- Mog Coin approached the range highs with bullish intent

- On-chain metrics did reflect firm accumulation that’s necessary for a breakout

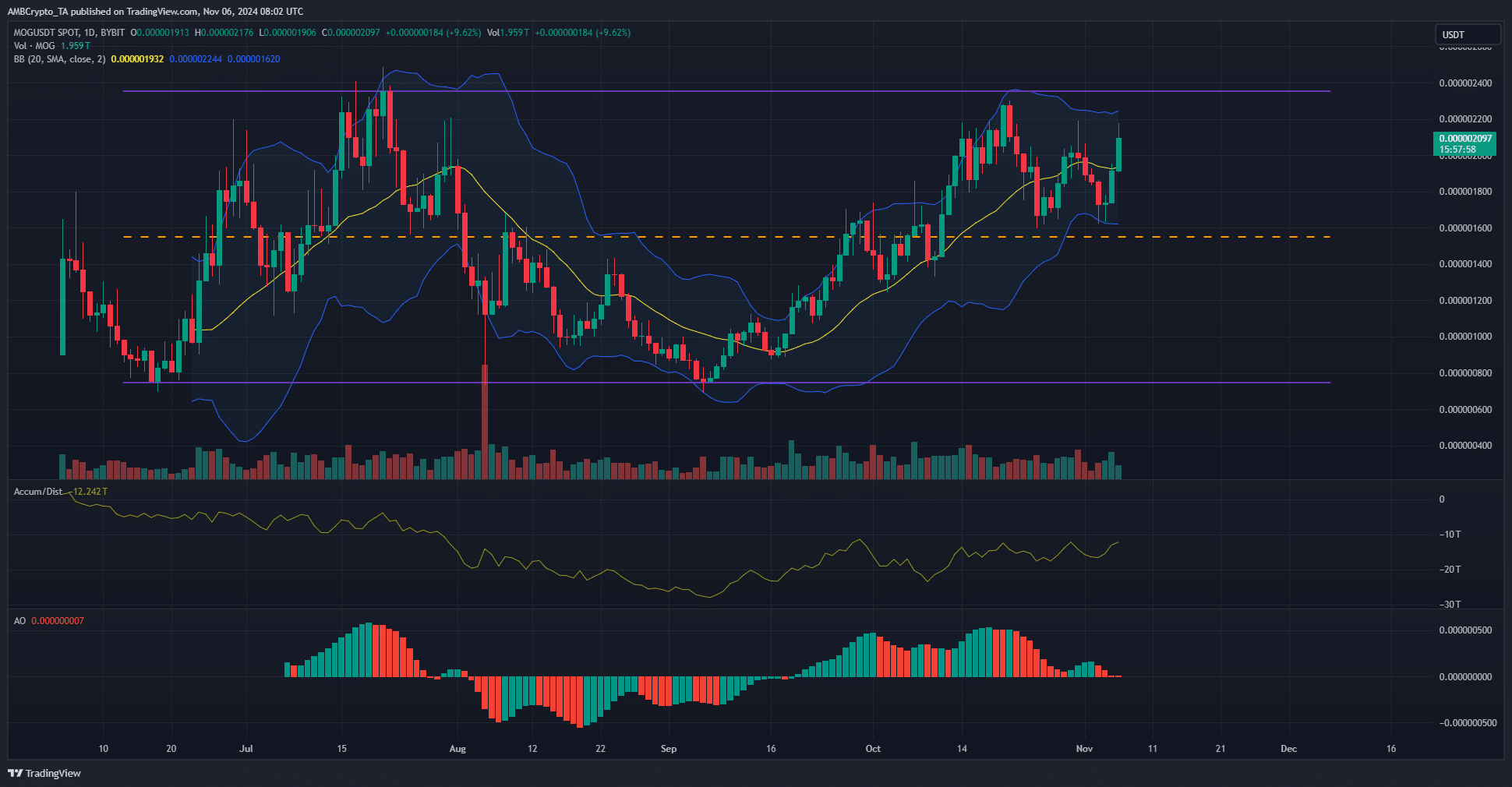

Mog Coin [MOG] was trading within a range that extended from $0.0000021 to $0.00000075 (MOG prices multiplied by 1000 here on for legibility). The meme coin price approached the mid-range level at $0.00156 and rebounded higher from the demand zone.

On Monday, the 4th of November, another such bounce was seen. Since those lows, Mog Coin is up by 27.5%, and up nearly 10% for the day. Will we soon witness a range breakout?

Average trading volume hints at a lack of faith

Source: MOG/USDT on TradingView

On the daily timeframe, the Awesome Oscillator fell toward the zero mark and showed that momentum was just barely bullish. The volume bars have been hovering at the the past 20 days’ average trading volume.

This came at a time when the bulls managed to defend the $0.00165 support zone. Additionally, the A/D indicator slowly crept higher to signal buyers had the upper hand.

This advantage on the volume front was enough to see gains in the upper half of the range formation but was not evidence for a breakout beyond the highs. Therefore, as things stand, traders can look to sell at the $0.0023 region.

A pullback to the mid-range region, or a breakout and retest of the range highs, can be used to re-enter long positions.

