- POPCAT appears bullish as it has formed a three-white soldier candlestick pattern that hints at a further rally.

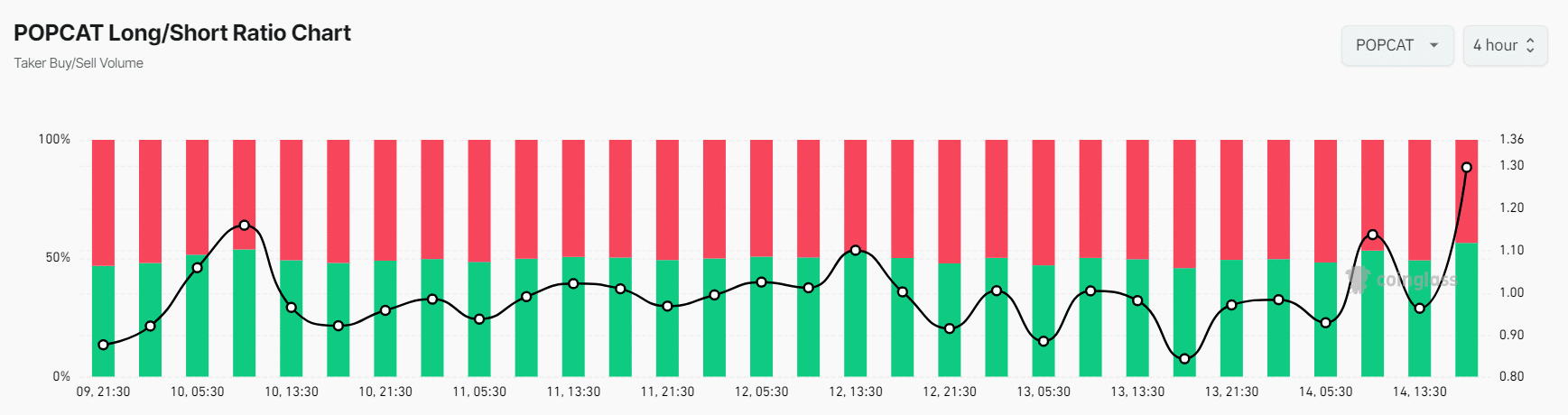

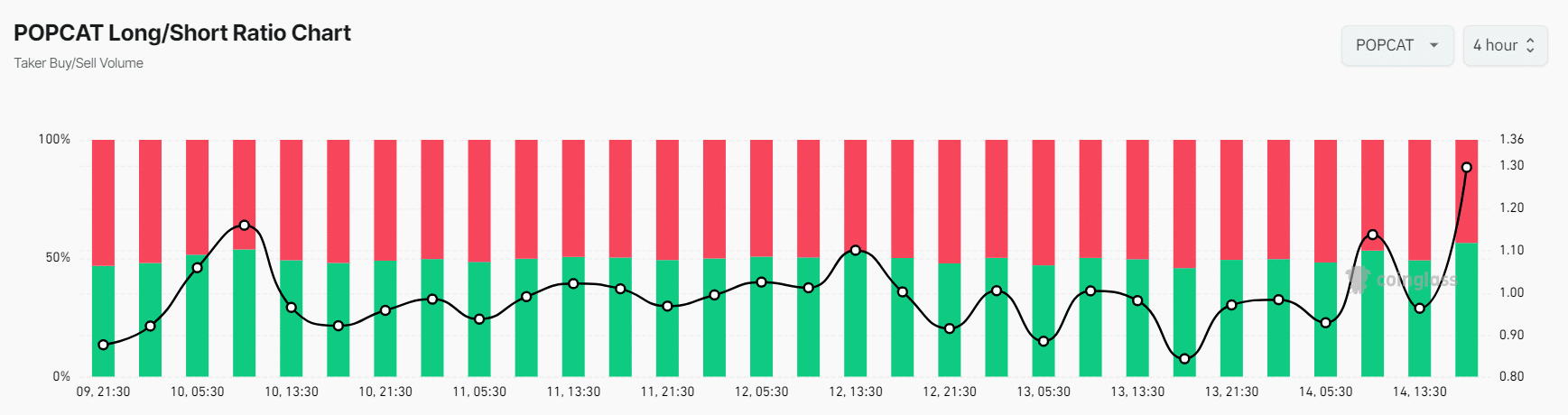

- POPCAT’s Long/Short ratio currently stands at 1.30, indicating a strong bullish market sentiment among traders.

