- ETH faces sell-off fears after $2 billion in Ethereum transfer.

- PlusToken ponzi scheme linked wallets have moved after 3 years

Over the last week, the crypto market has witnessed dark days. Three days ago, the crypto market was rocked by macroeconomic headwinds after Japan’s market crash and fears of U.S. economic recession.

Amidst these increased macroeconomic challenges, Ethereum [ETH] has been hit the most by external factors such as jump crypto and now the PlusToken Ponzi scheme.

PlusToken’s $2b ETH transfer

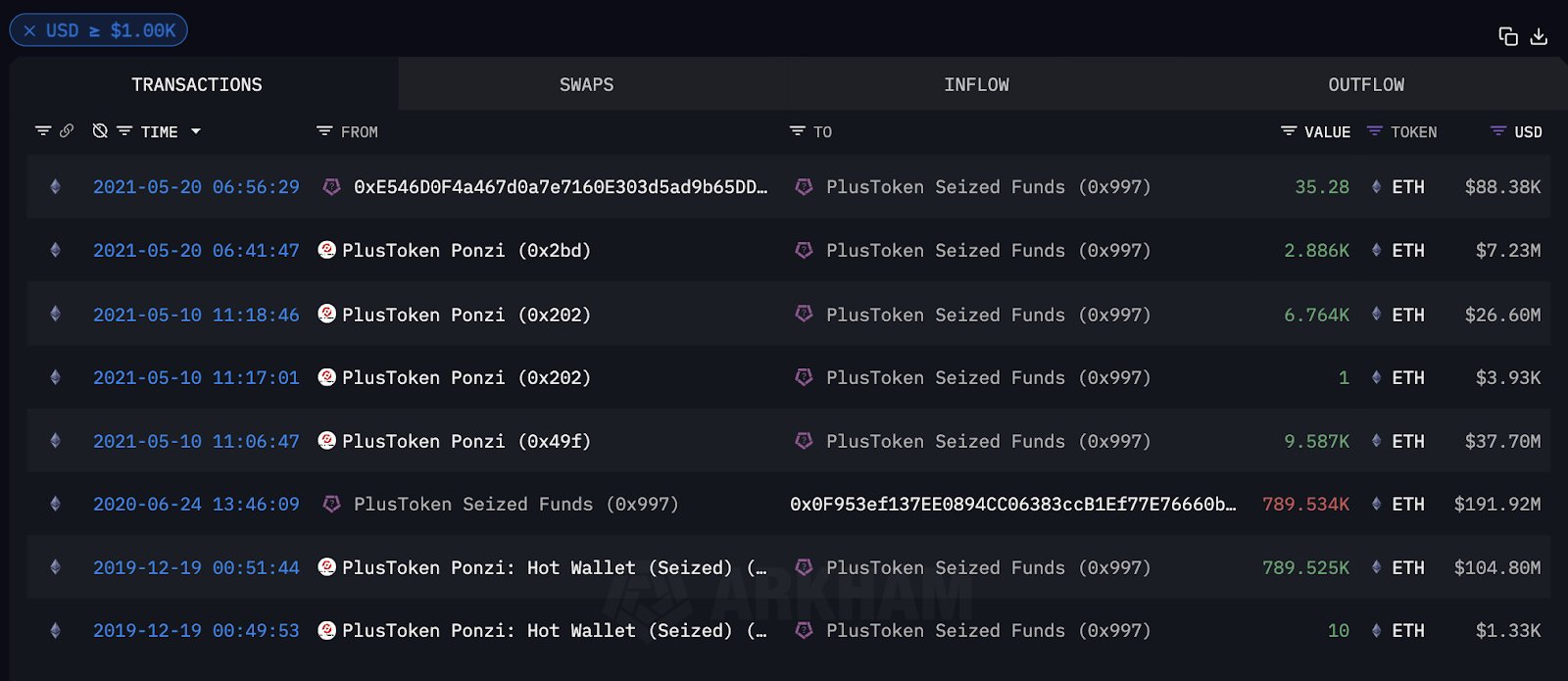

ETH has hit the headlines with analysts reporting that Ethereum wallets tied to PlusToken Ponzi that operated from 2018 to 2019 in China have moved.

