- POPCAT recently breached through a descending channel and may be eyeing a major price push

- Despite whales’ backing from Bybit, Binance, and Hyperliquid, spot traders in the market will play a key role

POPCAT gained by 37% in the last 24 hours, in addition to its bullish movement over the past week. Owing to the same, the altcoin is now returning 41% for investors who purchased the asset over the past month.

While the sentiment remains predominantly bullish, especially with high whale interest and a bullish technical setup, AMBCrypto spotted some factors that could hinder the asset’s potential rally.

Bullish breakout on the edge

POPCAT has presented a setup for a possible price rally on the chart, with the formation of a descending price channel. This pattern is formed by parallel support and resistance lines.

According to the same, if the momentum driving POPCAT’s movement is sustained and the asset manages to breach the resistance level, the price could hit $0.9822. This would represent a 370% price boom.

Source: TradingView

For a 3.7x rally to occur, it’s likely that the price retraces along the way, rather than a single upswing. However, if the overall bullish market sentiment holds true, POPCAT could eventually breach this level, trading as high as $2.08.

Whales are after a rally

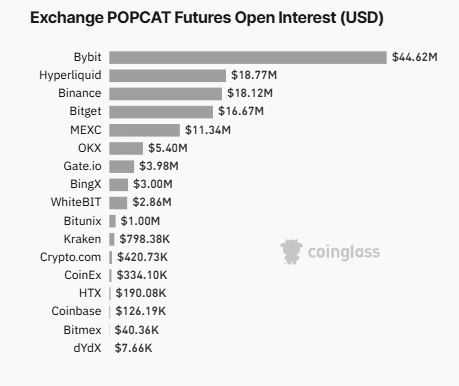

An analysis of Coinglass’s long-to-short ratio and the market’s Open Interest revealed that whales have been pushing for a major price rally.

First off, the broader market sentiment remains bullish, with the buying volume in the market exceeding that from sellers. This was evidenced by the long-to-short ratio having a reading of 1.0513.

When this ratio crosses 1, it implies a bullish market phase. On the contrary, below 1 implies that bears or sellers are dominant, with more downside to come.

Further analysis showed that a majority of buy contracts in the derivatives market are driven by whales or top traders who have major positions opened on the asset.

Source: Coinglass

At the time of writing, Bybit, Binance, and Hyperliquid whales dominated the unsettled contracts in the market. This cohort of traders had a collective position of $80.7 million out of the $127.89 million in Open Interest in the market.

With the general market being bullish—particularly with buying volume dominating—it means that these whales have more long contracts opened than short.

In fact, traders who bet against these whales saw major market losses as their positions were forcefully closed. Short traders in the last 24 hours have lost $1.24 million as the price moved against them. This type of major market liquidation underlined the strength of the bulls.

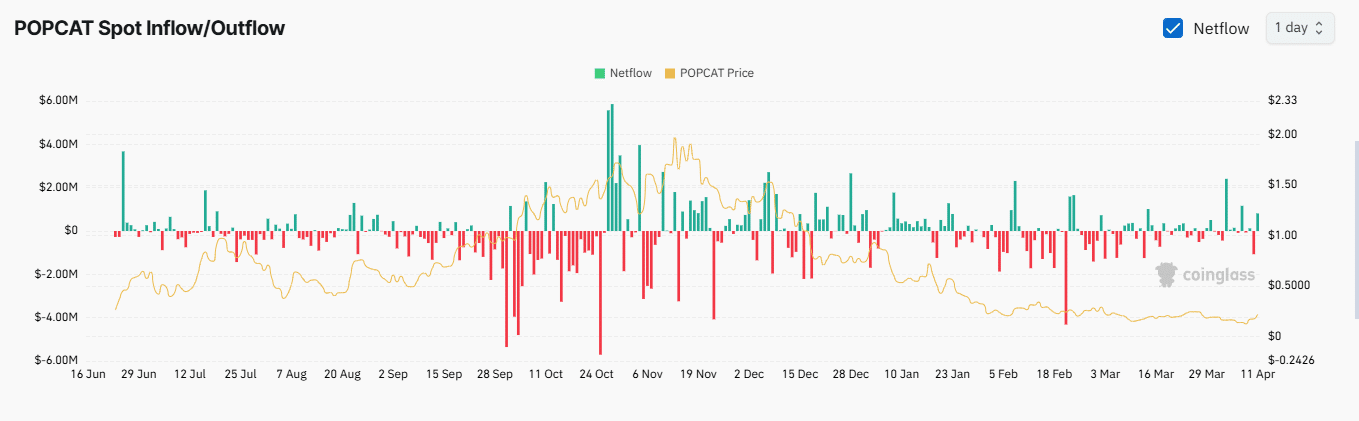

Profit-taking could slow down rally

Worth pointing out, however, that the bullish sentiment didn’t align with spot traders in the market. At press time, there was notable selling activity among spot traders – Reaching approximately $850,000 as per the exchange netflows.

Source: Coinglass

When a major amount of an asset is sold like this amidst a bullish market setup, it means that long-term traders are likely securing profit. Especially as they move their POPCAT from private wallets into exchanges to sell.

If this trend continues among long-term spot traders, it could impede POPCAT’s potential breach of the upper resistance level on the chart. This would slow down the bullish outlook, as predicted.