On-chain metrics signal distribution for Mog Coin

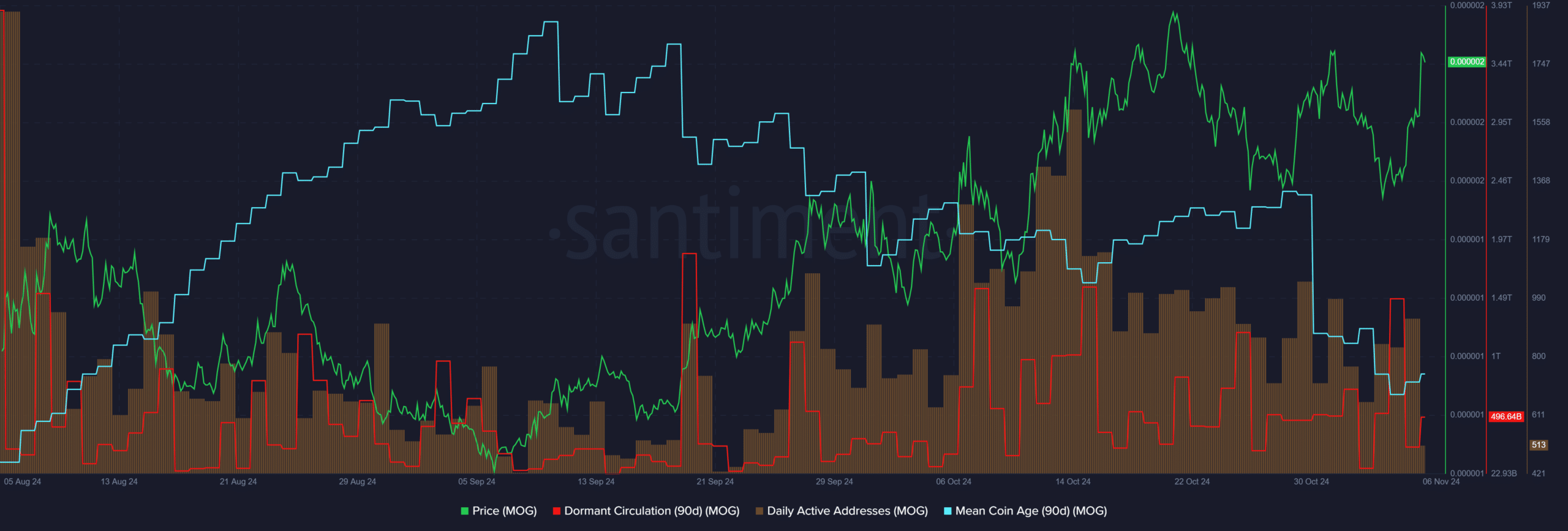

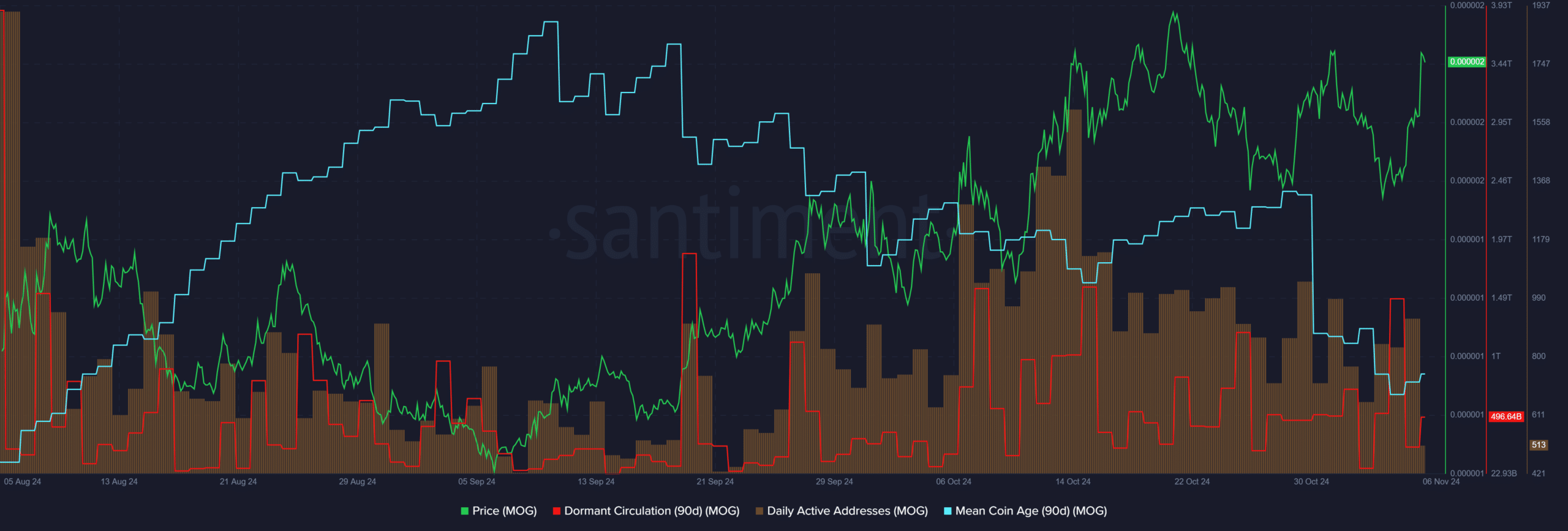

Source: Santiment

The dormant circulation spikes have been of a comparable size since late September. Another such spike occurred on the 4th of November when the price made a local bottom on the lower timeframes.

Realistic or not, here’s MOG’s market cap in BTC’s terms

The daily active addresses has been in decline over the past three weeks. More concerning to the HODLers was the steady decrease in the mean coin age over the past two months.

This downtrend indicated Mog Coin movement and likely profit-taking activity. It highlighted a lack of bullish belief among holders.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion