightened network activity amid the sell-offs – Often a sign of accumulation or speculative repositioning.

Sustained address growth and active usage indicated that investors aren’t exiting. Instead, they’re adjusting.

If this trend holds, XRP could be setting the stage for a stronger rebound once sentiment improves.

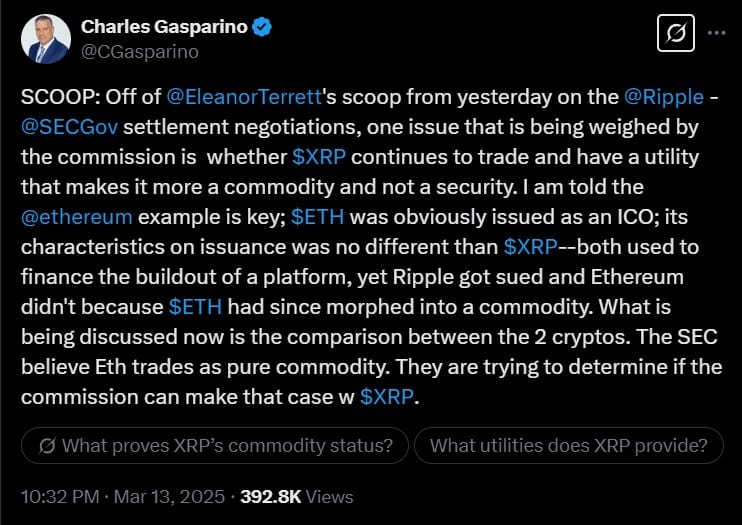

Ethereum’s precedent, Ripple’s parallels

Ethereum’s transition from an ICO-funded token to a recognized commodity has become a central reference in Ripple’s legal defense. The SEC previously refrained from prosecuting Ethereum, citing its decentralization and transformation over time.

Ripple is now pointing to this precedent, arguing that XRP has undergone a similar evolution.

Source: X

According to FOX News correspondent Charles Gasparino, Ripple is emphasizing these parallels as the SEC weighs XRP’s current utility. As he noted in a 13 March post on X, SEC officials are discussing “whether XRP continues to trade and have a utility that makes it more a commodity and not a security.”

Both ETH and XRP were initially used to finance platform development, yet only Ripple faced legal action. That comparison could ultimately shape the SEC’s decision on how to classify XRP.

Ripple’s defense strategy and the stakes of classification

Ripple’s legal team is focused on reframing XRP’s utility and market behavior to reflect that of a commodity. Their argument centers on the claim that XRP no longer depends on Ripple Labs or any central issuer. Instead, they are asserting that XRP operates independently in the market, much like ETH.

As Gasparino reported, the SEC is assessing whether XRP’s utility has become self-sustaining – Detached from its original fundraising purpose. A favorable ruling would end Ripple’s long-running legal entanglement and potentially unlock greater institutional interest in XRP. However, if the SEC concludes that XRP is still a security, Ripple could face fresh restrictions. And, exchanges may re-evaluate their listings.

In fact, the implications go beyond Ripple. This case could set a regulatory precedent for how digital assets are classified in the United States.