- SEC’s decision on the Bitwise Crypto Index ETF application has been postponed to March

- Will the incoming administration accelerate Crypto ETF approvals?

The SEC has delayed approval for Bitwise’s Crypto Index ETF application and postponed the decision to March. The agency needs more time to consider the proposed rule change submitted through the NYSE (New York Stock Exchange). Part of the regulator’s statement read,

“The Commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein.”

The Bitwise 10 Crypto Index Fund tracks top tokens dominated by Bitcoin [BTC], Ethereum [ETH], Ripple [XRP], and Solana [SOL]. Like Grayscale converted its Grayscale Bitcoin Trust Fund to spot BTC ETF, Bitwise sought the same for its index fund.

Will the new regime accelerate crypto ETFs?

Although similar Crypto Index ETF applications from Hashdex and Franklin Templeton were recently approved, they only focused on BTC and ETH. Both tokens have regulatory clarity as security.

However, eight other tokens on the Bitwise application, including XRP and SOL, still lack regulatory clarity on whether they are security tokens. Even so, the market expects positive outcomes from the incoming Trump administration.

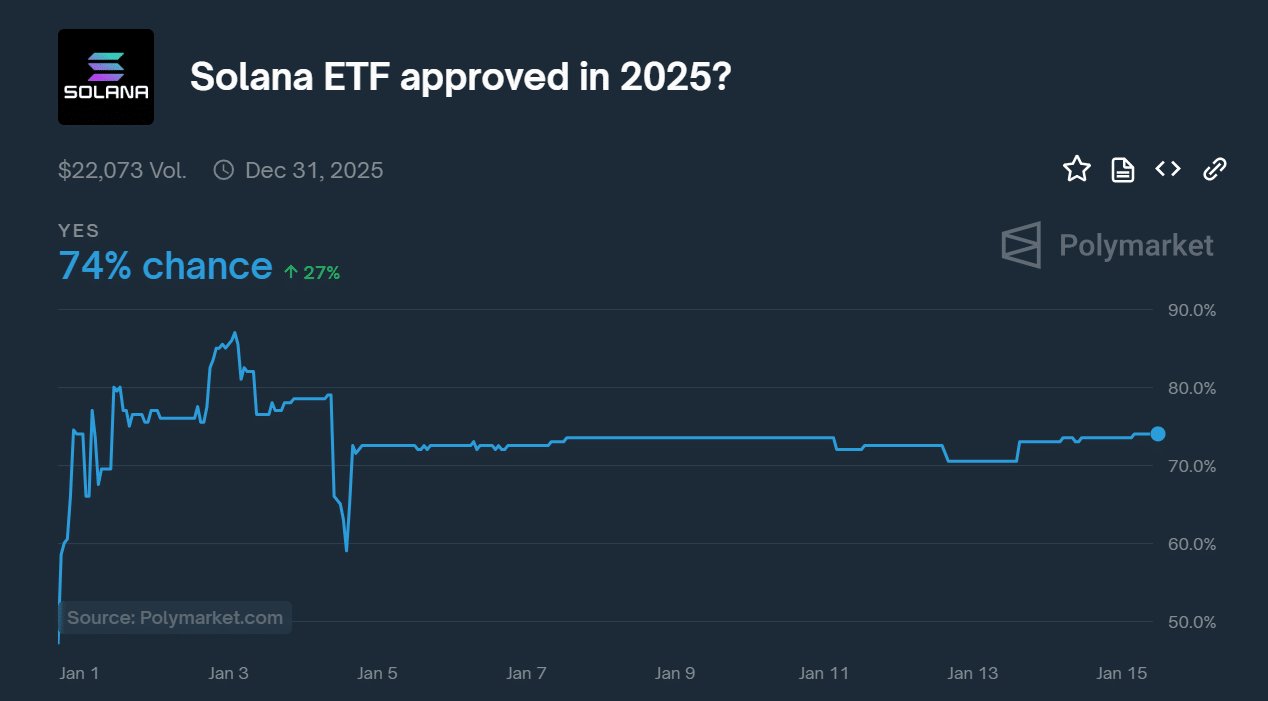

At press time, prediction site Polymarket priced a +50% chance for XRP and SOL ETF approval in 2025. The odds for the XRP ETF were 60%, while the market was pricing a 74% chance of approval this year for the SOL ETF.

Source: Polymarket

Simply put, the market expects the incoming administration to fast-track altcoin ETFs and could help crypto index ETF applications. Epecially if the regulatory status of other tokens is clarified.

In the meantime, outgoing SEC chair Gary Gensler has defended his enforcement action legacy and maintained his rhetoric that most crypto projects with no fundamentals would fail. In a recent interview with CNBC, Gensler said,

‘These other thousands of crypto projects need to show their use cases and underlying fundamentals, or they won’t persist.’

It remains to be seen whether the incoming pro-crypto SEC chair, Paul Atkins, will reverse some of the perceived anti-crypto actions and accelerate altcoin ETF approvals.