- RAY has dropped 20% amid increased sell pressure and low demand.

- Will the $5 support trigger a price recovery for the altcoin?

Raydium [RAY], Solana’s premier memecoin trading site, has lost over 20% of its token value in the past two weeks.

As of this writing, RAY consolidated tightly around $5 but faced increased sell-pressure from centralized exchanges. Will $5 support hold or crack?

RAY on the edge

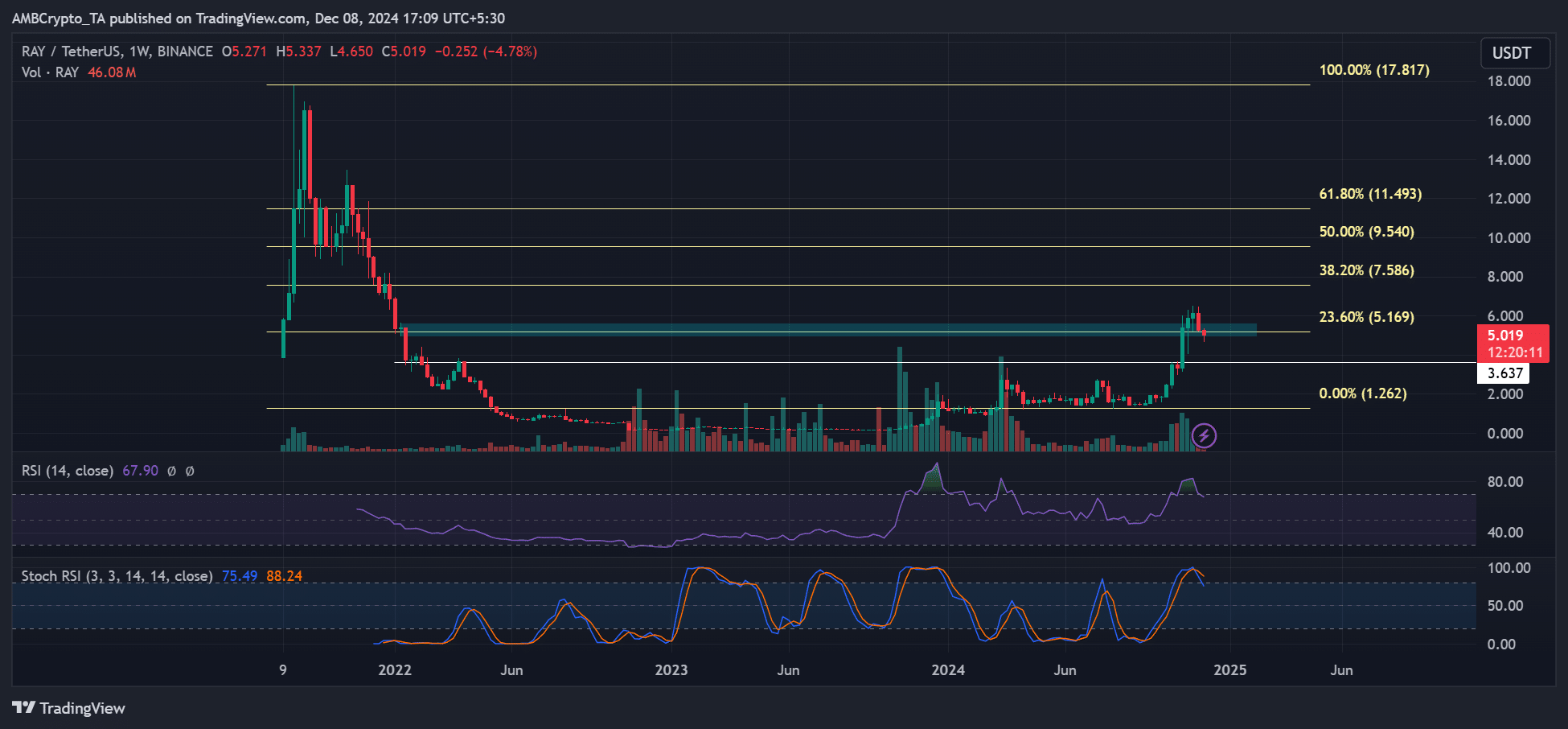

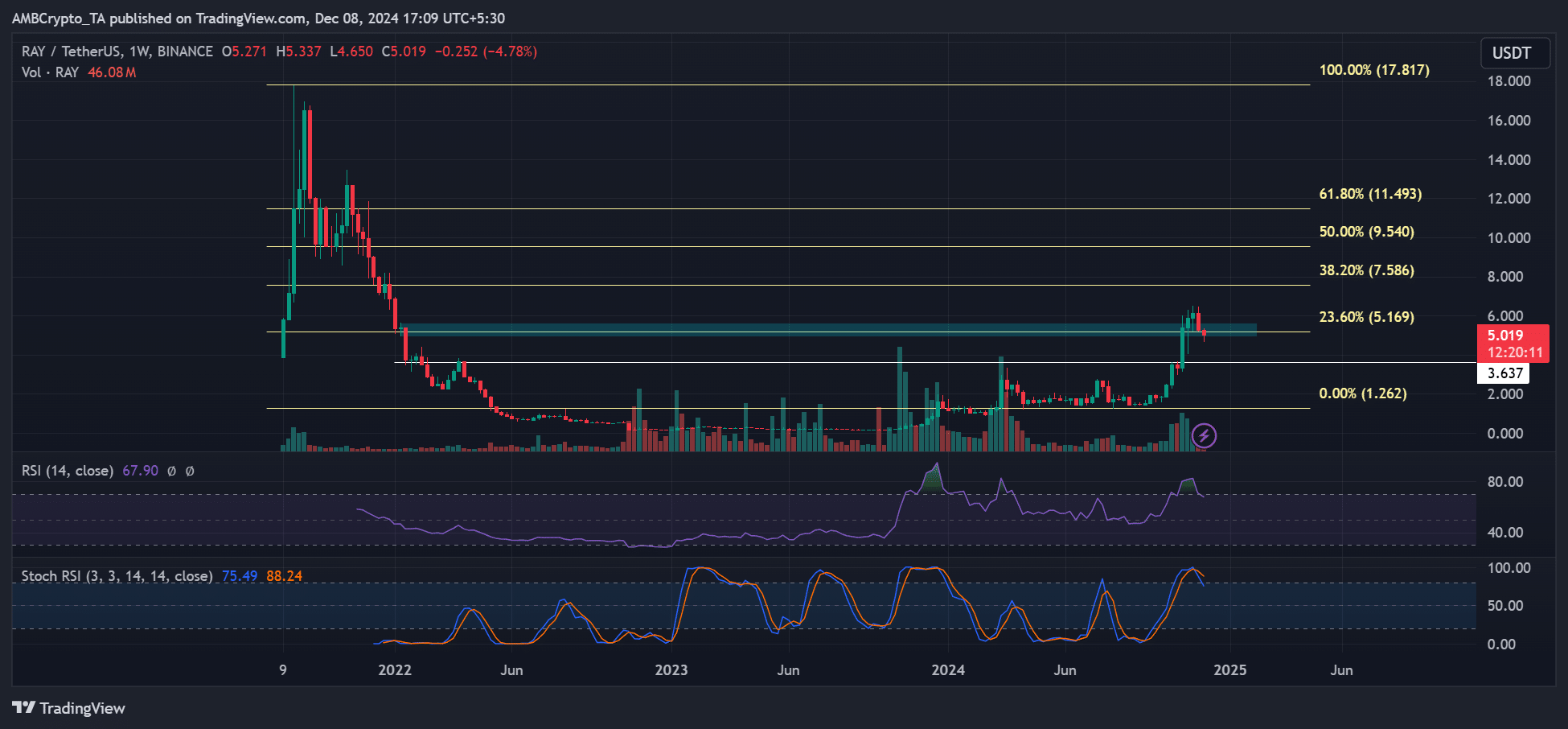

Source: RAY/USDT, TradingView

RAY entered price consolidation after hitting a record high of $6.5 in mid-November. Buying pressure declined afterwards as sell pressure compounded.

In December, RAY’s demand turned negative, as shown by the RSI below 50 median level on the 12-hour chart. This complicated recovery chances keep the altcoin confined to the lower range of its channel.

Will the $5 range-low and support break? Yes, if the sell pressure increases in the next few days.

Source: RAY/USDT, TradingView

However, the $5 level was a key psychological and Fib level that could reinforce the bull’s advance.

Losing the level would make a lower low and flip the market structure bearish. If so, $3.6 could be the next support level.

On the flipside, $7.5 and $9.5 could be reachable if bulls defended the $5 support.

