Whale accumulation suggests more upside ahead

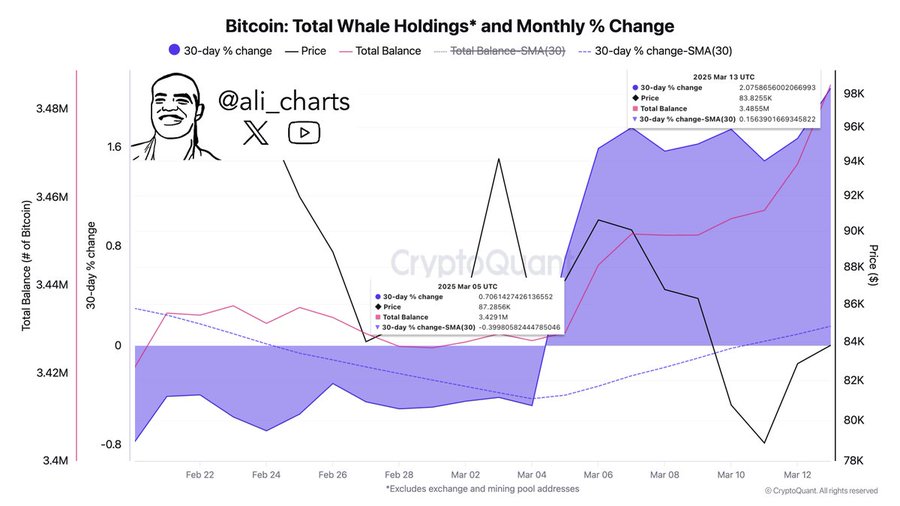

Supporting the case for a continued bull run is the behavior of Bitcoin’s largest holders.

Over the past week alone, whales have accumulated more than 60,000 BTC, a strong vote of confidence that aligns with historical post-halving trends.

Latest data shows a sharp uptick in total whale holdings — now above 3.45 million BTC — as well as a notable positive swing in the 30-day percentage change.

Source: X

This surge in accumulation typically signals a bullish outlook from long-term investors, who tend to front-run major price moves.

When paired with the post-halving historical window that points to mid-late 2025 for a cycle top, this renewed whale activity adds fuel to the thesis that Bitcoin’s current rally still has room to run.

Short-term consolidation, but momentum may return

Despite bullish longer-term signals, Bitcoin’s short-term outlook remained mixed. The daily chart showed BTC hovering around the $84,000 level following a pullback from recent highs.

The RSI was at 44.20, suggesting weak momentum and leaving room for further downside before the asset becomes oversold. Meanwhile, OBV has been trending downward, reflecting declining buying pressure.

Source: TradingView

Still, price action appears to be stabilizing after a stretch of sharp losses, hinting at potential consolidation before the next move.

If bulls manage to defend the $83,000-$84,000 support zone, BTC could attempt a push toward $88,000 in the near term. However, failure to hold current levels might open the door for a retest of $80,000.