- The price action of both Popcat and cat in a dogs world has a strongly bearish bias for the coming weeks.

- The sentiment behind both memes was neutral in the futures market, but one of them saw heightened spot demand recently.

Popcat [POPCAT] and cat in a dogs world [MEW] have both been trending downward on the price chart over the past month.

They have followed in the footsteps of the wider memecoin market, which has been in a slump since mid-November.

POPCAT was at a $741.9 million market cap at press time, and MEW at $563 million. An earlier report by AMBCrypto suggested there’s a chance that MEW can overtake POPCAT, but this has not yet happened.

A memecoin flippening might not be too far, but are there signs that MEW would be the stronger performer in the coming weeks?

Sentiment has been firmly bearish recently

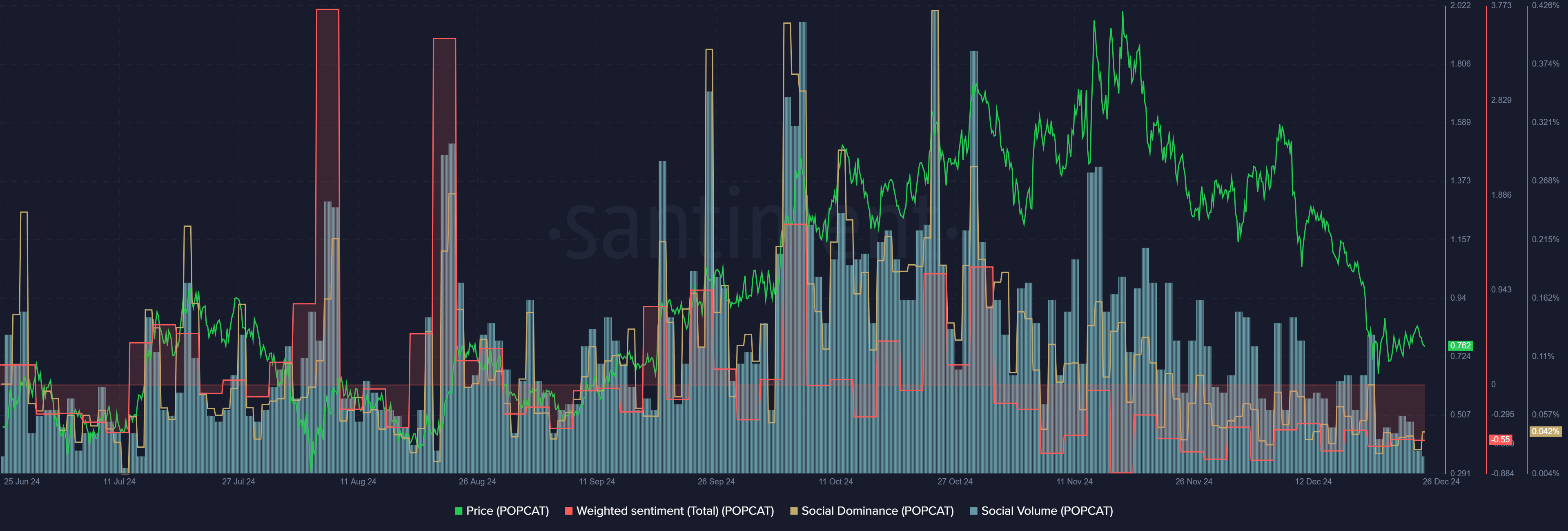

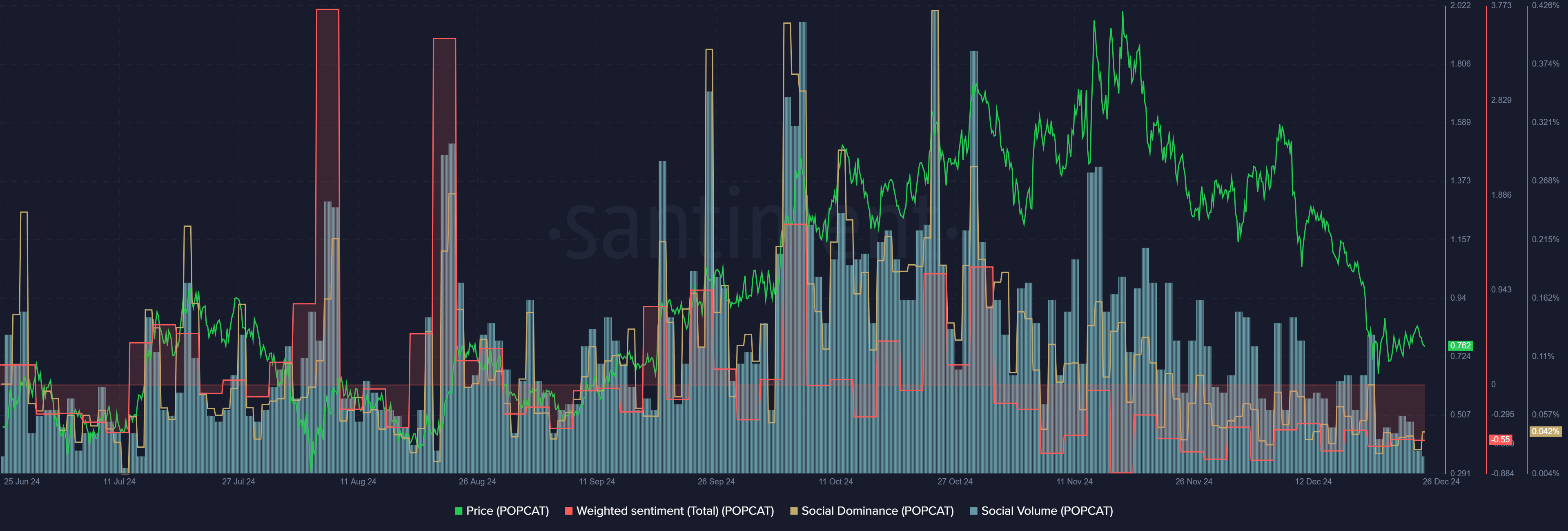

Source: Santiment

AMBCrypto compared the sentiment and social trends of both coins. The Weighted Sentiment was negative for POPCAT over the past month, showing a lack of enthusiasm among online engagement posts.

The Social Volume has also trended downward due to the price slump, and fewer market participants posted about the coin.

