- The number of biggest POL whales, holding the largest number of tokens, dropped sharply.

- A bullish trend reversal might push POL above $0.4 again.

Polygon [POL] recently underwent a major upgrade which changed the token’s name along with several other new updates. However, the latest update couldn’t propel a price hike. In the meantime, an unusual whale activity was noted.

What are whales doing after POL upgrade?

AMBCrypto reported earlier that the MATIC to POL upgrade went as planned by Polygon developers. The Polygon team mentioned that it has taken a year of community discussion to upgrade POL as the native token for Polygon.

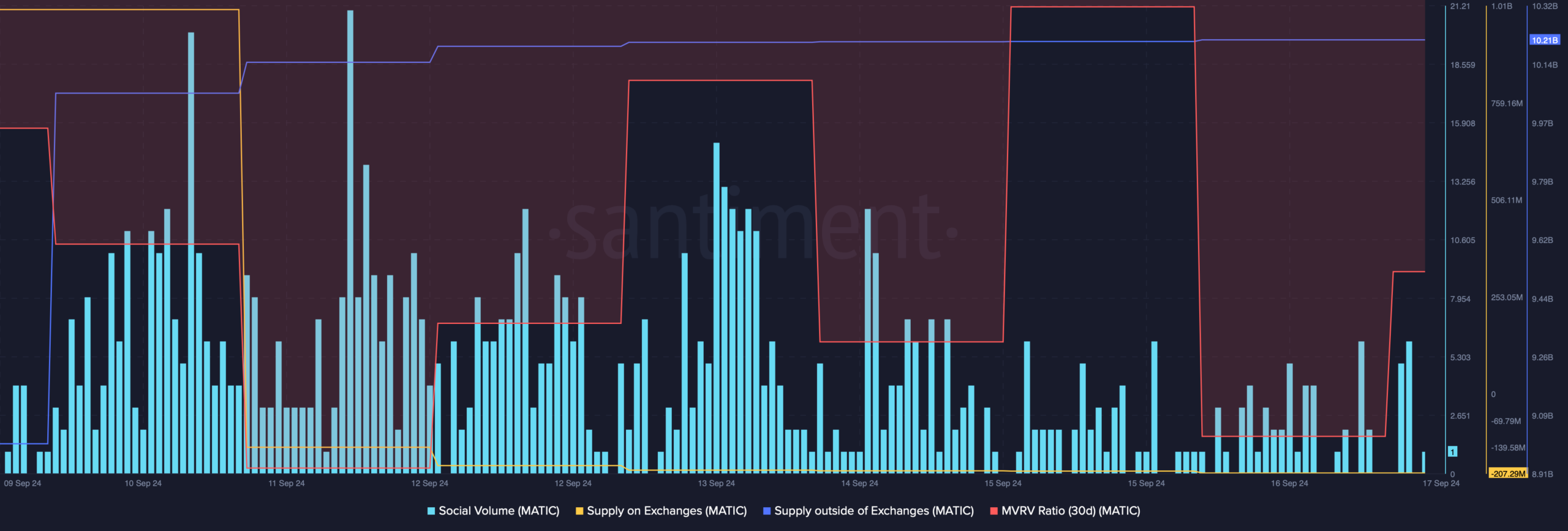

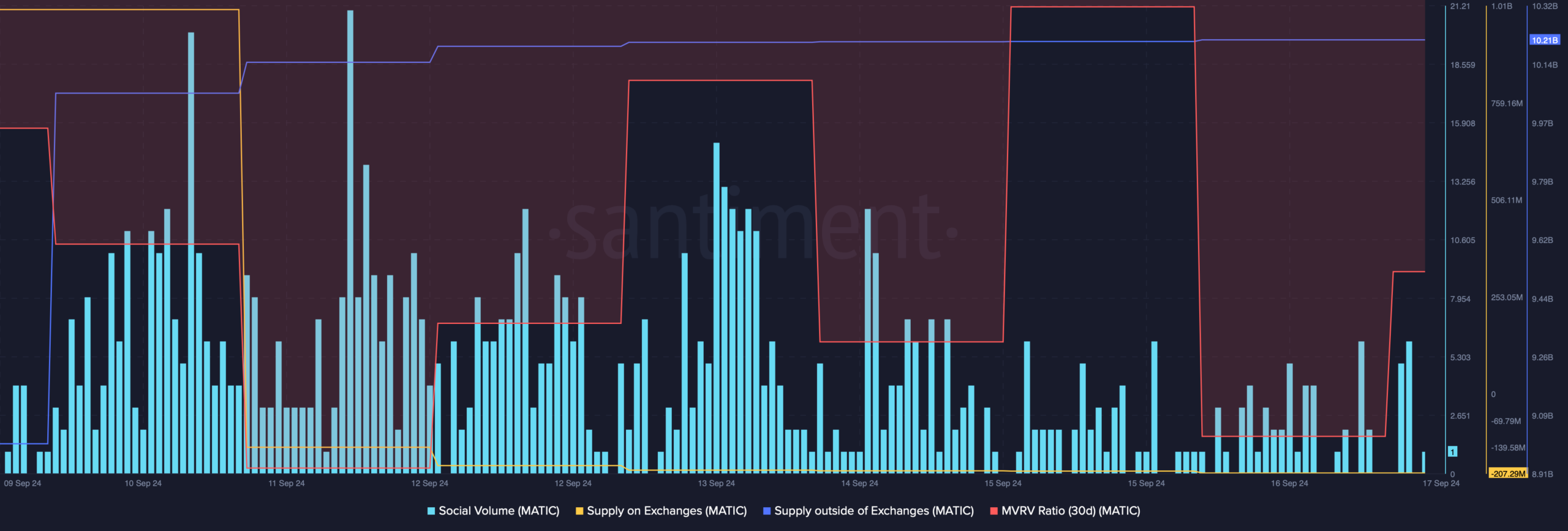

Days after the upgrade, POL whales made a major move. Santiment recently posted a tweet revealing that POL was among several that saw plenty of price anomalies after whale exchange wallet supply suddenly shifted to whale cold wallet supply.

Therefore, AMBCrypto planned to check IntoTheBlock’s data to find out how MATIC’s supply distribution was affected. As per our analysis, the number of addresses holding 1 billion to 10 billion POL tokens dropped by 50% in the last 30 days.

This metric clearly suggested that the biggest POL whales were reduced to half. In fact, addresses holding less number of tokens also dropped during the same period.

Source: IntoTheBlock

Will Polygon see price hikes soon?

While all this happened, POL’s price volatility dropped. This was the case as both its weekly and daily charts moved marginally. Therefore, AMBCrypto planned to check the token’s on-chain data to find what to expect from it in the coming days.

Our analysis of Santiment’s data revealed that the blockchain’s social volume declined. This happened despite the fact that Polygon recently underwent a major upgrade.

Apart from that, POL’s MVRV ratio also dropped, which can be inferred as a bearish signal.

However, it was interesting to note that while the number of whale addresses dropped, buying pressure on the token increased. This was evident from the massive drop in the supply on exchanges and a spike in the supply outside of exchanges.

Generally, a rise in buying pressure results in price increases.