The Ponzi scheme resulted to Chinese authorities seizing $4 billion in crypto. After over three years, the wallets were reported to have moved for the first time.

In 2020, Chinese authorities seized 833,083 ETH worth over $2 billion based on current market rates. The report appeared first from Lookonchain, adding that hundreds of wallets tied to plus token Ponzi scheme were moving.

However, another analyst took to X to clarify the issue, adding that most of the ETH were already seized, leaving $63 Million worth of ETH currently moving.

EmberCN clarified the reports through the X accounts, stating that,

“roughly tracked down about 12 addresses that have collected Plus Token-related ETH in the last 30 hours, with a total of 25,757 ETH ($63.1M). Part of these ETH were not transferred to Bidesk in 2021; part were withdrawn from Bidesk but not transferred to Huobi.”

Source: X

However, Arkham Intelligence disputed the analysis, adding that more than $450 million in ETH moved in the past 24 hours. Arkham, through the X noted that,

“OVER $450M PLUSTOKEN FUNDS MOVED. Plustoken wallets have been connected with dozens of wallets moving $464.7M of ETH in only the past 12 hours.”

Source: X

This worrying news and the availability of conflicting reports have left ETH investors, traders, and analysts worried about potential selling pressure.

ETH has experienced extreme fluctuations following the market crash on 5th July, reaching a low of $2116. While the altcoin is yet to recover fully from the market crash, the news of a potential $2 billion worth of ETH has increased market fears and selling pressure concerns.

This news has resulted in a decline in trading volume by 4.56% to $23.6 billion and a market cap decline of 3.59% to $291.1 billion.

What Ethereum price charts suggest

As of this writing, ETH was trading at $2,421 after a 3. 35% decline on daily charts. Equally, the altcoin’s market cap has declined by 3.79% to $290.8 billion in the last 24 hours, with trading volume declining by 4.05% within the same period.

Source: Tradingview

Therefore, AMBCrypto analysis shows the decline is not an isolated sell-off after the PlusToken movement but wider price corrections.

RVGI was below zero at -3961, suggesting that the closing prices are lower relative to the trading range. Thus the market is experiencing a strong bearish momentum.

Source: Tradingview

The relative strength index was also at 26, an oversold zone suggesting that ETH has experienced massive selling pressure.

At this level, RSI suggests that selling is overextended, and a potential reversal is imminent as it presents a buying opportunity for traders to buy the dip.

