- Mog Coin has rallied by over 30% in 24 hours to an all-time high of $0.00000316.

- Open interest has also increased to record highs of over $1.35 million.

Mog Coin [MOG], at press time, traded at $0.00000316 after a 31% gain in 24 hours. Following these gains, MOG is inching closer to ranking among the top 100 largest cryptocurrencies after its market cap crossed above $1 billion for the first time.

Data from CoinMarketCap shows peak interest in the meme coin after trading volumes surged by more than 300% in 24 hours.

Mog Coin also reached an all-time high of $0.00000338 on 6th December, with the main factor driving the frenzy being its listing on Coinbase.

Can MOG sustain the gains?

MOG’s recent gains saw 100% of wallets become profitable, a factor that could trigger a selloff as is usually the case with meme coins.

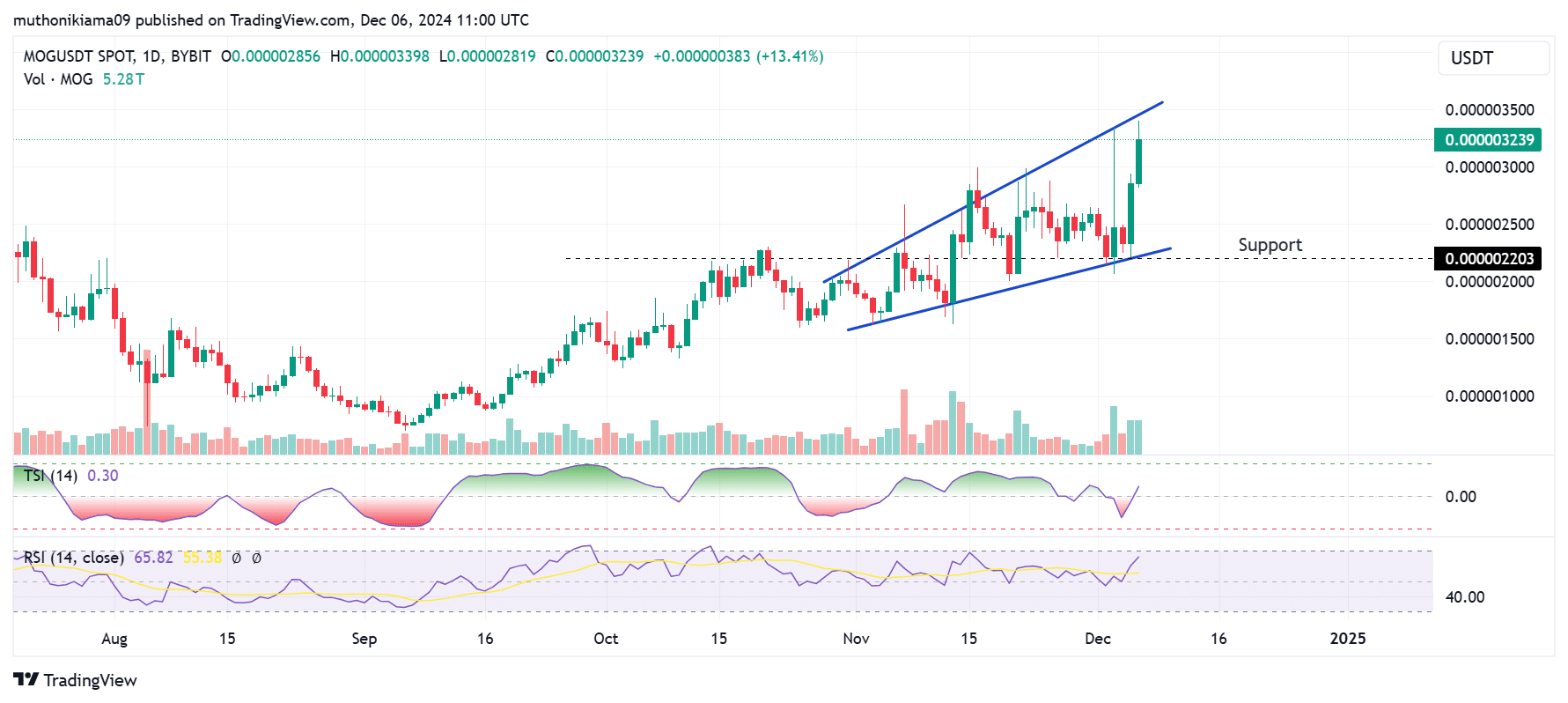

However, the Relative Strength Index (RSI) of 66 on MOG’s daily chart shows that buyers remain in control of the trend. In fact, the RSI is tipping north and continues to trend above the signal line, showing a bullish momentum.

