- The DOGE/Pepe fractal on the 3-day time frame was still in play as of press time.

- The global profitability and long/shorts accounts percentage suggested an uptrend.

The biggest frog-themed memecoin on the Ethereum [ETH] network by market cap, Pepe [PEPE], seemed to be emulating Dogecoin’s [DOGE] 2021 price pattern.

Analyzing the three-day timeframe, DOGE reached its highs after Bitcoin’s [BTC] halving period, coinciding with a peak in the altcoin market cap, as OTHERS.D aligned too.

This pattern was apparent in PEPE’s recent activities. Pepe has shown similar momentum, rallying sharply in correspondence with Bitcoin’s price movements and the broader altcoin market dynamics.

DOGE hit a major peak in January 2021, shortly after Bitcoin had surged to new highs. Similarly, the fractal on PEPE suggested it’s potential to reach new highs.

Source: Trading View

Observing DOGE’s 2021 movement, it rallied from previous highs to significantly new levels as Bitcoin and the altcoin sector grew.

PEPE’s current price action closely mirrors this phase, indicating that it may not only reach but possibly exceed its previous high marks in the coming periods, given the market conditions and investor interest.

Pepe prediction after a new ATH

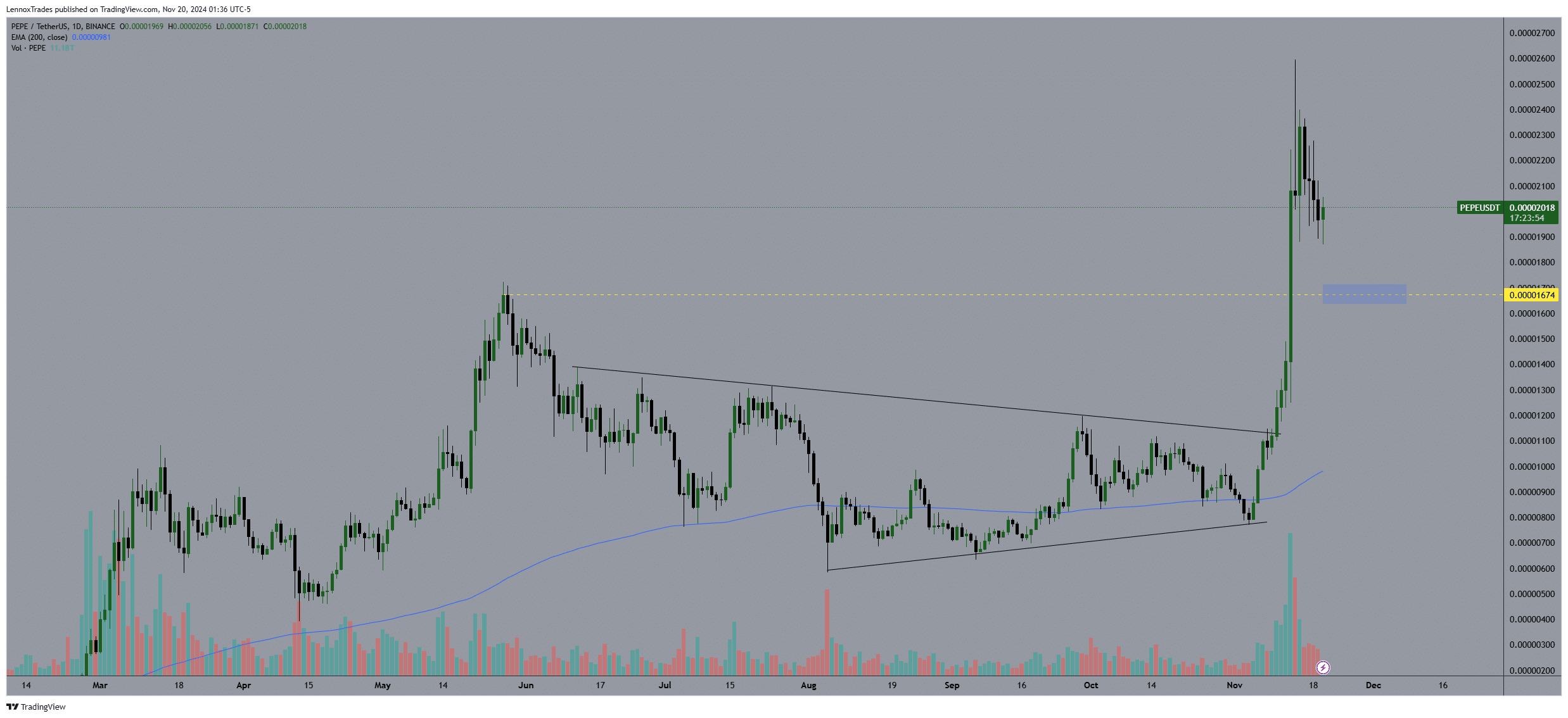

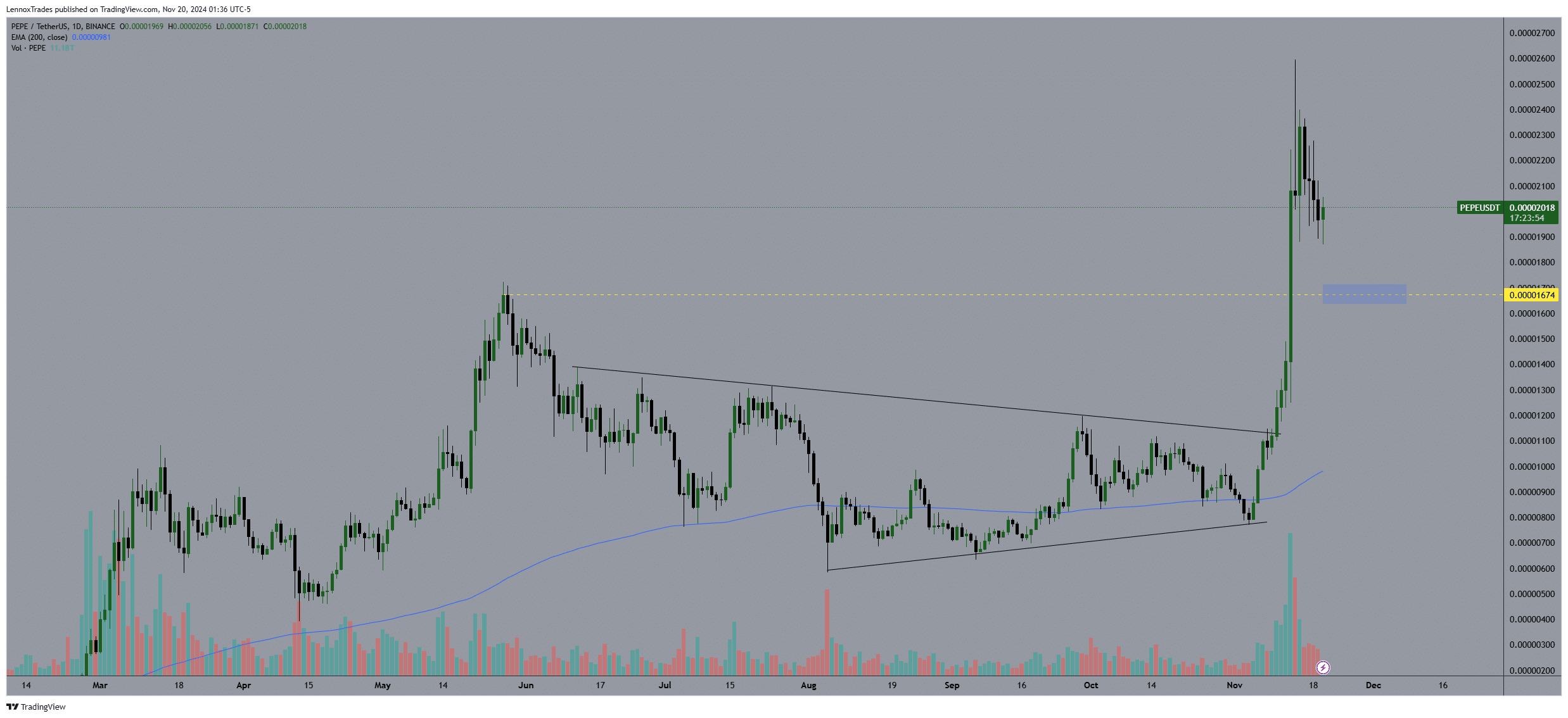

Examining PEPE’s price action on the daily chart showed an ascent as it burst through a descending wedge pattern, rallying to new highs recently.

This breakout was characterized by a spike in trading volume, signaling strong buyer interest.

However, after achieving these highs, the volume began to taper off, indicating a cooling in buying pressure.

PEPE is in a pullback phase, hovering above a critical support level at $0.0000167 that need to be maintained for further uptrend.

Source: TradingView

Pullbacks often precede further upward movements, especially in volatile markets like memecoins. If PEPE sustains above this support zone, it’s likely to resume its rally, potentially revisiting higher levels.

The overall market sentiment around memecoins remained bullish, suggesting that any dips might be short-lived as the cycle of volatility continues.

Global profitability and accounts percentage

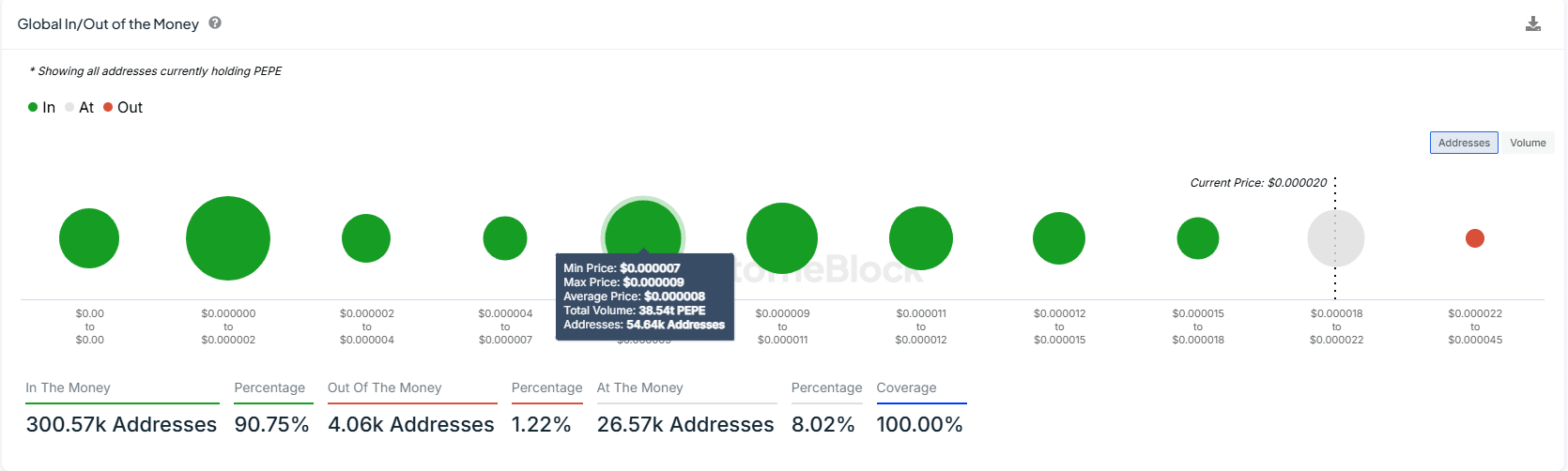

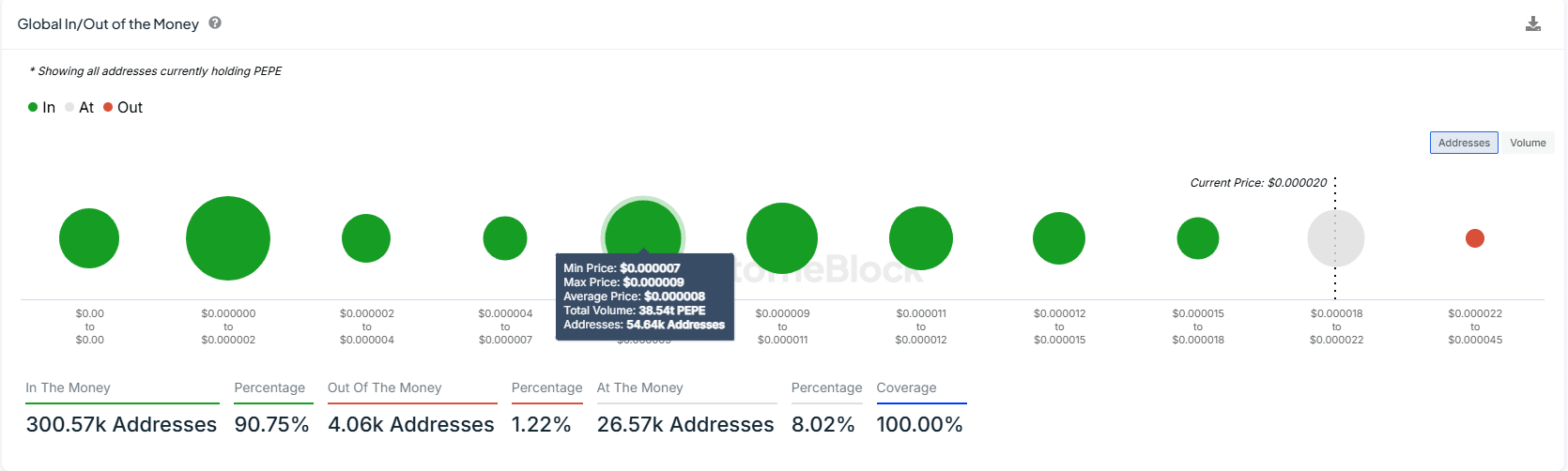

Additionally, PEPE was bullish among holders, with a staggering 90.75% of all addresses being “in the money,” indicating that the majority purchased their tokens at a lower price than the press time market value, set at $0.000020.