RAY sell pressure

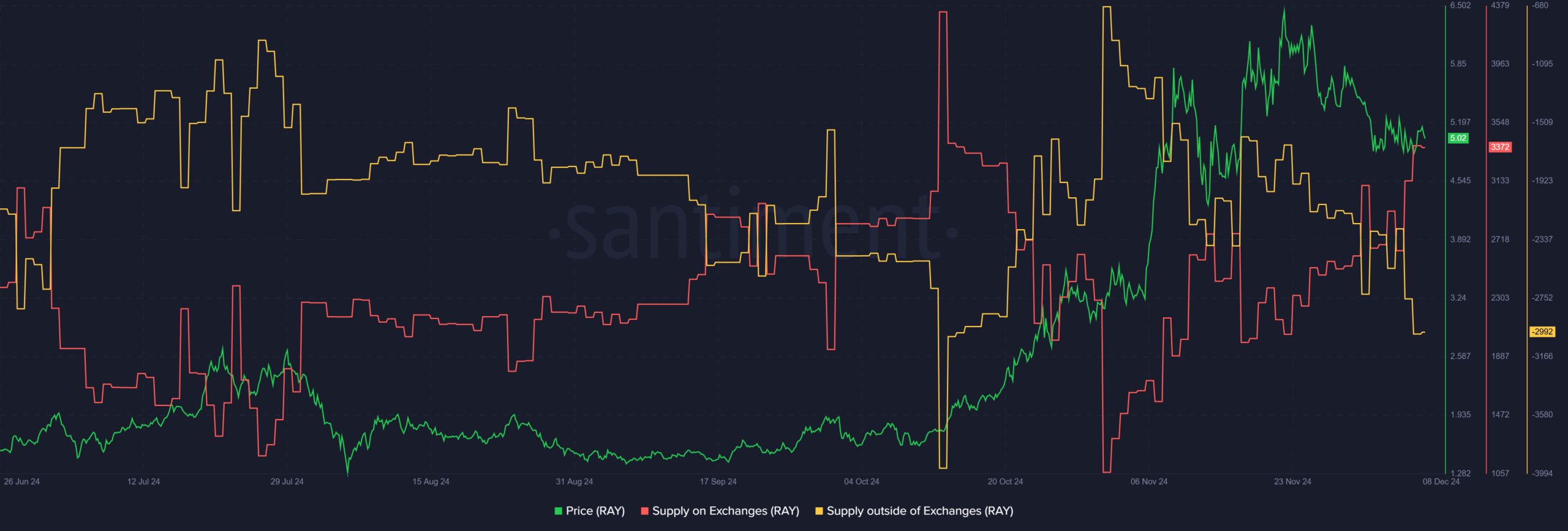

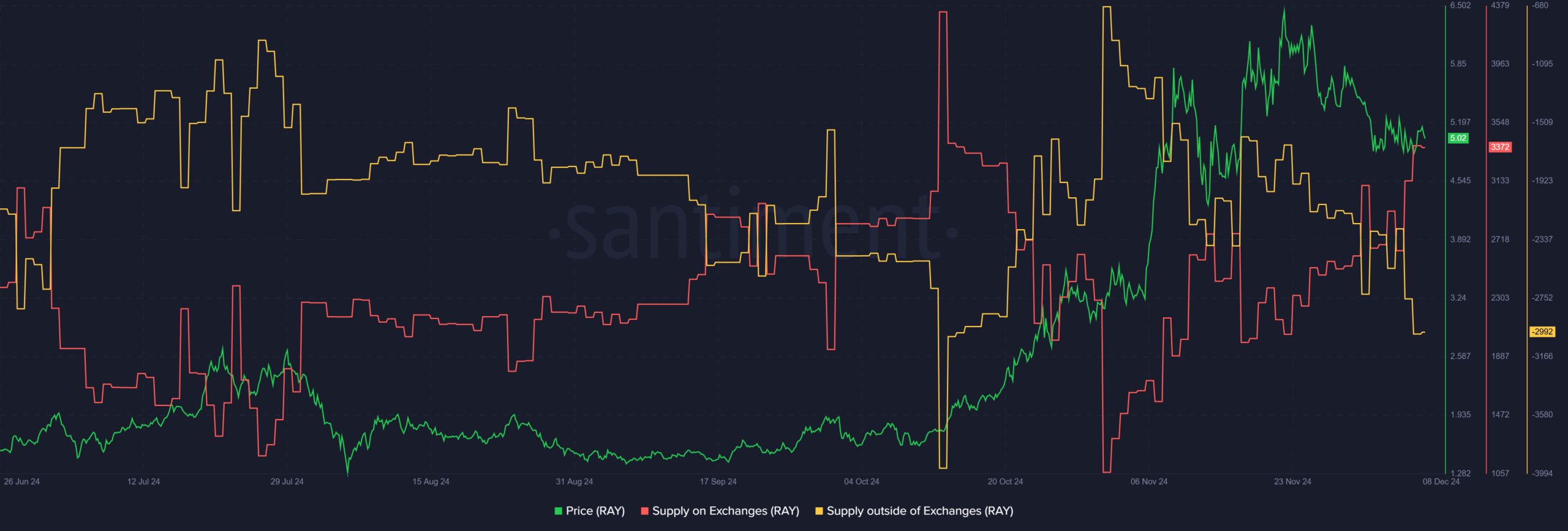

Source: Santiment

According to Santiment, sell pressure (supply on exchanges, red line) steadily increased in November.

Over the same period, new demand (supply outside exchanges, yellow) for the altcoin dropped. This was contrary to the strong buying trend in October, suggesting short-term holders booked profit in November and December.

The sell-off stalled RAY’s rally at $6.5 and could only reverse it eased.

While the sell-off could be a great buying opportunity for investors eyeing long-term strategies, there wasn’t a clear sign for RAY traders.

Read Raydium [RAY] Price Prediction 2024-2025

For swing traders, a weekly candlestick close above $5 could suggest strengthening and a potential buying opportunity. Such a move would increase the odds of RAY soaring to the middle or upper channel target of $7.5.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion