- Crypto mining stocks have lost $12 billion, despite Bitcoin’s stability

- Decoupling between mining stocks and Bitcoin could foreshadow volatility and deeper market stress

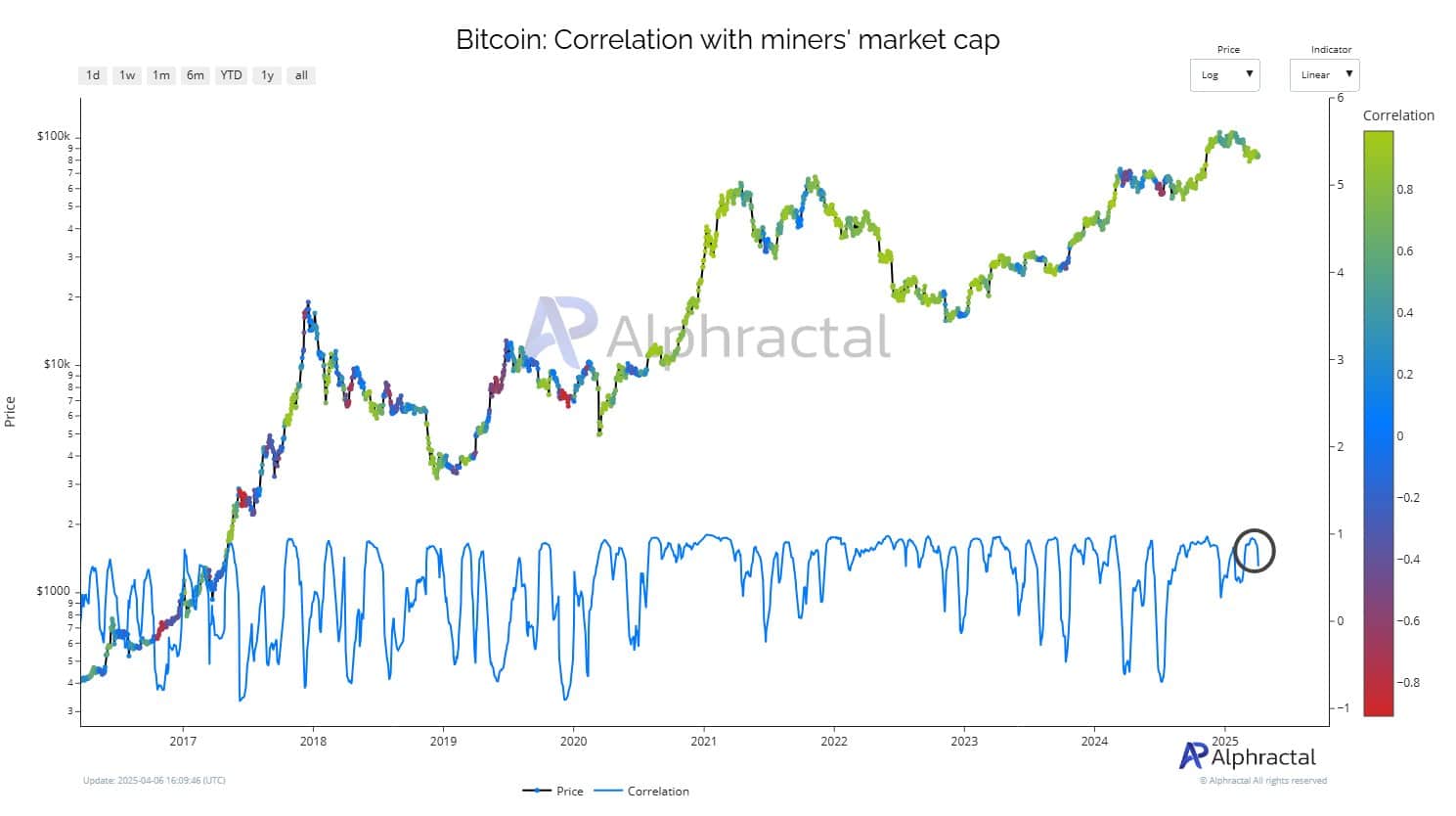

Crypto mining stocks have taken a sharp hit, shedding over $12 billion in market value and returning to early 2024 levels. What’s particularly notable isn’t just the scale of the drop, but the timing – Occurring despite Bitcoin’s [BTC] relative price stability. This decoupling between mining stocks and BTC is raising concerns. Especially as it often precedes periods of market turbulence.

