- PayPal’s stablecoin market cap has plummeted by 40% to $618 million since August.

- Strategic partnerships and yield changes were impacting PYUSD’s competitive position in the market.

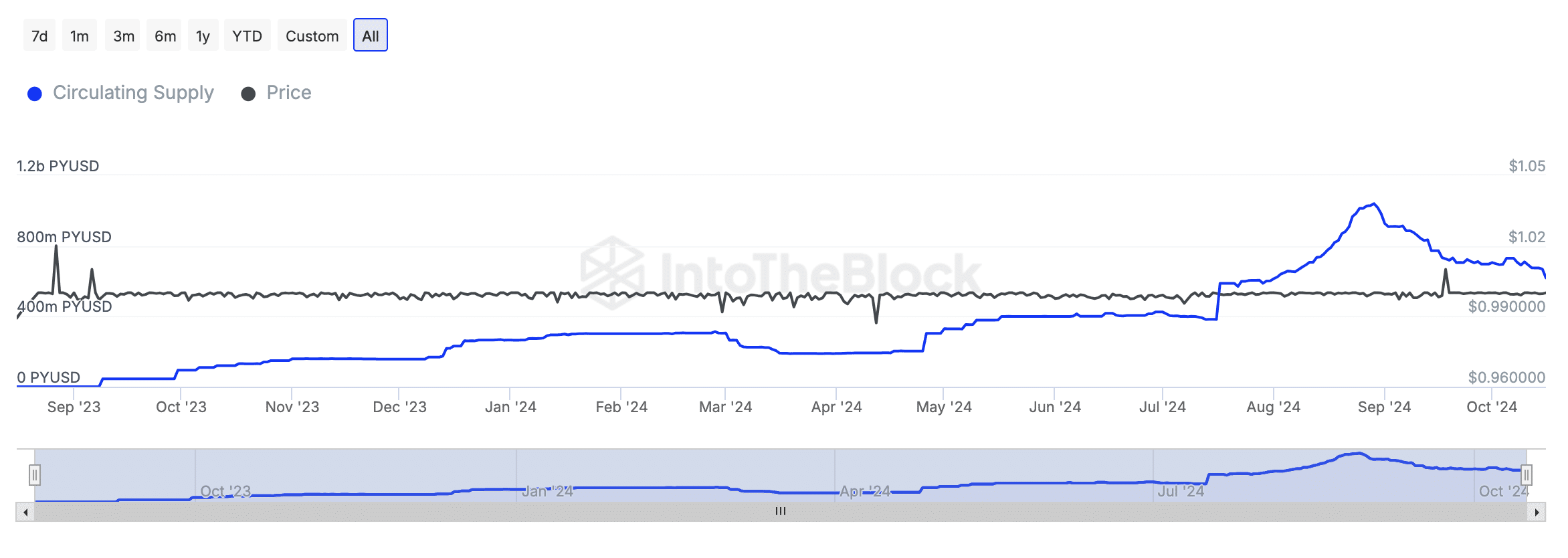

PayPal’s dollar-pegged stablecoin PYUSD has faced a steep decline since it peaked above $1 billion in late August.

Once ranked as the fourth-largest stablecoin, its press time market cap sat at $618 million, reflecting a sharp 40% reduction in just over a month.

This downturn highlighted the ongoing challenges for PayPal’s token amid fierce competition and fluctuating demand within the stablecoin market.

Source: IntoTheBlock

The journey so far

Launched on the Ethereum [ETH] mainnet in August 2023 and later expanded to Solana [SOL] in May 2024, PayPal’s USD initially showed significant momentum, particularly in Q3 2024.

By mid-August, the stablecoin’s supply on SOL had even surpassed its presence on ETH, positioning it as one of the fastest-growing stablecoins during that period.

In a notable milestone, its market capitalization doubled between July and August, surpassing $1 billion for the first time.

However, recent performance indicates a setback, with the token retreating from some of its earlier gains over the past month.

Partnership with Kamino Finance

PayPal USD’s initial growth was significantly bolstered by a strategic partnership with Kamino Finance, a Solana-based lending platform.

This collaboration offered attractive yields to PYUSD holders, with PayPal providing subsidies to enhance returns.

At its peak, Kamino offered yields of around 17% on PYUSD deposits, drawing substantial interest.

But recent weeks have seen these returns decline to under 7%, impacting the appeal for PYUSD holders.

Other SOL-based platforms, like Drift and Marginfi, which once offered similar high returns, have also adjusted their annualized rewards. This points to a broader trend of reduced incentives across these protocols.

Shedding light on the same, DragonFly Capital managing partner Haseeb Qureshi took to X (formerly Twitter) and noted,

“PYUSD circulating supply has completely round tripped as the @KaminoFinance incentives they were blasting out have tapered off.”

However, the trend could be poised for a shift, as Kamino recently included PYUSD in its ‘altcoin market,’ allowing users to borrow against assets like WIF, POPCAT, and BONK memecoins.

This strategic addition brings new incentives, with depositors collectively earning an extra $10,000 in PYUSD rewards each week, potentially boosting engagement and demand for the stablecoin.