Source: Santiment

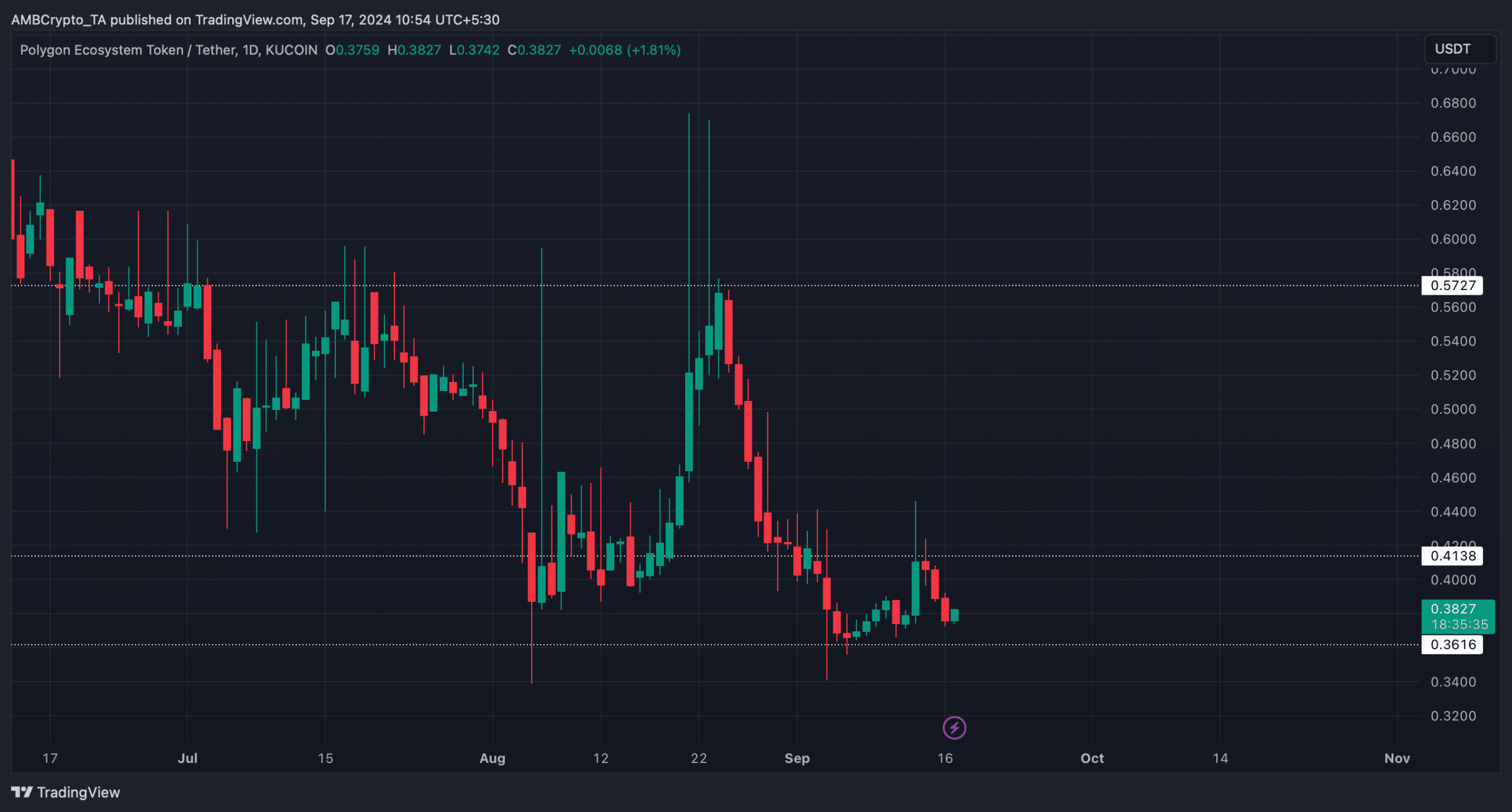

AMBCrypto then checked the token’s daily chart to find out possible targets of POL. We chose to do that as, at press time, Polygon’s fear and greed index was in a neutral position.

Is your portfolio green? Check out the MATIC Profit Calculator

Whenever the metric hits this level, it indicates that the market could move in either direction in the coming days. If the bears continue to dominate the market, then POL might soon fall to $0.36.

But if the bulls step up their game, then it won’t be surprising to watch Polygon touching $0.41. A breakout above that could push the token to $0.57.

Source: TradingView