- POL price consolidates within a descending triangle, with a potential 40% breakout looming.

- Positive metrics, including rising active addresses and declining exchange reserves, favor a bullish outlook.

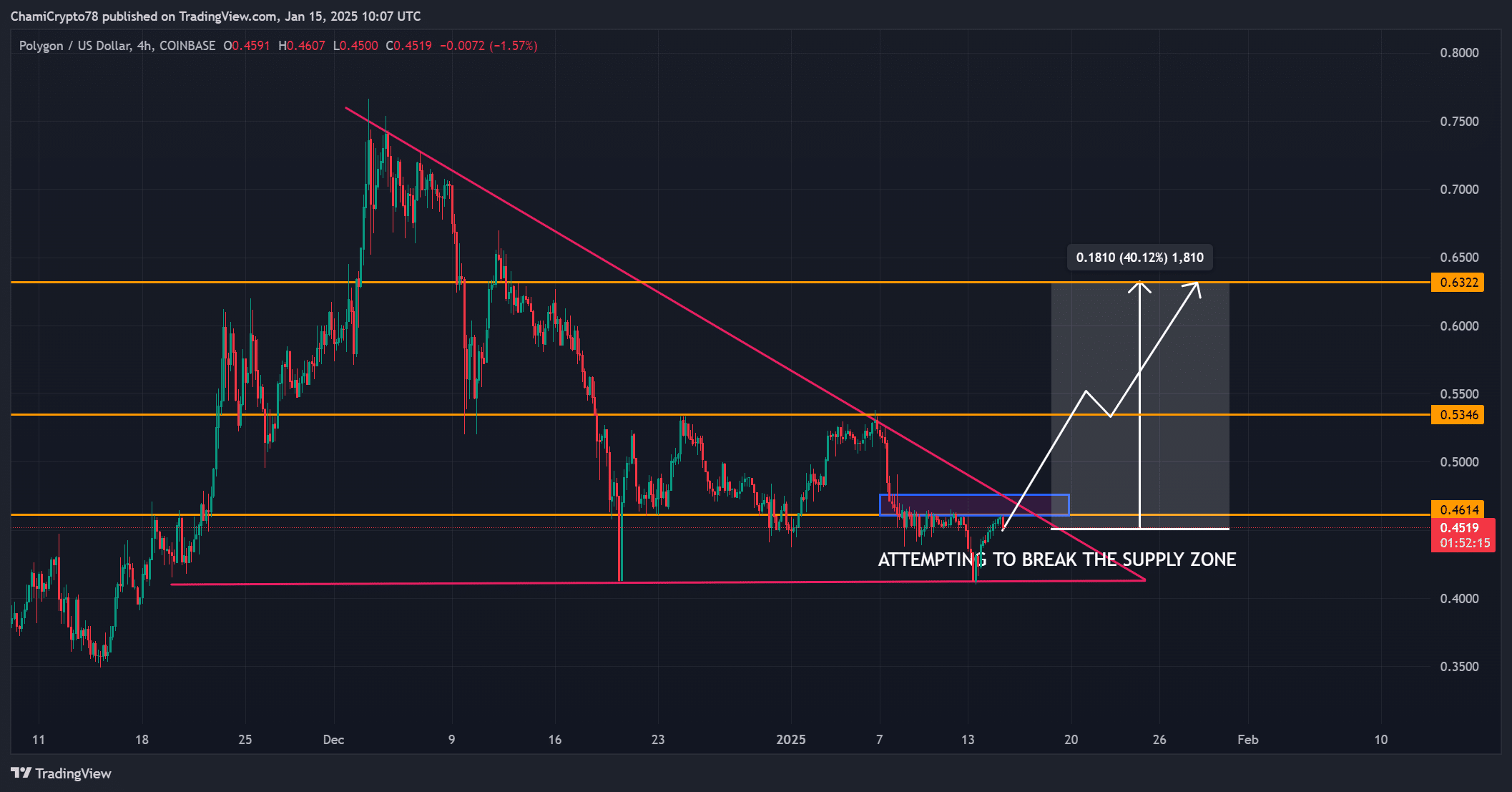

Polygon [POL] was nearing a pivotal moment as its price action consolidated within a descending triangle on the 4-hour chart. The range between $0.47 and $0.41 remains a critical zone, with bulls and bears battling for control.