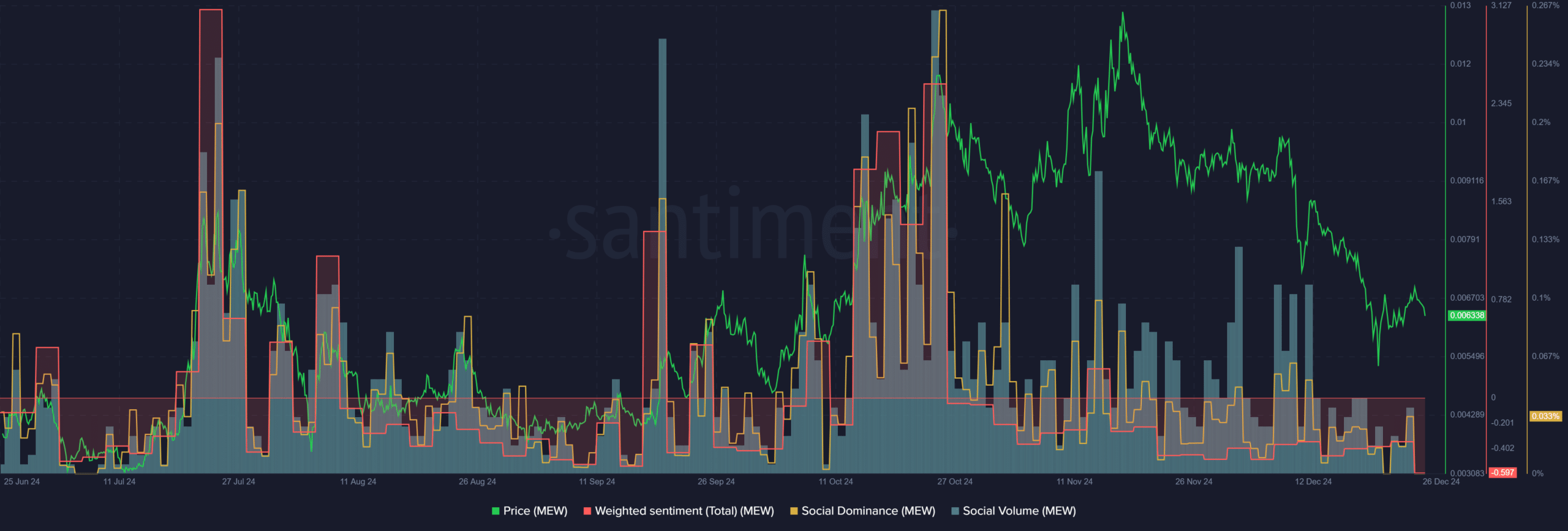

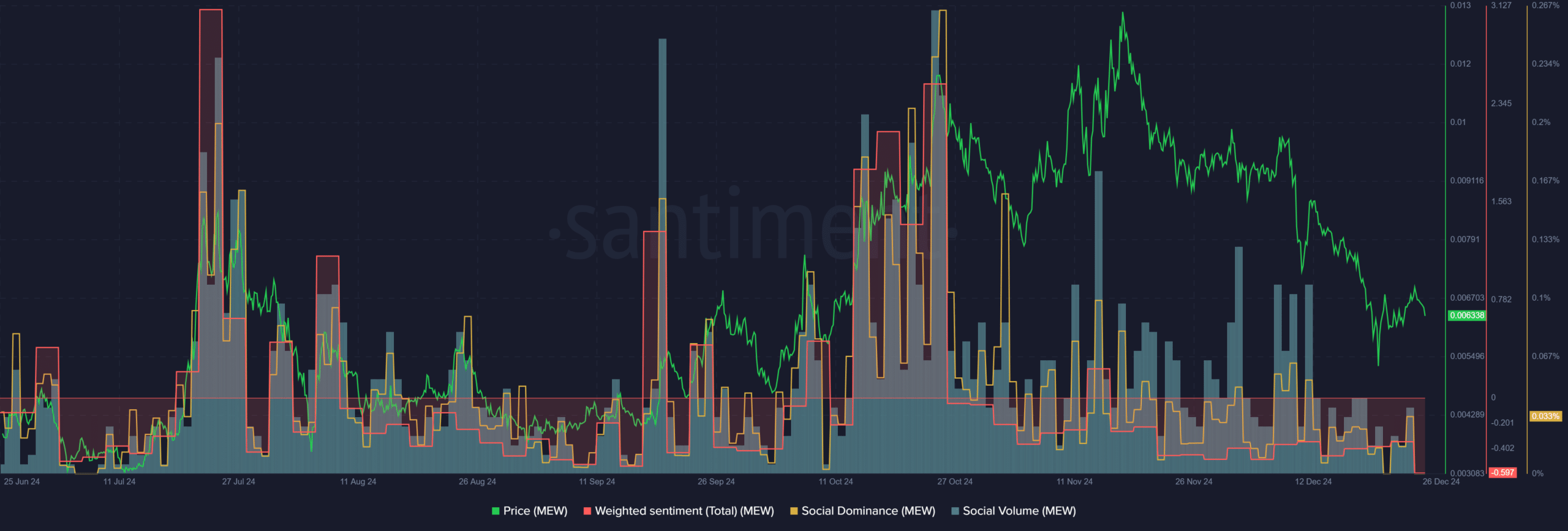

Source: Santiment

Other altcoins have also grabbed public attention in the past two or three weeks, while memecoins have been in a slump.

The Weighted Sentiment of MEW showed some positive trend in mid-November, which quickly reversed. Like POPCAT, MEW’s Social Volume, and hence its dominance, has also trended steadily lower over the past month.