PYUSD in comparison with USDT and USDC

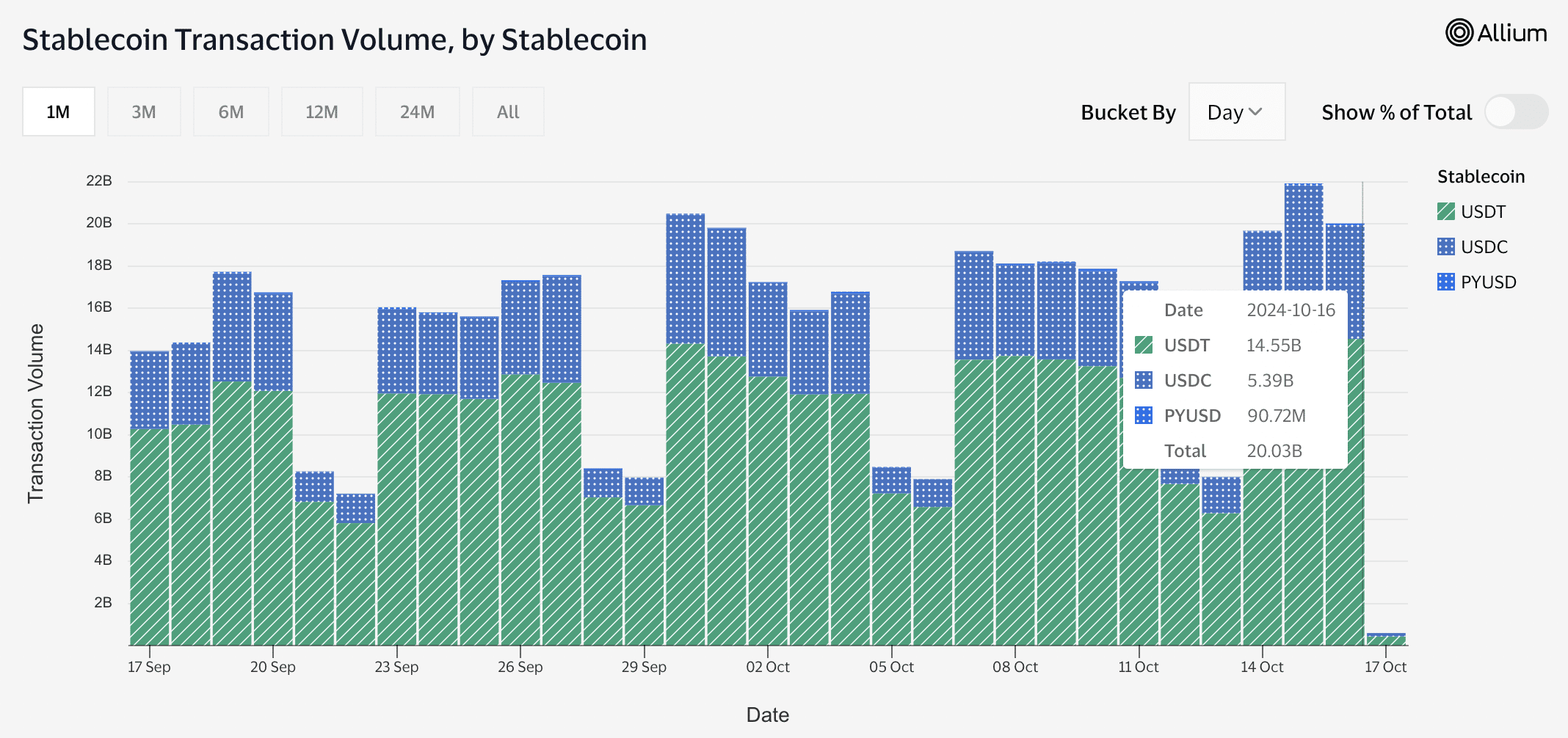

The decline in PYUSD’s market cap, especially on Solana, highlights shifting dynamics in the stablecoin market, contrasting with the stability of USDT and USDC.

While PYUSD saw a high demand early on, recent drops in yield incentives have reduced its appeal. This resulted in a decrease from $600 million to $267 million on Solana.

Meanwhile, approximately $350 million PYUSD remained in circulation on Ethereum, where it may have a stronger foothold due to the blockchain’s established DeFi infrastructure.

In contrast, USDT and USDC have maintained stable market caps, underscoring their dominance and consistent demand across platforms.

Visa’s on-chain analytics further highlights the competitive landscape of stablecoins as of the 16th of October, revealing that USDC hit $5.39B in transaction volume, while USDT reached $14.55B.

In stark contrast, PYUSD lagged significantly, with just $90.72 million in transaction volume.

Source: visaonchainanalytics

Despite this, PYUSD’s total cross-chain market capitalization surged by 375% year-over-year, according to CoinGecko data. This positioned it as the ninth-largest stablecoin by market cap.

This remarkable growth indicates a strong resilience and potential for future expansion in the rapidly evolving stablecoin ecosystem.