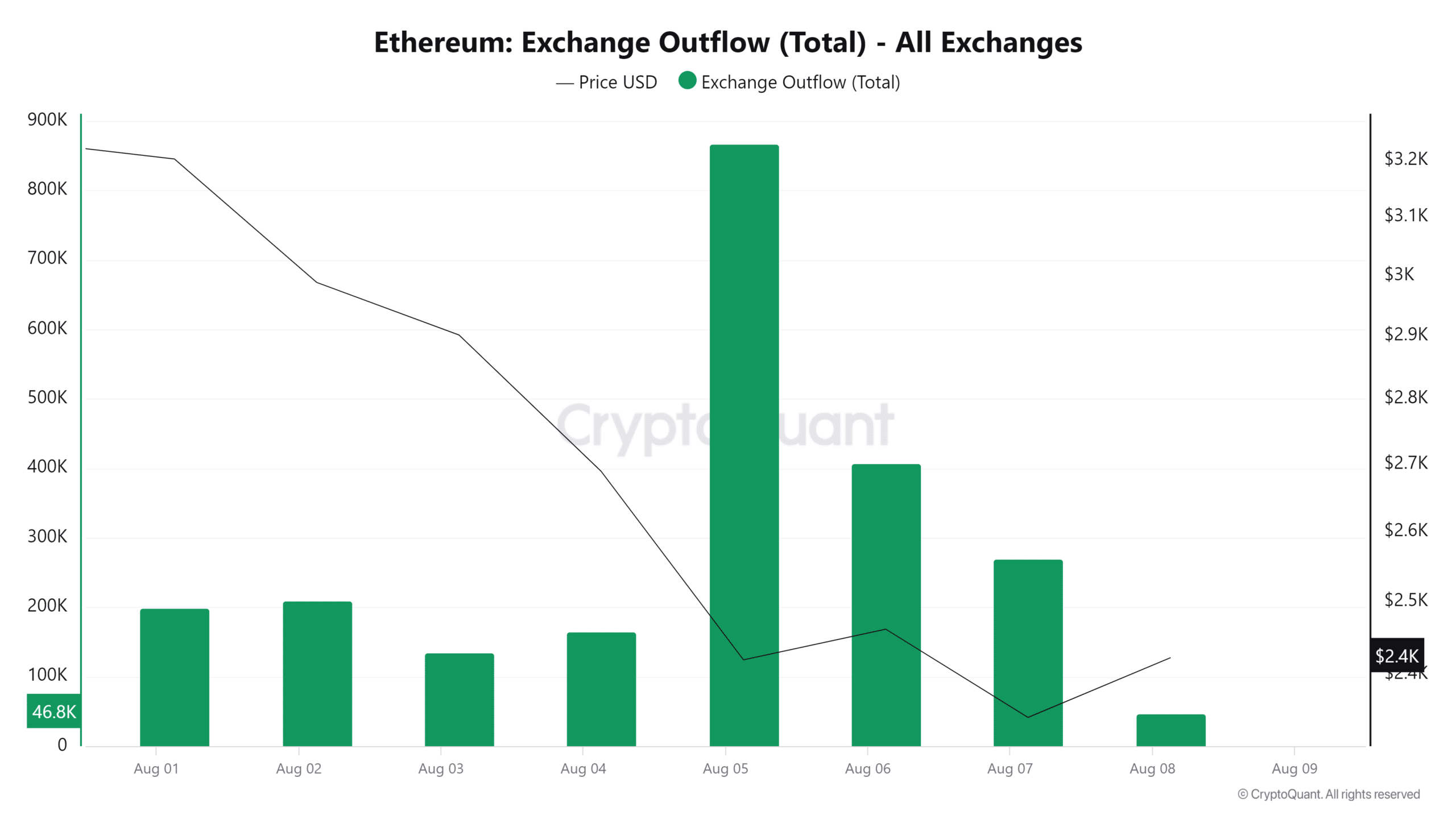

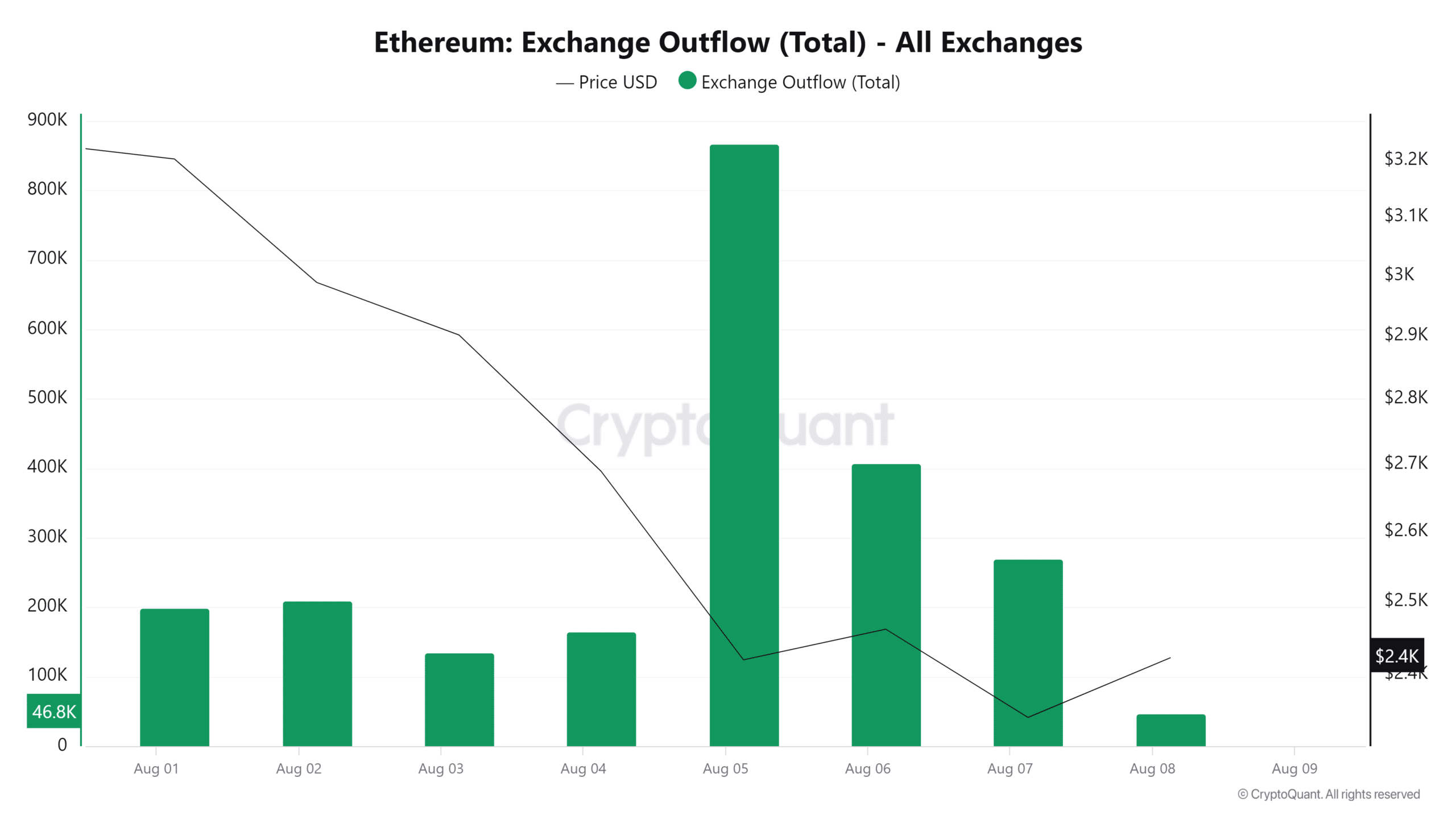

Source: Cryptoquant

Looking further, our analysis of Cryptoquant shows exchange outflow has declined over the past seven days. This suggests traders are keeping their assets liquid for potential selling.

The sentiment shows investors lack confidence in ETH’s long-term prospects, thus keeping the crypto where it can be sold easily.

