- RAY hits 2-year high as its price goes parabolic since September.

- Assessing the link between RAY’s price action and Raydium’s performance on key metrics.

RAY, the native token on the Raydium DEX on Solana [SOL], just hit a new 2-year high.

Its performance so far, especially in the last two months, has delivered better gains than Bitcoin [BTC], which also achieved a new high on the 6th of November.

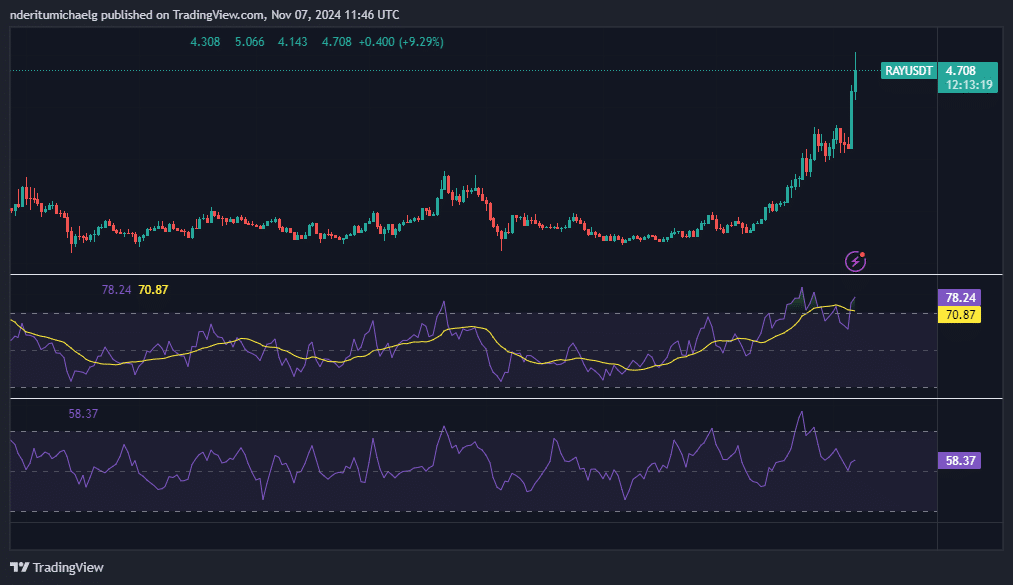

A look at RAY’s price action revealed a parabolic performance that had its roots in September accumulation. The token traded as low as $1.35 in September, but by October, it was clear that the bulls were fully in charge.

RAY soared as high as $5.06 in the last 24 hours, which was equivalent to a 276% rally from Its lowest price point in September.

For context, Bitcoin only achieved a 45% upside from its lowest price point in September to its recent new local high.

Source: TradingView

Despite this performance, RAY still has a substantial amount of room for growth before reaching its all-time high. The token peaked at $17.80 in August 2021.

Nevertheless, short term pullbacks are likely to occur now that RAY is extremely overbought.

The token demonstrated bearish divergence with the RSI’s lower high. Also, the MFI has been dipping lower, indicating that profit-taking has been taking place.

Reflection of Raydium’s performance?

The Solana blockchain has been enjoying robust utility in 2024 and Raydium has been benefiting as one of the top DEXes.

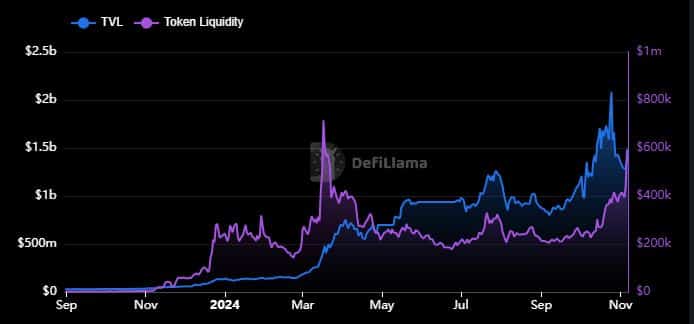

Raydium’s TVL had less than $40 million and less than $10,000 in token liquidity exactly 12 months ago.

Both metrics registered impressive growth recently, with TVL peaking at $2.08 billion in October but has since pulled back to $1.50 billion. Meanwhile, RAY token liquidity has since soared to $597 million.

Source: DeFiLlama

This TVL and token liquidity growth underscore the Raydium DEX’s growing momentum in 2024 in line with Solana’s ecosystem growth.

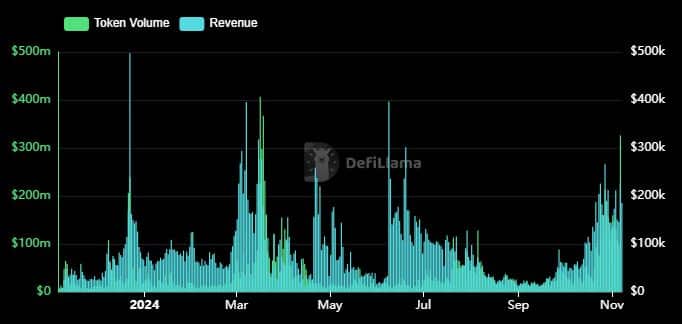

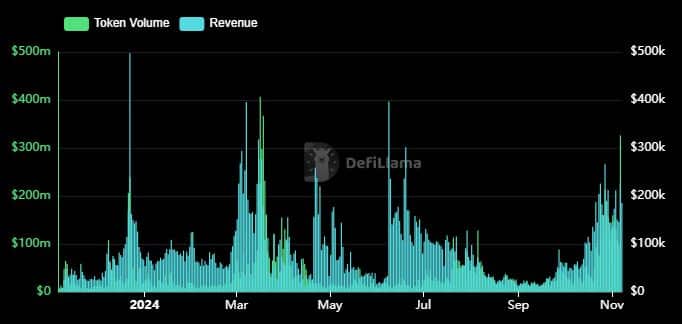

However, that growth and network activity was more evident in Raydium’s revenue and volume data.

Both volume and revenue registered their highest spikes in March, June and October, followed by dips during the rest of the time.

For example, the highest token volume since the start of 2024 was around $406 million in March. Meanwhile, the highest revenue was $395,000 in March.

Source: DeFiLlama

The latest data indicates that both token volume and revenue have been on the rise since September. This reflects the spike in activity during bullish months.

Read Raydium’s [RAY] Price Prediction 2024–2025

It also aligns with the observation that the same metrics dipped during slow or bearish months.

Based on the above observation, it was clear that DEX activity has had a noteworthy impact on RAY demand. This trend will likely continue as the bull market becomes more heated.