Could this be a sign of rough waters ahead for the crypto sector?

The $12 billion retreat

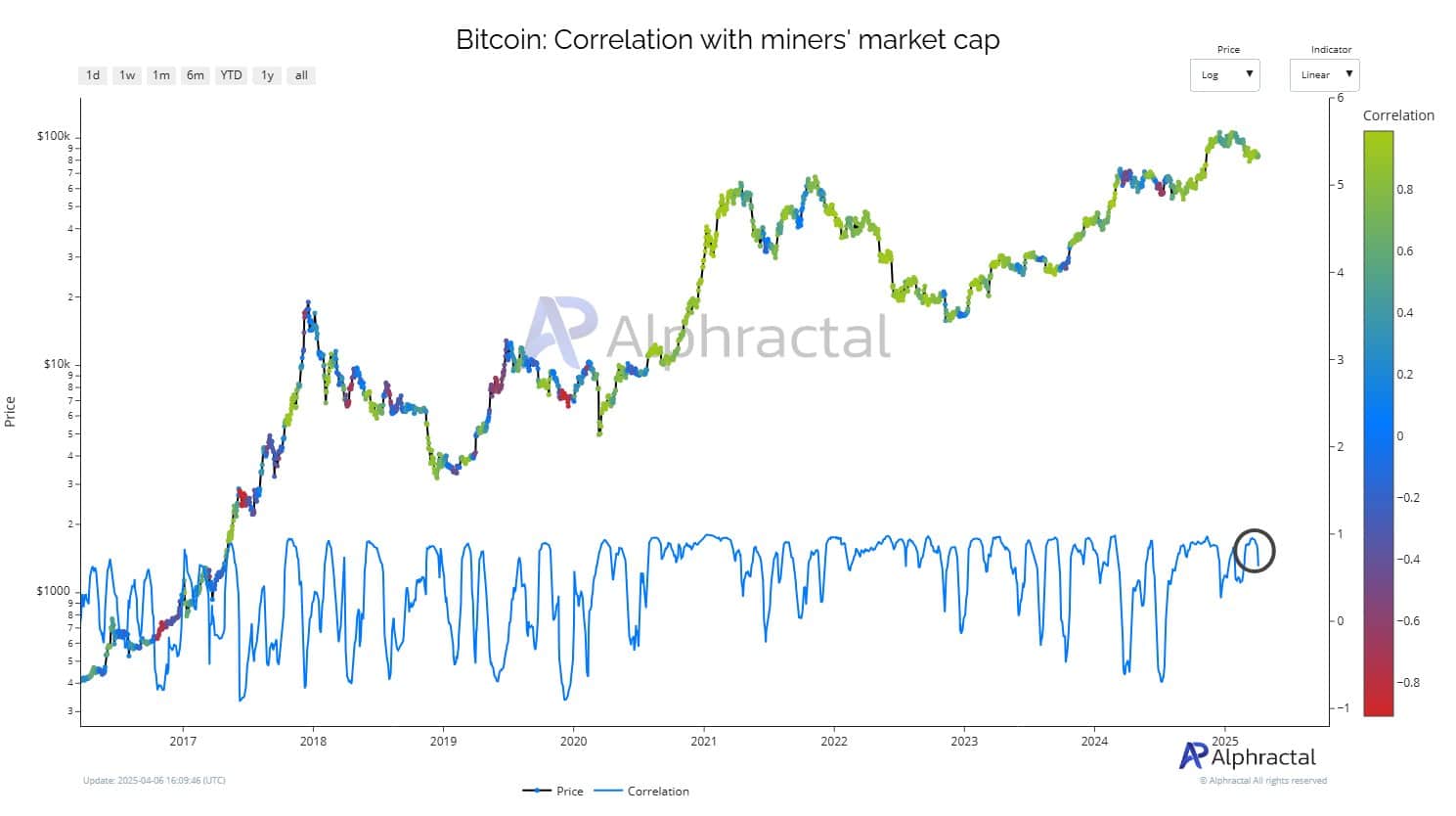

Source: Alphractal

Bitcoin mining stocks have lost over $12 billion in market value since February, falling from above $36 billion to under $24 billion – Erasing all gains made in early 2024. Key miners have seen sharp double-digit declines.

What’s notable is that this plunge comes even as Bitcoin’s price remains relatively stable.

Decoupling from BTC – A red flag?

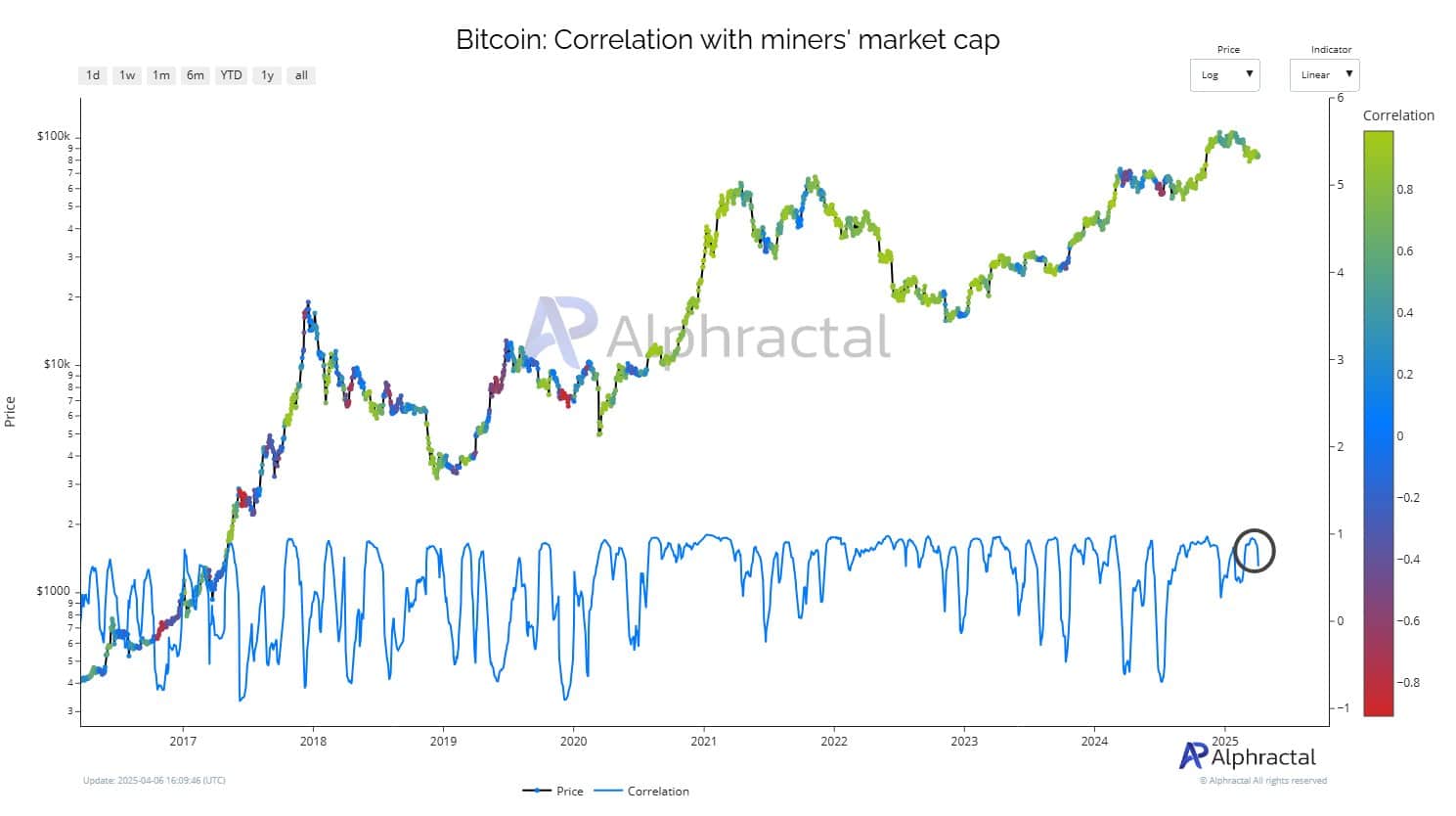

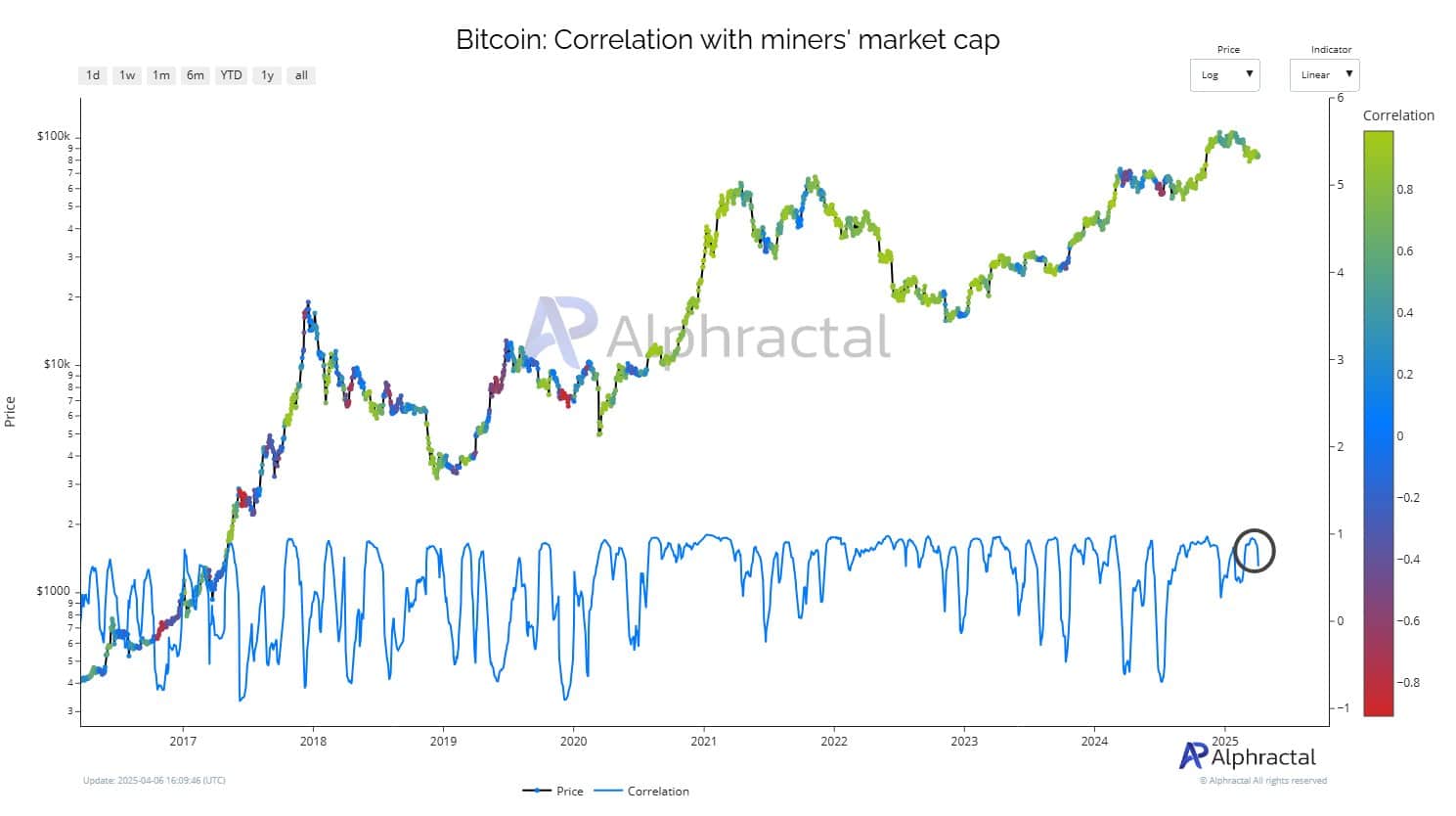

Miners are breaking away from Bitcoin – and not in a good way. Despite BTC holding above its $65k support, miner equity valuations have tumbled, triggering a steep decline in correlation.

In fact, data underlined that the correlation between Bitcoin’s price and miners’ market cap dipped sharply, nearing negative territory for the first time since mid-2022.

Source: Alphractal

Historically, such decouplings have preceded volatility spikes or directional shifts in BTC.

Whether this signals a market re-evaluation of miners, structural stress ahead of the halving, or broader sentiment cracks – This time feels different.