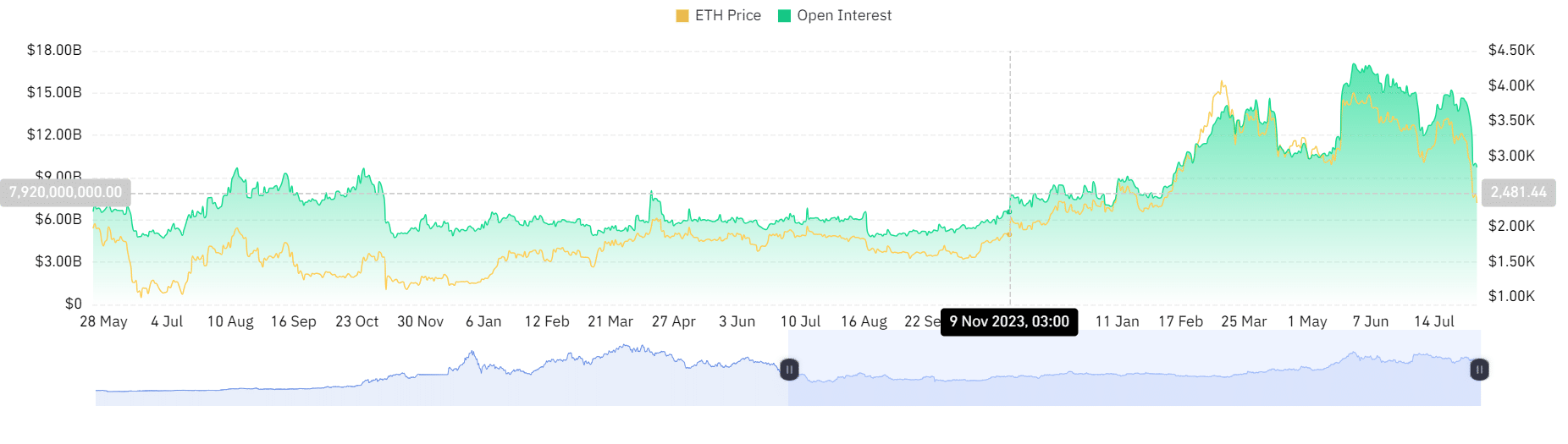

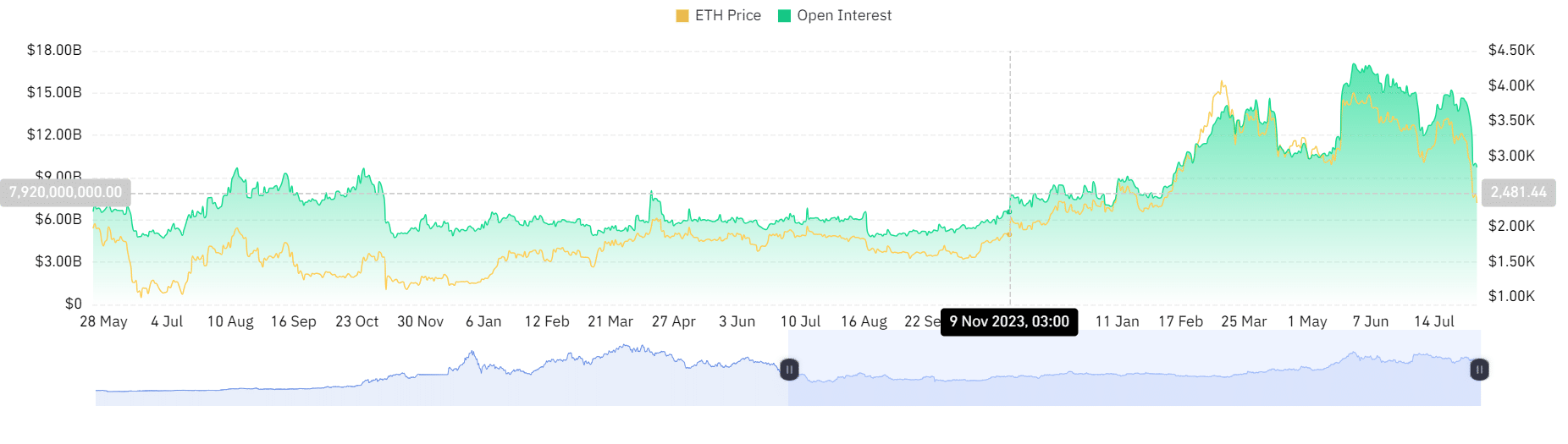

Source: Coinglass

Also, Coinglass data shows ETH’s open interest has declined over the past seven days. Open interest has declined from a high of $14.6 billion to $9.7 billion.

Read Ethereum’s [ETH] Price Prediction 2024-25

The decline in open interest shows investors have been actively closing their positions without opening news.

Therefore, although the PlusToken ponzi scheme held ETH has moved, ETH has been experiencing a decline already. Thus, the current price action is not an isolated case of PlusToken ponzi scheme transfers.