- PEPE’s large transactions dropped 26% as active addresses decreased by 7.43% in the last 24 hours.

- Price consolidation persisted as PEPE approached a potential breakout.

The hype around the Pepe [PEPE] memecoin continued to sail through turbulent conditions, as key on-chain data flashed contradictory tendencies.

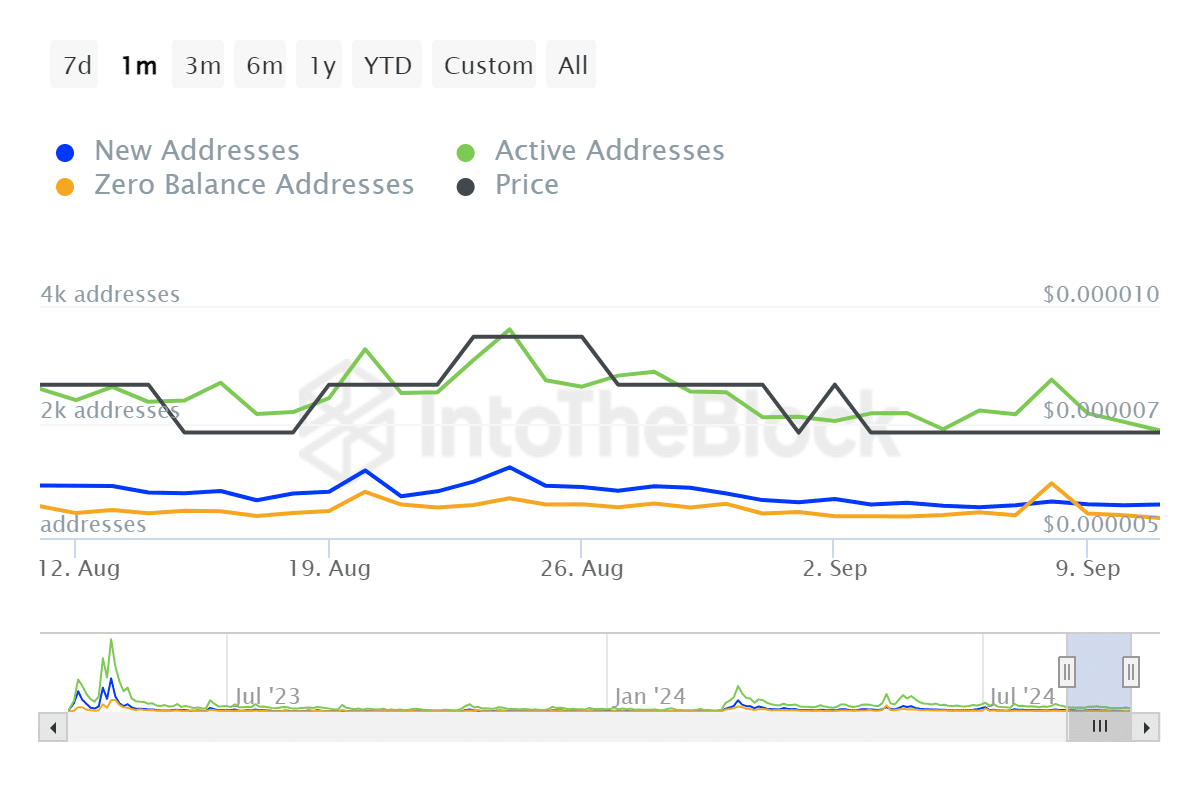

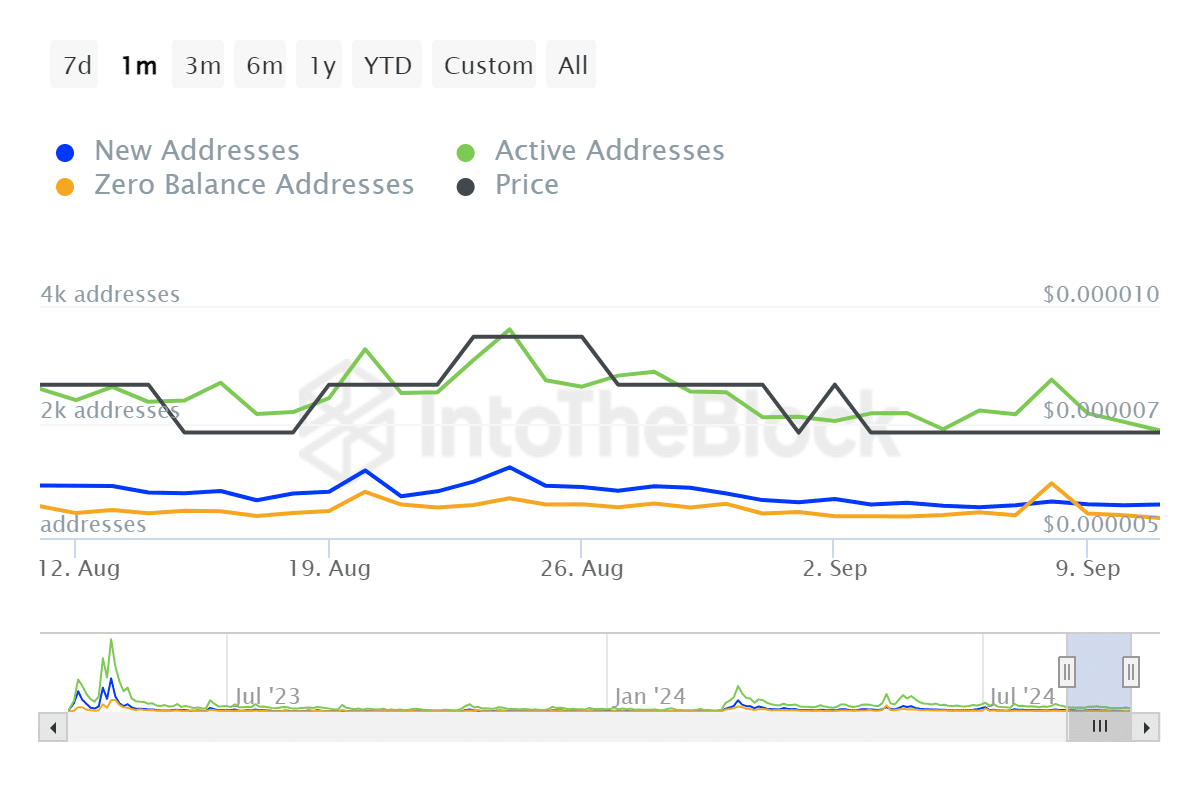

Inasmuch, IntoTheBlock and Santiment revealed interesting trends that might mold the near-term price action of PEPE.

User engagement takes a hit

Most importantly, large transaction volume for PEPE has dropped sharply by 26%. This, usually seen to be indicative of whale activity, would suggest large players are stepping away from the market.

On top of the decreased whale activity, active addresses were down by 7.43% over the last 24 hours. A drop like this may point to a cool-off of user interest or changes in trading sentiment.

A decrease in active addresses would normally go hand in hand with a reduced trading volume and could have consequences for liquidity.

Source: IntoTheBlock

Despite these declining datasets, the price chart of PEPE appeared to be in a symmetric triangle pattern. This generally forms before a strong volatility expansion, where price will increase or continue to fall.

This contraction in volatility, as reflected by the reduced large transactions, has a significant correlation with the aforementioned consolidation phase.

What’s ahead for PEPE?

As PEPE approaches the apex of its symmetric triangle, market participants and investors should keep a close look on the memecoin’s ongoing developments, especially considering whale movements.

This is because a decline in whale activity, combined with a decline in user activity, may indeed indicate periods of accumulation or distribution, depending on market sentiment.

Read Pepe’s [PEPE] Price Prediction 2024–2025

So, the ongoing consolidation could be setting the stage for a possible breakout.

However, the direction of the breakout could be determined by the market broader sentiments and the near future development on the memecoin.