Short-term outlook more bullish for POPCAT

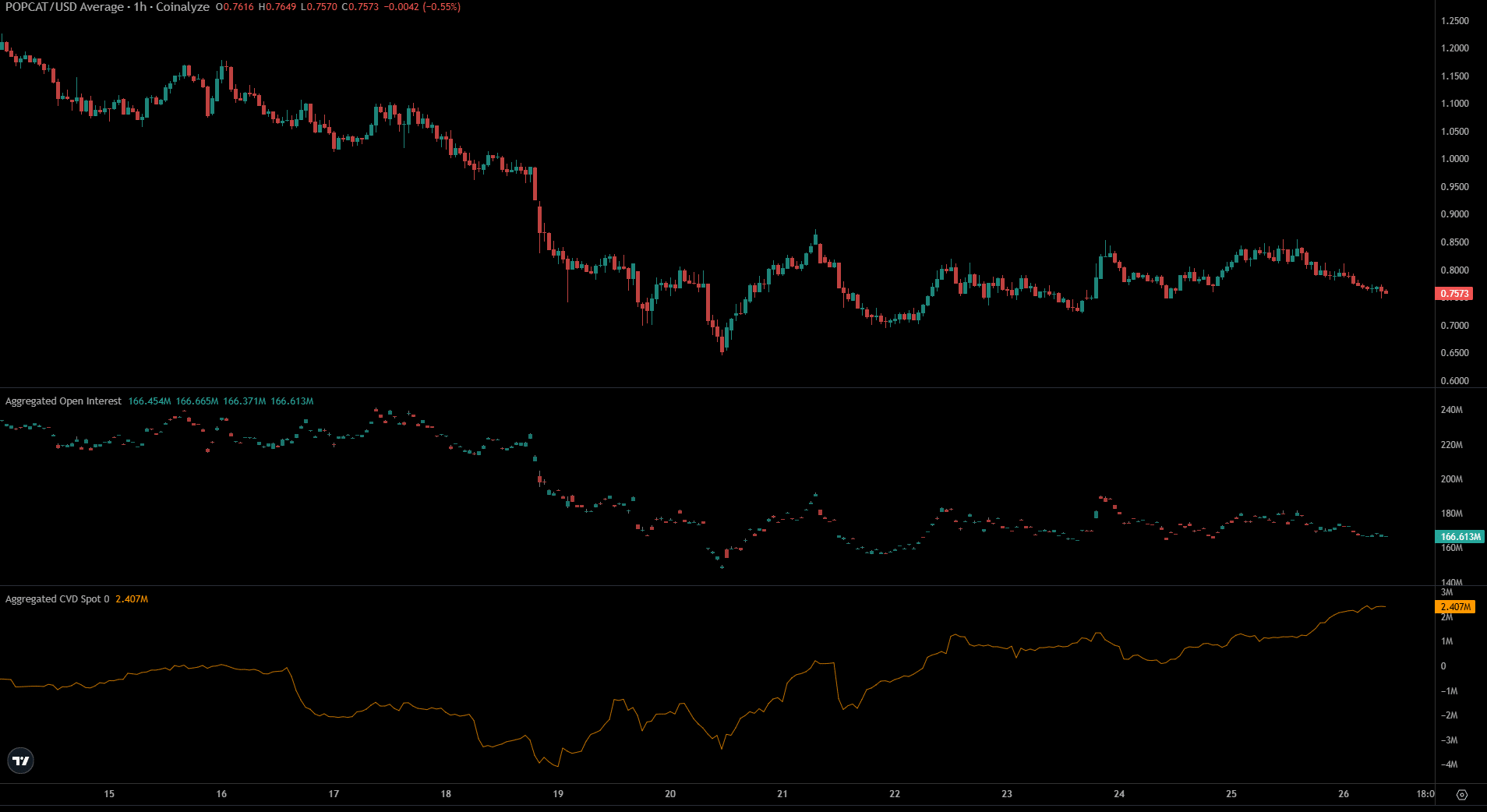

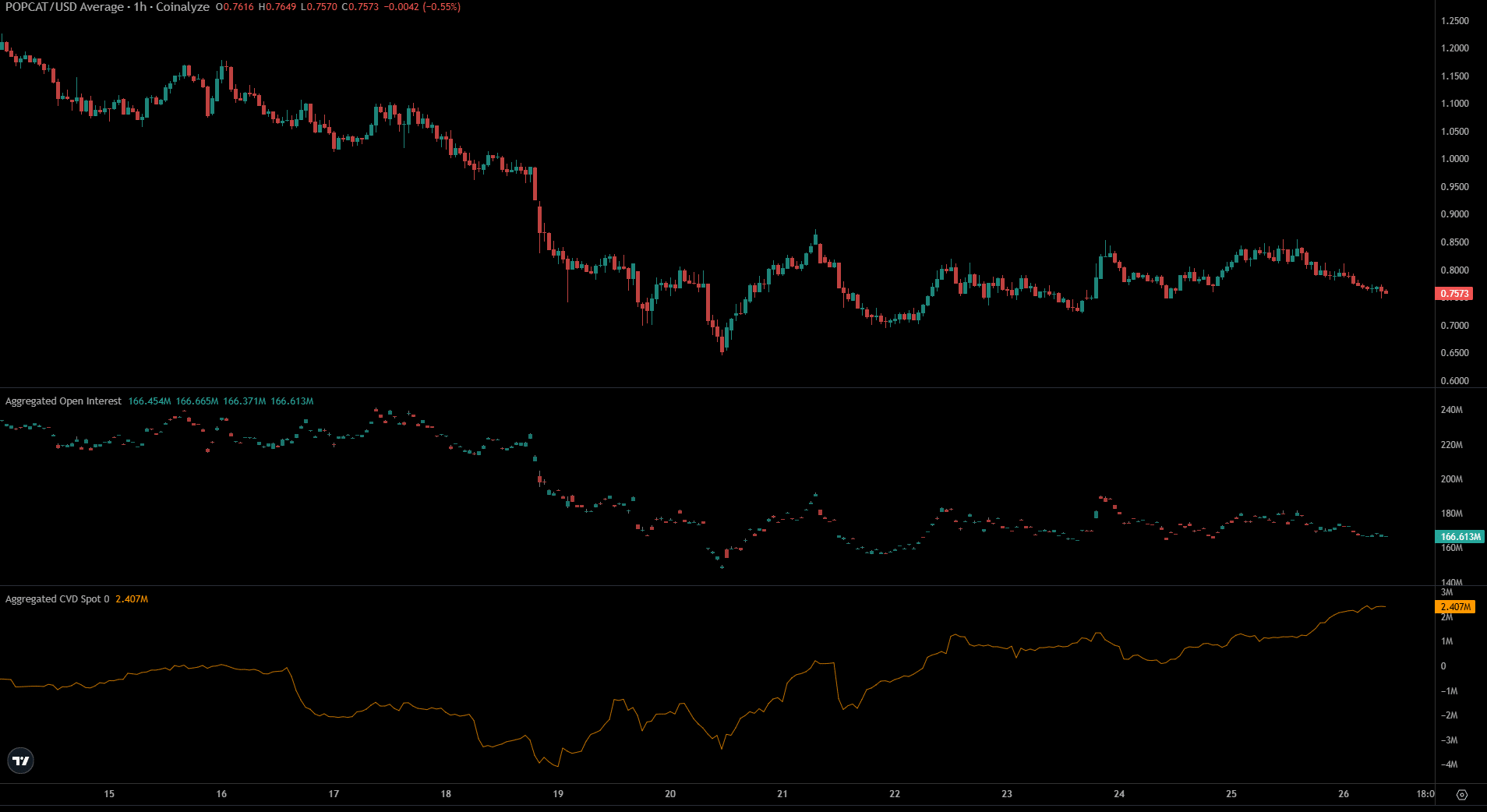

Source: Coinalyze

The data from Coinalyze shed light on the short-term sentiment behind the two memes. The Open Interest for Popcat has remained steady at around the $165 million-$170 million mark over the past week.

This showed speculators preferred to remain sidelined and were not confident about a strong short-term trend, bullish or bearish.

The spot CVD was trending strongly higher, a sign of potential price gains in the coming days.