Only a small fraction, 1.22%, of addresses were “out of the money,” showing potential losses based on current prices, while 8.02% were “at the money,” trading around the break-even point.

Source: IntoTheBlock

This robust majority of profitable addresses could drive a sustained upward trajectory for PEPE, as most investors remain incentivized to hold, potentially waiting for higher peaks before realizing profits.

This strong holder base provided a solid foundation for future price appreciation.

Read Pepe’s [PEPE] Price Prediction 2024–2025

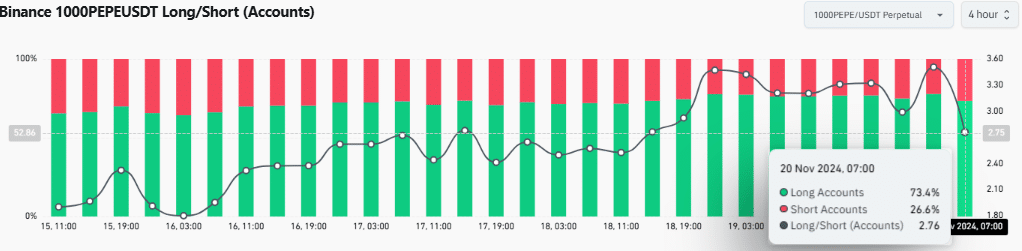

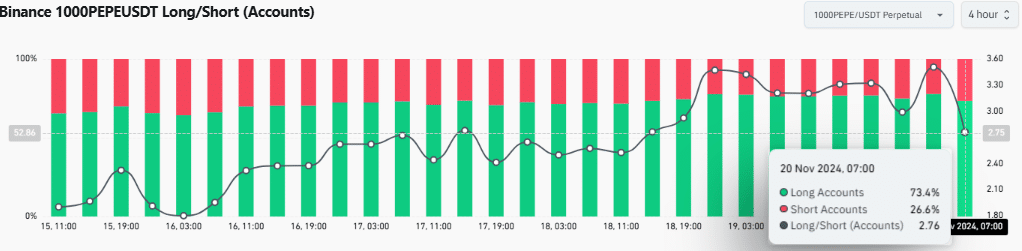

Again, the global Long/Shorts accounts ratio suggested bullish sentiment as long positions dominated, making up 73.4% of accounts compared to 26.6% for shorts.

Source: Coinglass

This strong long dominance, with a ratio of 2.76 to 1, strongly indicated a continued upward trend, suggesting that Pepe might maintain its rally, driven by the overwhelming market optimism.