However, traders should watch out for the ascending broadening wedge pattern that usually precedes a trend reversal. If MOG fails to breach the upper trendline and consolidates within the channel, it could lead to exhaustion and a downward breakout.

Source: Tradingview

Despite the bearish pattern, the Trend Strength Index (TSI) shows that the uptrend remains strong after flipping from bearish to bullish. If the TSI maintains a positive value, MOG could experience more gains and form successive all-time highs.

Conversely, if the TSI starts to drop and MOG falls below the support level at $0.0000022, it will confirm a bearish reversal.

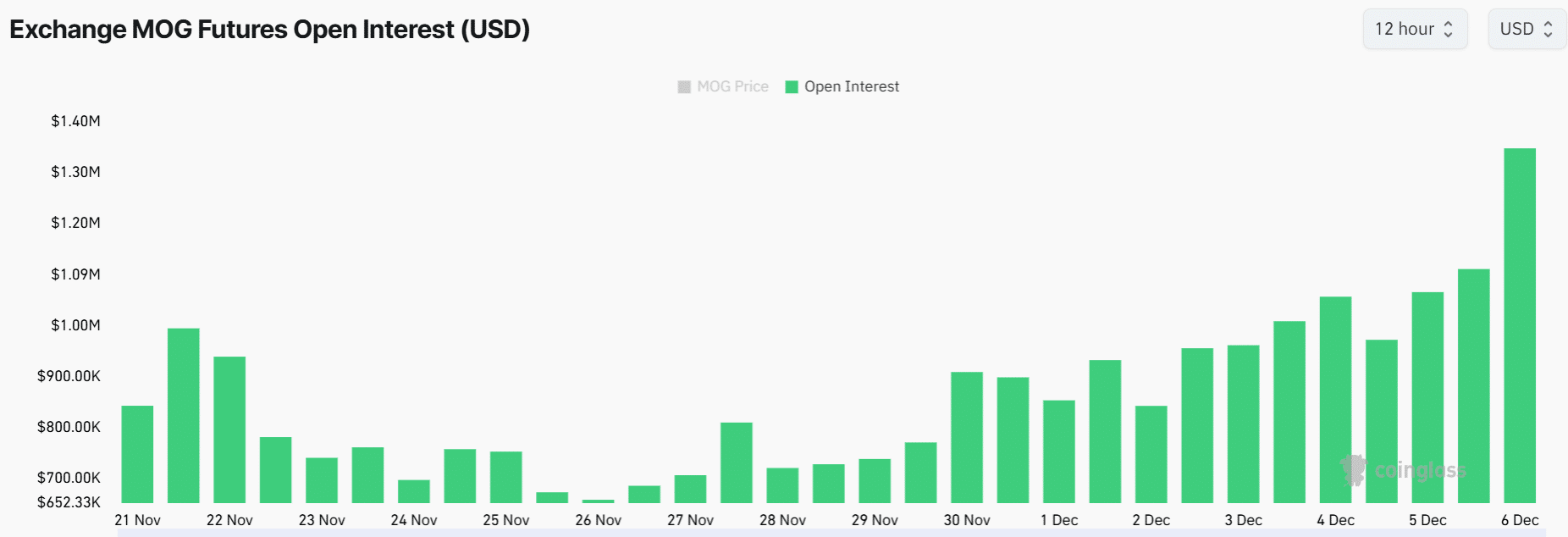

Open interest rises to record highs

MOG’s open interest has increased alongside the price suggesting a bullish bias. At press time, open interest stood at $1.35M after a 30% gain in 24 hours per Coinglass.

Source: Coinglass

As the number of newly opened positions on MOG in the derivatives market increases, the price is poised to rally due to increased liquidity.

However, traders should watch out for an extreme rise in open interest as that could cause a spike in price volatility.