Miners’ profitability and sentiment under pressure

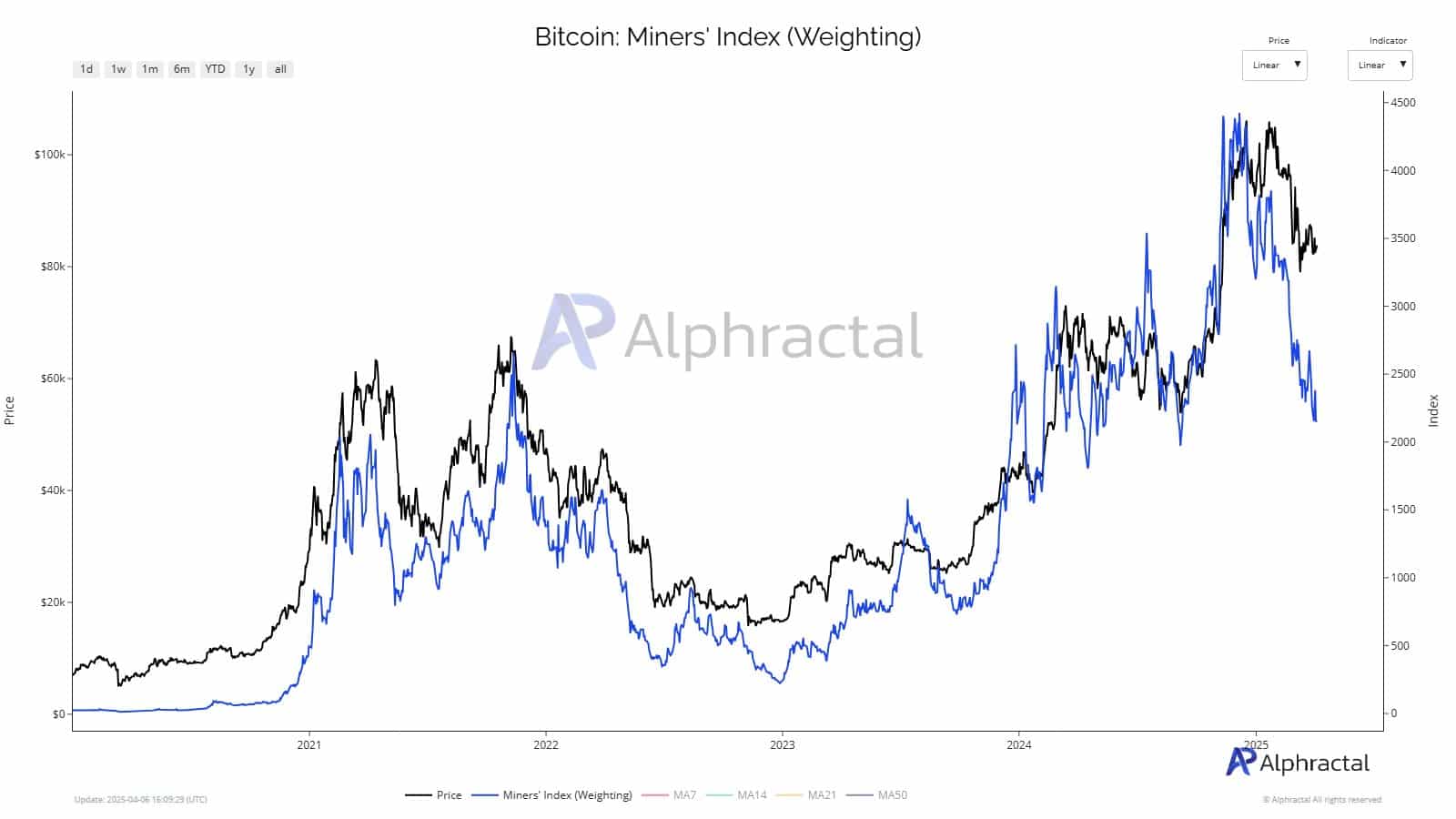

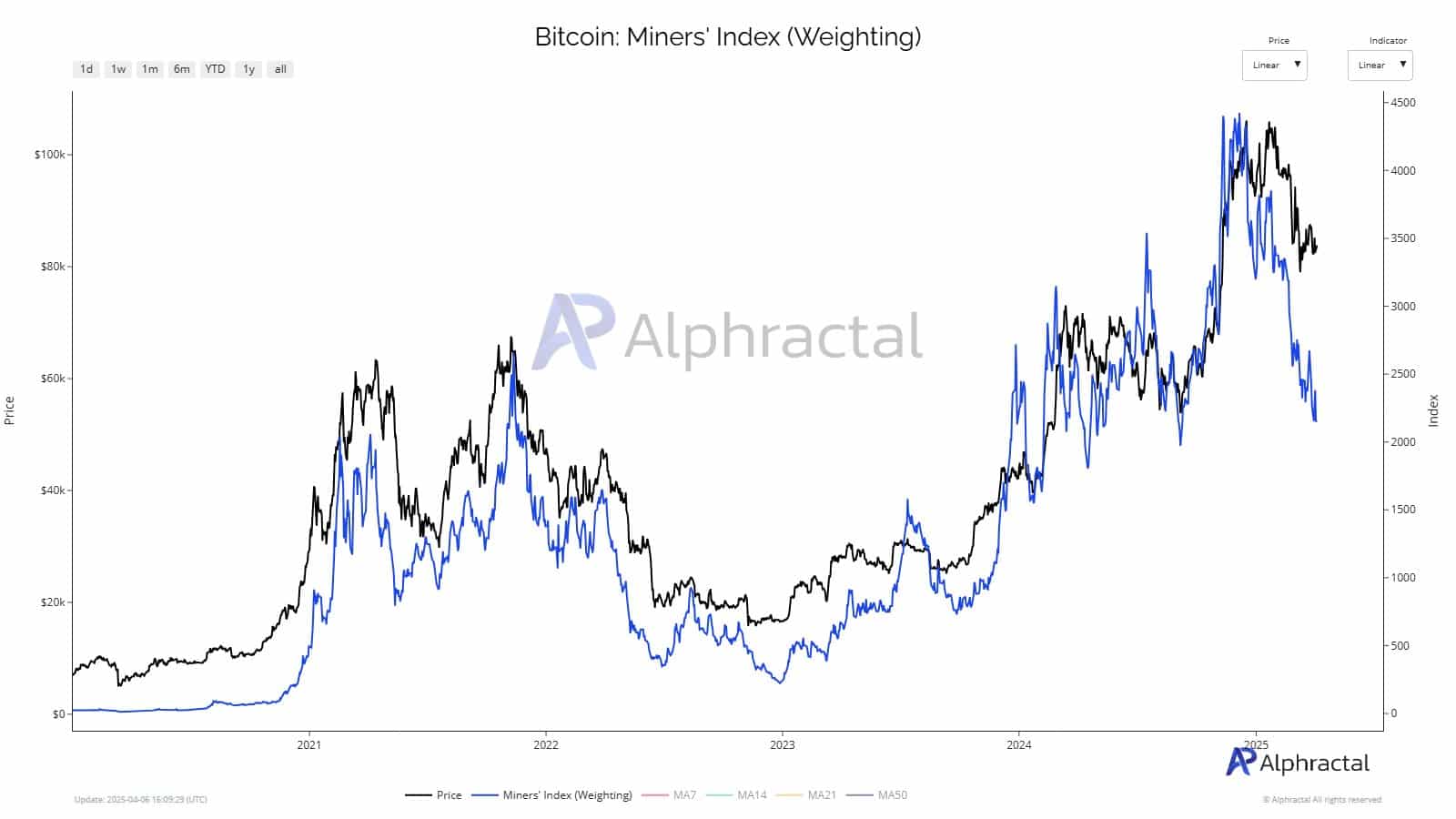

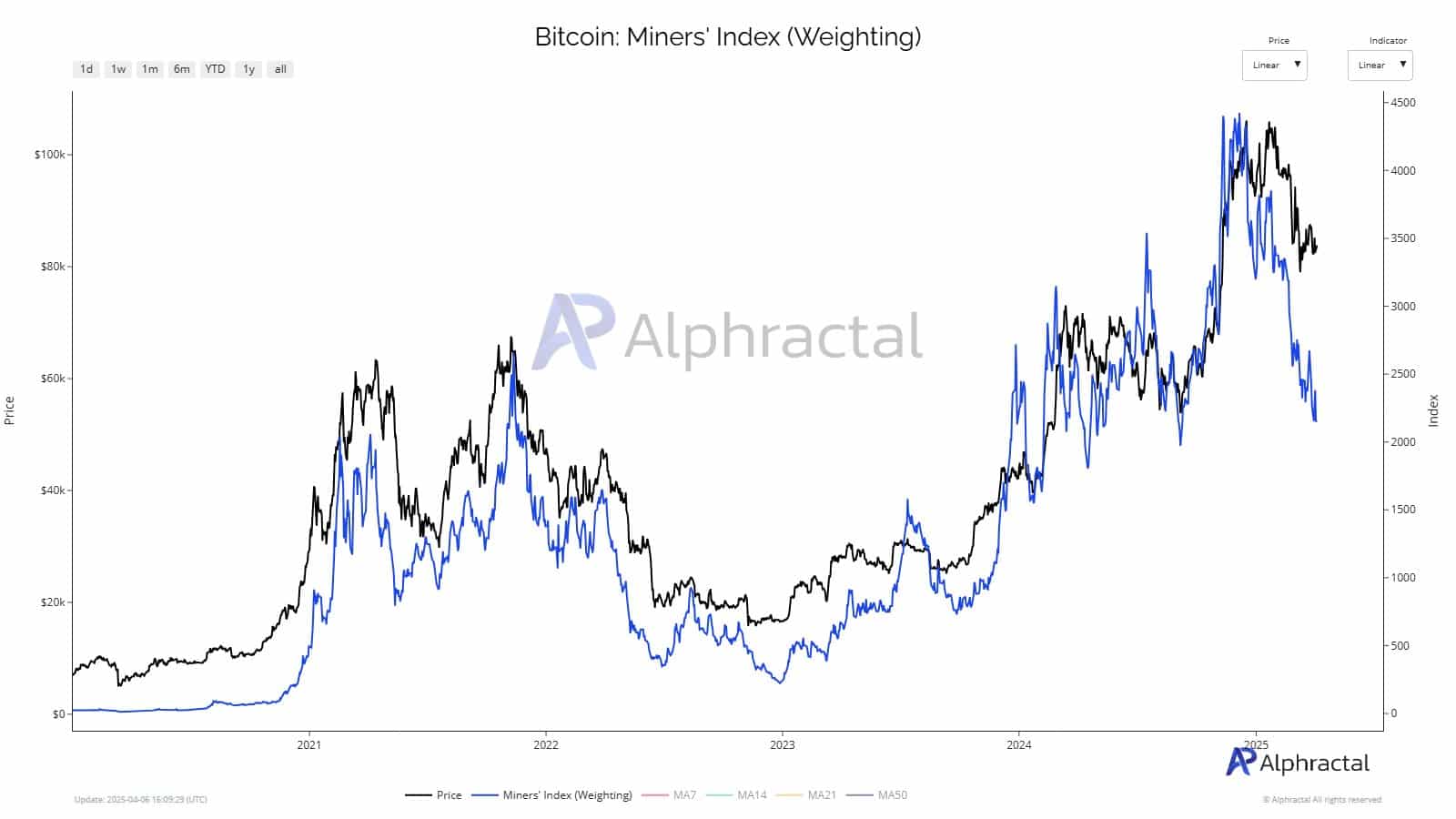

Post-halving economics, rising energy costs, and trade-related uncertainty – especially around President Trump’s April tariff hints – are squeezing Bitcoin miners. The miners’ index highlighted a sharp decoupling from Bitcoin’s price, reflecting deep stress across the sector.

At the same time, investor appetite appears to be shifting too.

Source: Alphractal

According to Galaxy Digital, for instance, Spot Bitcoin ETFs are gaining favor, offering exposure without the operational and regulatory risks tied to mining firms.

CEO Mike Novogratz has also emphasized ETF-driven inflows as a major bullish force for BTC in 2025. With capital rotating out of miner stocks, miners may face a sentiment winter even as Bitcoin rallies.

What this means for the broader market

The decoupling between Bitcoin miners’ stocks and BTC’s price may be a warning signal. Similar divergences in early 2022 preceded broader corrections, suggesting miners could again be a leading indicator of market stress. Institutions are taking note – Underperformance in mining equities point to deeper operational and regulatory challenges, prompting a possible shift towards direct BTC exposure or ETFs.

Tech stocks offer a parallel – Recent U.S. tariffs have triggered steep losses, with analysts warning of decade-long setbacks. As with tech, external shocks could reshape crypto dynamics, turning this divergence into a signal and not a blip.

Next: Bitcoin’s road to $75K – Is crypto’s latest dip a bear trap in the making?

Source link