- Satoshi’s 1.1 million BTC remain untouched since early mining using the Patoshi Pattern.

- Institutional holders like BlackRock and MicroStrategy now own more Bitcoin than Nakamoto.

Satoshi Nakamoto, the enigmatic creator of Bitcoin [BTC], has once again found their dormant fortune thrust into the spotlight as BTC prices surge past $94,000.

With an estimated 1.1 million Bitcoin under their control, untouched since the protocol’s earliest days, Nakamoto’s holdings have now soared past the $103 billion mark, dramatically reclaiming billionaire status.

This rally, which marks a 27% rebound from Bitcoin’s recent five-month low, has sparked both celebration and unease within the crypto community.

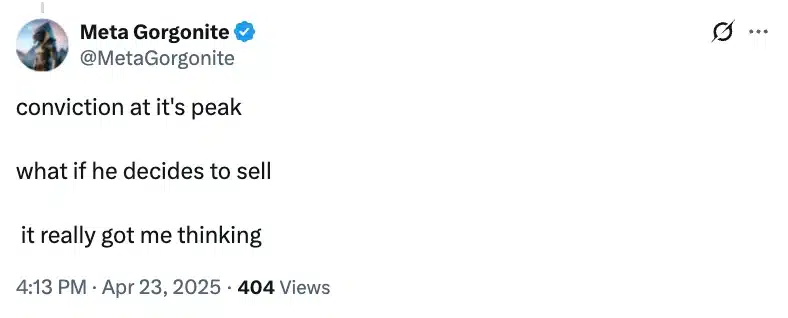

As the asset approaches uncharted highs, speculation is intensifying around the one question that has lingered for years: what happens if Satoshi ever decides to sell?

Source: Meta Gorgonite/X

Community concerned about Satoshi’s next move

Echoing similar sentiments, was another X (formerly Twitter) user – Dan Lucro, who added,

“The question is, will he ever sell… and when?”

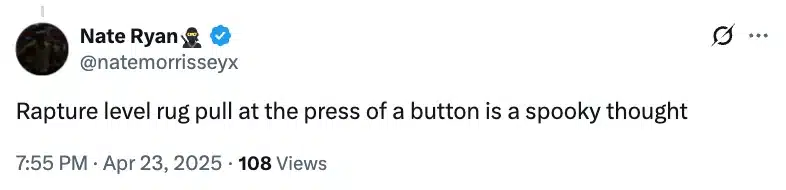

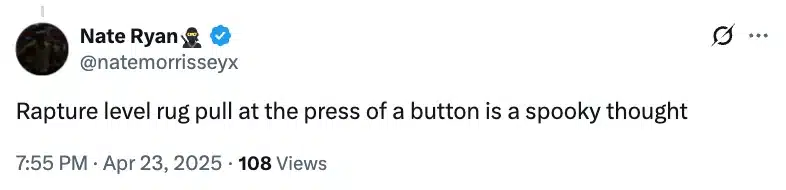

As expected, another user put it best when he said,

Source: Nate Ryan/X

Is the concern valid?

Even as Bitcoin’s price continues its upward trajectory, falling to $92,357.57 at press time, following a 1.44% daily drop, Satoshi Nakamoto’s legendary Bitcoin holdings remain untouched.

The estimated 1.1 million BTC attributed to Bitcoin’s mysterious creator were mined in the network’s infancy using what is now known as the “Patoshi Pattern,” a distinct mining fingerprint that has helped trace these early coins.

Despite growing market speculation and price momentum, Nakamoto has never moved a single coin from this massive stash, further fueling the mystique surrounding their identity and long-term intentions.

Satoshi Nakamoto vs. institutional investors

As Bitcoin’s institutional adoption continues to grow, entities like BlackRock and MicroStrategy now collectively hold more BTC than Satoshi Nakamoto’s estimated stash.

While Tesla’s 11,509 BTC may not rival these giants, its steadfast commitment to holding Bitcoin as a corporate asset reflects a broader shift among public companies embracing digital currencies.

Yet, the absence of fiduciary responsibility sets Nakamoto’s untouched holdings apart, unlike corporations whose Bitcoin reserves are subject to regulatory oversight and shareholder scrutiny.

Interestingly, MicroStrategy chairman Michael Saylor recently floated the idea of permanently removing access to BTC by destroying private keys after death.

Hence, in a market shaped by both institutional control and mythical origins, the tension between utility and ownership continues to define Bitcoin’s evolving narrative.