- Michael Saylor predicts Ethereum will be classified as a crypto-asset security

- Charles Hoskinson was quick to respond to the Bitcoin maxi’s comments

The United States is taking steps towards regulating the cryptocurrency market, beginning with platforms like Kraken, Coinbase, and Uniswap. Now, it would seem that it’s turning its attention towards Ethereum [ETH]. As expected, opinions are divided about such an endeavour.

While some oppose the Securities and Exchange Commission’s (SEC) classification of ETH as a security, MicroStrategy’s executive chairman Michael Saylor believes otherwise.

Michael Saylor’s argument

According to the exec, Ether, the world’s largest altcoin, should be classified as a crypto-asset security rather than a commodity. Speaking at the MicroStrategy World 2024 conference, Saylor added,

“By the end of May, you’ll get to know that Ethereum is not going to be approved. Then it will be clear to everyone that Ethereum is deemed as a crypto asset security and not a commodity.”

He went on to say,

“After that, you’re gonna see that Ethereum, BNB, Solana, Ripple, Cardano, everything down the stack is a crypto asset security unregistered.”

Here, the implication of what Saylor is claiming is that none of the aforementioned tokens will ever be included in a spot ETF or accepted by Wall Street or recognized by mainstream institutional investors as crypto-assets.

Charles Hoskinson steps in

Needless to say, Saylor’s remarks didn’t go down well with everyone. Criticising the exec’s remarks, Cardano’s co-founder Charles Hoskinson took to X (Formerly Twitter) and noted,

“Michael if your only argument for Bitcoin is that governments are appraising it and liking it and that all the altcoins are hated by governments, you are on the wrong side of history, my friend.”

His response highlighted the prevalent notion among Bitcoin maximalists that cryptocurrencies beyond Bitcoin might be deemed illegal or fraudulent. This critique further touched upon a broader debate within the cryptocurrency community, one regarding the legitimacy of alternative digital assets.

However, this isn’t the first time Hoskinson has taken a stand for altcoins. A month ago, a Forbes article labeled several cryptocurrencies as “crypto zombies.” The list included Cardano [ADA], Ripple [XRP], and Bitcoin Cash [BCH].

Responding to the aforementioned criticism Hoskinson said,

“Hey guys @tezos @Algorand @bitcoincashorg @Ripple_XRP1 @StellarOrg @BobSummerwill we are all Crypto Zombies according to Forbes. I guess it’s because we got all the brain.”

Additionally, Ben Armstrong, also known as BitBoy Crypto, expressed concerns about Cardano and said- “ADA is DEAD for REAL.” Clearing the air around the same, Hoskinson replied,

“Sorry, Ben. Once you get on the Ada is going to die train, we have nothing more to discuss about Cryptocurrencies. I wish you good fortune in the years to come.”

Investors’ interests remain unaffected

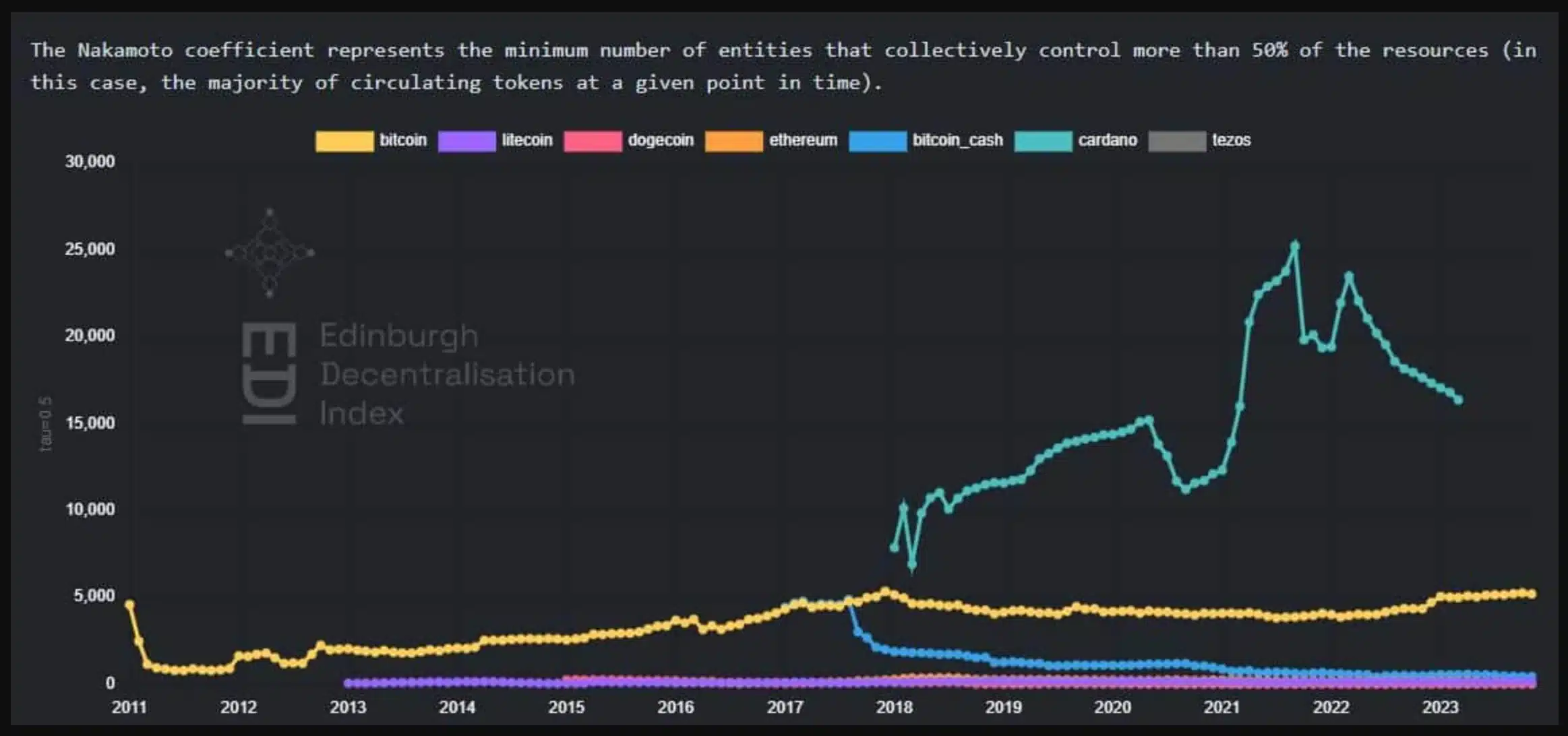

These comments highlight that such speculations are just guesses. In fact, recent findings show that Cardano has a higher Nakamoto coefficient than other altcoins, indicating greater decentralization.

Source: EDI