At press time, POL was trading at $0.4505, reflecting a minor 0.02% dip in the last 24 hours. Therefore, a breakout in either direction will likely determine the token’s next significant move. Will the bulls overcome resistance to ignite a rally, or will the bears push prices lower?

Is the POL price ready to break the supply zone?

POL’s price is trapped in a descending triangle, repeatedly testing the $0.47 resistance level. The token is making another attempt to break above this supply zone, which could set the stage for a strong upward move.

A breakout above $0.47 would signal bullish momentum, with a potential 40% rally toward $0.63. On the other hand, if POL fails to hold above $0.41, it could face downward pressure and retest lower support levels.

This pivotal battle will decide the token’s immediate trajectory.

Source: TradingView

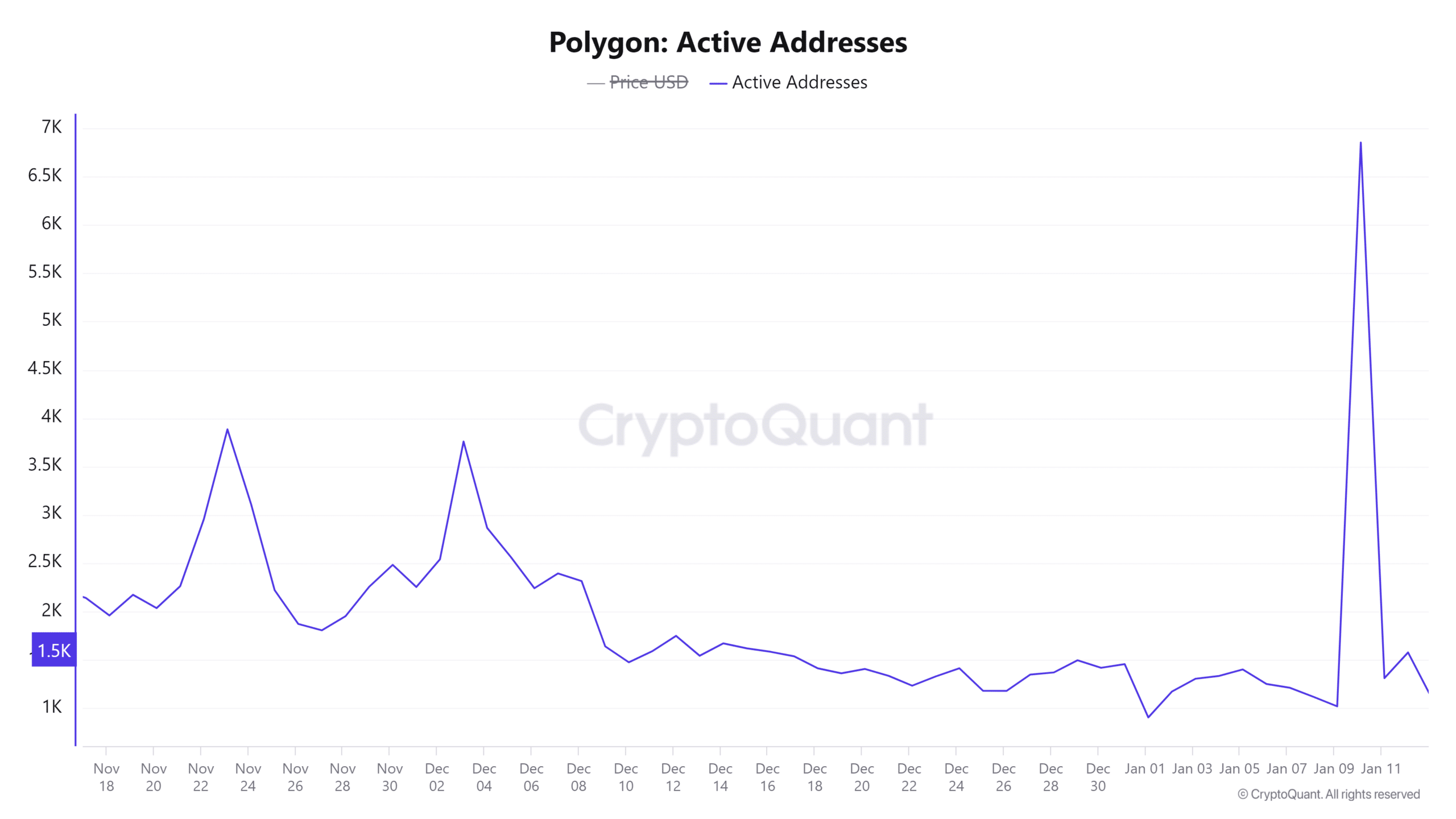

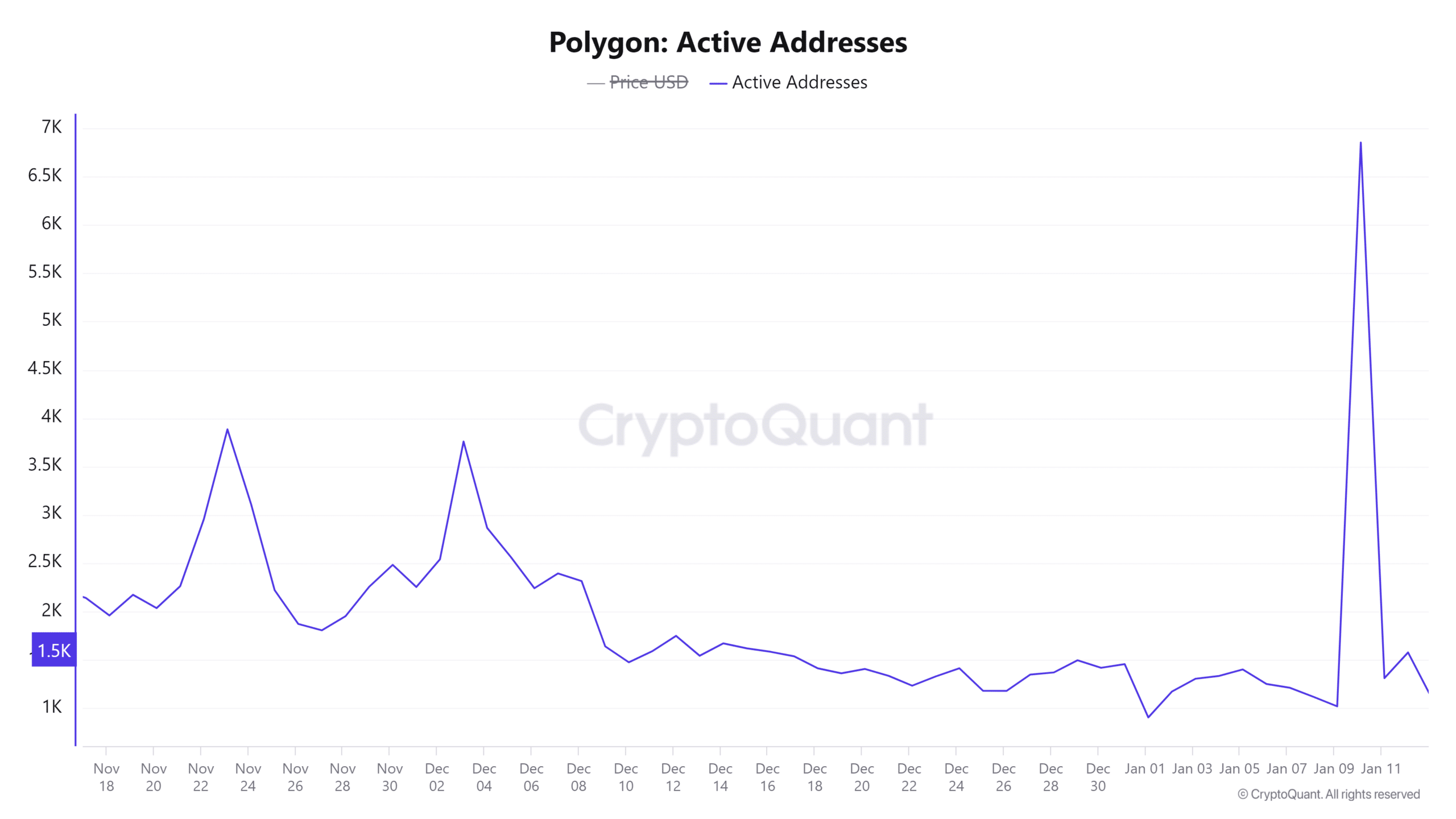

What does the rise in active addresses indicate?