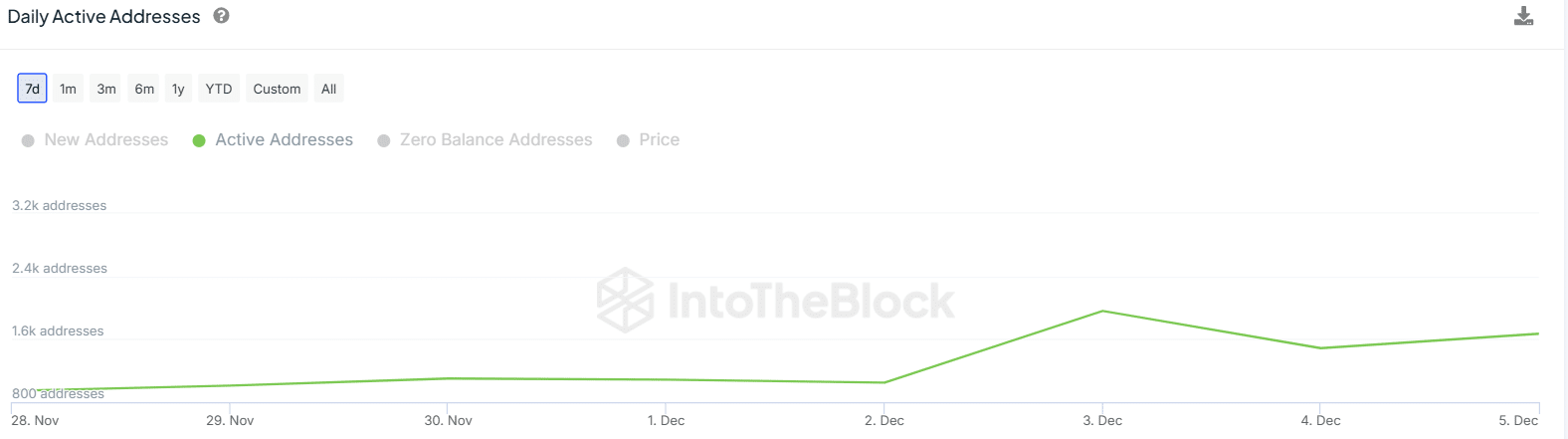

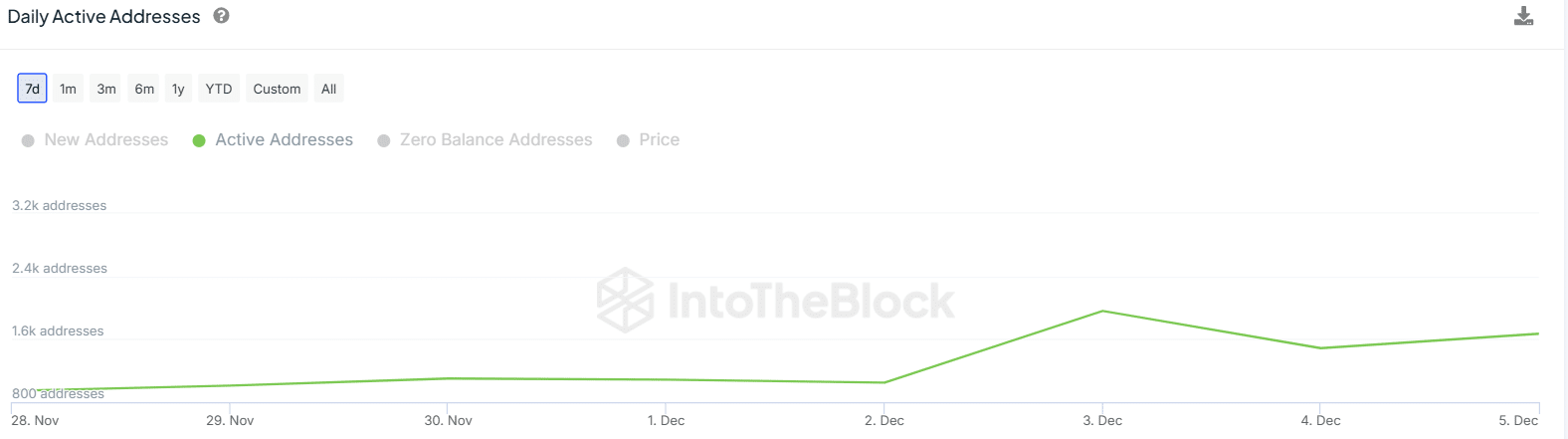

Active addresses on the rise

The number of daily active addresses on MOG has also been on a notable rise in the last seven days as depicted by data from IntoTheBlock. These addresses have increased to 1,670 from around 1,000 earlier this week.

Source: IntoTheBlock

Given that these addresses increased in tandem with the RSI, it points towards high buying activity. Therefore, if these addresses start to drop, it could ignite a downtrend due to reduced buying pressure.