The popular Solana-based memecoin Popcat [POPCAT] is making waves in the realm of cryptocurrency with its impressive price momentum and is attracting whales and investors.

On 14th October, the blockchain-based transaction tracker Lookonchain made a post on X, stating that a notable whale bought $1.94 million worth of POPCAT from Binance, the world’s largest cryptocurrency exchange.

Whale adds 1.38 million POPCAT

According to the post on X, this whale acquired a significant 1.38 million POPCAT tokens at an average price of $1.41. This massive purchase highlights the whale’s belief in the memecoin and suggests a potential upside rally for POPCAT in the coming days.

However, this massive purchase follows the sell-off of $4.44 million worth of the popular meme coin Dogwifhat (WIF). Earlier, this whale had invested in WIF, but lost $4.4 million. Now, it is shifting to POPCAT potentially due to its impressive performance in the past few days.

POPCAT technical analysis and Key levels

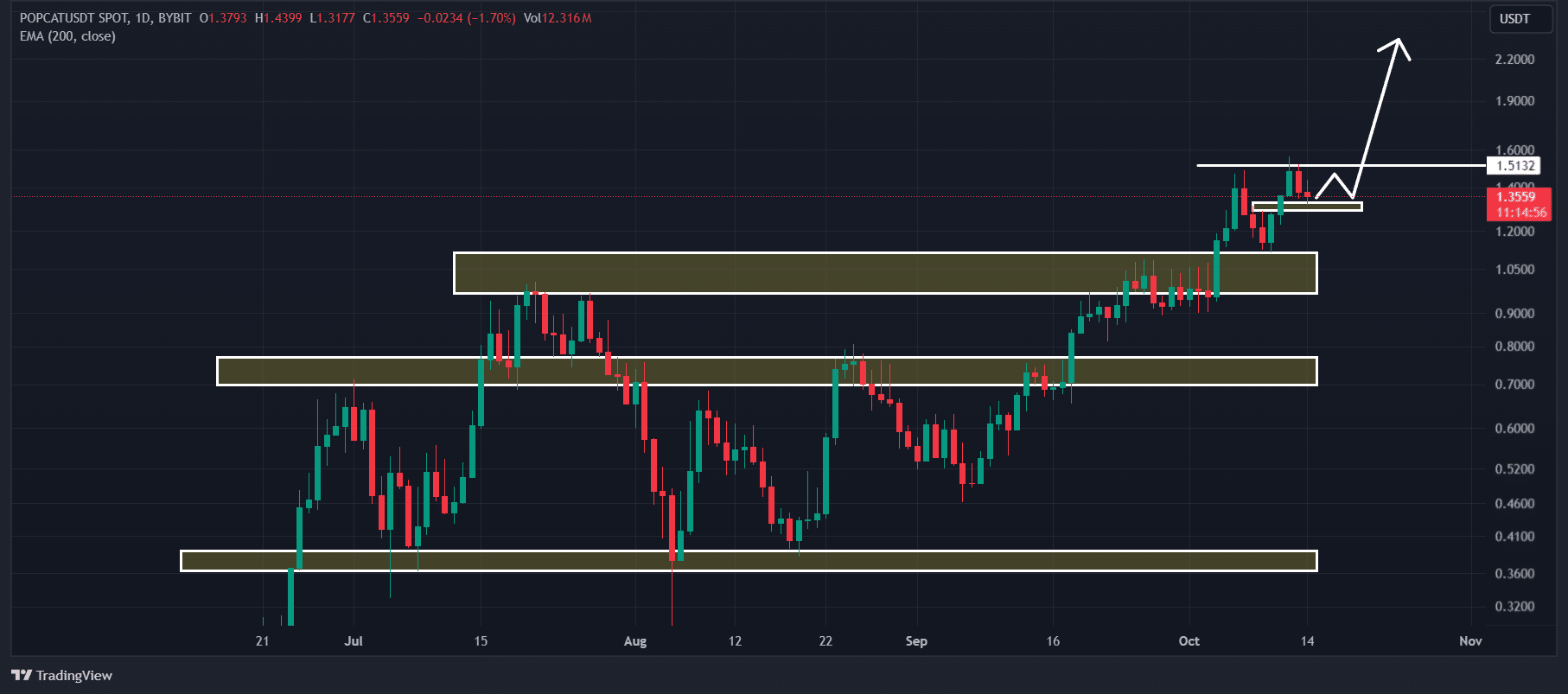

According to AMBCrypto’s technical analysis, POPCAT is on an uptrend, but after a significant 30% rally, it is experiencing a price correction.

However, on the daily chart, the memecoin has formed a bullish three-white soldier candlestick pattern that suggests a further rally in the coming days.

Source: TradingView

While analyzing POPCAT’s daily chart, it appears that the memecoin may experience some short-of-price correction before we see a notable upside rally.

Based on historical price momentum, if POPCAT closes a daily candle above the $1.56 level, there is a strong possibility it could reach a new all-time high in the coming days.

Bullish on-chain metrics

This positive outlook was further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, POPCAT’s Long/Short ratio currently stands at 1.30, indicating a strong bullish market sentiment among traders.

Source: Coinglass

Additionally, its future open interest has dropped by 10.5% in the past 24 hours. This decline in open interest indicated that a higher number of positions were liquidated than built in the last 24 hours.

Currently, 56.5% of top traders hold long positions, while 43.5% hold short positions.