The number of active addresses has climbed by 1.17% in the past 24 hours. This increase reflects higher user engagement, suggesting renewed interest in the network.

Rising active addresses often signal growing demand and potential market momentum. If this trend continues, it could support a bullish breakout. However, sustained activity is essential for maintaining long-term growth and price stability.

Source: CryptoQuant

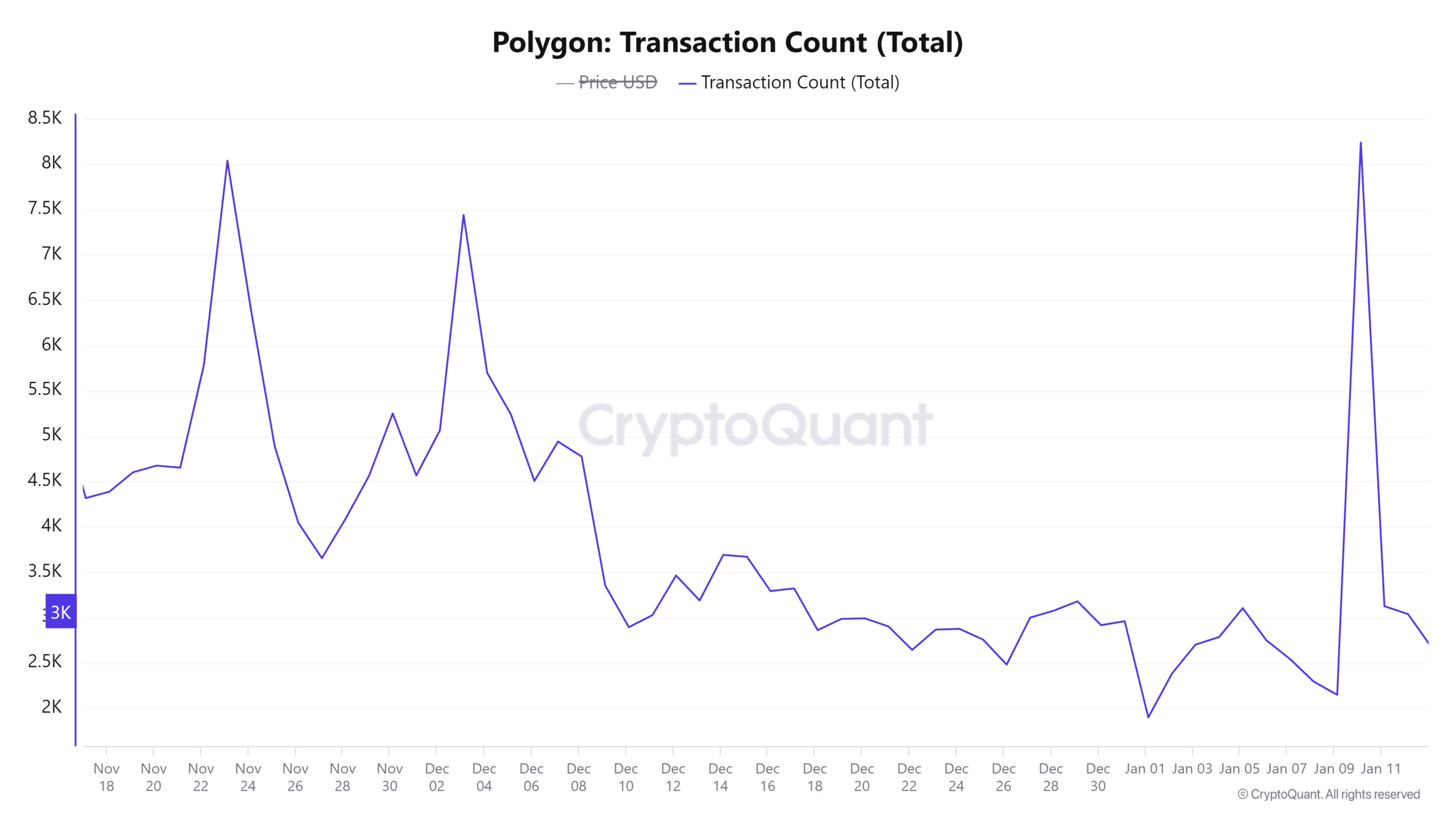

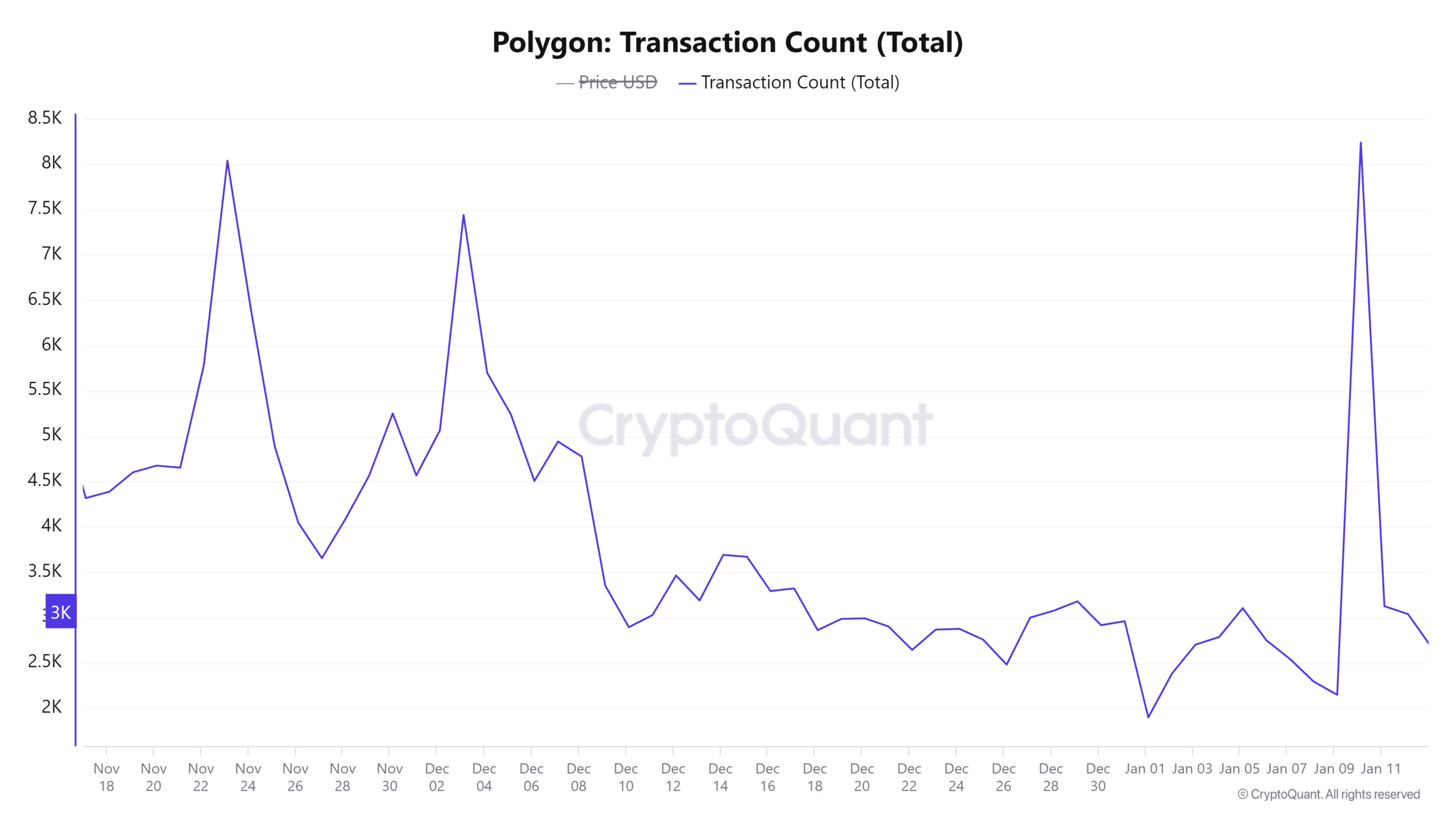

Does the transaction count confirm market activity?

POL’s transaction count has risen by 1.3%, totaling 2.886K transactions in the last 24 hours. This uptick demonstrates consistent network usage and growing user participation.

Furthermore, higher transaction activity often indicates increased adoption, which could support bullish sentiment. Therefore, if transaction volumes remain steady or continue to grow, they could bolster the likelihood of a breakout above the key resistance level.