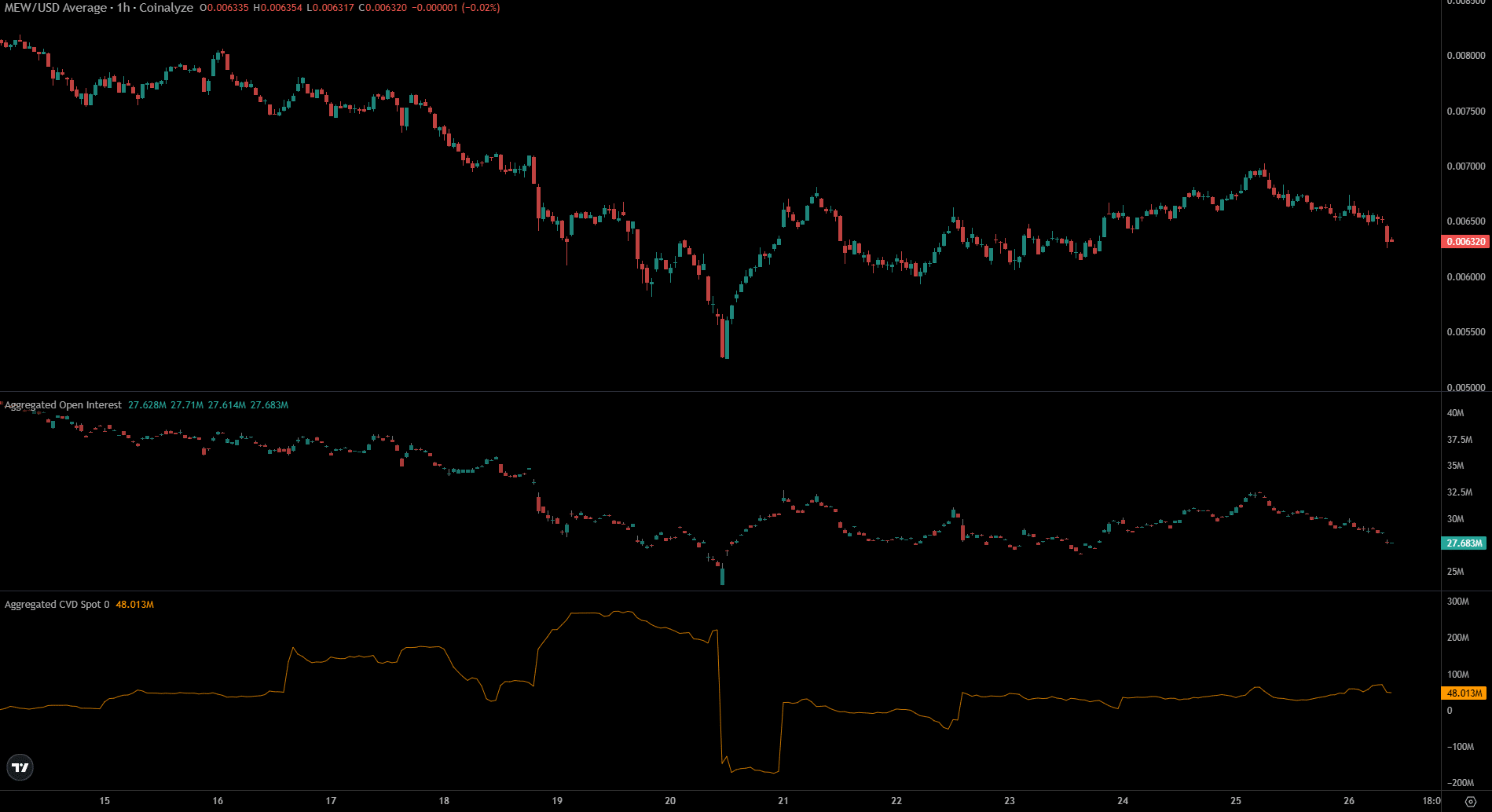

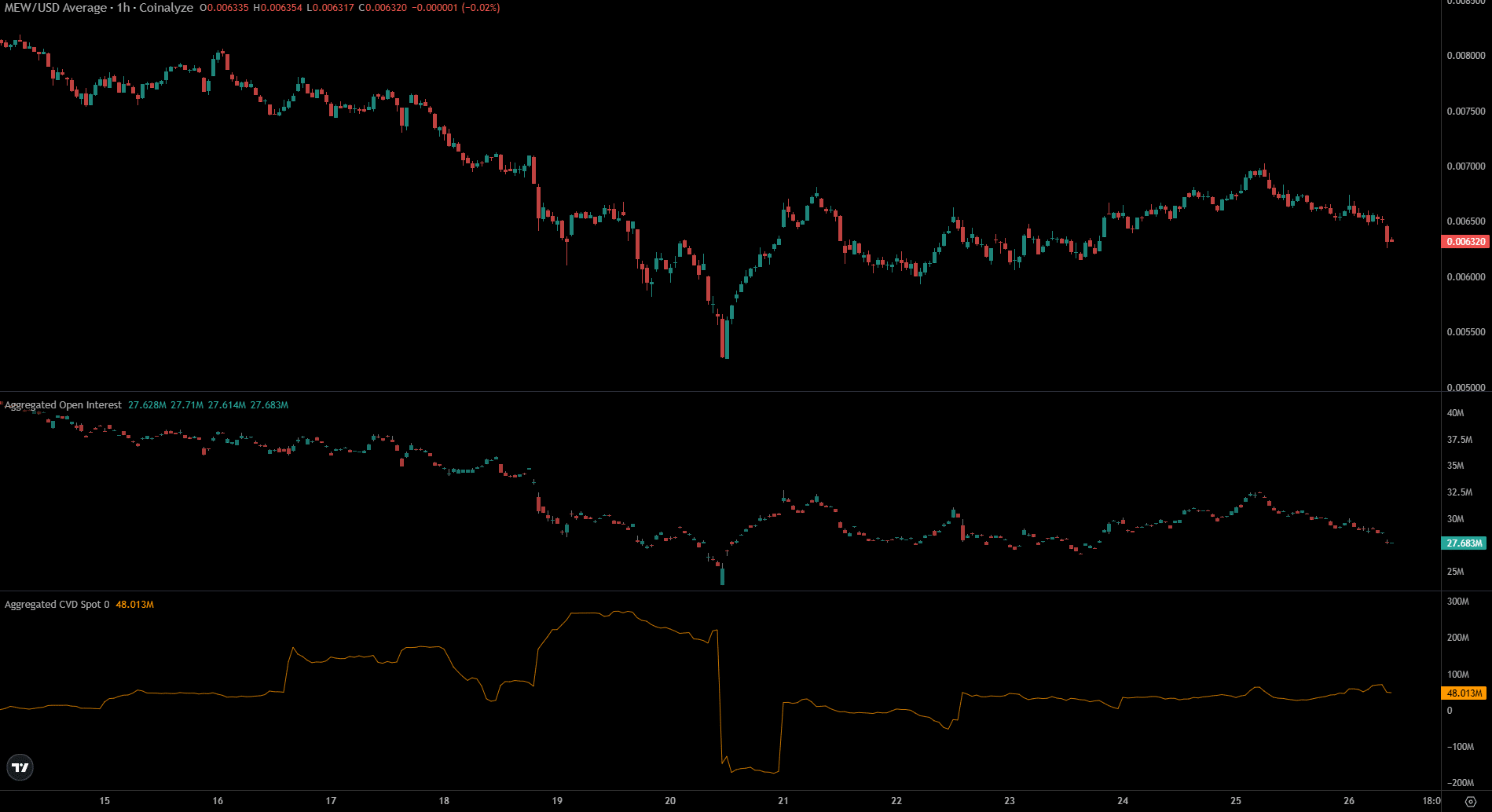

Source: Coinalyze

The Open Interest behind MEW also hovered around the $28 million mark, showing lowered speculative expectations.

Yet, the much lower OI numbers meant POPCAT was the more popular asset in the futures market. The spot CVD has been static in recent days.

Is your portfolio green? Check the Popcat Profit Calculator

Overall, neither the social nor speculative trends of MEW gave indications of higher bullish conviction. This criterion is essential for a meme coin flippening.

The price action of both cat memes has been in lockstep, although POPCAT has shed more value in the past month.