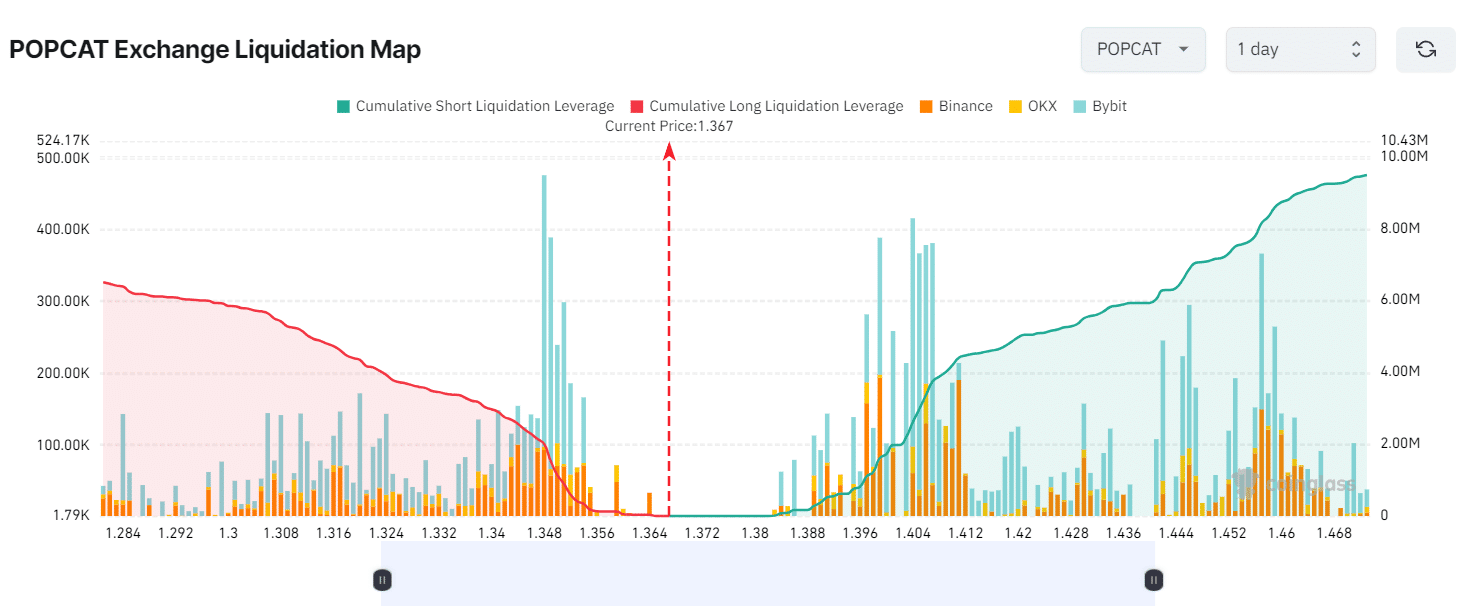

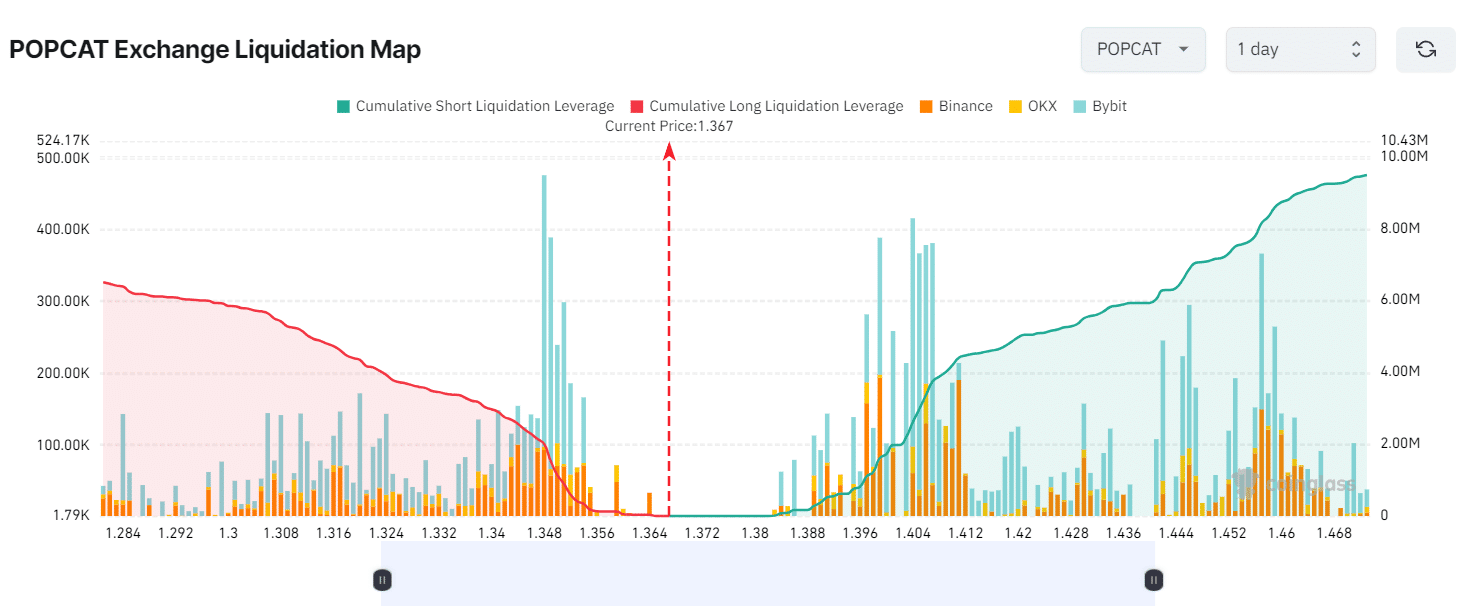

As of press time, the major liquidation levels are at $1.348 on the lower side and $1.399 on the upper side, with traders over-leveraged at these points, according to the Coinglass data.

Source: Coinglass

If the bull’s participation increases and the price soars to the 1.399 level, nearly $1.62 million worth of short positions will be liquidated. Conversely, if the sentiment shifts and the price drops to the $1.348 level, approximately $2 million worth of long positions will be liquidated.

Is your portfolio green? Check the Popcat Profit Calculator

This data suggests bulls are currently dominating the asset and believe that POPCAT’s price will soar in the coming days.

At press time, POPCAT was trading near $1.36 and has experienced a price decline of over 7.55% in the past 24 hours. During the same period, its trading volume has jumped by 40%, indicating higher participation from traders and investors potentially due to its price decline.