Source: CryptoQuant

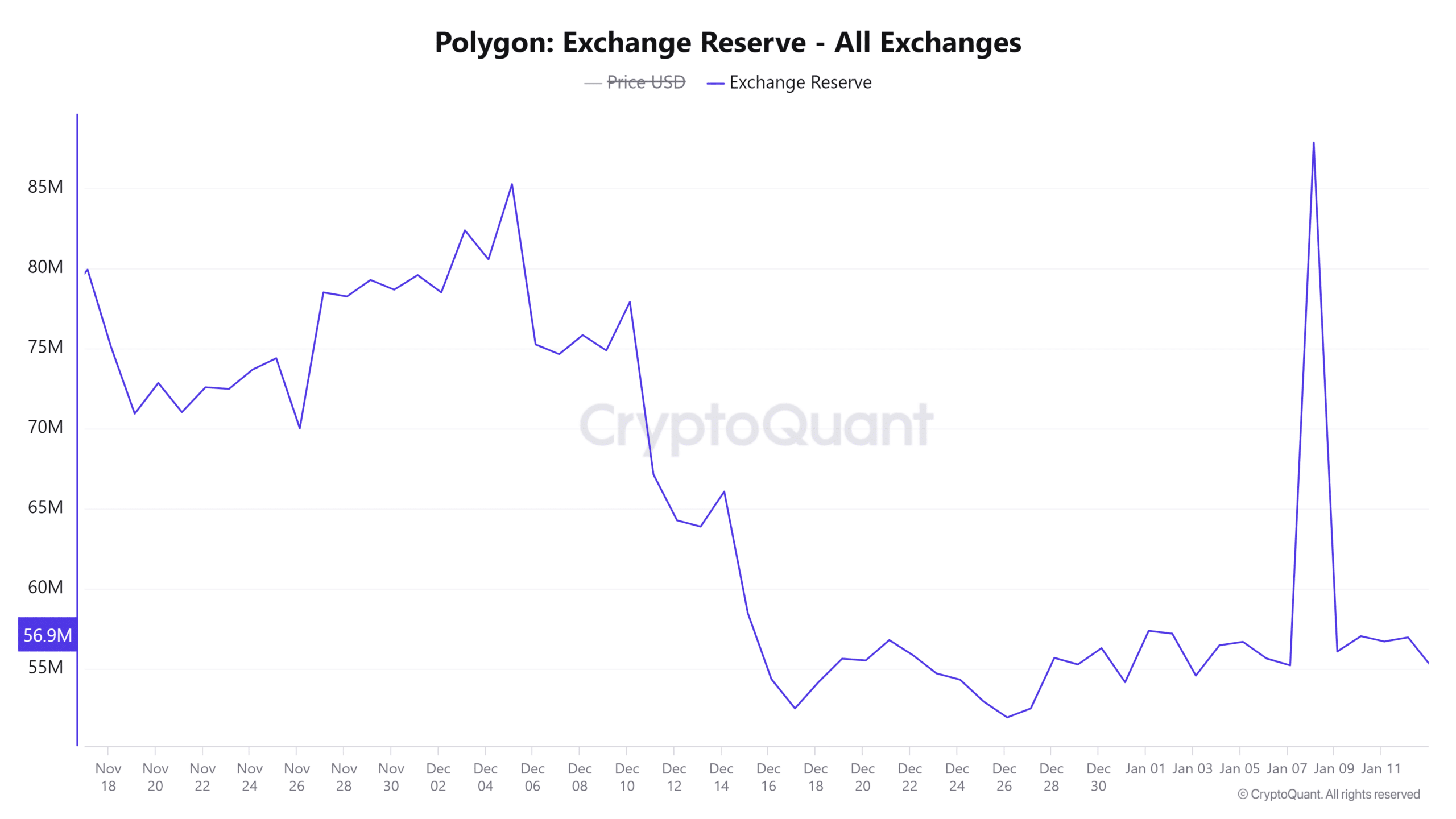

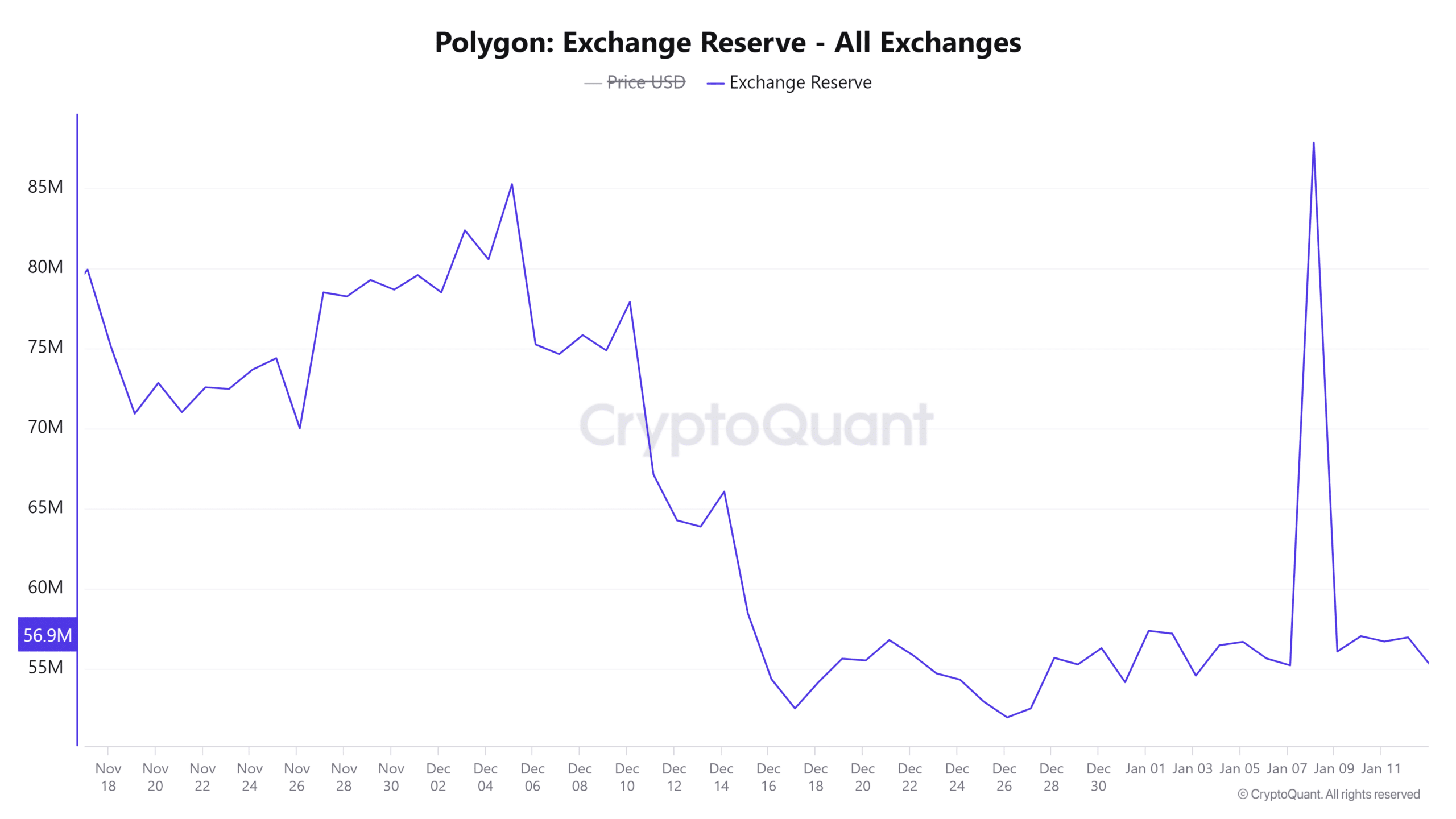

Why is the exchange reserve declining?

The exchange reserve dropped by 1.23%, now standing at 56.9M. A declining reserve suggests fewer tokens available for trading on exchanges, possibly indicating accumulation by long-term holders.

Lower reserves often lead to reduced selling pressure, creating favorable conditions for a price surge. However, if demand weakens, this accumulation trend might not translate into immediate upward momentum.

Source: CryptoQuant

Is your portfolio green? Check out the POL Profit Calculator

Conclusion: Will POL soar or sink?

Polygon’s price action is at a critical juncture. The increase in active addresses and transaction count, coupled with declining exchange reserves, signals strong bullish potential.

Therefore, if bulls break above the $0.47 resistance, a rally toward $0.63 becomes highly likely. However, failure to hold this level could lead to bearish dominance and a downward move. For now, all eyes are on the supply zone.